Looking Good Tips About Post Closing Entries To T Accounts

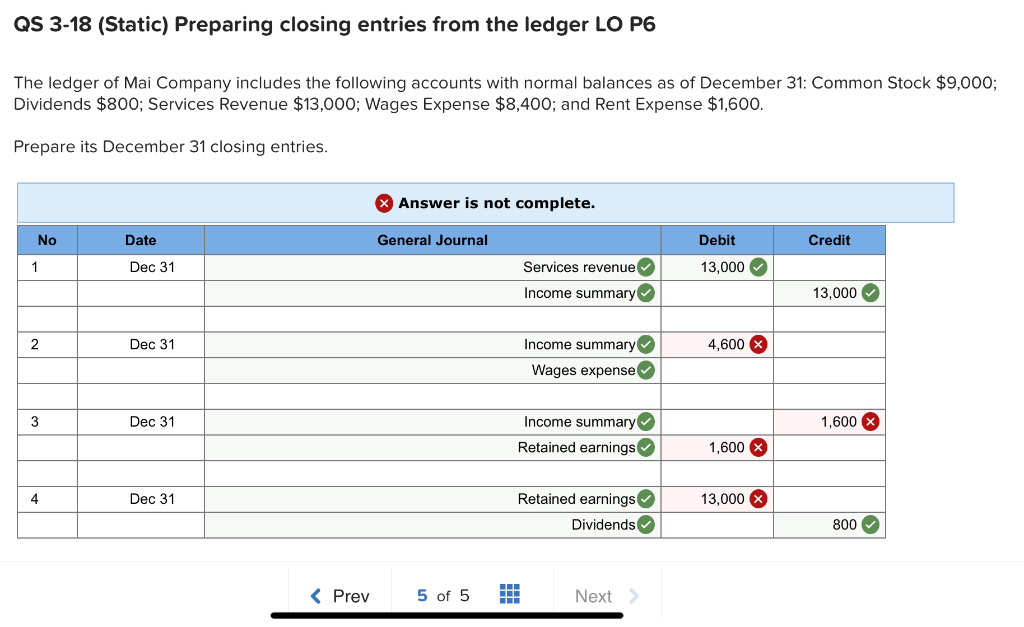

A closing entry is a journal entry that is made at the end of an accounting period to transfer balances from a temporary account to a permanent account.

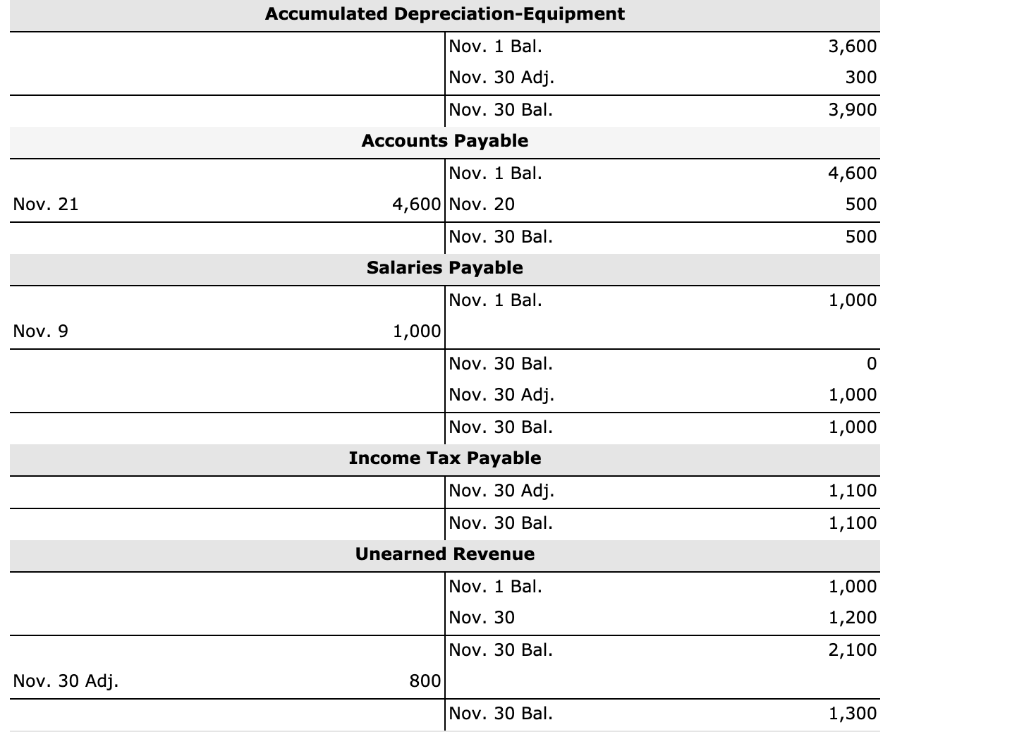

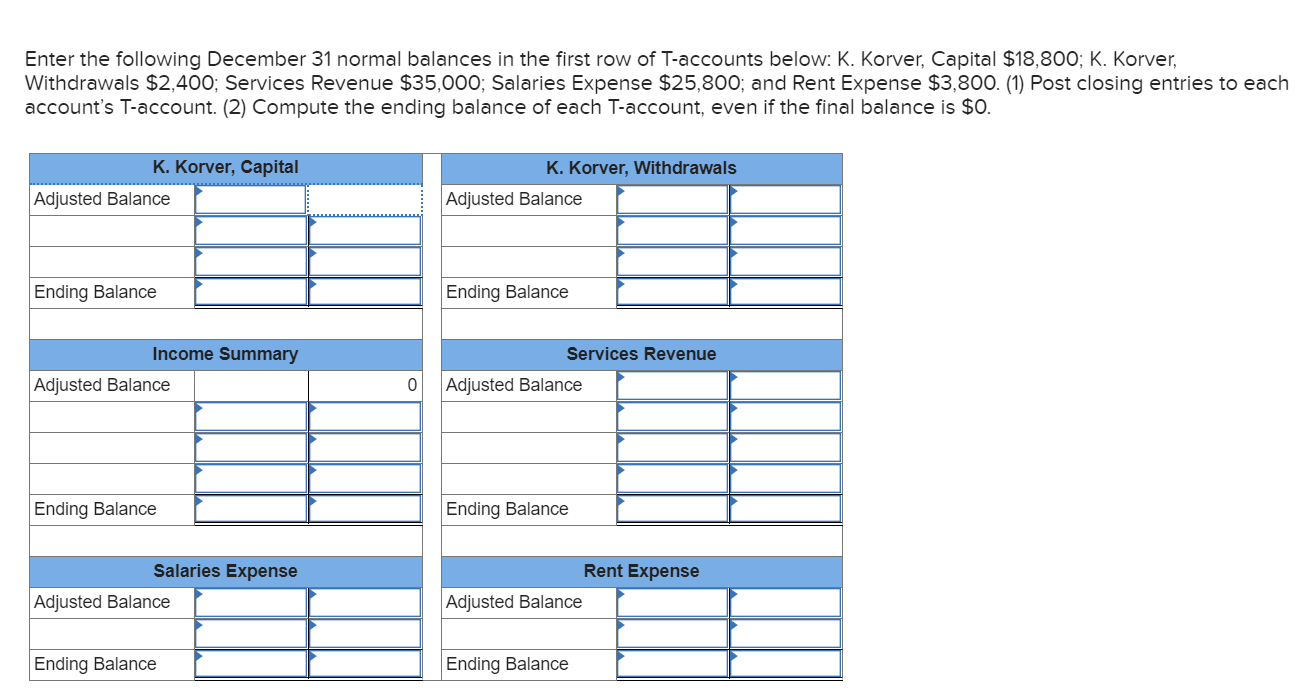

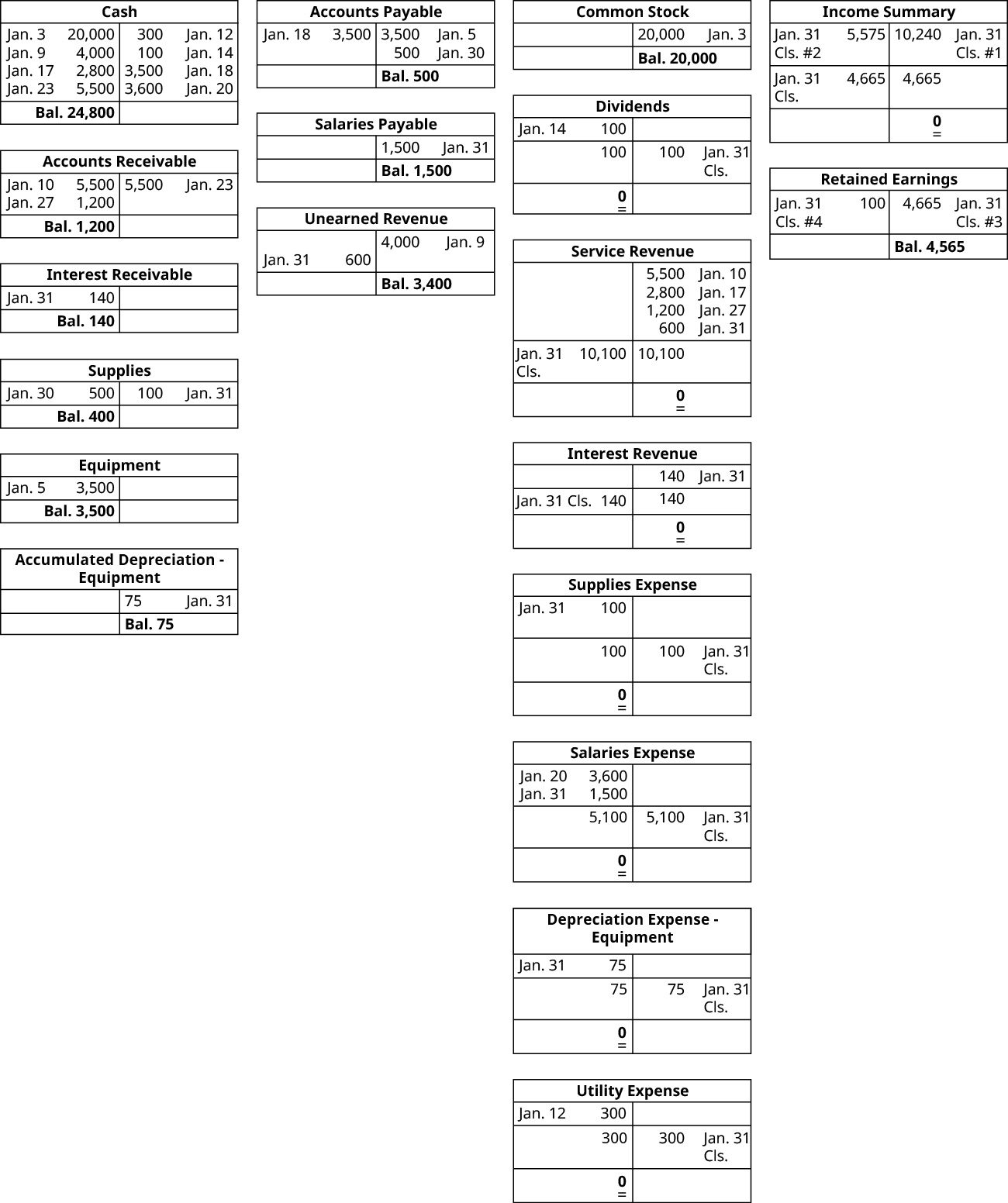

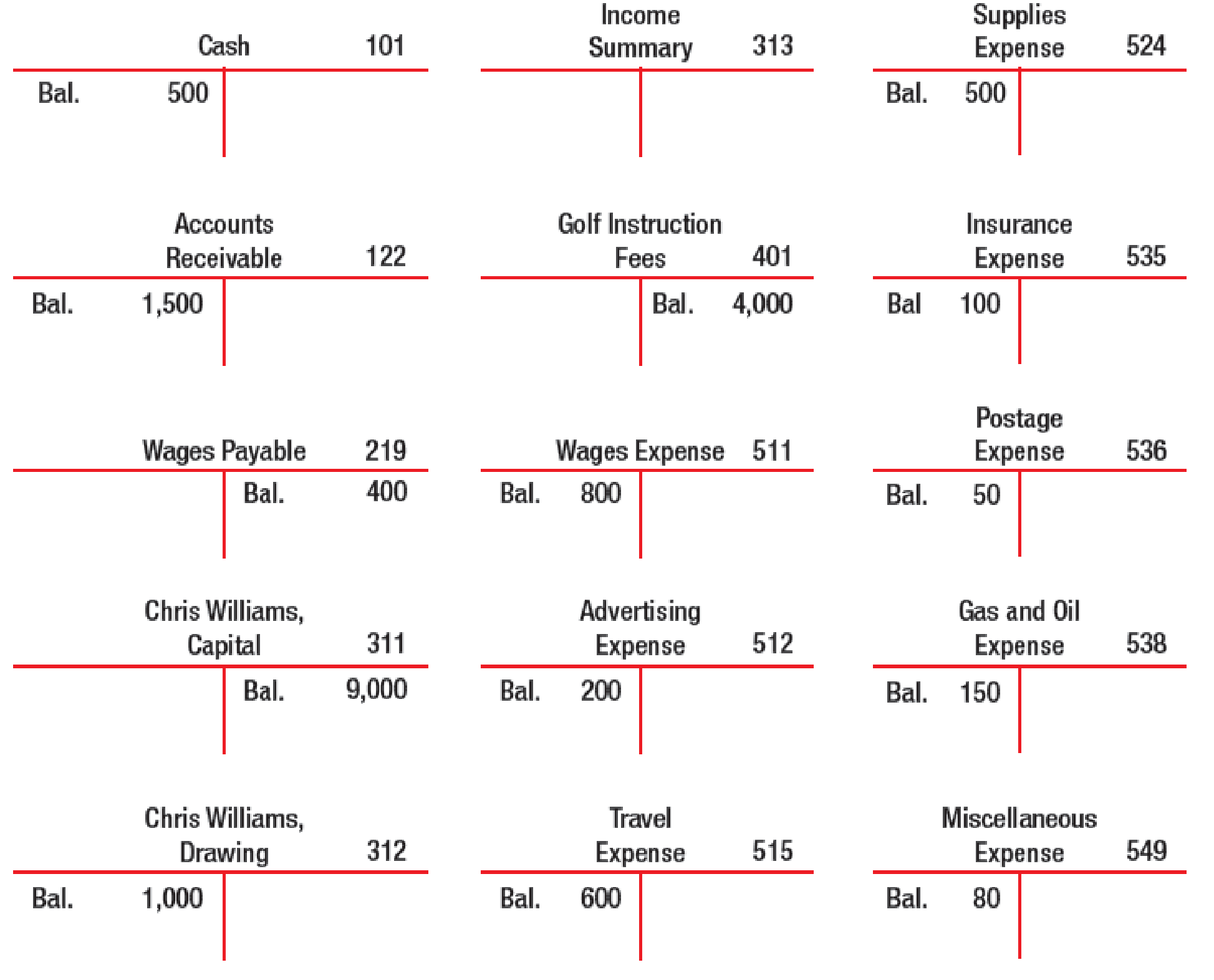

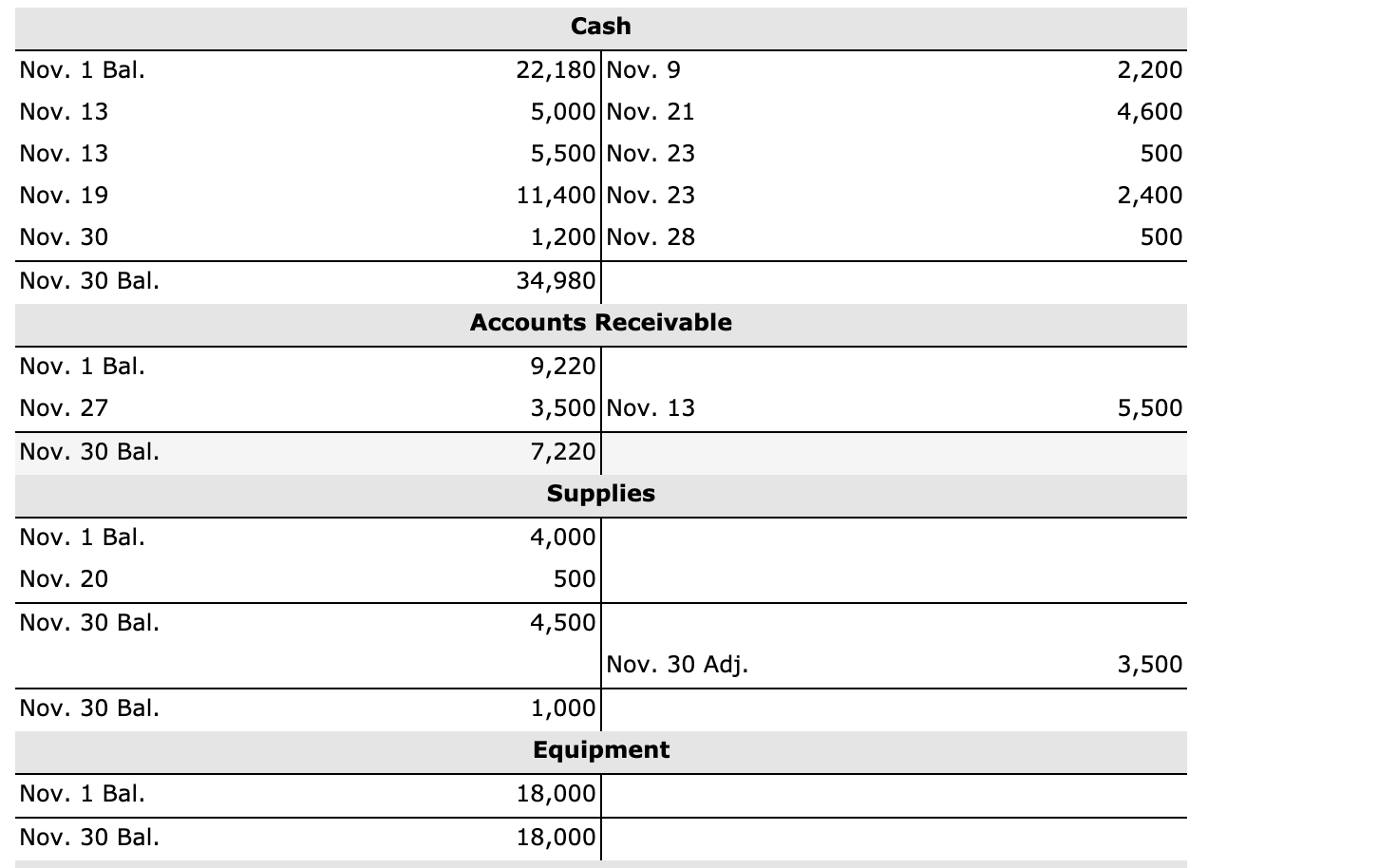

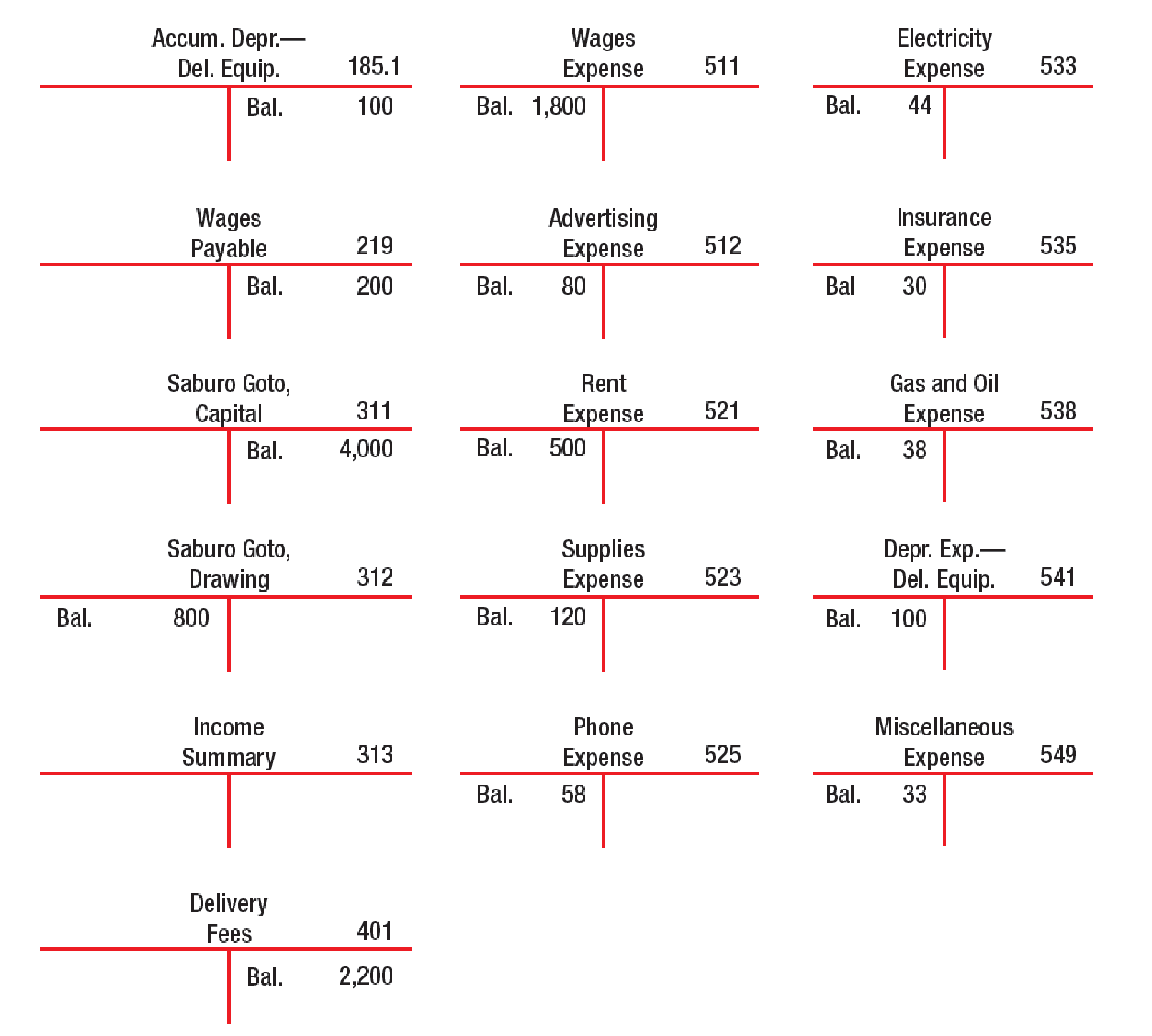

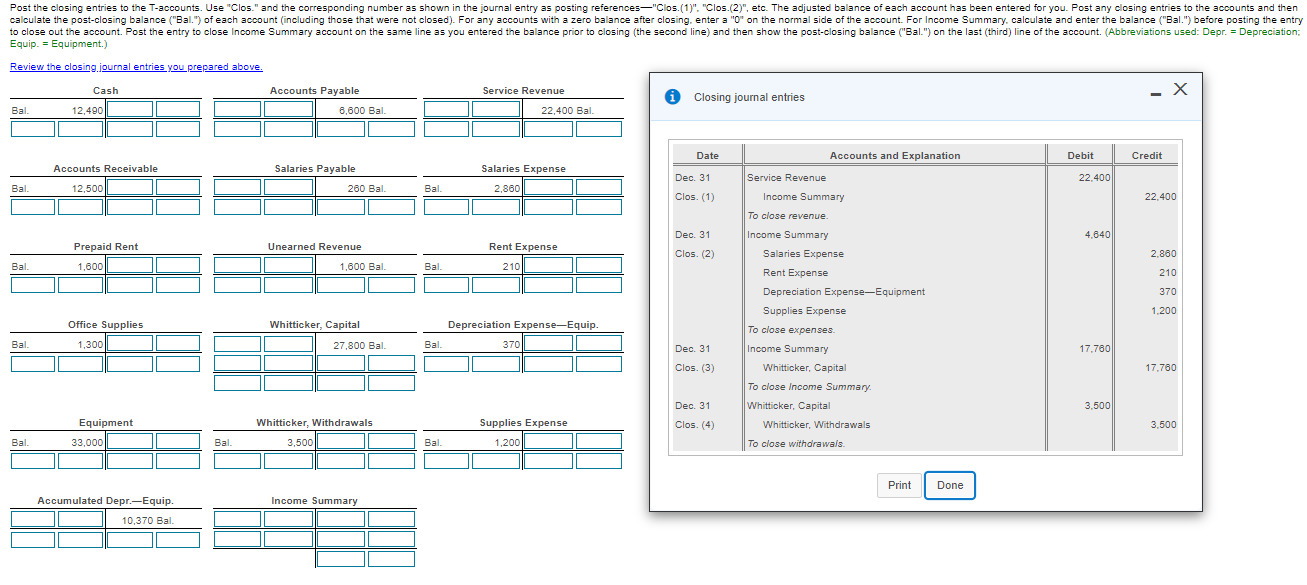

Post closing entries to t accounts. When all accounts have been recorded, total. Its purpose is to test the equality between debits and credits after the. Closing entries are journal entries posted at the end of an accounting period to reset temporary accounts to zero and transfer their balances to a permanent.

This is recorded as a closing entry by debiting the. We see from the adjusted trial balance that our revenue accounts have a credit balance. By zeroing out the temporary accounts, you can start.

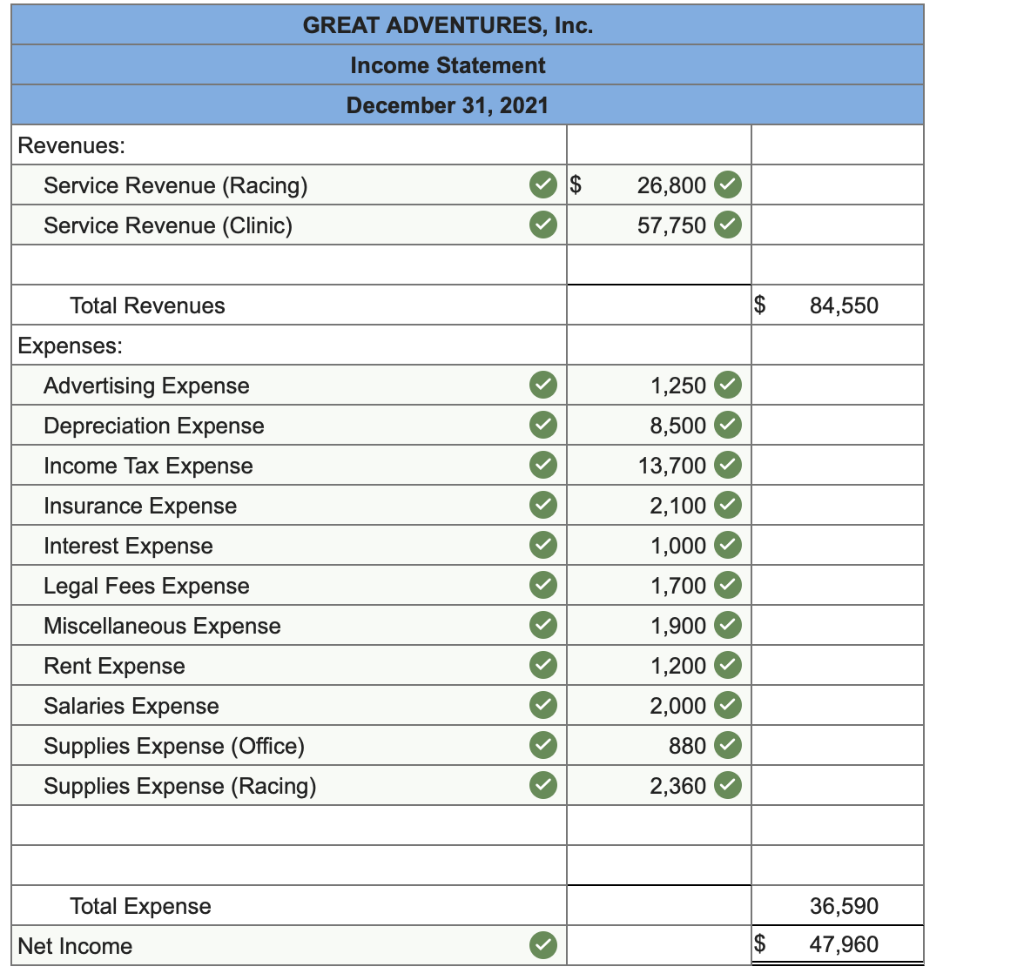

For example, if the business had $100,000 in expenses and $150,000 in revenues, the business had a gain of $50,000. Use clos. and the corresponding number as shown in the journal entry as posting referenceslong dash— clos. Closing entries serve two main purposes:

This transaction shows expenses incurred by the company and the creation of liability to pay off that expense. The following are the journal entries recorded earlier for printing plus. On january 3, 2019, issues $20,000 shares of common stock for cash.

Enter debits on the left and credits on the right side of the t. T accounts for the income statement. ️ lilac blue puff hood giveaway have you ever wanted an ellore hoodie for free?

An account’s balance is the amount of that item at a particular. Close revenue accounts close means to make the balance zero. It has a credit balance of $9,850.

To zero out the temporary accounts and to update the permanent accounts.