Underrated Ideas Of Info About Outstanding Shares On Balance Sheet

These reports often can be found on a company’s investor relations page.

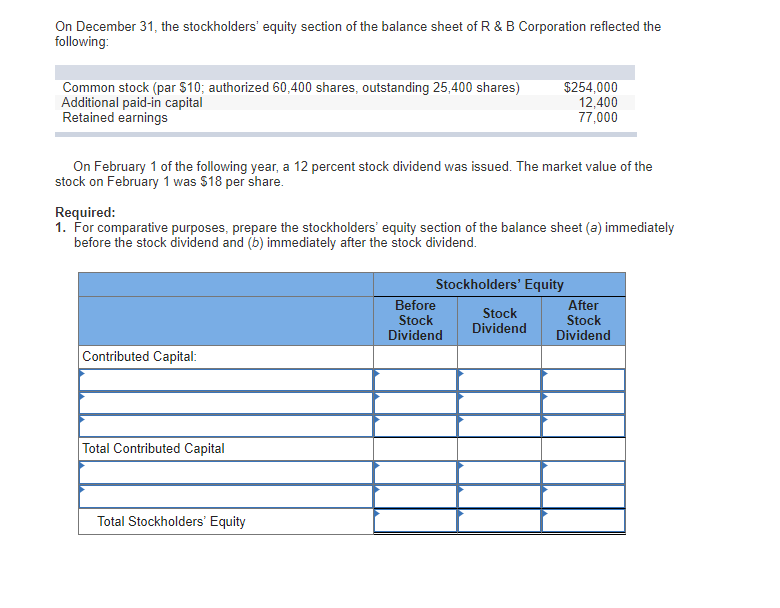

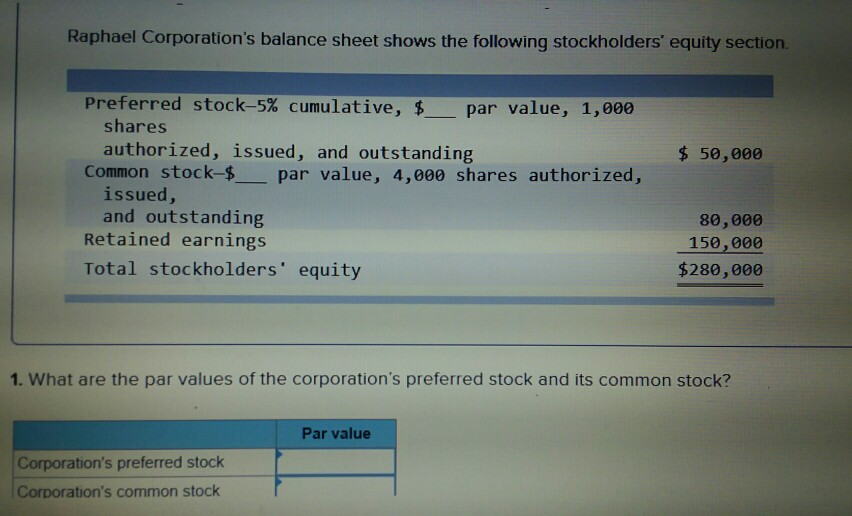

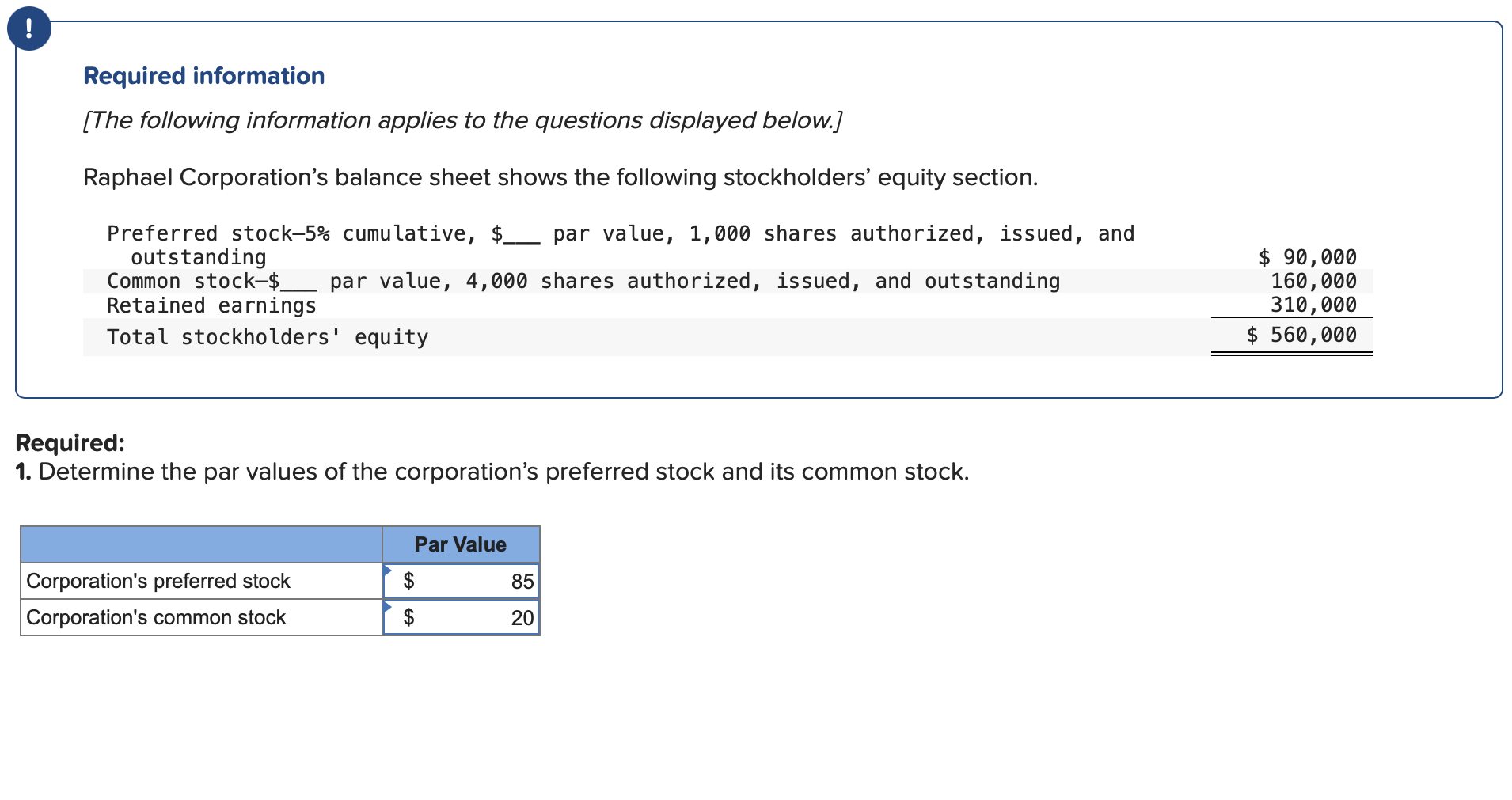

Outstanding shares on balance sheet. This line refers to a special class of shares that gives investors. Look on the income sheet to find the business' net income. Look in the line item for preferred stock.

