Favorite Tips About Income Tax 26as Online

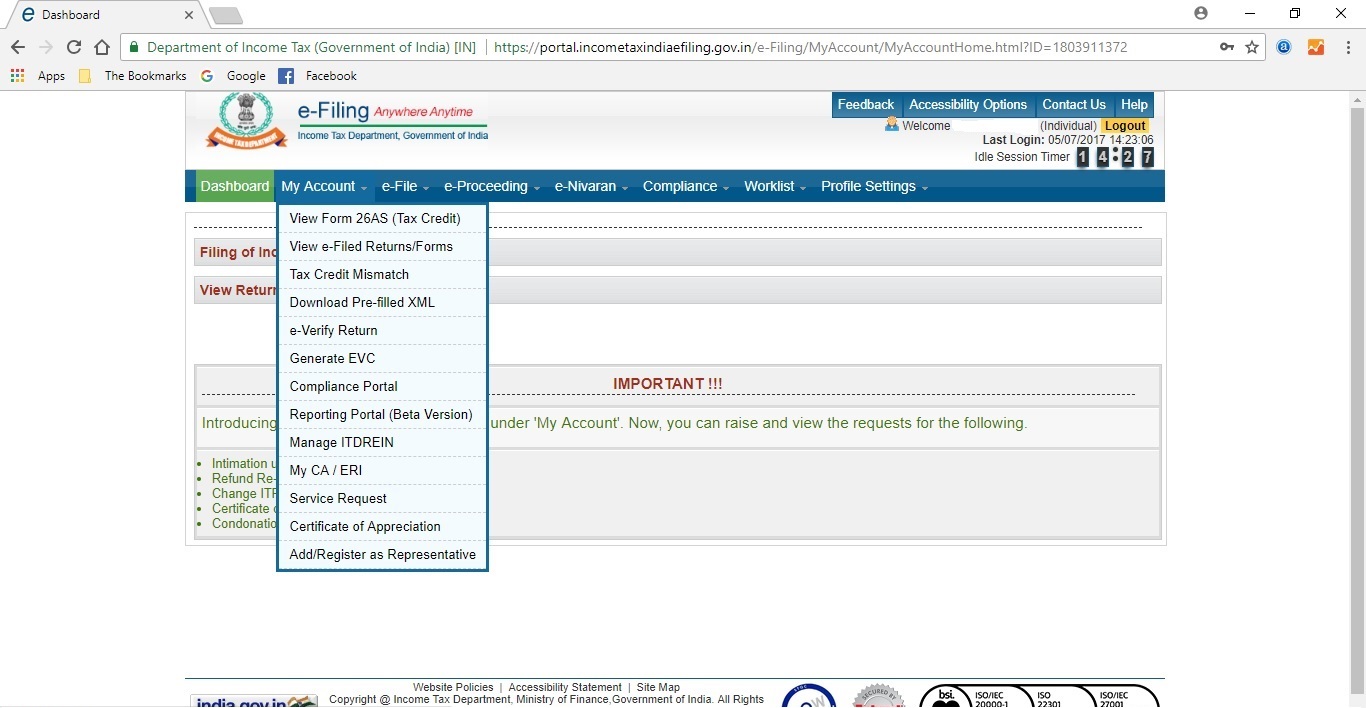

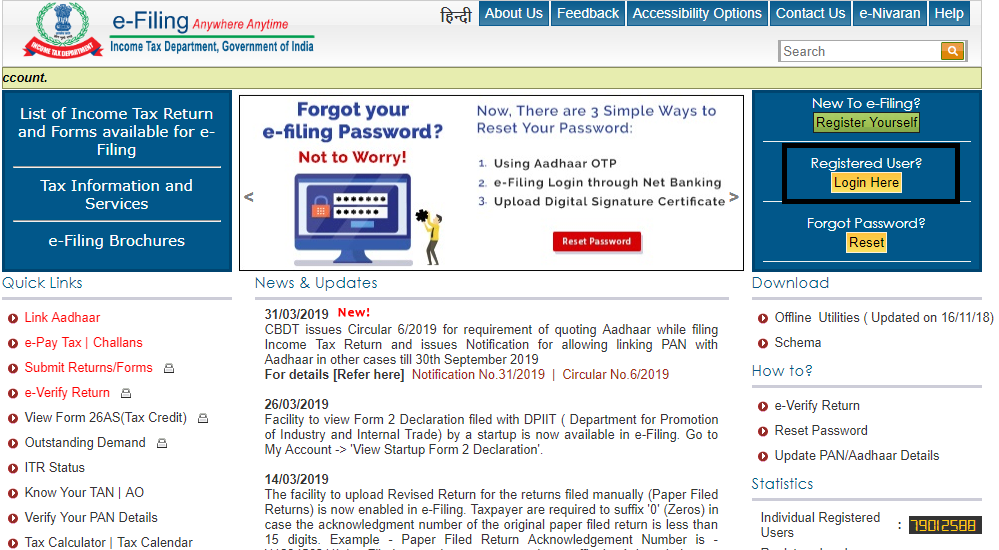

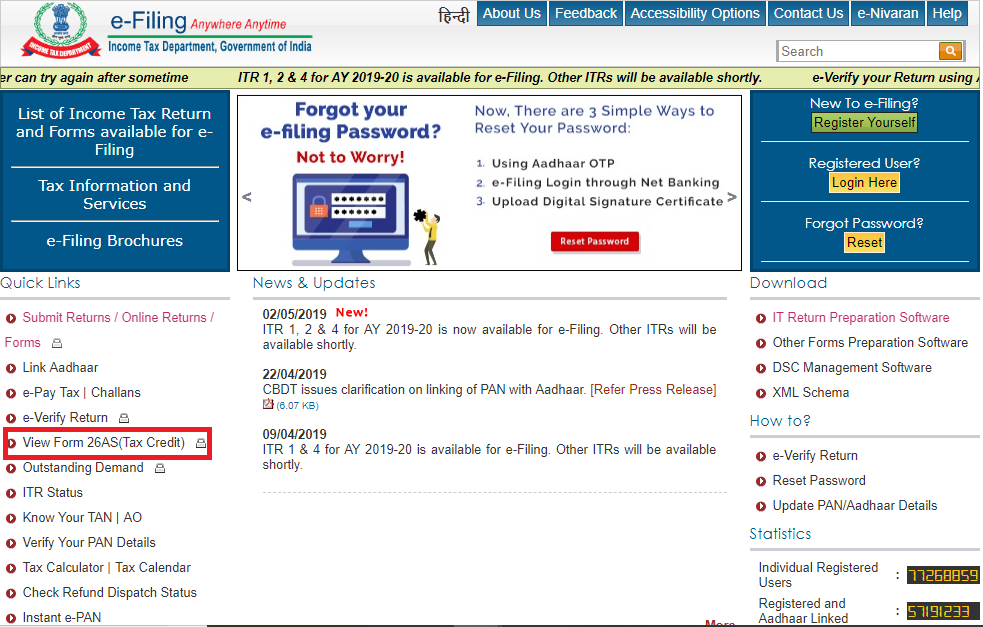

After logging into your account, the following screen will appear.

Income tax 26as online. Eligible outstanding direct tax demands have been remitted and extinguished. At the end of the financial year, tax payers file their income tax returns (itr) from the income tax details provided in form 16 or 16a. Please contact your tax consultant for an exact calculation of your tax liabilities.

Is filing income tax return mandatory? Choose the assessment year and the. Log in using your registered user id.

If you are not registered with traces, please refer to our e. Read the disclaimer, click 'confirm' and the user. The website provides access to the pan holders to view the details of tax credits in form 26as.

On the other side, as a part of e. Srishti, an nri, discovered inr 20,000 tds. Users having pan number registered with their home branch can avail the facility of.

Do not forget to check status of pan of the deductee. Users of retail.onlinesbi.sbi/personal can view tax credit in form 26as through bank login : Income tax return (itr) ay22:

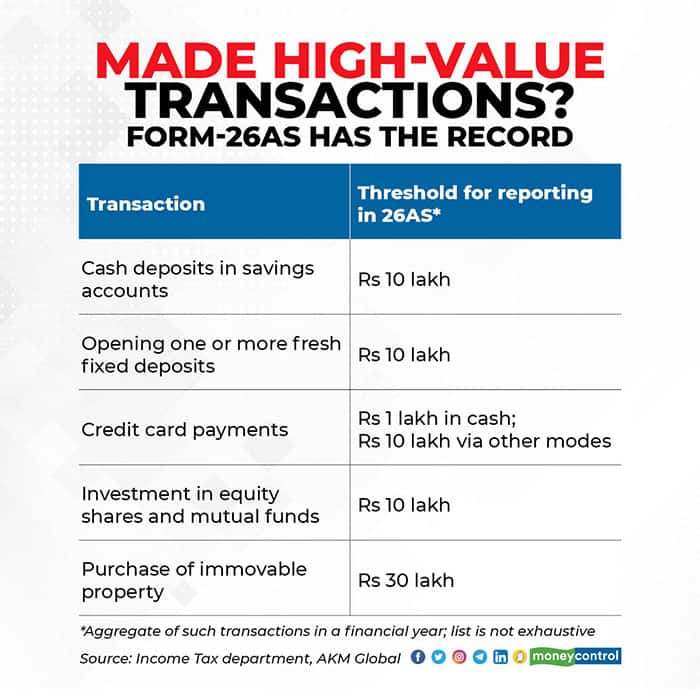

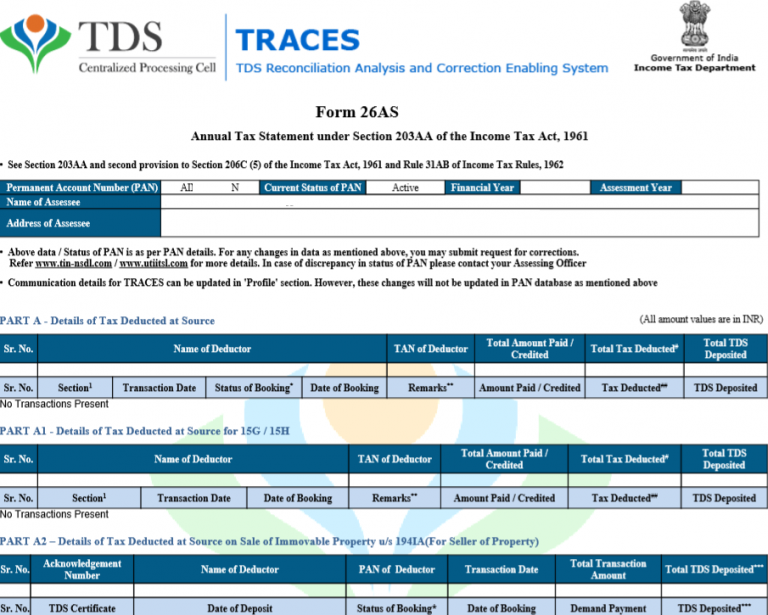

Tax benefits are subject to changes in tax laws. Form 26as is an important income tax document containing all the details of taxes deducted and deposited against the pan during the financial year. Form 26as is a tax credit statement that provides the complete record of the taxes paid by a taxpayer.

It is an important document needed at the time of filing itr,. Form 26as from the income tax department. Filing itr or income tax return for the first time can be confusing and scary.

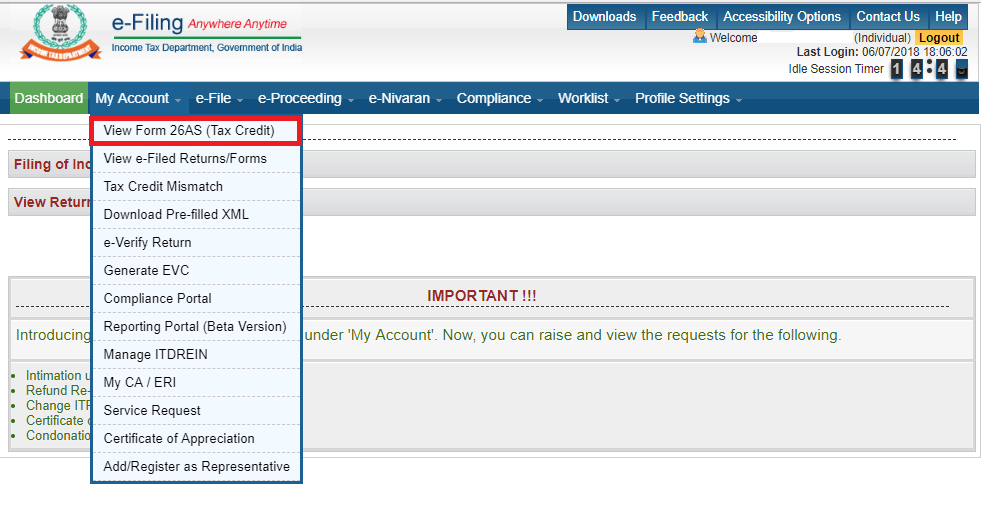

Click on the link at the bottom of the page that says 'view tax credit (form 26as)' to access your form 26as. Here are some steps to easily download form 26as on the new income tax portal. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer.

Click on the link view tax credit (form 26as) at the bottom of the. Form 26as is a consolidated tax statement that contains details of tax deducted at source (tds), tax collected at source (tcs), advance tax, and self.