Simple Tips About Retained Earnings In Balance Sheet Meaning

The recording of retained earnings is done on the balance sheet of a.

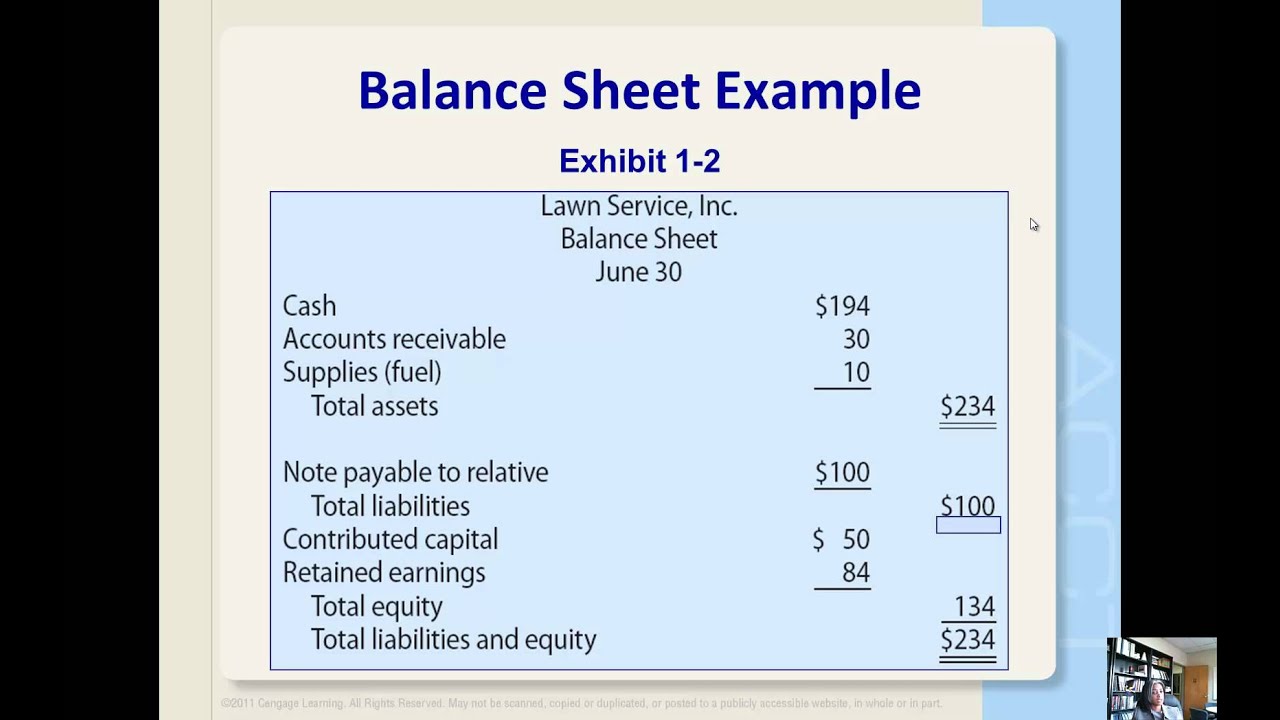

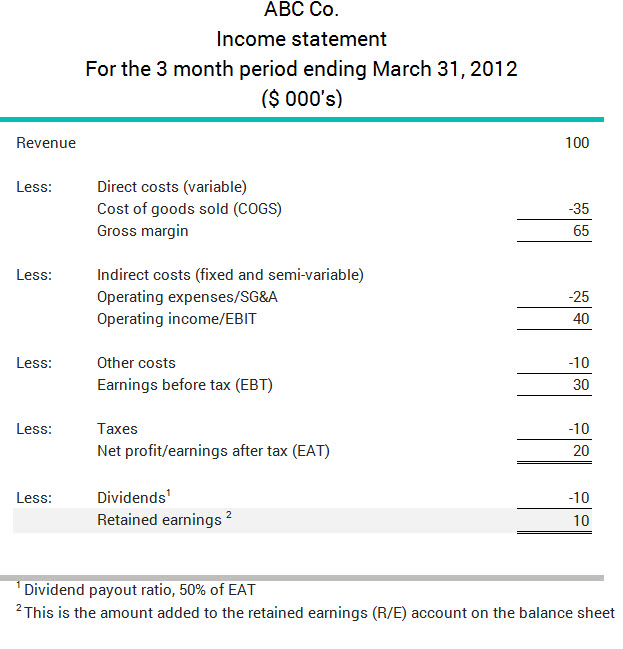

Retained earnings in balance sheet meaning. Calculation and what it means. Retained earnings can be found in the shareholders’ equity section of a company’s balance sheet. Retained earnings on a balance sheet represent the accumulated profits of a company.

