First Class Info About Payment Balance Sheet

What is a balance sheet?

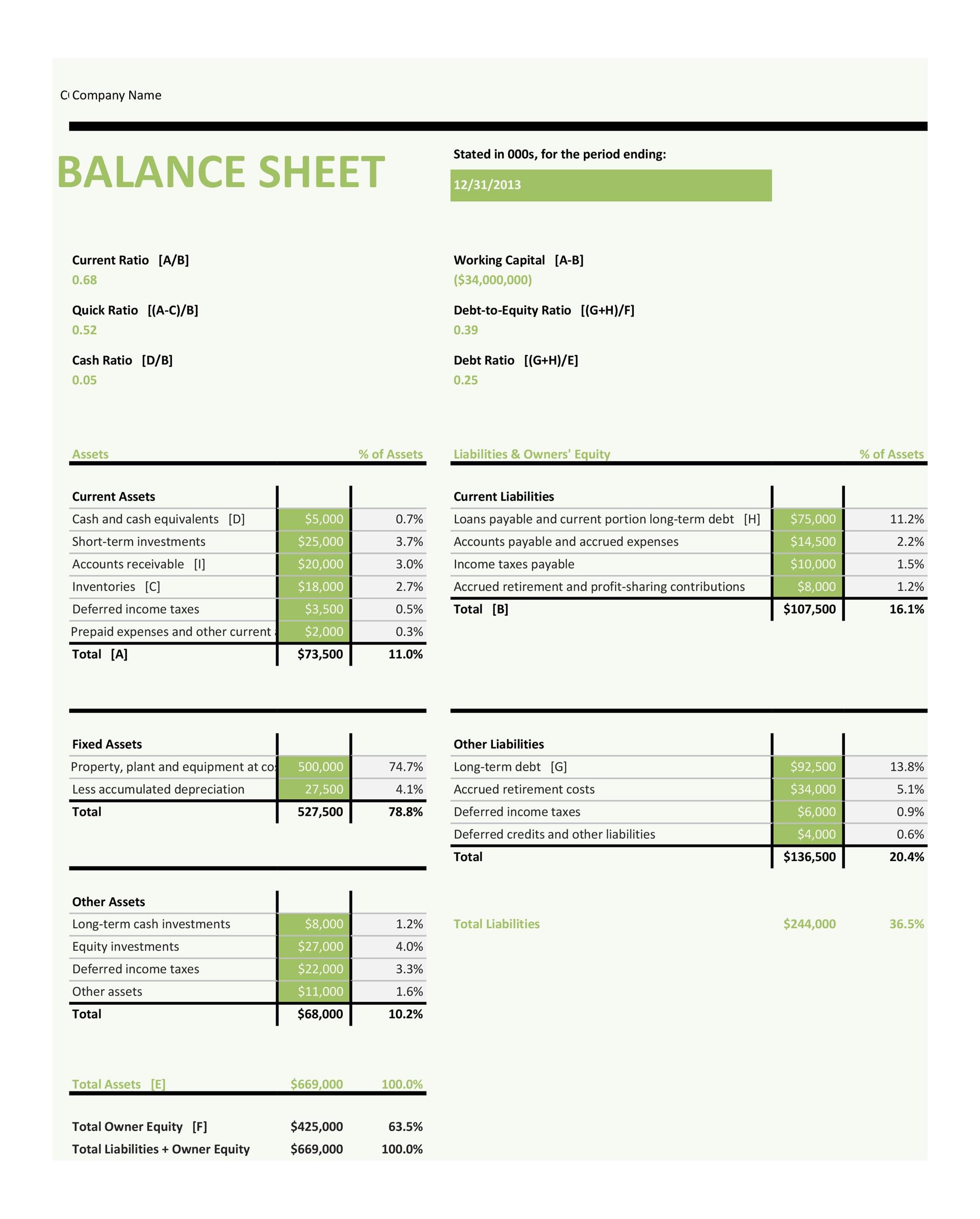

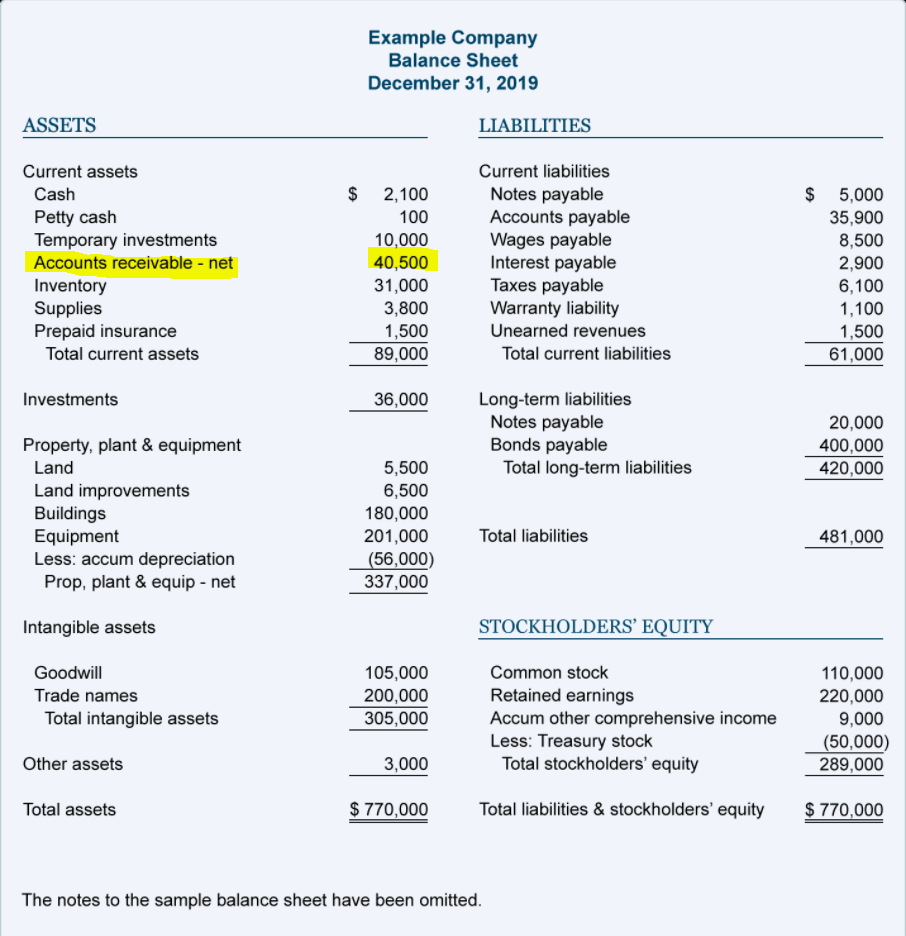

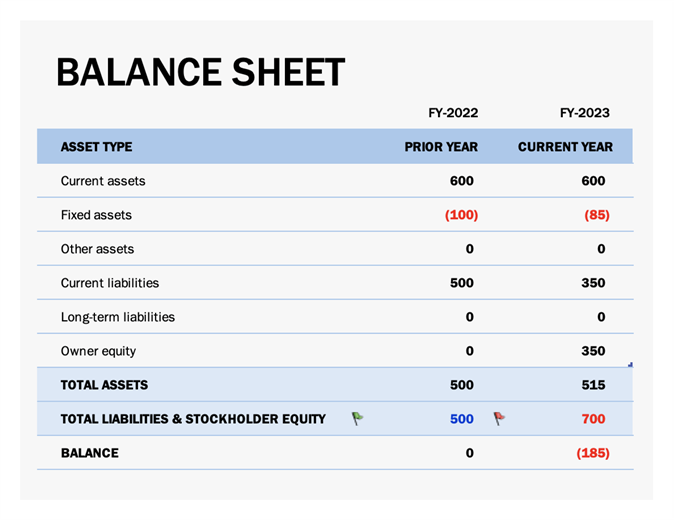

Payment balance sheet. The advance payment is classed as earned revenue if the payment is for goods and services that have been partially or completely delivered to the customer, but have not yet been invoiced. Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date.the main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. When a company purchases goods or services, it receives an invoice from the vendor.

