Formidable Tips About Total Capital Balance Sheet

We have transformed the group and delivered consistent execution of our “driving progress 2023” plan, building a strong earnings and capital distribution track record, while maintaining a robust balance sheet.” “today we have an attractive business model, with leading and scaled.

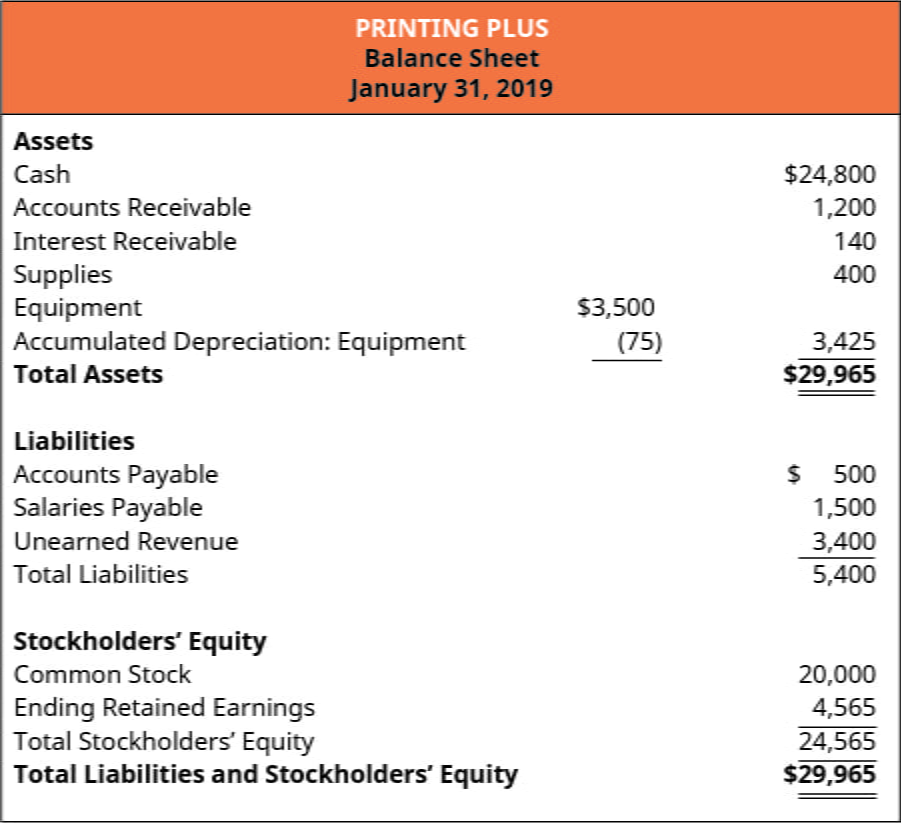

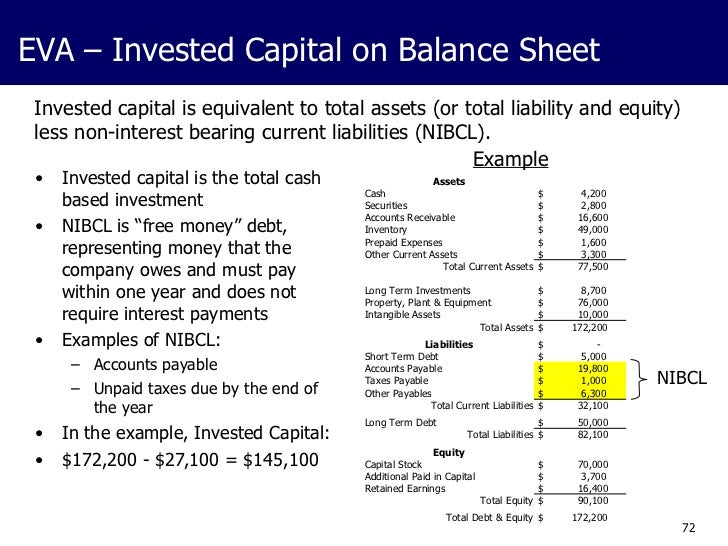

