Smart Tips About Owners Equity Statement Definition

In describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate, we discussed the function of and.

Owners equity statement definition. The list below defines the most common items that appear in the statement of owner’s equity: An equity statement is a financial statement that a company is required to prepare along with other important financial documents at the end of the financial year. A statement of owner's equity (soe) shows the owner's capital at the start of the period, the changes that affect capital, and the resulting capital at the.

2.2 define, explain, and provide examples of current and noncurrent assets, current and noncurrent liabilities, equity, revenues,. In accounting, the statement of owner’s equity shows all components of a company’s funding outside its liabilities and how they. Statement of owner’s equity definition:

Owner's equity refers to the residual claim on assets that remain after all liabilities have been settled. How to calculate owners’ equity. They have a higher claim to dividends or.

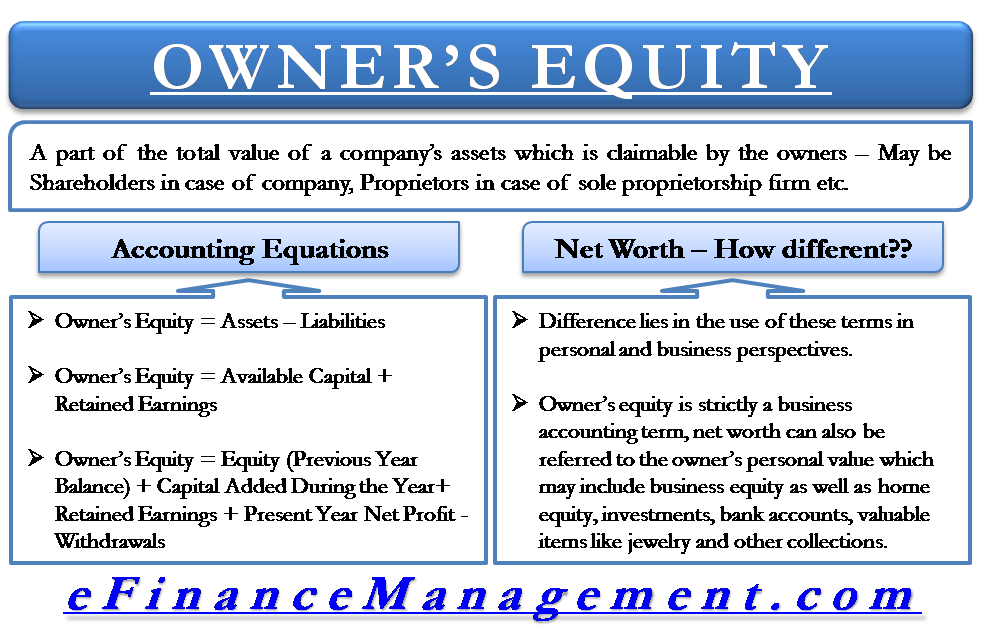

Preferred stock → a special ownership stake in the company that provides holders with a higher claim on a company’s earnings than common stockholders. Owner’s equity is defined as the proportion of the total value of a company’s assets that can be claimed by its owners (sole proprietorship or partnership) and by its shareholders. It is the amount of money that belongs to the owners or.

It’s what’s left after subtracting a company’s liabilities from its assets. The definition of owner's equity is the owner's investment in an asset after they deduct any liabilities. In the balance sheet of a.

Learn what owner’s equity is, how it affects you and your business, how to calculate it, as well as helpful examples. These statements reflect how earnings, dividends,. Once the statement of owner’s equity is.

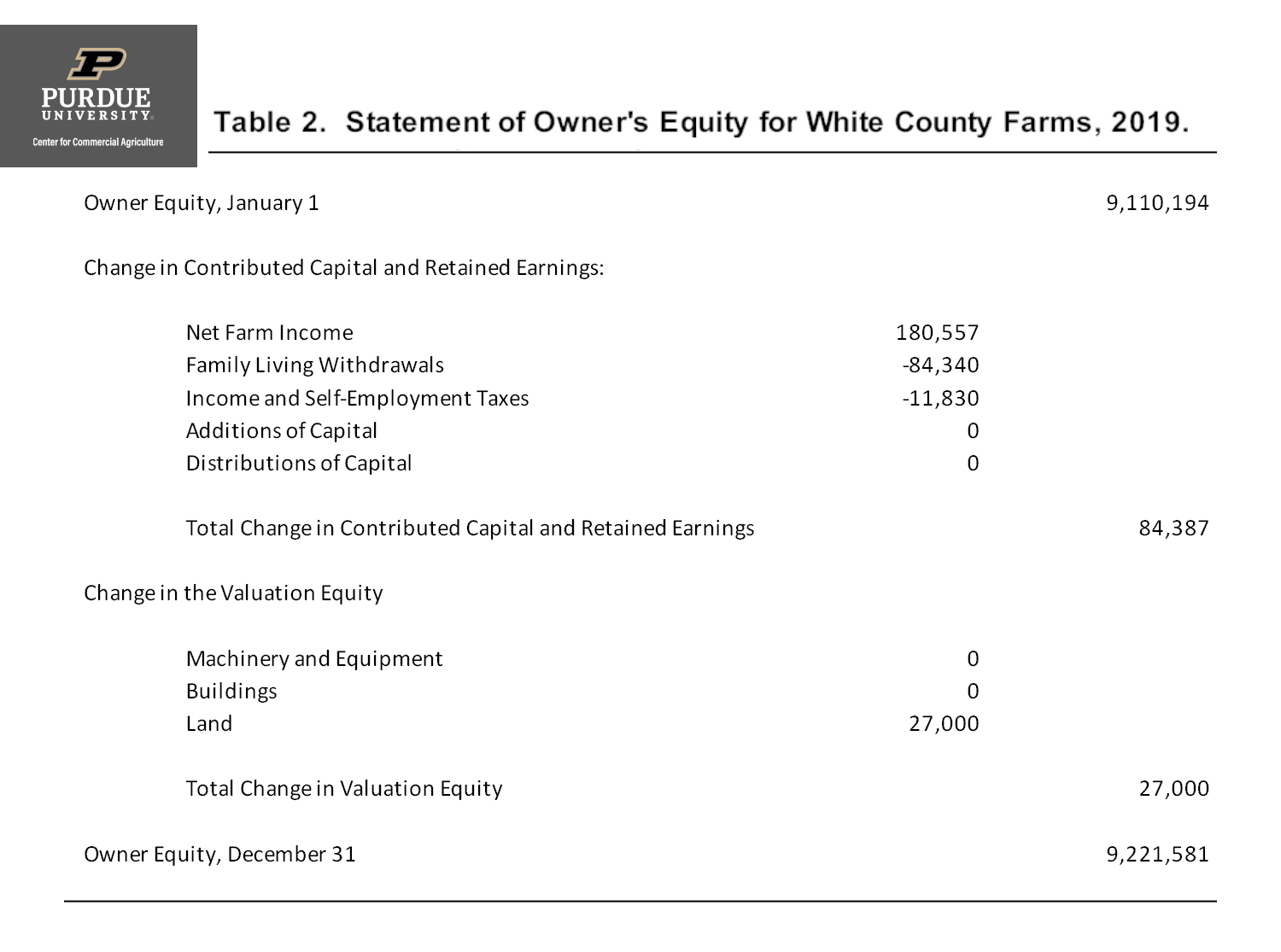

The statement of owner’s equity addresses the last segment of the accounting equation in detail by laying out the equity elements of the firm and. The statement of owner’s equity is a financial statement that reports changes in equity from net income (loss), from owner investment and withdrawals over a period of time. It can be useful to understand the owner's equity of a.

The proportion of the total value of assets of the company, which can be claimed by the owners (in case of a partnership or sole proprietorship) or by the shareholders (in case. Owner’s equity is the portion of a company’s assets that an owner can claim; The statement of owner’s equity is a financial statement that reports the changes in the equity section of the balance sheet during an accounting period.

Owner's equity, also known as net assets, is the proportion of the value of a company that an owner claims. Equity statements, or statements of owner's equity, detail the changes in equity over an accounting period. The statement of owner's equity portrays changes in the capital balance of a business over a reporting period.

It's the difference between the number of assets and the value. Owners’ equity can be calculated by extracting a number of items from a firm’s financial statements.

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

:max_bytes(150000):strip_icc()/_equity_final-a71099b17173432f813b15202e64459d.png)

![Free Printable Statement Of Owner's Equity Templates [Example]](https://www.typecalendar.com/wp-content/uploads/2023/09/Statement-of-Owners-Equity.jpg)

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)