Real Tips About Pro Forma Financial Statements Are Used To

They can look forward or backward, revealing insights that standard financial statements.

Pro forma financial statements are used to. Pro forma statements are used to analyze the financial impact of a major business decision. And they’re not just for big corporations. Pro forma financial statements are a great resource for predicting a company’s financial position after a certain change is made.

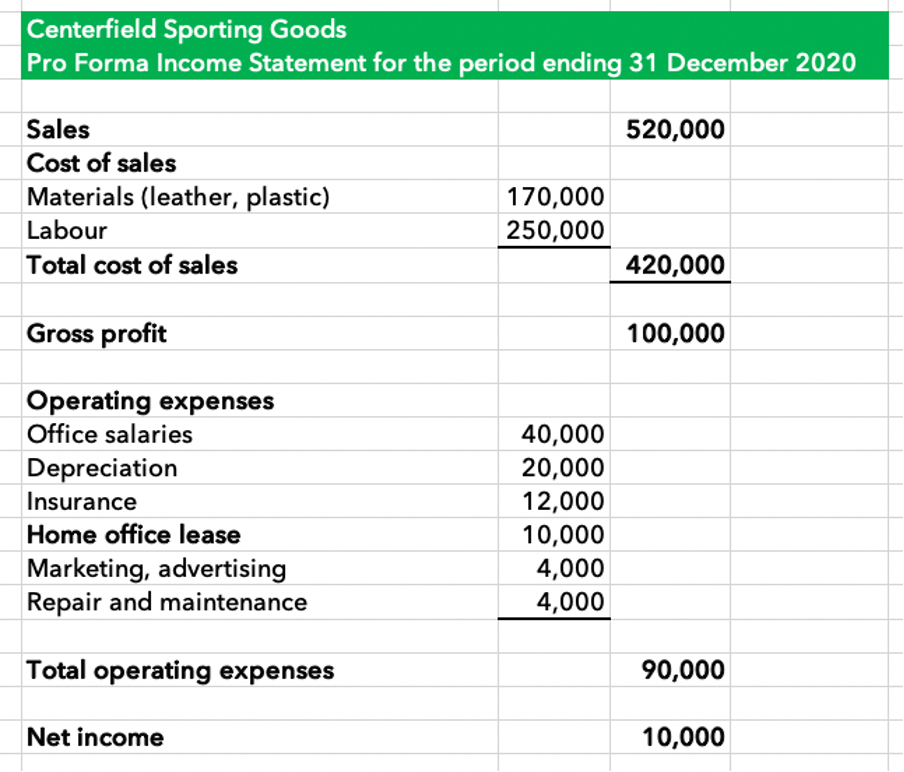

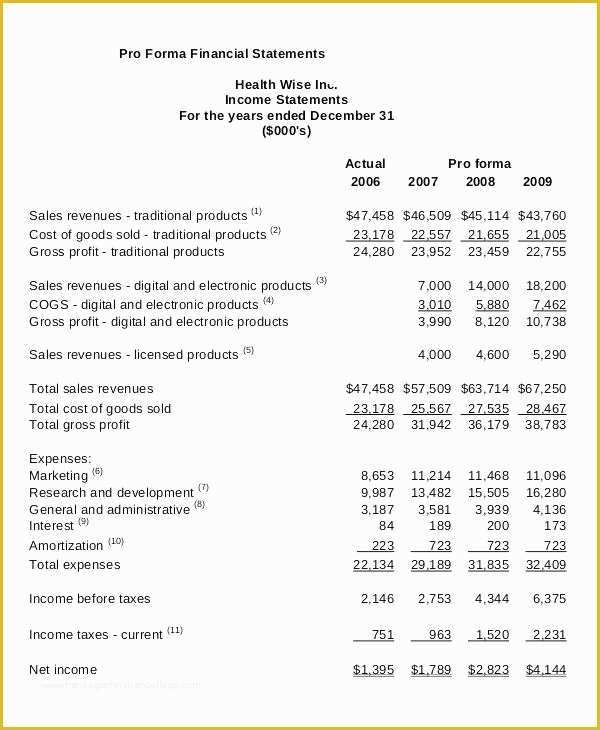

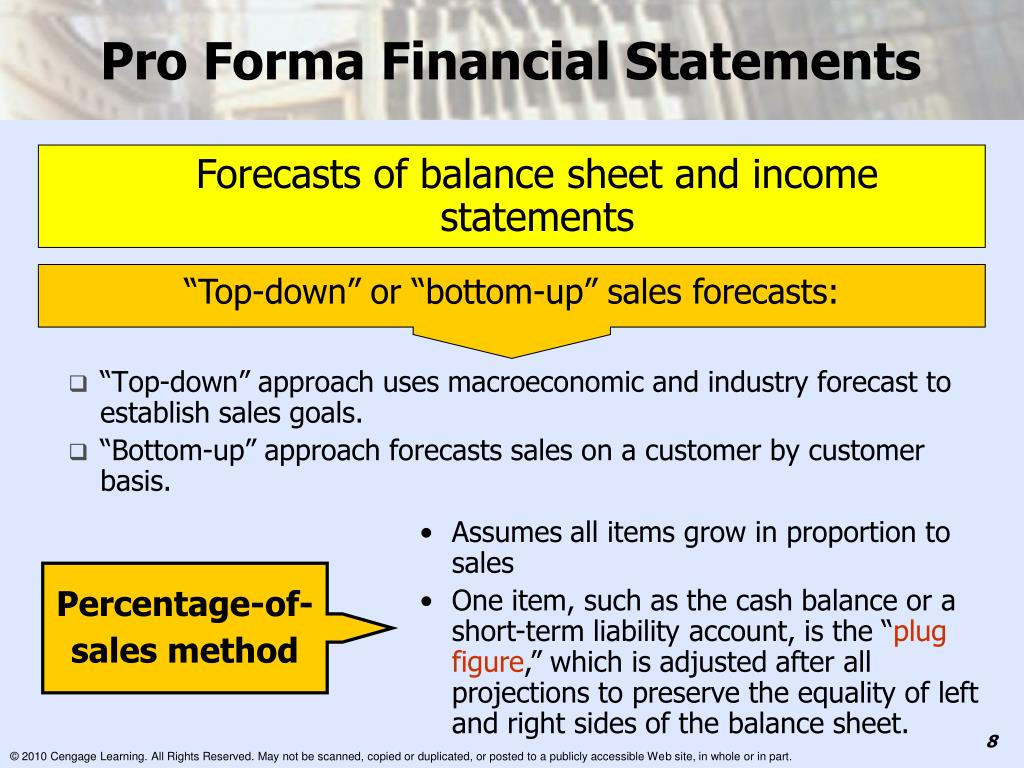

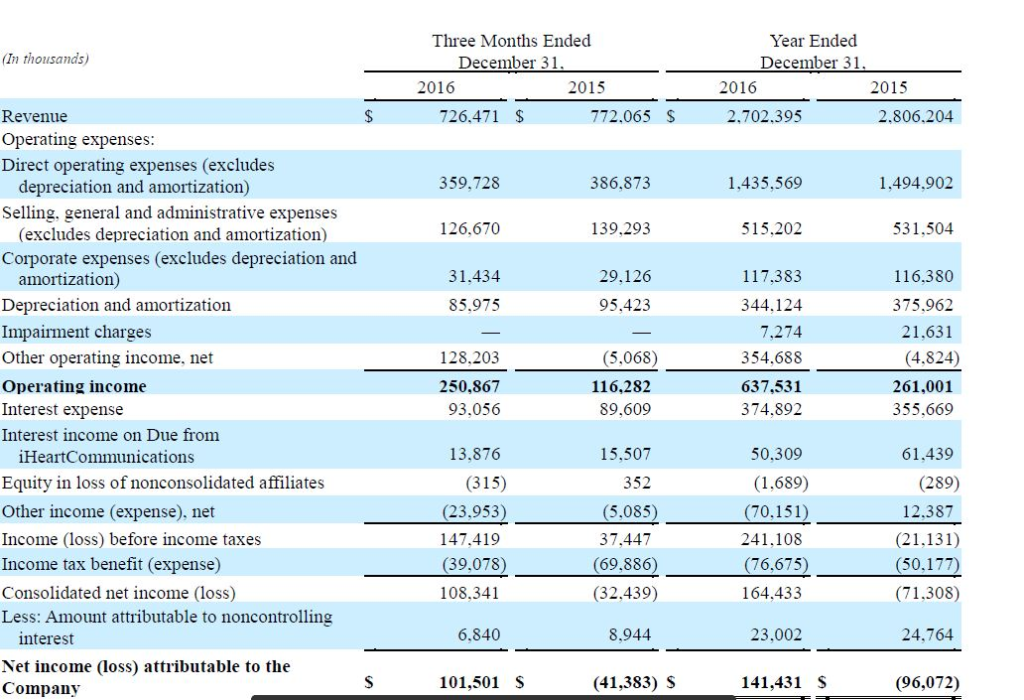

The process of preparing pro forma financial statements is similar to the processes used when creating the income statement, balance sheet, and statement of cash flows. In financial accounting, the term pro forma would refer to a report of the company’s earnings. But it would exclude unusual or nonrecurring transactions.