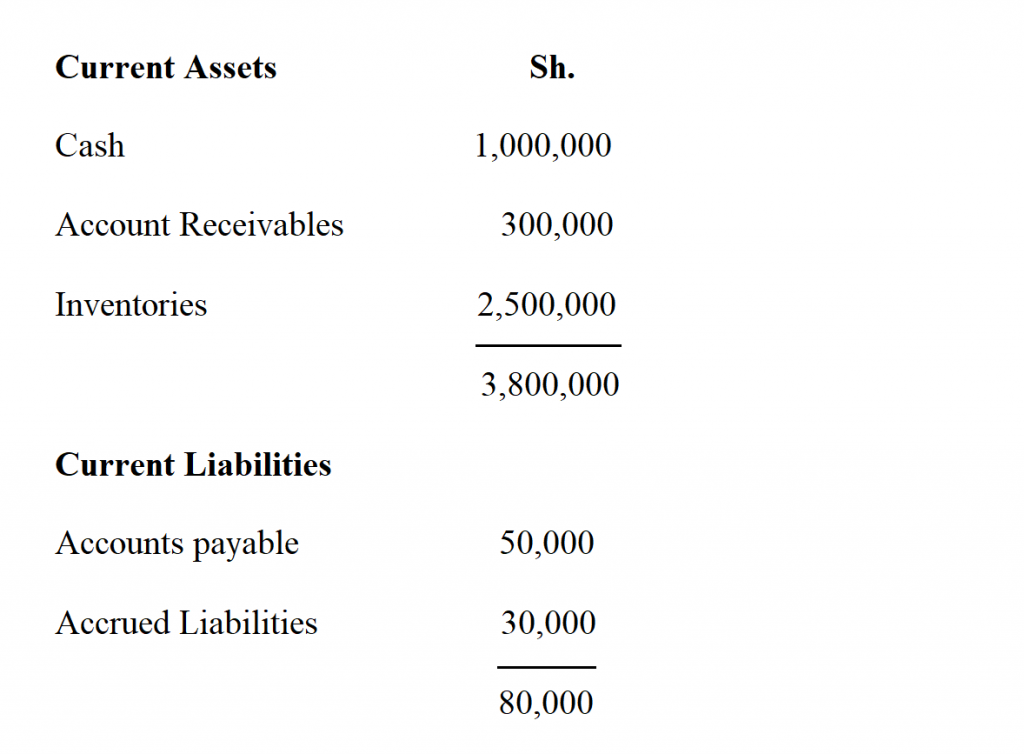

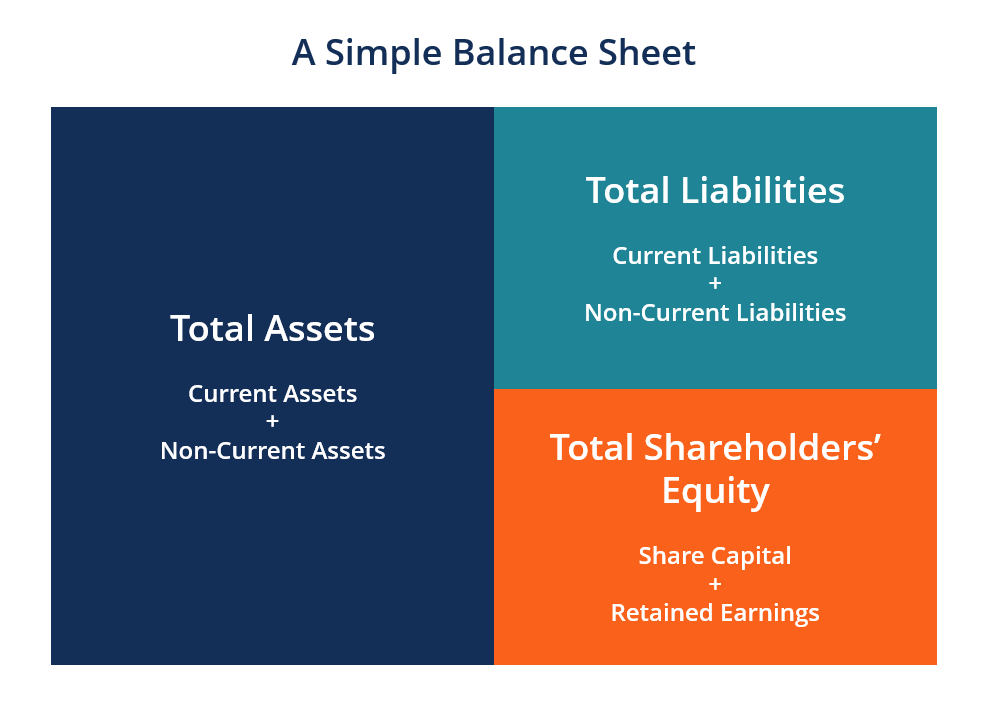

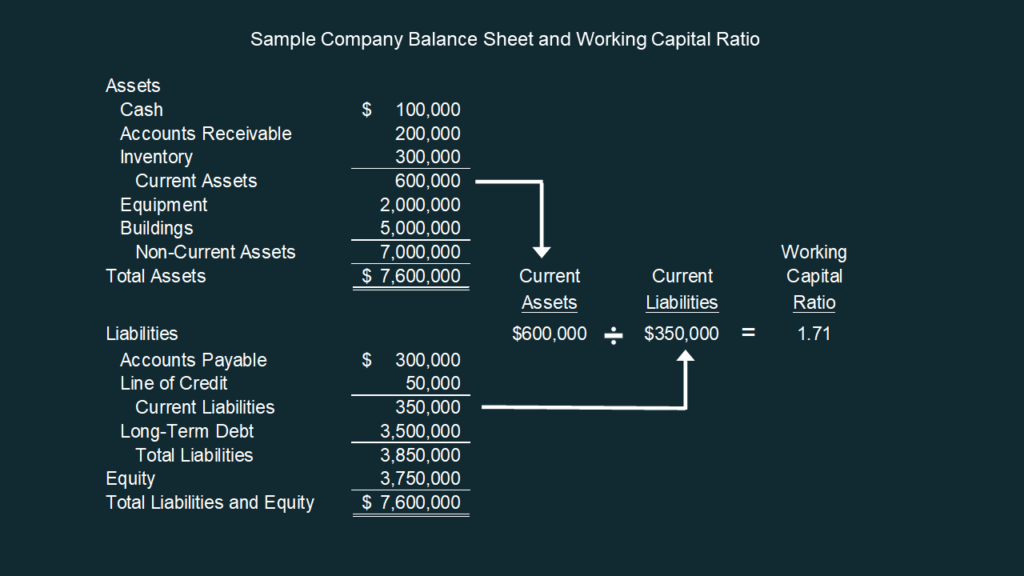

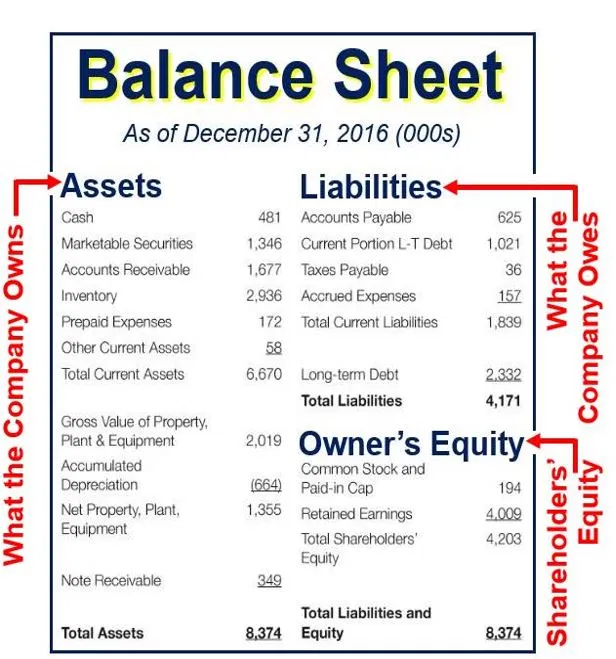

Total capital balance sheet. Assets = liabilities + equity. Hence, the balance sheet is often used interchangeably with the term “statement of financial position”. What is a balance sheet?

Updated june 24, 2022. Increasing your liabilities) or getting money from the owners (equity). Companies that are undercapitalized mean the company does not have enough capital on hand to.

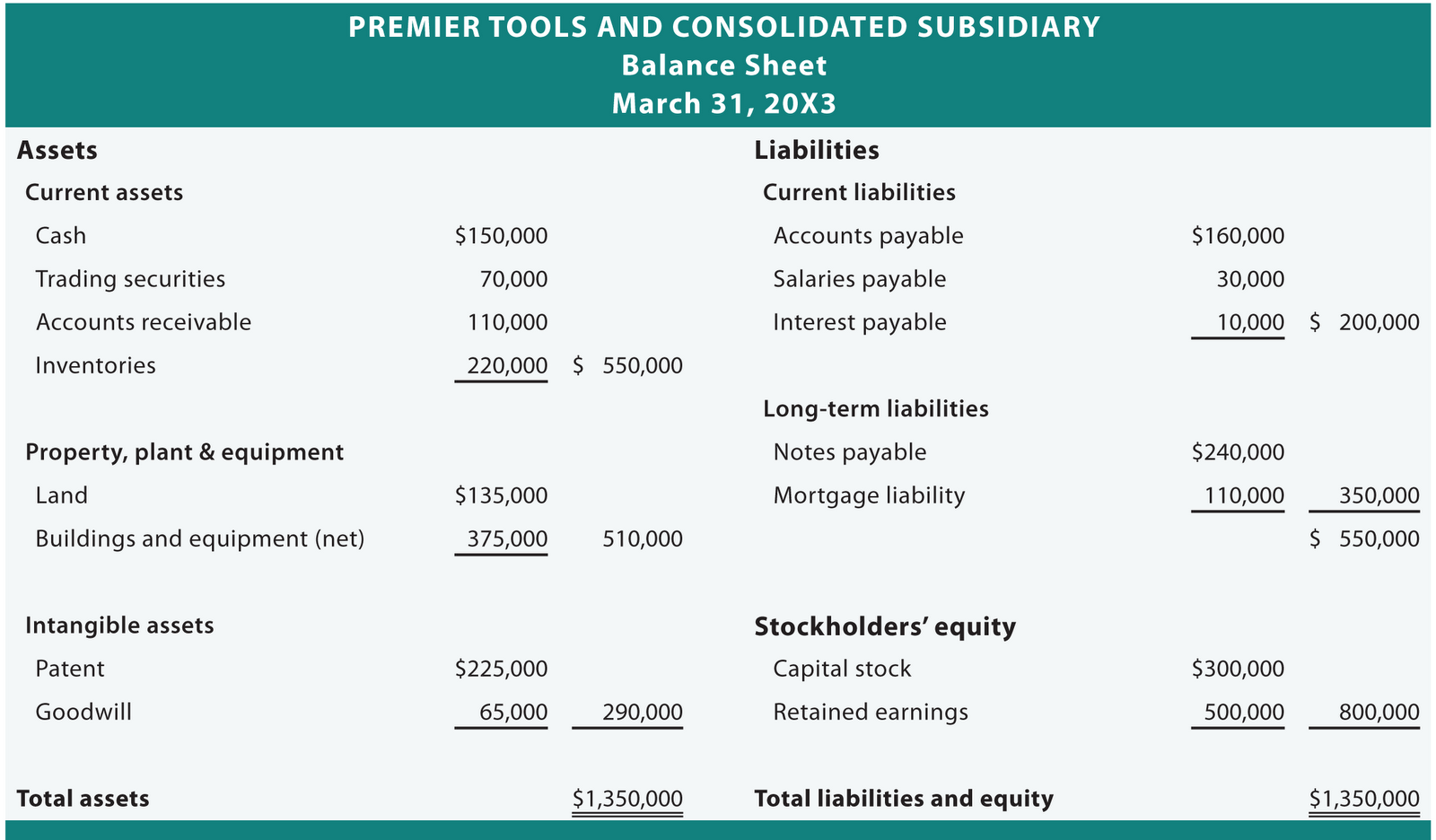

Understanding the different types of capital and how to calculate them can help you properly manage your company's finances. Assets = liabilities + owner’s equity. The balance between assets, liability , and equity makes sense when applied.

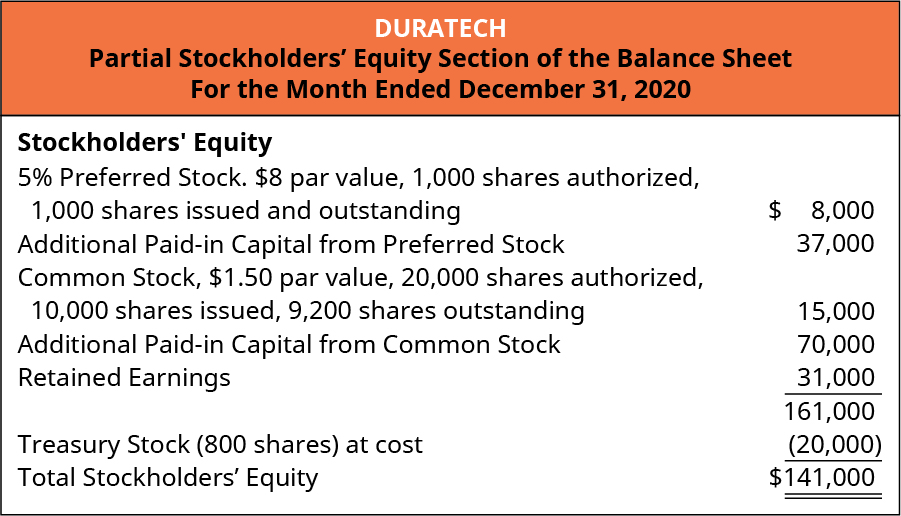

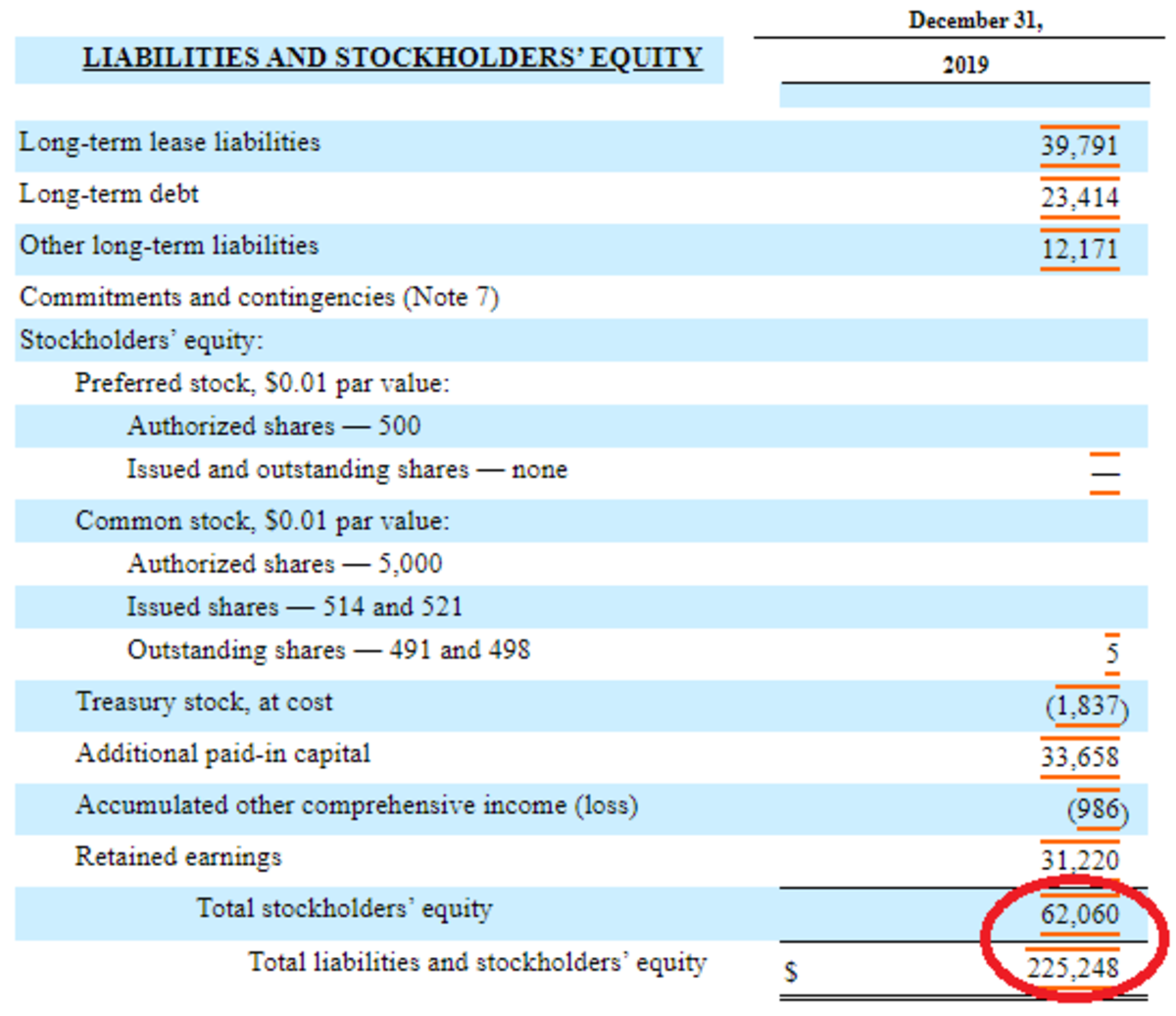

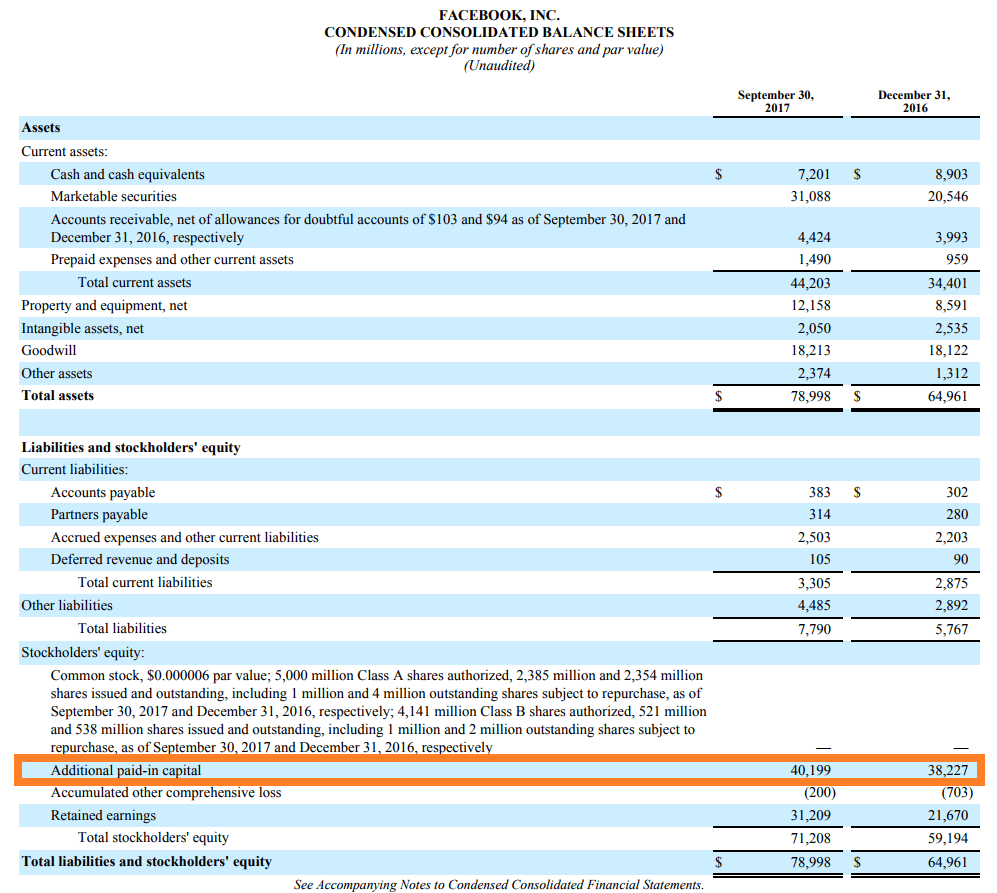

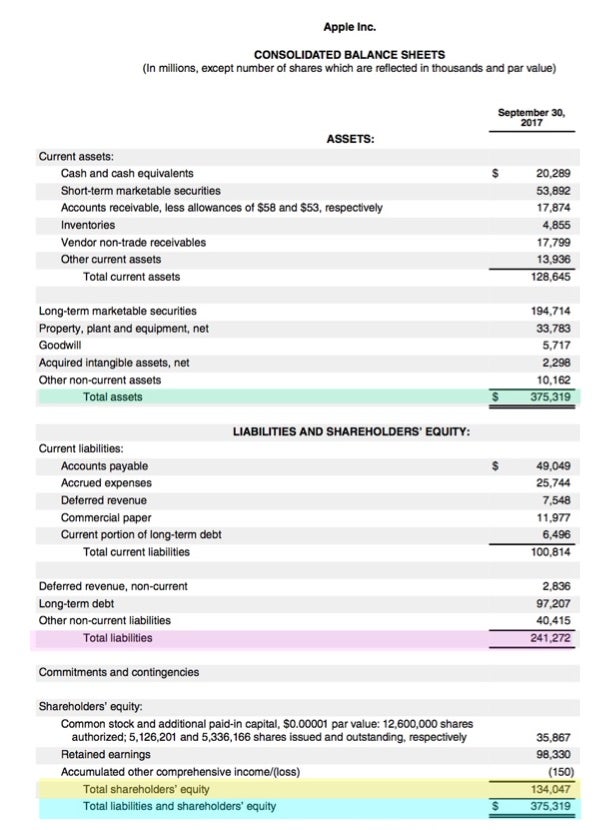

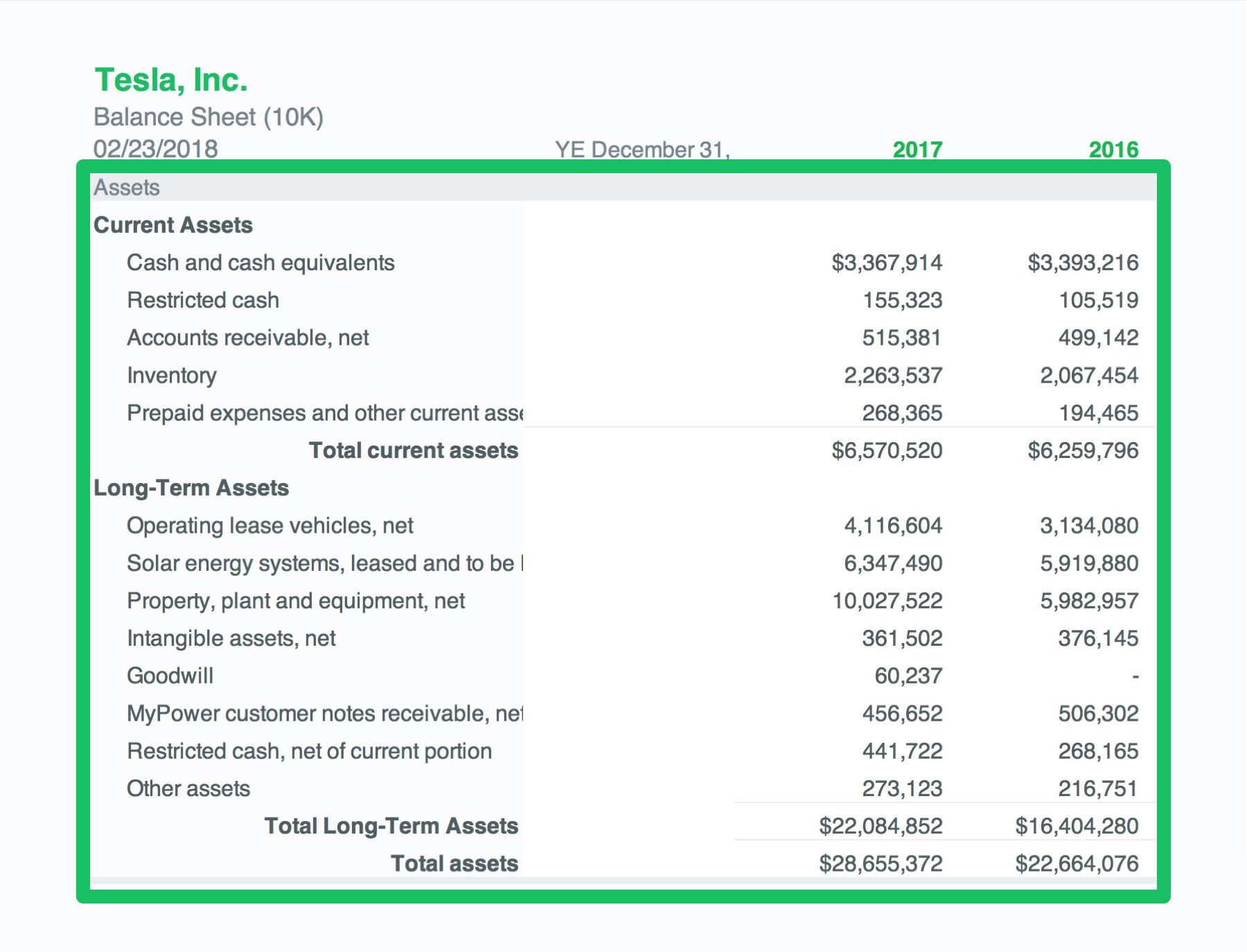

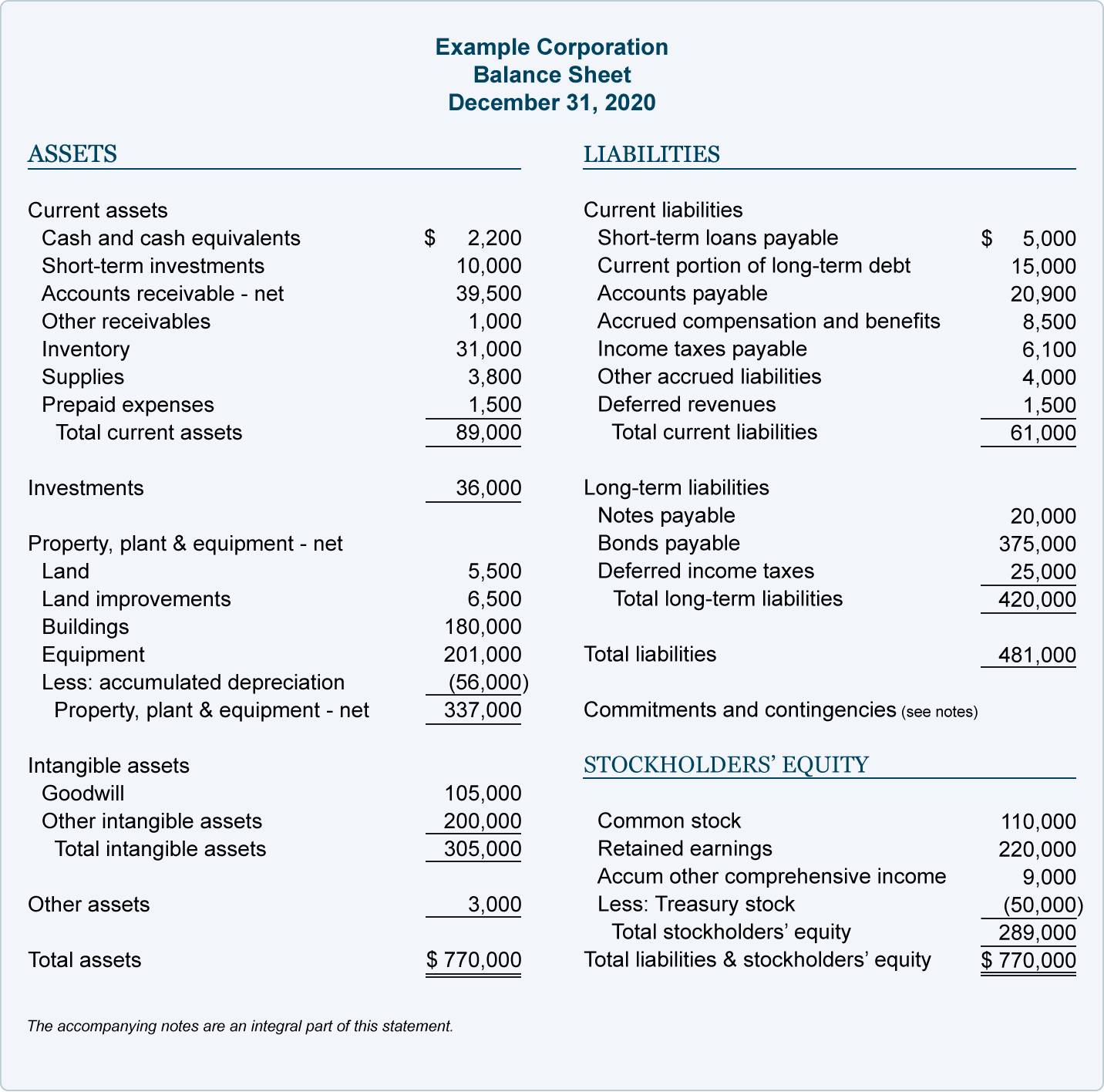

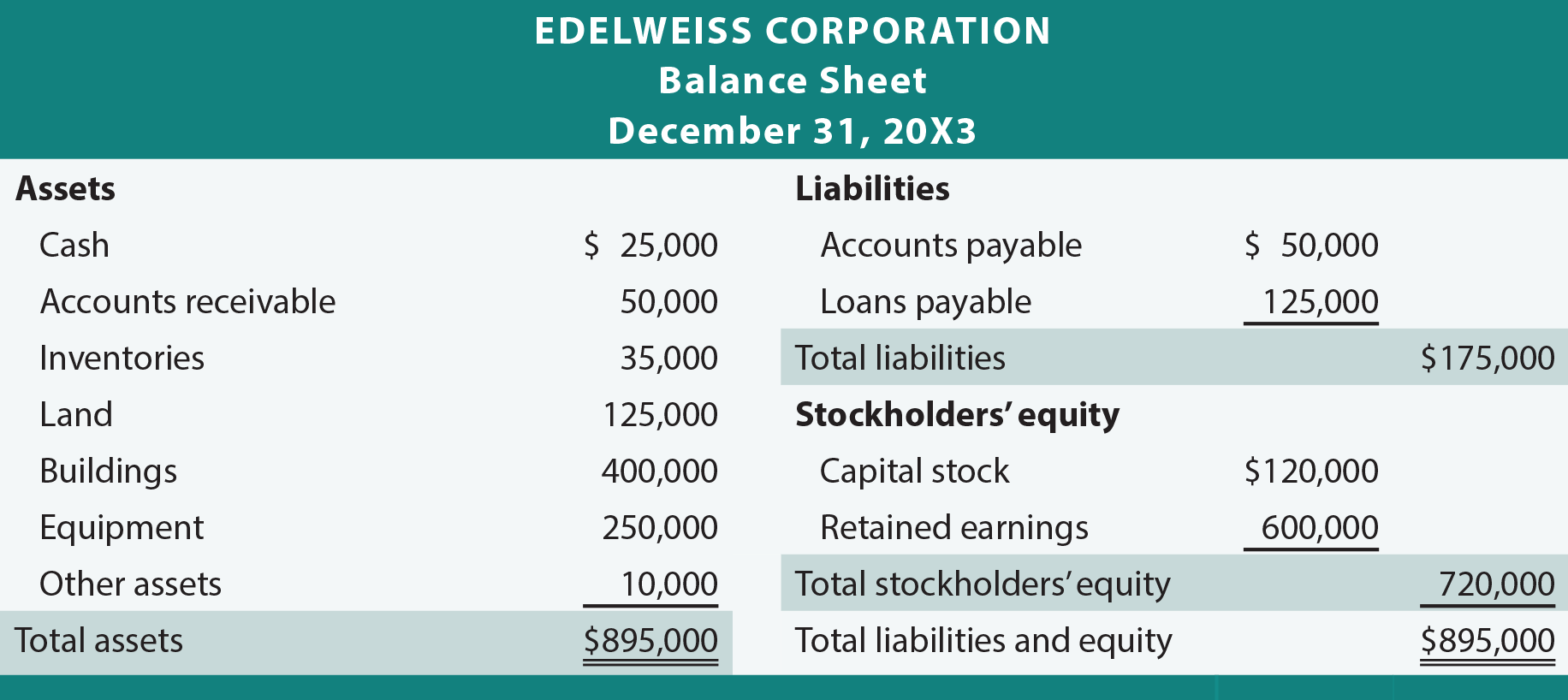

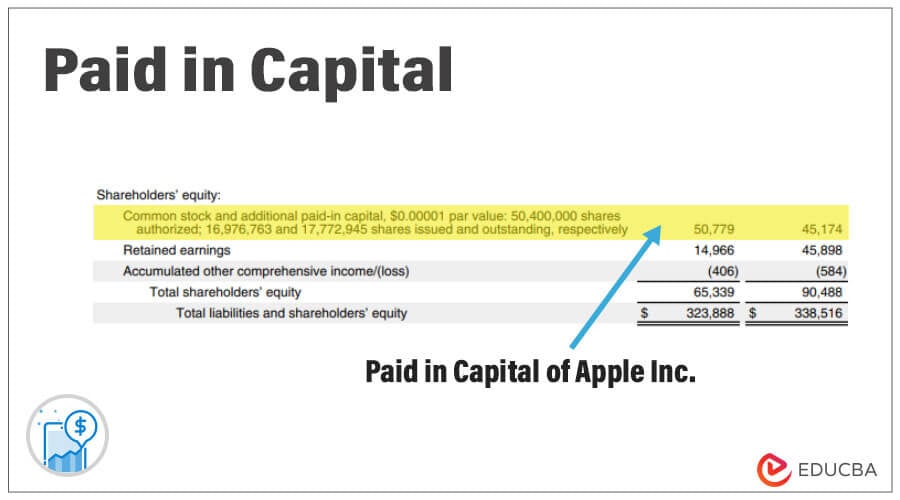

Also referred to as capital structure, total capitalization is what companies across industries depend on to fund expansions, projects and product development. A company's balance sheet provides the information necessary to calculate capital employed. The balance sheet formula is assets = liabilities + shareholders’ equity.

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. To general fund ‐ state. Using the formula provided above, we arrive at the following figures:

Assets go on one side, liabilities plus equity go on the other. This financial statement is used both internally and externally to determine the so. This is one of the calculations that's traditionally used when determining a company's return on capital.

According to the last reported balance sheet, fastenal had liabilities of us$661.3m due within 12 months, and liabilities of us$452.8m due beyond 12 months. Write a custom formula to transform one or more series or combine two or more series. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it.

A balance sheet provides a snapshot of a company’s financial performance at a given point in time. Balance sheets are the best way to periodically review a company's financial status, and capital is one of the most important elements on a balance sheet. Total assets, millions of u.s.

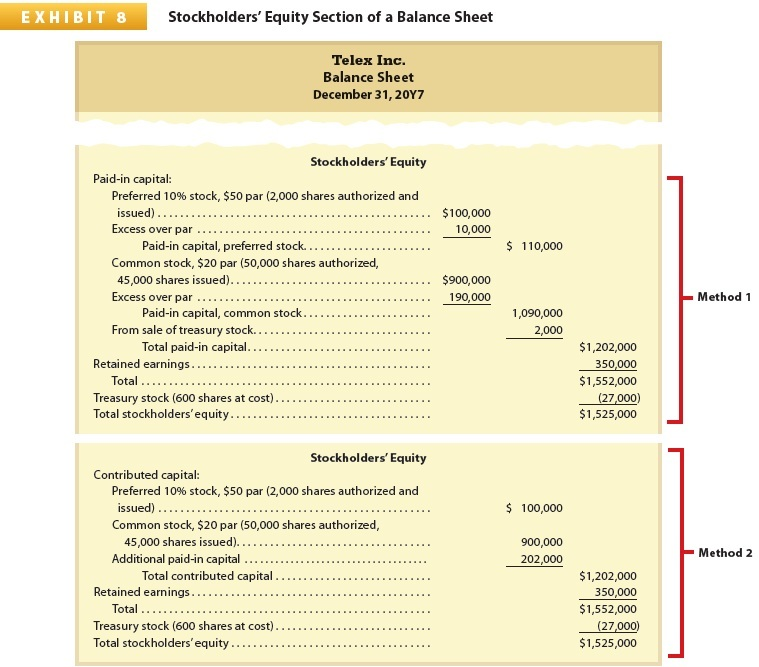

Hazardous substance tax (february 2024 forecast) other revenues (cost recovery, penalties, etc.) fund transfers. In finance, capitalization refers to the book value or the total of a company's debt and equity. A firm’s total capitalization is the sum total of debt, including capital leases, issued plus equity sold to investors, and the two types of capital are reported in different sections of.

The notes section contains detailed qualitative information and assumptions made during the preparation of the balance sheet. It can also be referred to as a statement of net worth or a statement of financial position. In this article, we discuss what capital is.

:max_bytes(150000):strip_icc()/ScreenShot2021-05-03at11.03.30AM-985f846f70e347c69f0f288359e7beed.png)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)