When dividends are paid, the impact on the balance sheet is a decrease in the company's dividends payable and cash balance. Here we explain how an entry in accounting is made for it along with examples, and vs prepayment. Updated april 30, 2021 reviewed by amy drury what are dividends?

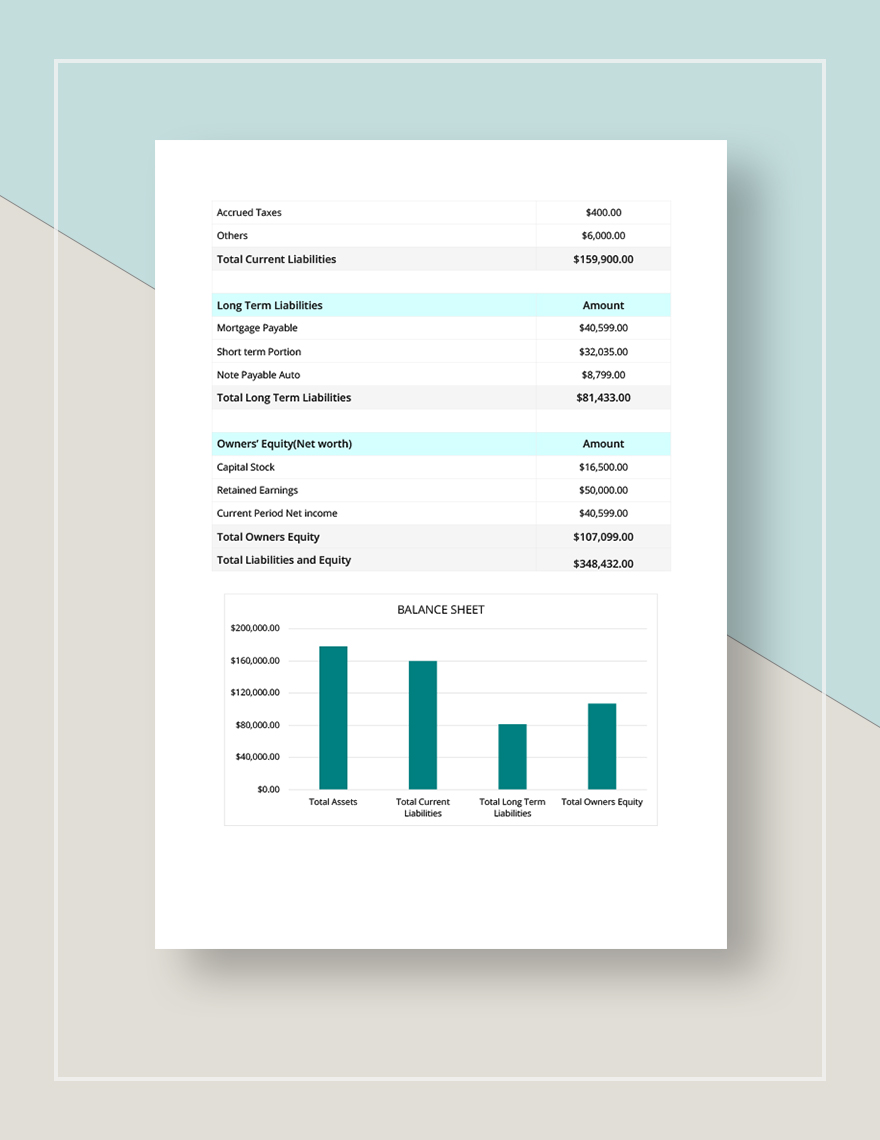

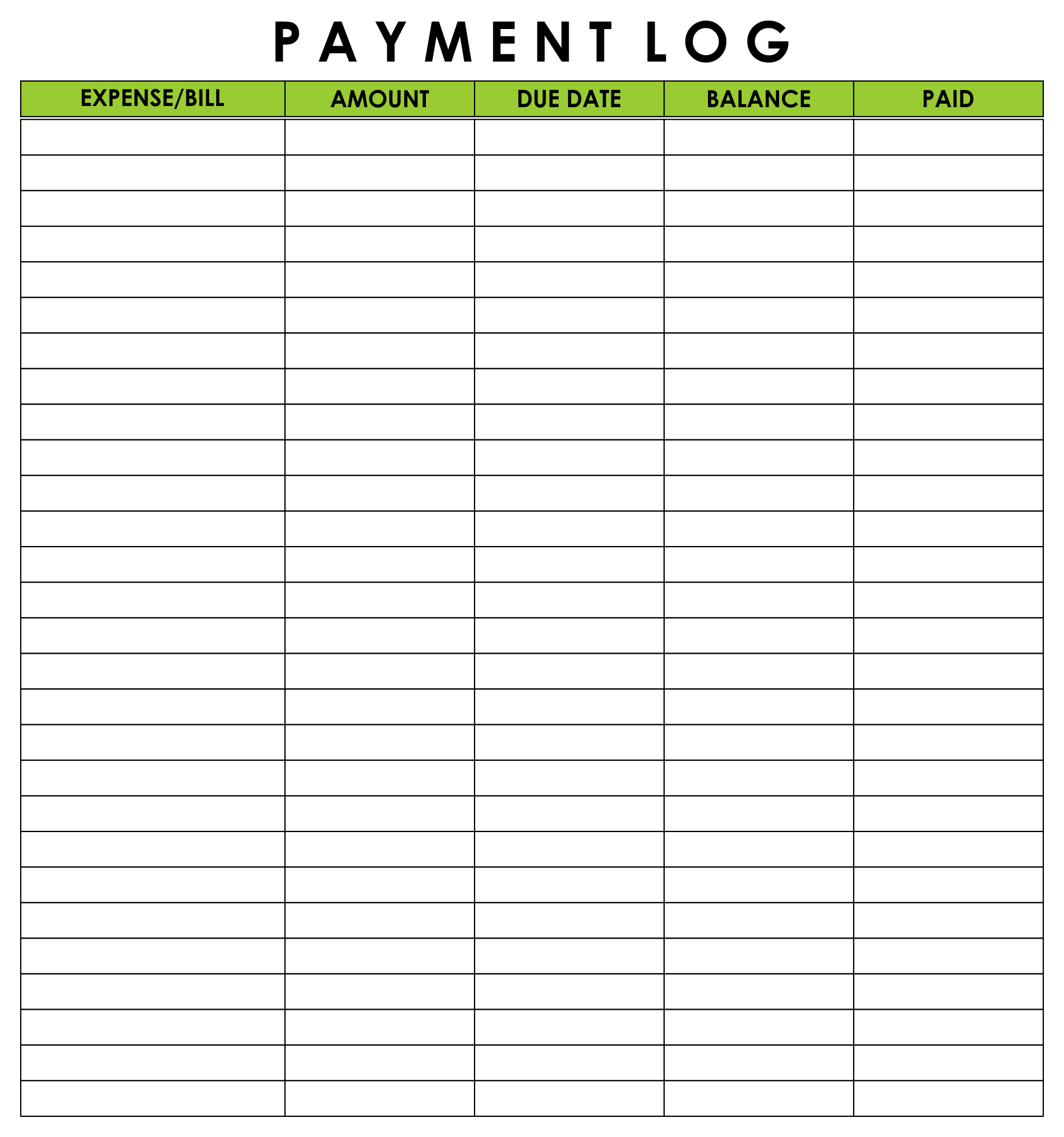

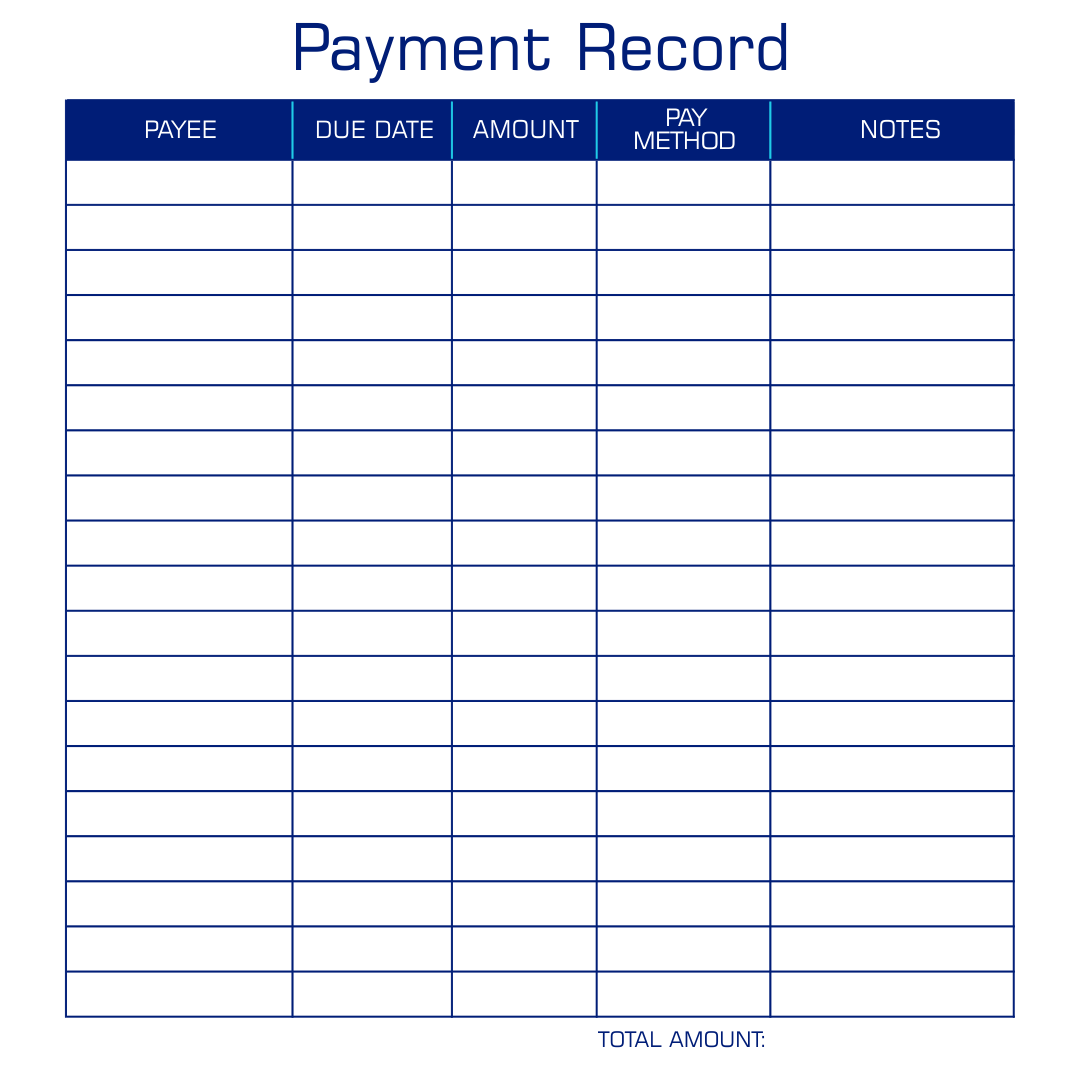

Browse dozens of sample blank bill statements, proforma invoices, standard work payment balance sheets, and even law firm tax invoices. A balance sheet includes a summary of a business’s assets, liabilities, and capital. Accounts payable (ap) is a liability that appears on a company’s balance sheet.

Advance payments are recorded as assets on a company's balance sheet. Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new. Creating your personal balance sheet.

Balance sheets are typically organized according to the following formula: It appears on the assets side of the balance sheet as a prepaid expense for the buyer. Close brothers group plc said it won’t pay any dividends for the 2024 financial year as it looks to strengthen its balance sheet amid a regulatory review of historic car finance loan.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. As these assets are used, they are expended and recorded on the income statement for the period in which they are incurred. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

The company’s balance sheet is an accounting report that shows a company’s assets, liabilities, and shareholders’ equity. Personal assets are what you own. While the balance sheet can be.