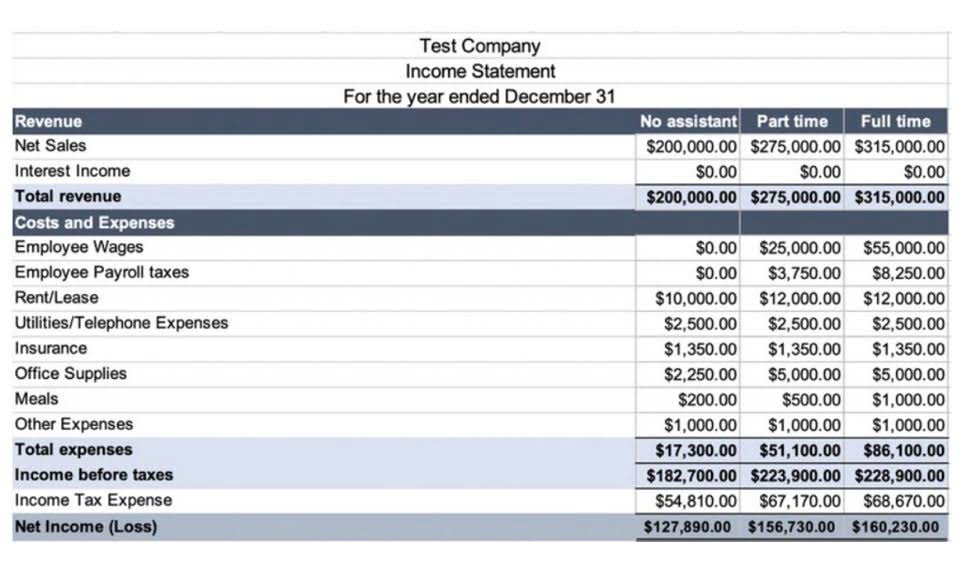

Accordingly, the company’s management can include or exclude line items that they feel may not accurately measure its estimates. A pro forma uses hypothetical data or other assumptions about a company’s future values, such as revenue and expenses, to forecast future financial performance, especially future growth. Pro forma statements are useful with regard to tracking future financial direction and occurrences, often including some historical numbers to help account for what the projected outcomes should look like.

Pro forma financial statements are valuable tools managers can use to plan for the future, anticipate and control risks and acquire funding for their business. When it comes to accounting, pro forma statements are financial reports for your business based on hypothetical scenarios. How are pro forma financial statements used?

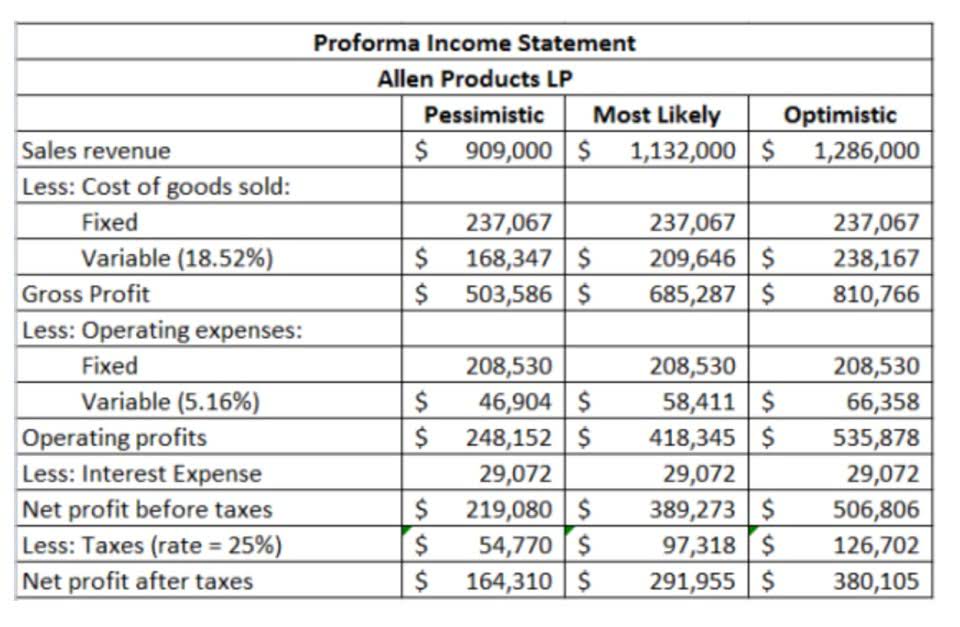

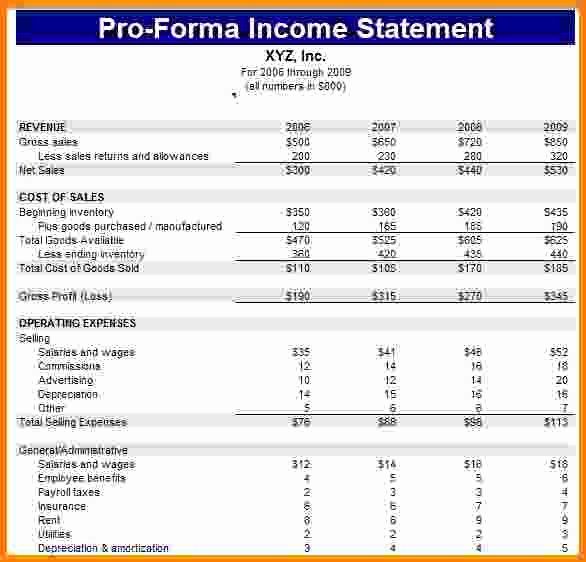

Pro forma statements allow you to make feasible guesses as to what your financial position will be in the next quarter and year. They’re a way for you to test out situations you think may happen in the future to help you make business decisions. Some standard pro format statements include the.

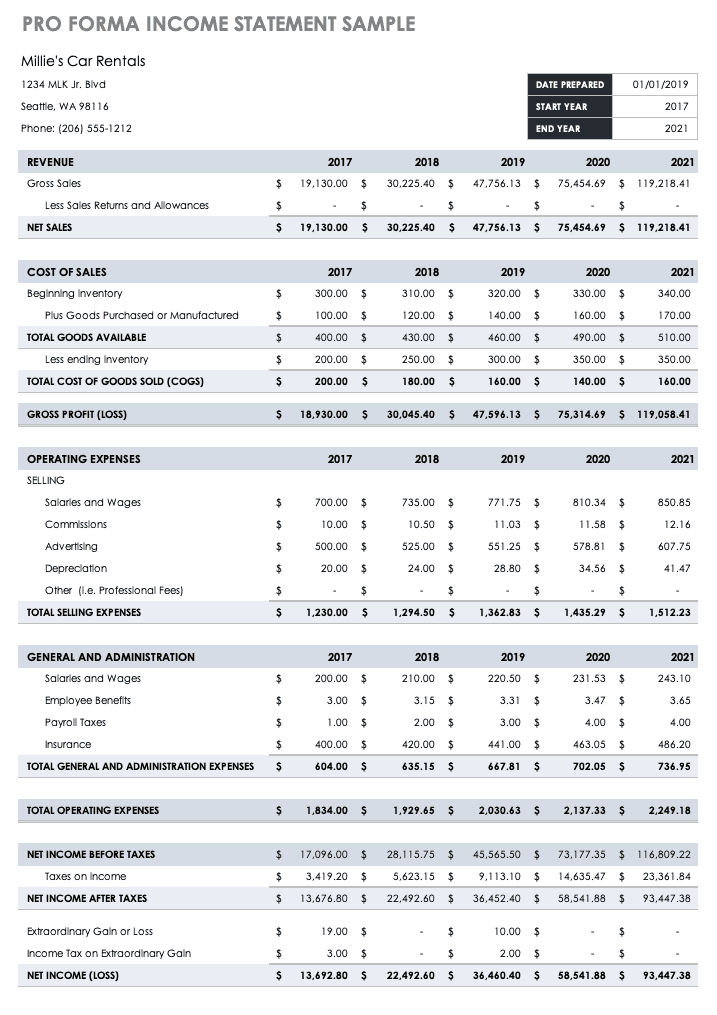

Pro forma financial statements are projections of future expenses and revenues, based on a company's past experience and future plans. You can use pro forma financial statements to predict the impact of financial decisions; How to use pro forma financial statements.

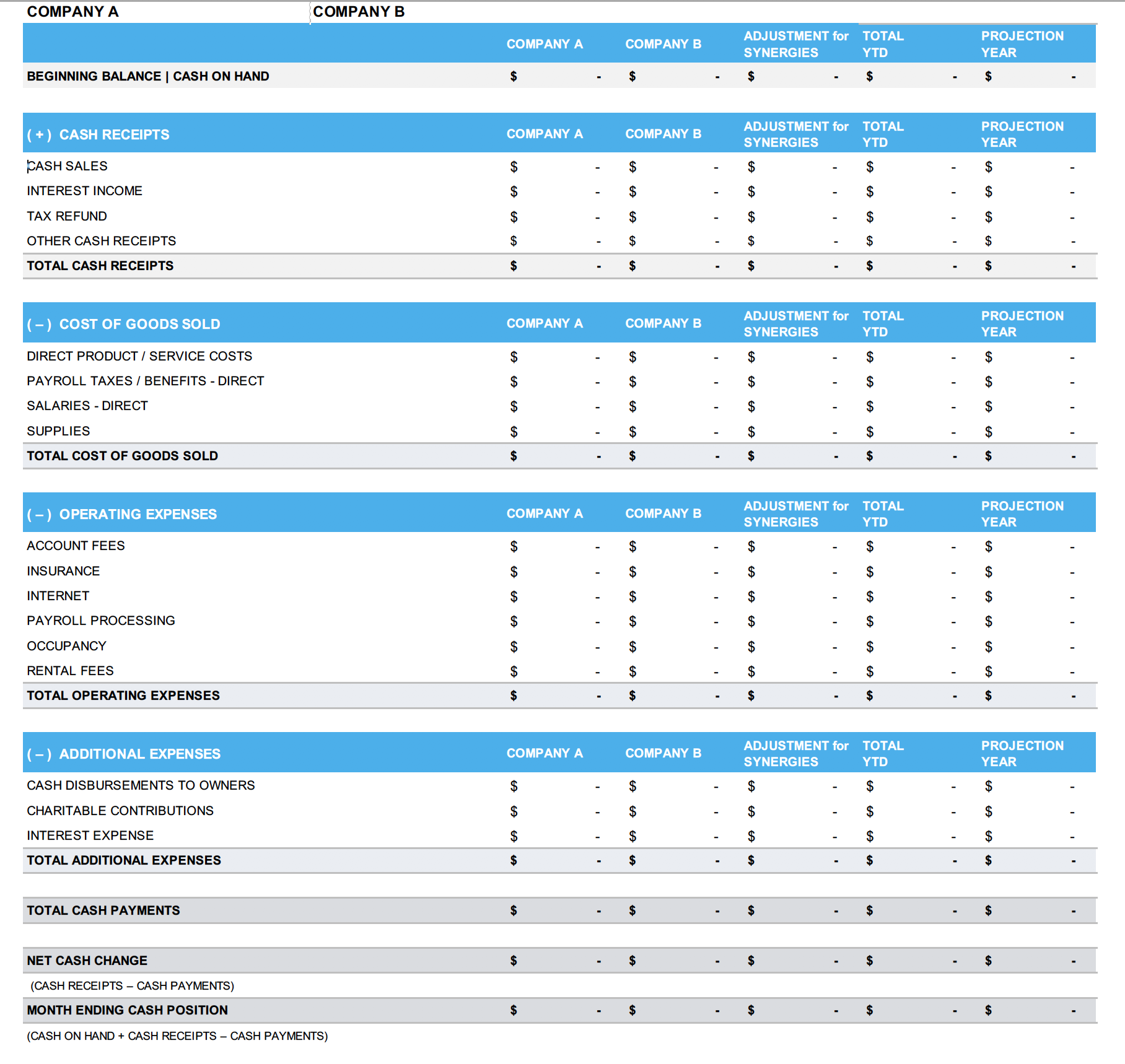

There are three major pro forma statements: That would mean that your pro forma statements would show what your income, account balances and your cash flow would look like with an extra £50,000. A pro forma cash flow statement is a financial report that shows projected cash flow generated from business operations.

Pro forma financial statements present the complete future economic projection of a company or person. Small business owners can benefit from them as well. These statements are used to present a view of corporate results to outsiders, perhaps as part of an investment or lending proposal.

Learn about the components of pro forma statements like balance sheets, income statments and cash flow for a better. It's not hard to imagine a situation where a company is hit by drastically decreased cash flow and doesn't have the time or liquidity to make the proper adjustments—just think of march 2020. Organizations can use either the direct or indirect method of cash flow reporting to create a pro forma cash flow statement.

4 main types of pro forma statements. Pro forma financial statements are financial reports issued by an entity, using assumptions or hypothetical conditions about events that may have occurred in the past or which may occur in the future. A pro forma is a set of financial statements that predicts the expected future performance of a company.