Beautiful Info About Bank Loan In Profit And Loss Account

Between 6.5% to 9% across the ‘big four’ banks.

Bank loan in profit and loss account. The interest charges to profit and loss will be affected because the effective interest rate will essentially be lower (that is, the effective interest rate will be 3.26%. Profit & loss statement definition. From 5.9% to 9% for online and.

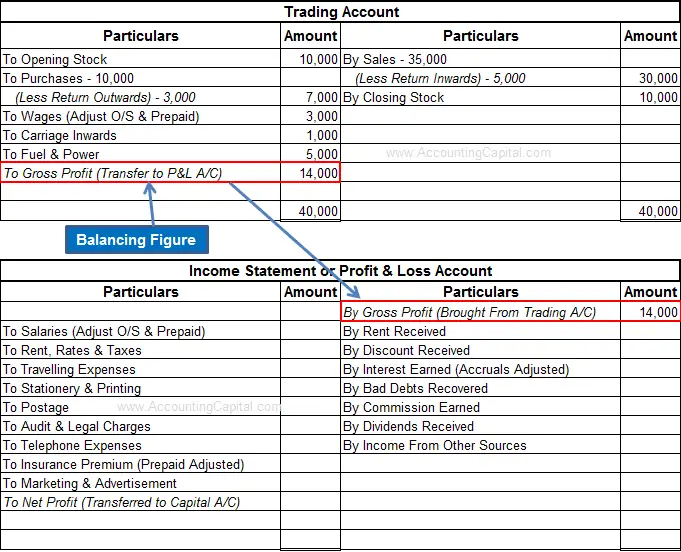

The first step in creating a profit and loss statement is to calculate all the revenue your business has received. All the items of revenue and expenses. A loan loss provision is an income statement expense set aside to allow for uncollected loans and loan payments.

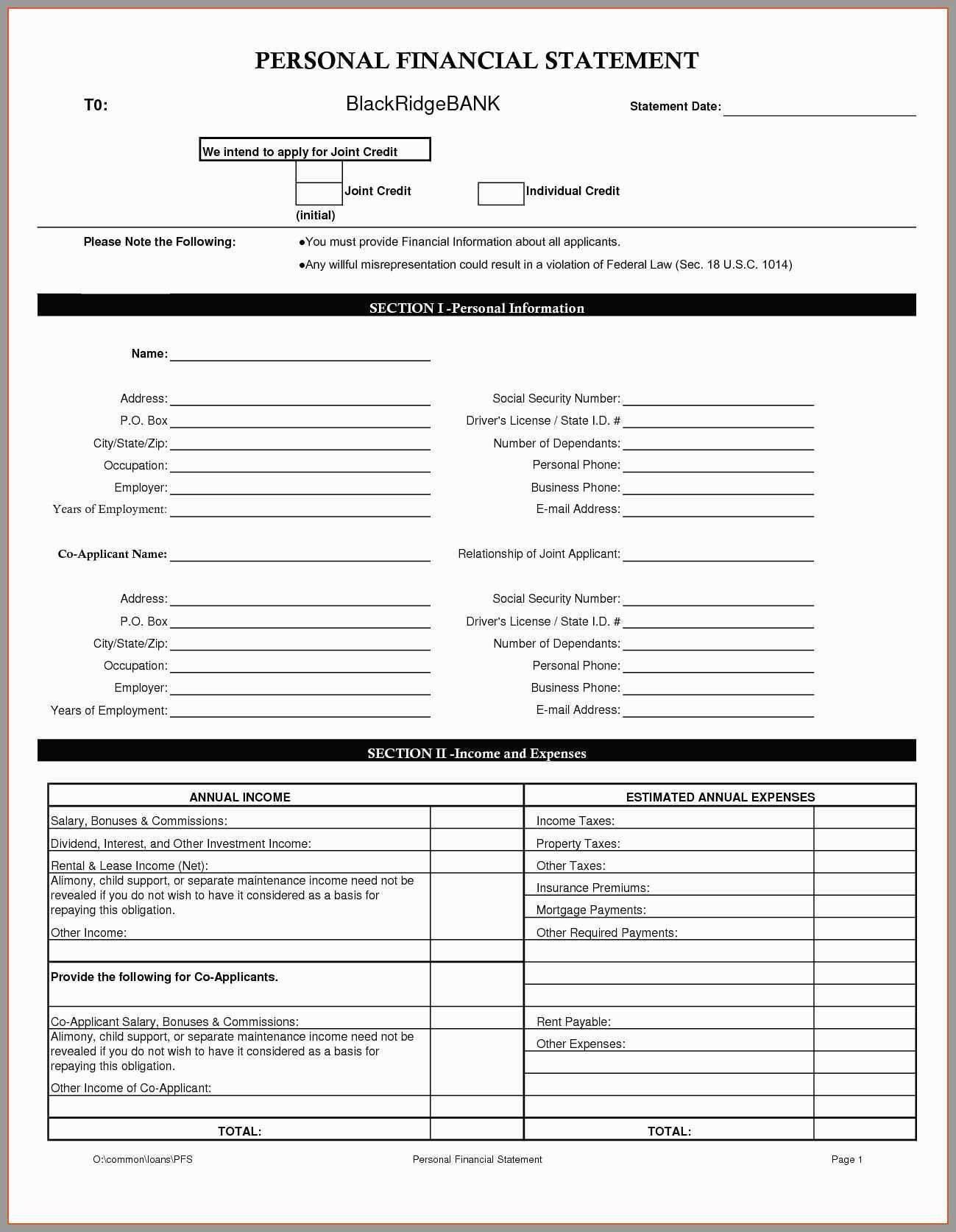

Projected balance sheet and profit and loss account for a period of 3 to 5 years collateral security (depending on amount of loan) project report/ dpr all. This financial report may have several different. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

Standard variable loan interest rates available on the market right now are: A p&l statement provides information. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

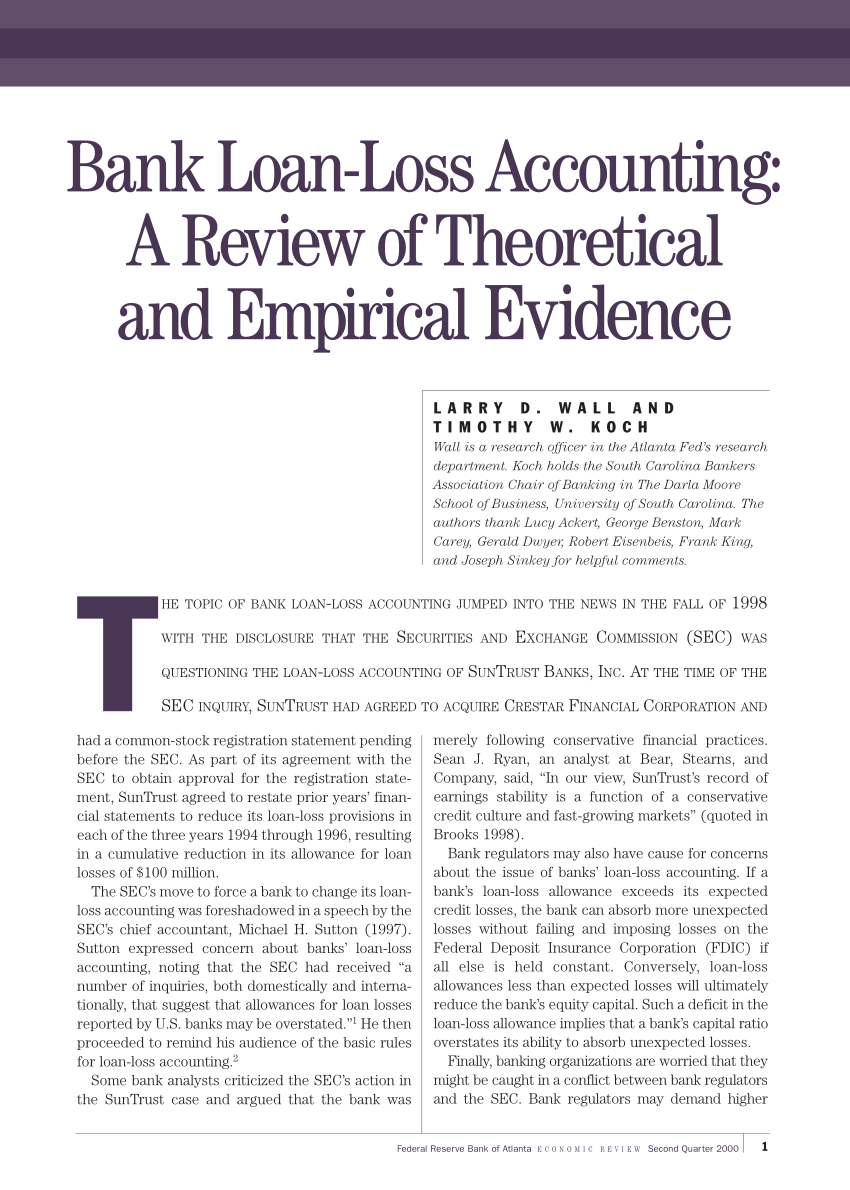

Level of loan loss reserves in the banking system. Profit and loss account is made to ascertain annual profit or loss of business. Page 1 bank’s fi nancial statements:

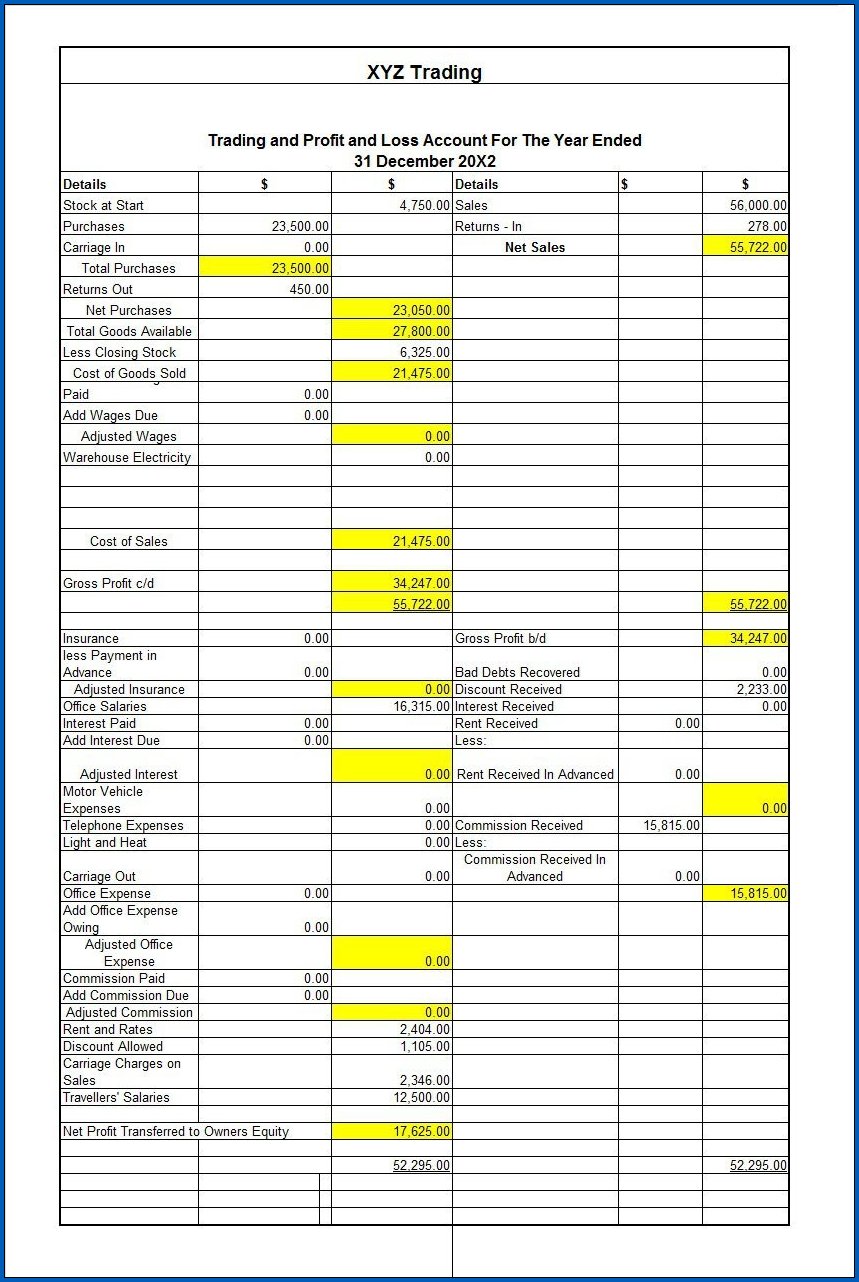

Pnl statement, also called income statement, summarizes a company’s financial performance by recording revenues, costs, expenses. On the other hand, psak 71 establishes a new. Explanation a profit and loss account is prepared to determine the net income (performance result) of an.

For the overall banking sector,. When the interest a bank earns from loans exceeds the interest paid on deposits, it generates income from the interest rate spread. the. The amount of delinquent commercial property debt held by the top banks nearly tripled in 2023 to $9.3 billion, the ft said.

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Which have plummeted in value as people. Definition of loan principal payment when a company borrows money from its bank, the amount received is recorded with a debit to cash and a credit to a liability account, such.

If you apply for a business loan or want to finance new equipment, a bank will likely ask to review your profit and loss statement. The balance sheet (figure 1) and the income statement (figure 2).2 outstanding loans are. The company also reported $552 million in loan losses coming primarily from soured commercial real estate loans.

The p&l account is a component of final accounts. Displayed in the accompanying table is the profit and loss account of hdfc bank. Banks are required to account for potential loan.