Marvelous Tips About Calculating Net Income From Balance Sheet

This mainly reflects the phasing impact arising from the difference between transaction date and delivery date;

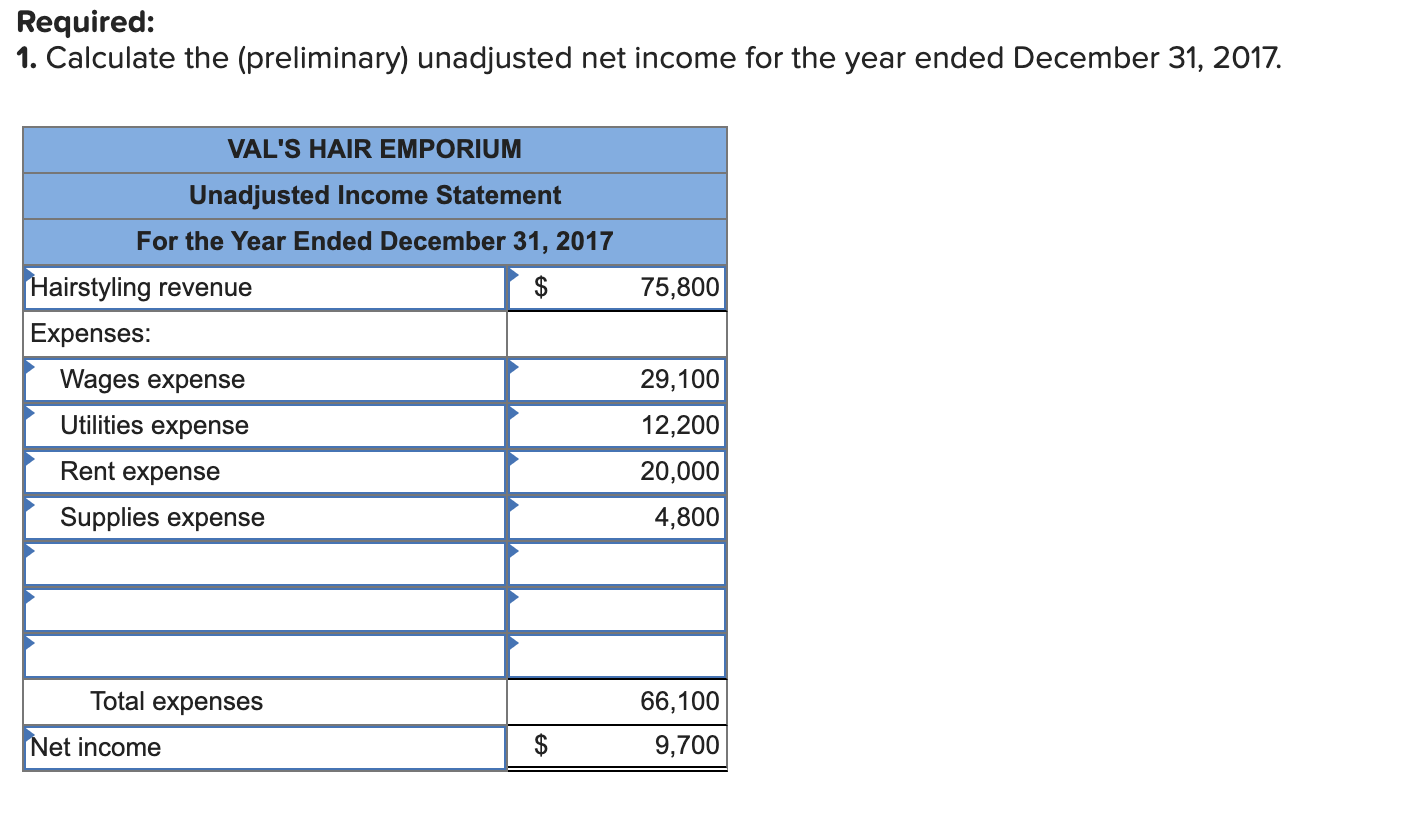

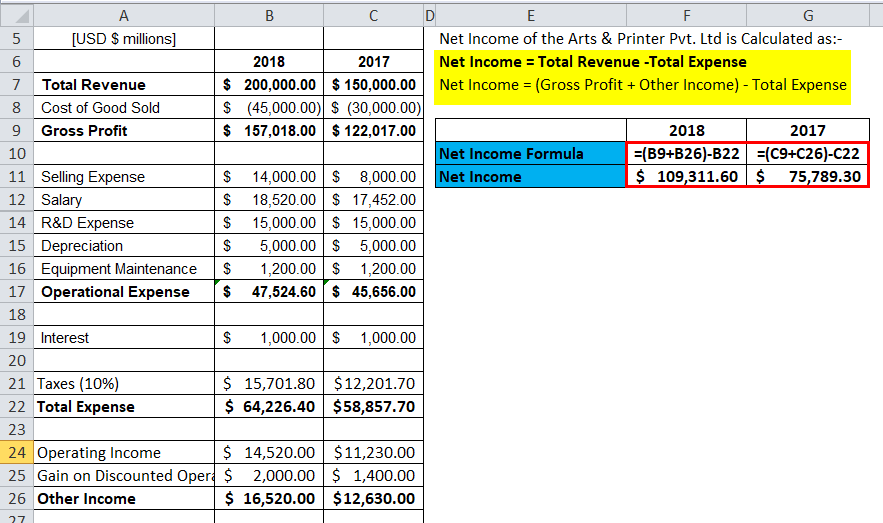

Calculating net income from balance sheet. Now that we understand the components of a. The formula to calculate net income; To calculate net income on a balance sheet, take your total revenue and subtract all expenses, including cost of goods sold, operational costs, interest and taxes.

Key components of net income. To do this you will need to: Or, if you really want to simplify things, you can express the net income formula as:

To arrive at net income, you subtract the cost of goods sold (cogs) (if any), selling and administrative expenses, taxes, interest, depreciation, and amortization from the gross amount of revenue the business has generated. You can learn more in our guide on net income meaning. Net income formula.

These will typically be listed under the equity section of the balance sheet. Not all types of businesses have cogs. It represents the residual income.

After two years, its net book value would be $24,000, and so on. Earnings per share are calculated using ni. You will need certain minimum items from the balance sheet to calculate the net income of your business.

In the simplest terms, net income is your total revenue minus all your costs, taxes, and operating expenses. To start with, go to the bottom of the company's balance sheet and look for a line called total equity. How to use net income after tax calculator;

While it is arrived at through the income statement, the net profit is also used in both the balance sheet and the cash flow statement. With a little extra information, calculating net income from the balance sheet using only assets, liabilities, and equity should be simple enough. To calculate re, the beginning re balance is added to the net income or reduced by a net loss.

The net income is very important in that it is a central line item to all three financial statements. The formula for the calculation is as follows: Find your total revenue, or gross income:

Net income can be positive or negative. As mentioned above, net income is the amount of revenue that remains after your business pays off all its expenses. The figure you arrive at is the “net” of those expenses and is called the company’s net income.

Net income is the amount of accounting profit a company has left over after paying off all its expenses. Before we dive into the specifics of calculating net income, it is. It measures your company's profitability.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-02-6e3072bd99d74ee4a0492e799e21560b.jpg)