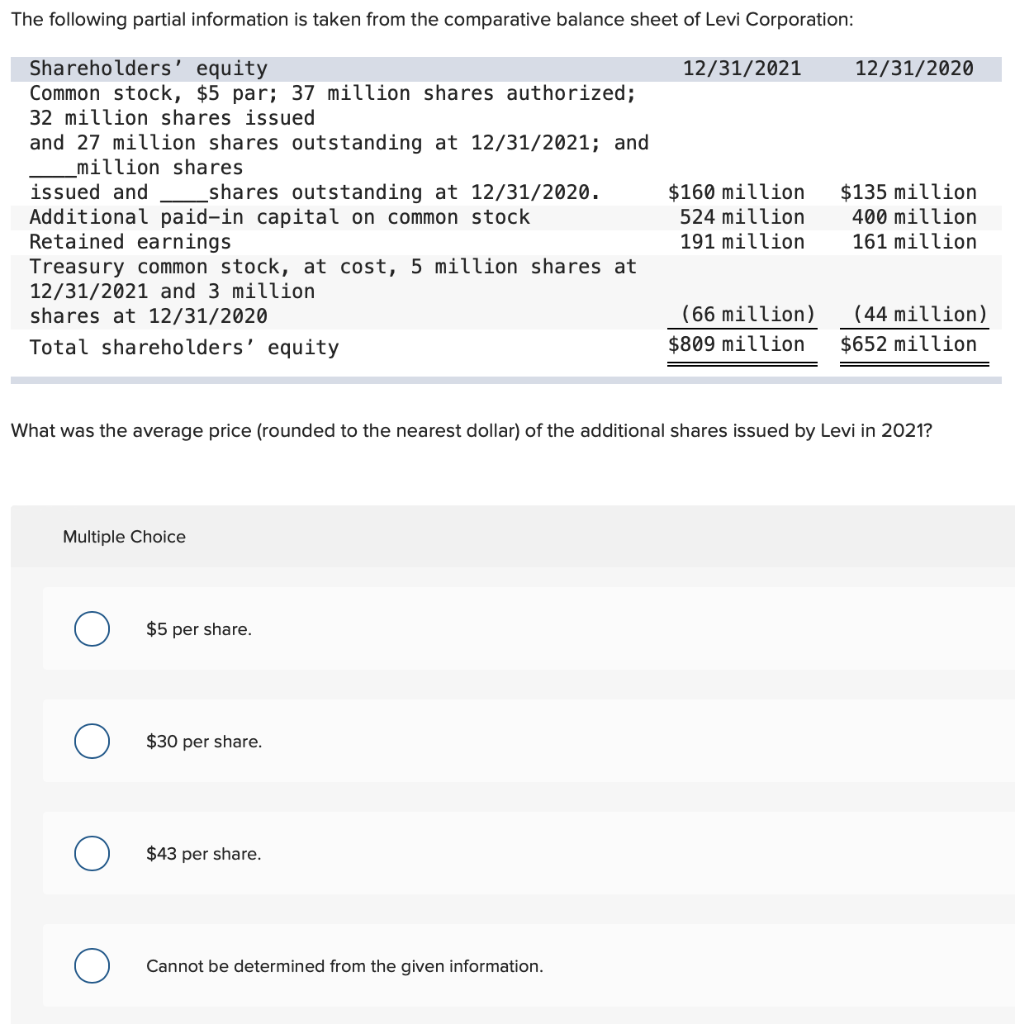

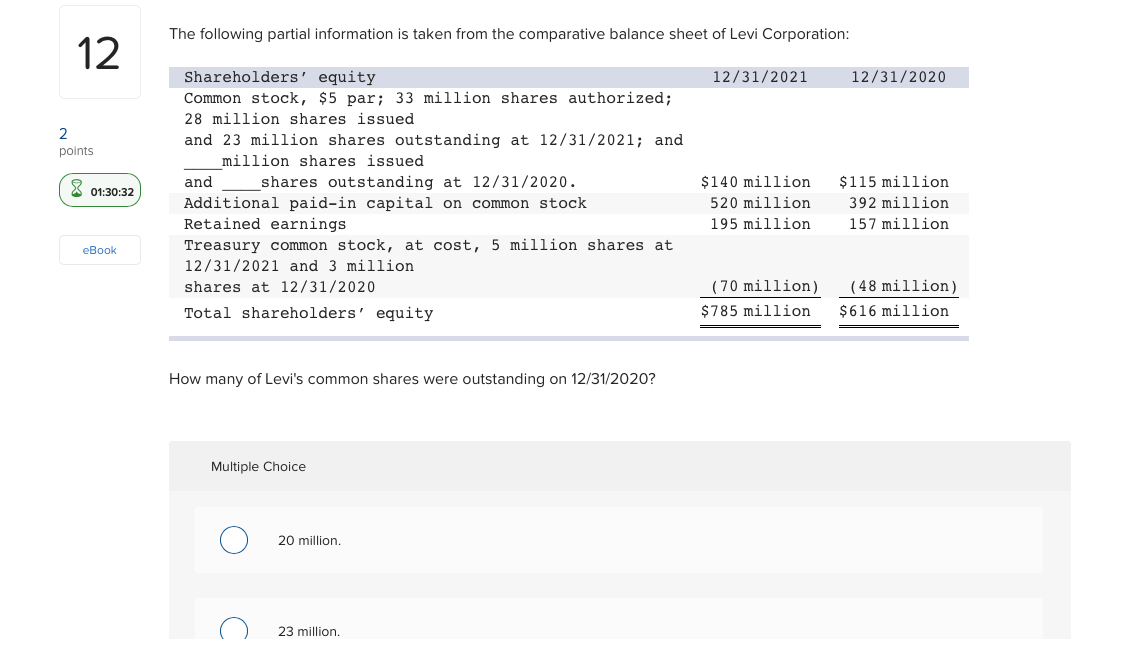

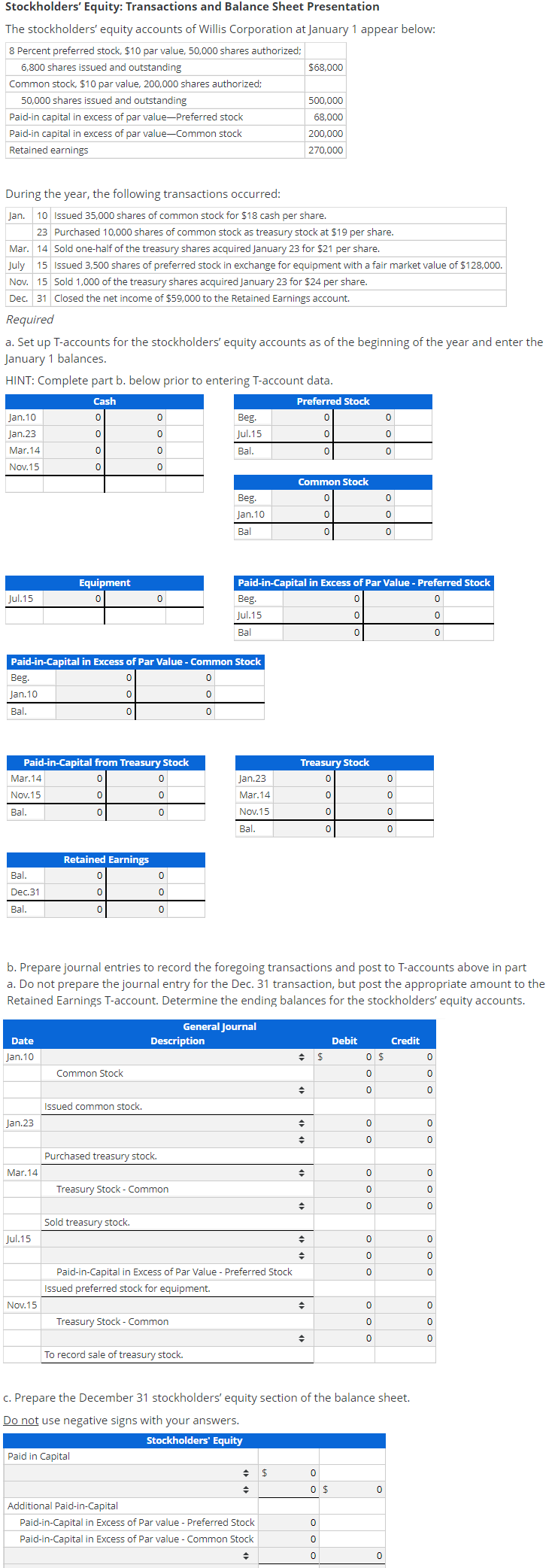

Thanks to the sec, common stock outstanding is very easy to calculate all companies are required to report their. It is the number of shares that have been authorized and issued to investors, which can be both institutions and individuals. Shares outstanding is a financial number that represents all the shares of a company's stock that shareholders, including investors and employees, currently own.

Additionally, publicly listed corporations are required to disclose the total shares outstanding and issued shares, and they typically do so in the investor relations parts of their websites or on the websites of. Outstanding shares are the shares available with the company’s shareholders at the given time after excluding the shares that are repurchased by the company, and it is shown as part of the owner’s equity in the liability side of the balance sheet of the company. It is also equal to the shares outstanding number.