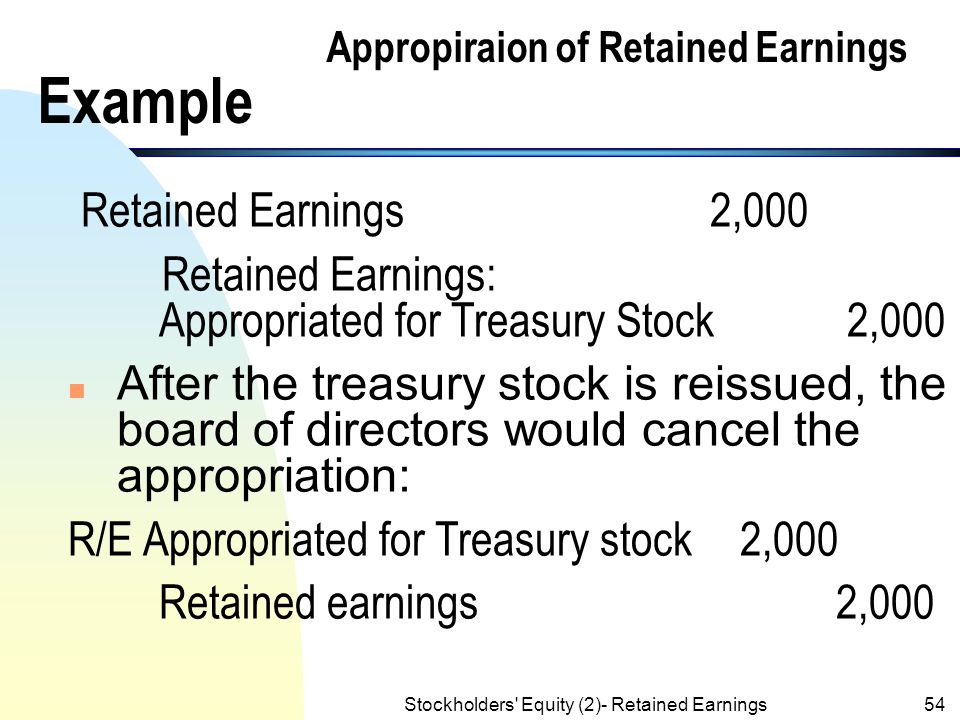

Retained earnings appear on the trial balance as part of equity and represent the link between the income statement and the balance sheet. Retained earnings, on the other hand, are derived from the bottom line, or profit of the income statement and is an important element in both the shareholder’s equity portion of. Retained earnings are one element of an owner’s equity, or a shareholder’s equity, and are classified as such.

For manual calculations, you should take into consideration the following. Retained earnings refer to the residual net income or profit after tax which is not distributed as dividends to the shareholders but is reinvested in the business. Retained earnings can be found on the right side of a balance sheet, alongside liabilities and shareholder’s equity.

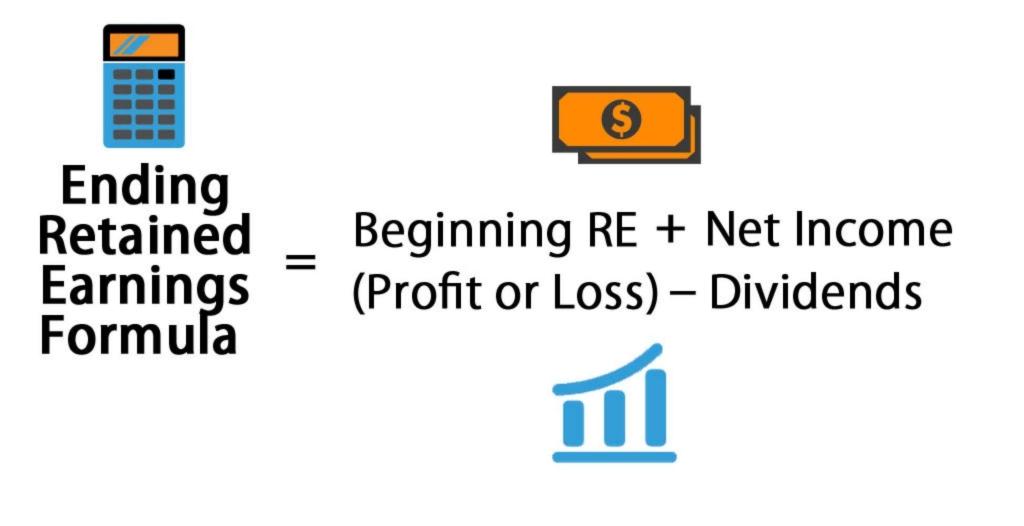

Retained earnings on a balance sheet. Retained earnings are cumulative on the balance sheet. To calculate retained earnings, follow these steps:

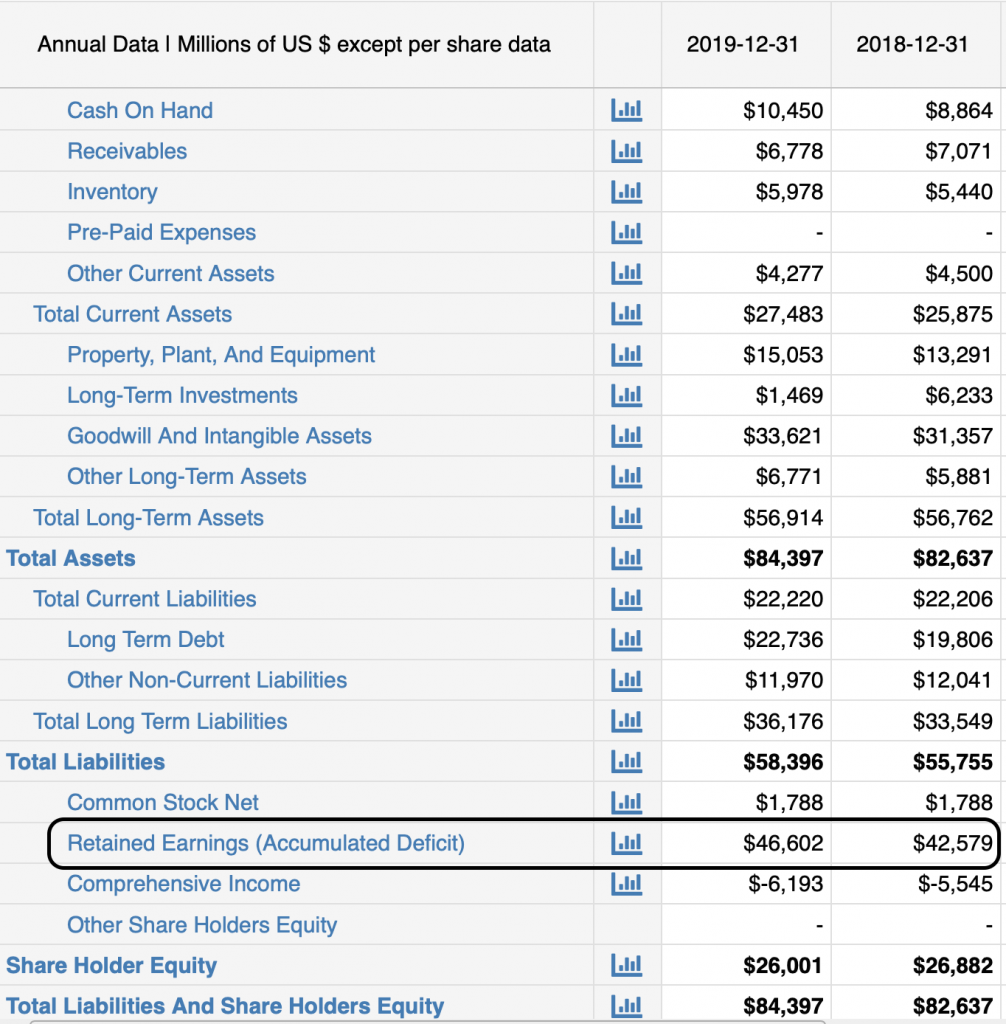

In the next accounting cycle, the re ending balance from the previous accounting period. Net income can be found near the end of a company’s income statement. At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends paid to shareholders.

Balance sheet retained earnings can be calculated by taking the beginning balance of retained earnings on the balance sheet,. The purpose of these earnings is to reinvest the. Now that we’ve recorded the expense on the income statement and the corresponding entry in liabilities, our balance sheet is unbalanced.

Next, find the net income. This financial metric is reported under shareholders’ equity and reflects the. Financials for the most recent quarter look like this:

The investor wants to know what retained earnings look like to date. Locate the beginning retained earnings on your previous period’s balance sheet. Retained earnings are the amount of profit a company has left over after paying all its direct costs, indirect costs, income taxes and its dividends to shareholders.

Retained earnings on a balance sheet are the amount of net income remaining after a company pays out dividends to its shareholders. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders.