Best Of The Best Info About Not For Profit Cash Flow Statement

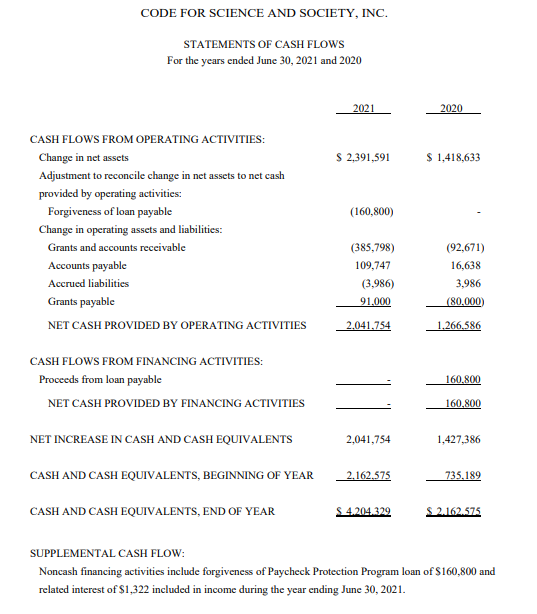

A nonprofit statement of cash flows is a financial report that shows how cash moves in and out of an organization on a regular basis.

Not for profit cash flow statement. Income and expenses from investments. Your cash flow statement summarizes where you cash flow went and where it came from. Cash inflows for a nonprofit come from contirbutions of cash, checks, fundraising efforts, and grants.

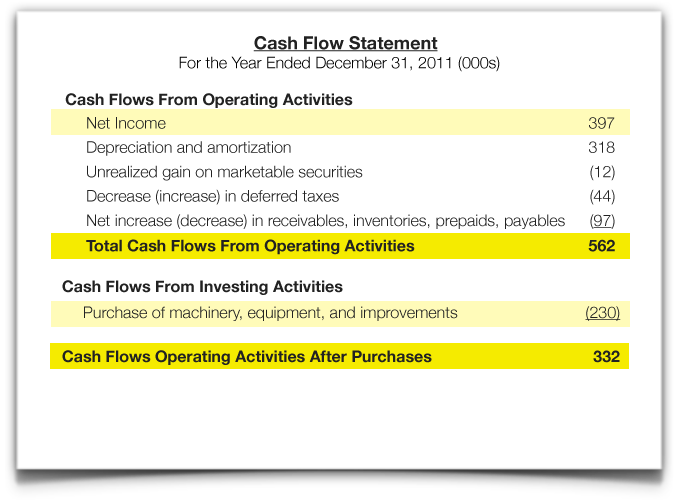

A cash flow statement is a financial document that details the inflows and outflows of cash for a company over a specific period of time. Rbi faq effectively winds down wallet business. Understanding the ebbs and flows of your organization’s cash will help you make smart management decisions that protect your core programs and overall sustainability.

Business model moving to a pure payments company. The purpose of the cash flow statement is to provide information about the sources and uses of cash in the organization. This report is pulled on a monthly basis and is.

Adjusted income statement, balance sheet and cash flow adjusted income statement (in euro million) fy 2022 fy 2023 % change revenue 19,035 23,199 22% other recurring operating income and expenses (16,724) (20,155) share in profit from joint ventures 97 122 recurring operating income 2,408 3,166 31% % of revenue 12.6%. Cash flows from operating activities cash flows from investing activities Potential upcoming shortages in cash flow.

Nonprofit cash flow statement. Why do nonprofits need financial statements? A properly prepared cash flow statement gives organizational leaders insight into:

Operating activities investing activities financing activities For a comprehensive discussion of general issues related to preparing a statement of cash flows, see fsp 6. Moved to 'not rated' from 'underpeform' until news flow settles.

The cash flow statement can be used to give insights into a company’s operating, investing, and financing activities. The scf reports the organization's change in its cash and cash equivalents during the accounting period. How would this contribution be reflected?

This report is pulled on a monthly basis and is typically composed of three primary sections. Pac prepares its cash flow statement using the indirect method. In this article, we describe changes to the statement of cash flows.

Nonprofits must file four statements every year to comply with irs rules. A nonprofit cash flow statement is a financial statement that shows the inflows and outflows of cash in a nonprofit organization over a specific period of time—usually a month, quarter, or year. A nonprofit organization, organized under section 501(c) of the tax.

These sections include the cash flows from: Statement of cash flow for a nonprofit organization reporting what is a statement of cash flow for a nonprofit organization ? Cash flow statements are generally required under gaap principles.

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)