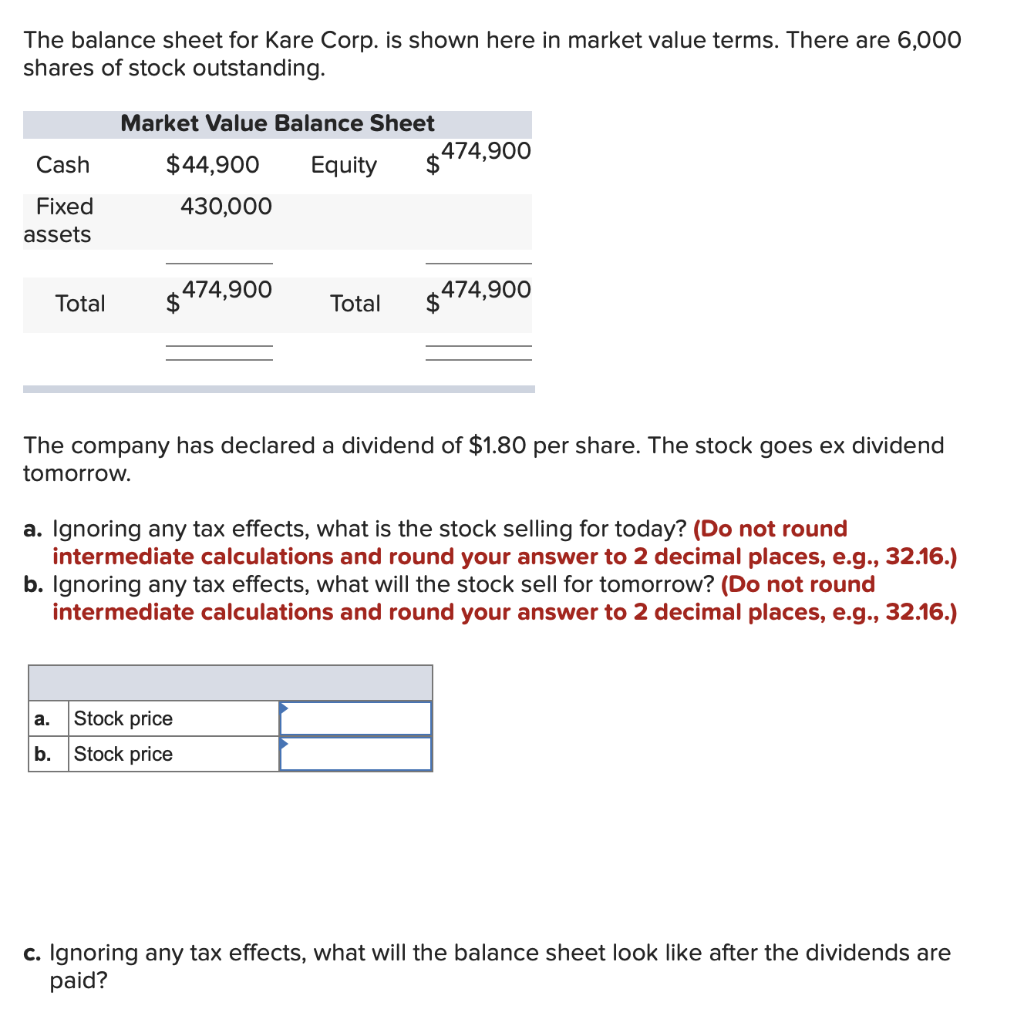

For investors, knowing the shares outstanding is important for calculating financial metrics and understanding the stake in a company that a share represents. Public reports in which companies list the total outstanding shares include a quarterly or annual report or a balance sheet. Outstanding shares are the number of a company's shares available on the secondary market.