The fundamental accounting equation states that a company’s assets must be equal to the sum of its liabilities and shareholders’ equity. Fact sheets published by the irs in 2023. Among other values, the balance sheet includes how much money a company expects to be paid (as assets) and how much it expects to pay out (as liabilities).

The balance sheet is based on the fundamental equation: Assets = liabilities + owners’ equity Furthermore, the accounts payable balance is reflected in the balance sheet, specifically in the current liabilities section, and includes all invoices that are due to be paid.

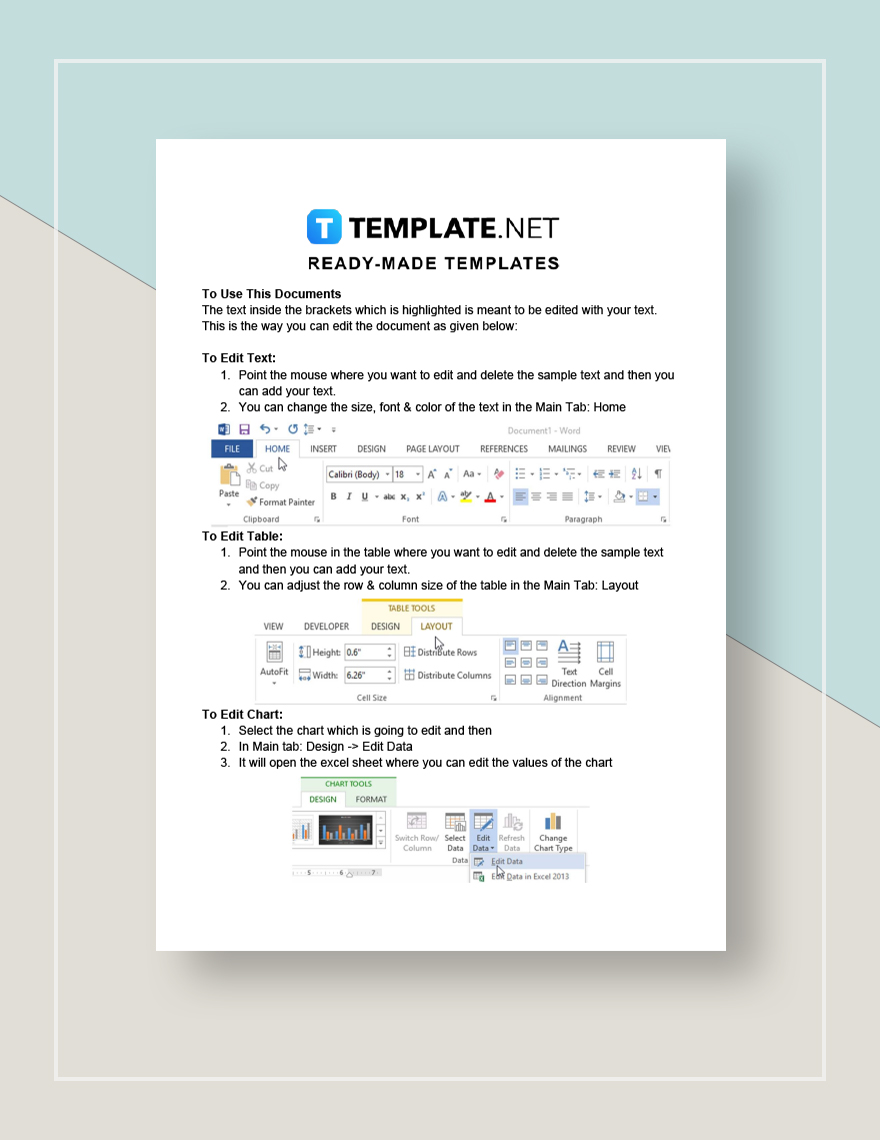

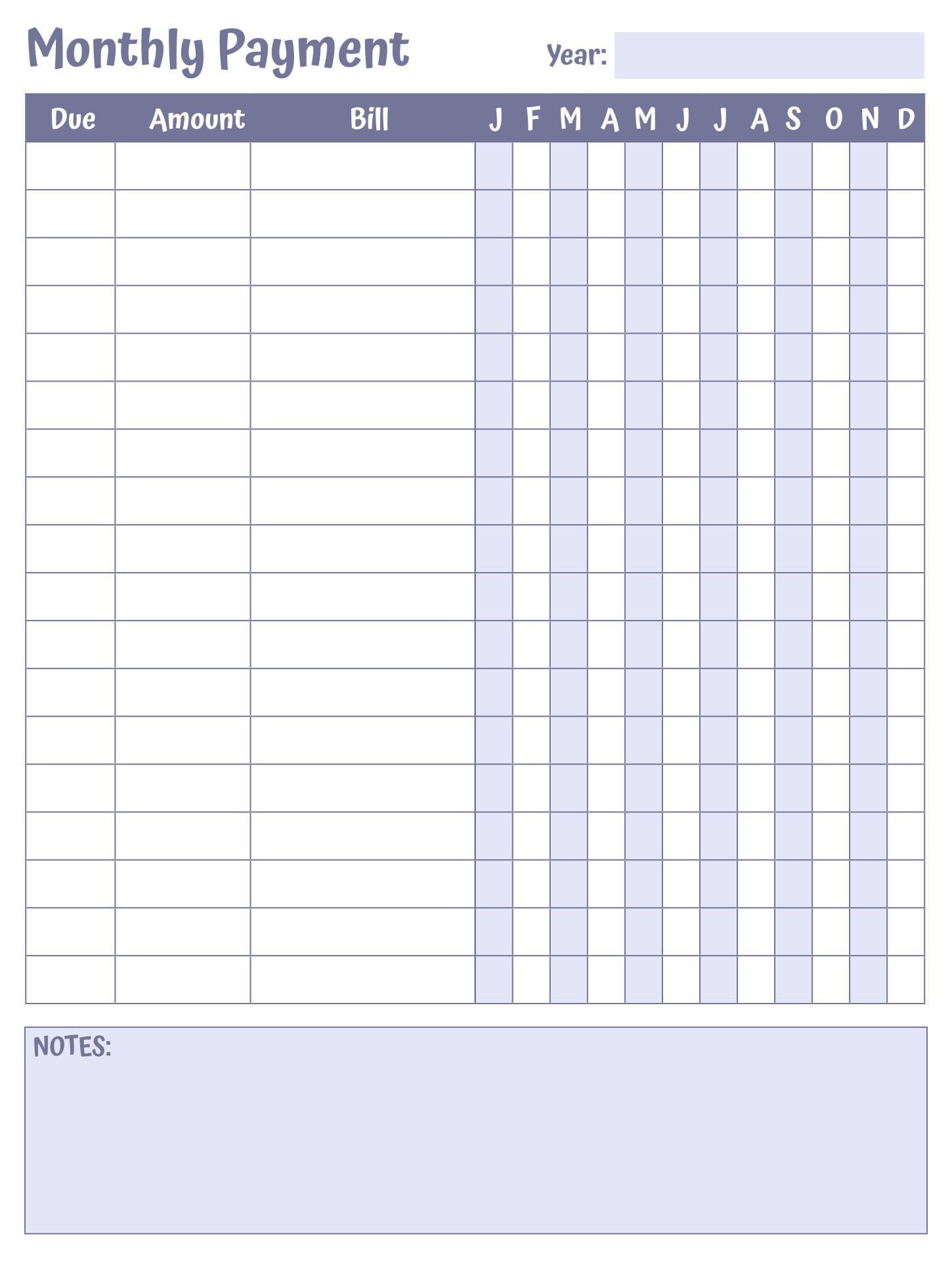

Sales and balance sheet update for the 47 weeks ended 21 january 2024, further trading statement for the full 2024 financial year, strategic response and cautionary announcement sales update for. As a result, the balance sheet size is reduced. Managing work budget & accounting free balance sheet templates get free smartsheet templates by andy marker | january 7, 2019 (updated april 28, 2023) we’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors.

![49 Free Payment Schedule Templates [Excel, Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2021/03/payment-schedule-template-12-scaled.jpg?w=790)