Outstanding shares include share blocks held by institutional investors and restricted. The total number of a company's outstanding shares as seen in the balance sheet is the sum of float and restricted shares. Basic shares outstanding are a company’s total number of shares available for trading in the stock market.

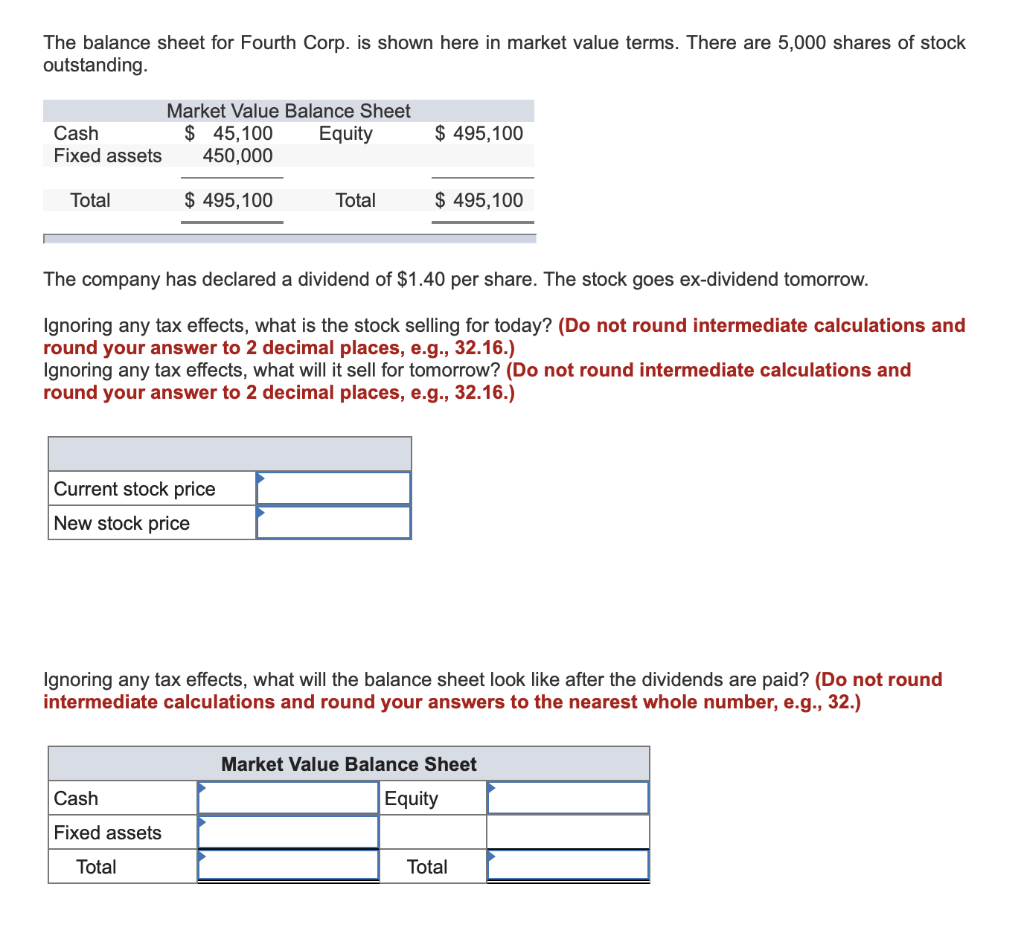

The outstanding shares are less than or equal to issued shares. The current stock price multiplied by the. How outstanding shares work.

Go to the balance sheet of the company in question and look in the shareholders' equity section, which is near the. You can find the number of shares outstanding by looking at the company’s balance sheet. They can also be found on the company’s annual report in the capital section.

The number of outstanding shares may also be used to calculate the company’s market capitalization : Shares outstanding are located on a company’s balance sheet and listed under the shareholders’ equity section. March 23, 2021 what are basic shares outstanding?

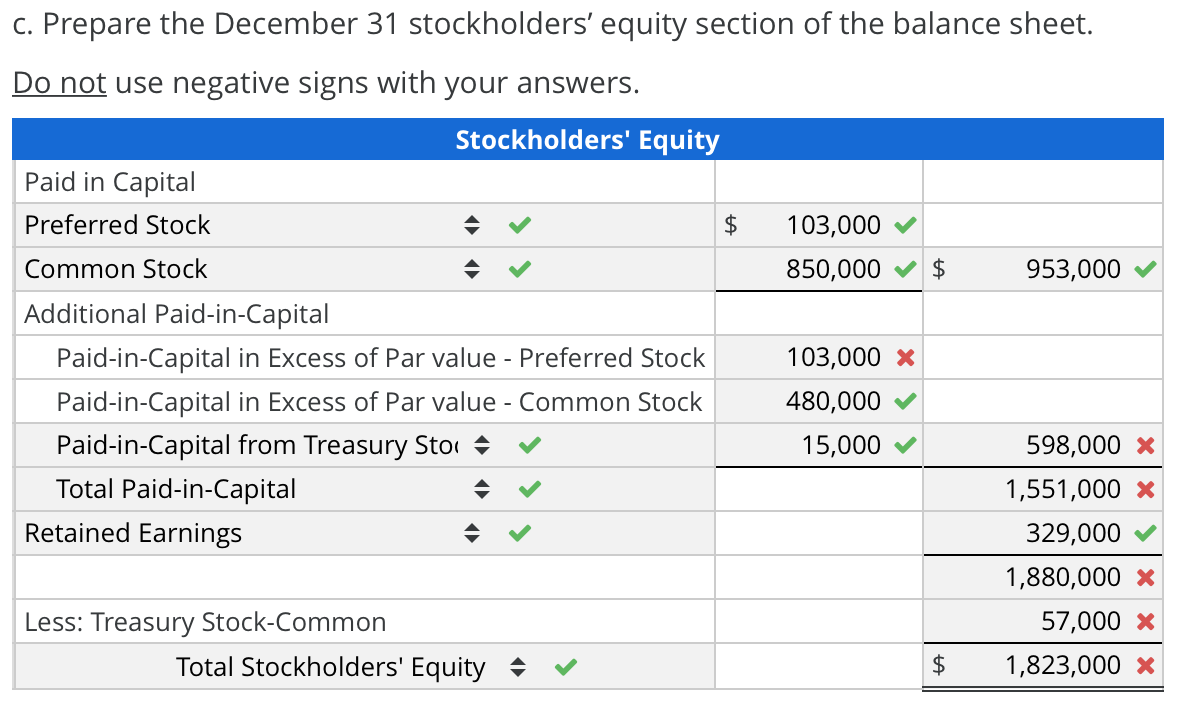

What are outstanding shares? Voting rights dividend preferences priorities in the event of liquidation The number of issued shares is recorded on a company’s balance sheet as capital stock or owners' equity, while the shares outstanding (issued shares minus any shares in the treasury).

They are reflected as capital stock. All companies that publicly trade stock must list this figure on the balance sheet. However, typically there are multiple different share types with varying: