Fun Tips About Statement Of Management Responsibility Bank Balance Sheet Example

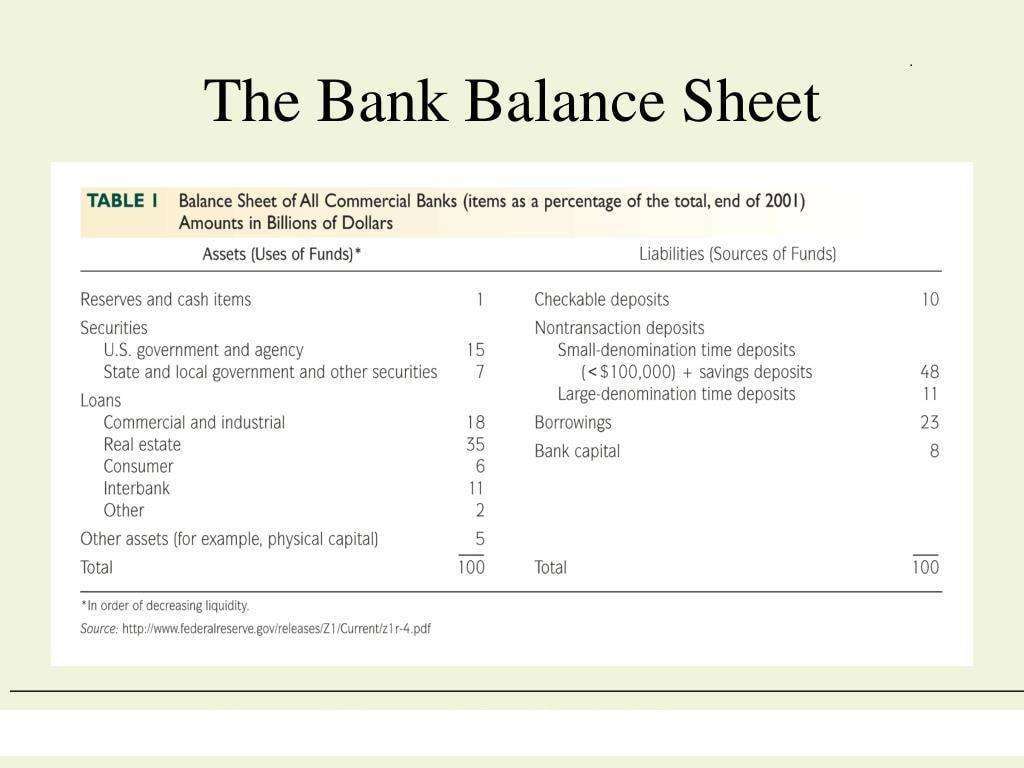

Here we also discuss the definition, loans, and advances in bank balance sheets along with the example.

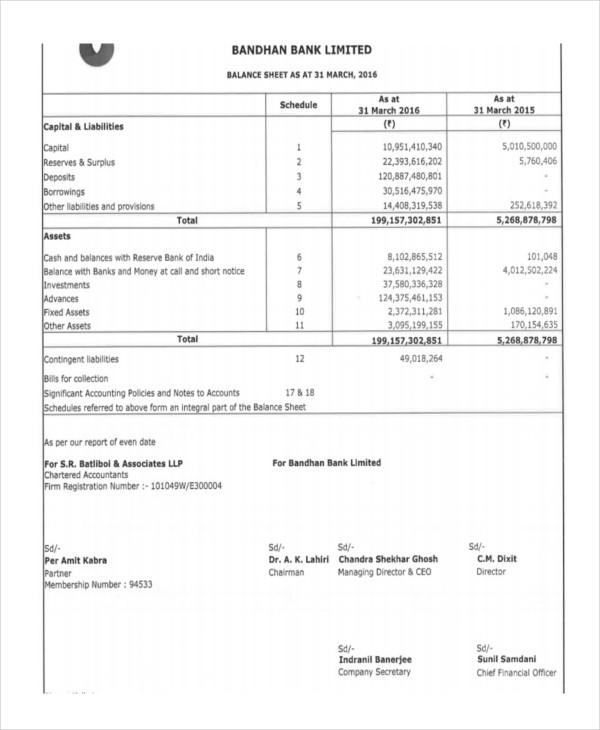

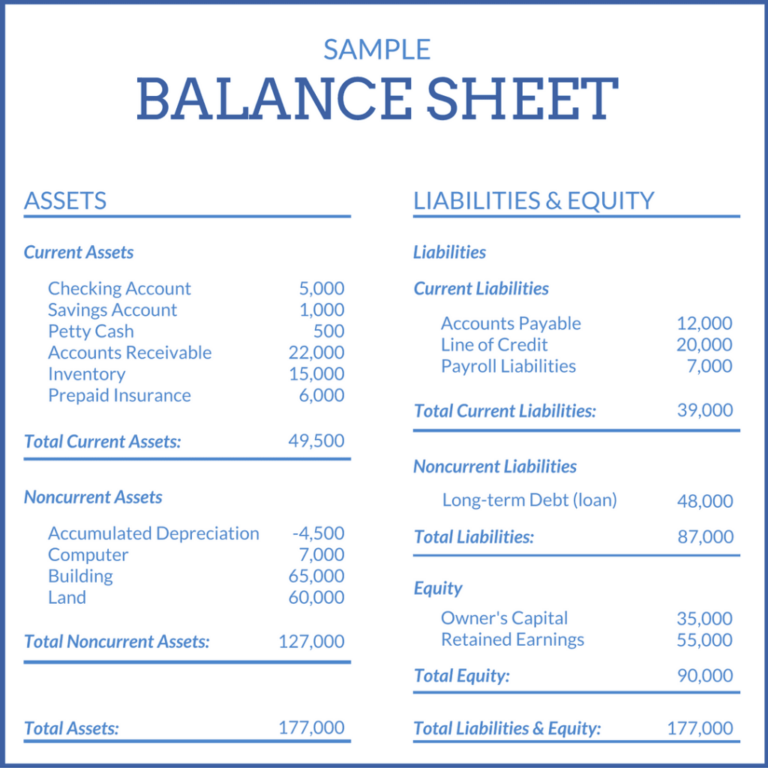

Statement of management responsibility bank balance sheet example. We have audited the consolidated financial statements of bank of montreal (the bank), which comprise: Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date. Income statement for the period from january 1 to december 31, 2021.

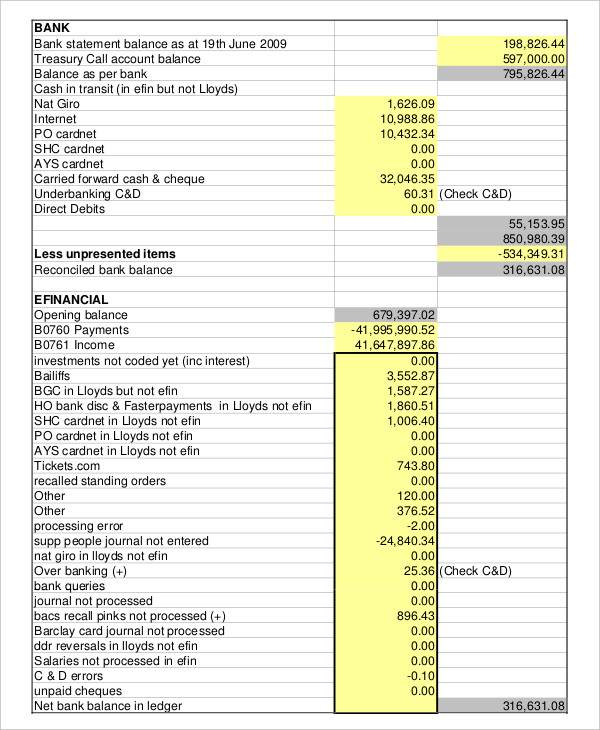

The consolidated financial statements, the notes thereto, and other financial information contained in the management’s discussion and analysis have been prepared in accordance with international financial reporting standards as issued by the international accounting standards board and are the responsibility of the management of kinross gold. It involves comparing the balances in the balance sheet with the general ledger and supporting documents such as bank statements, credit card statements, and invoices. The balance sheet is based on the fundamental equation:

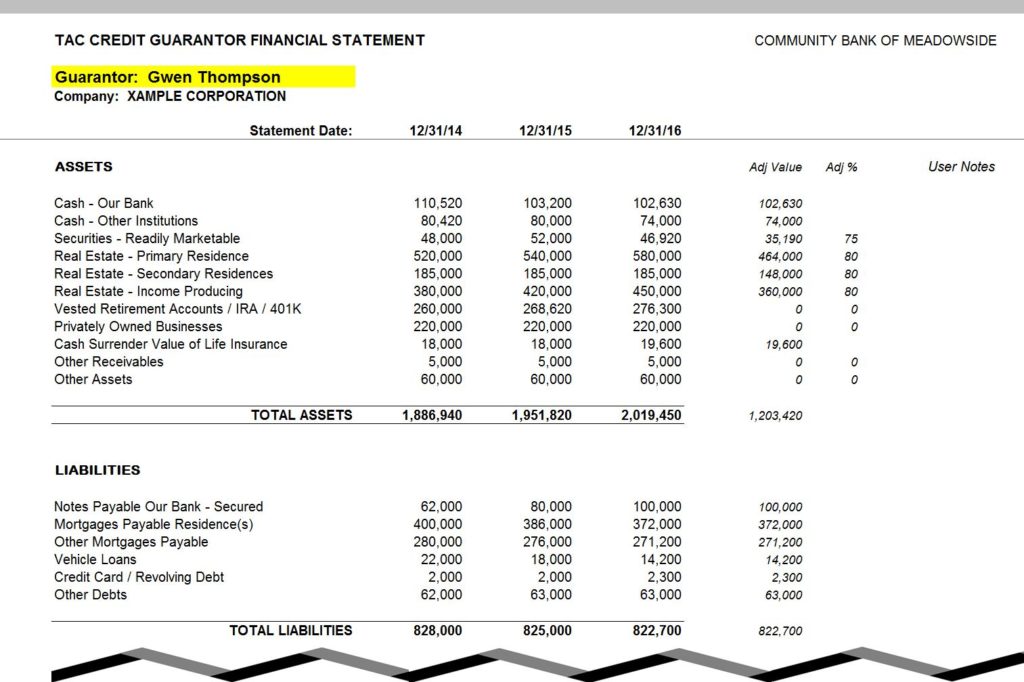

Reconciliation of balance sheet helps identify any. A company has $8 million in total assets, $5 million in total liabilities, and $3 million in total equity. Debt equity common and preferred shares recall from cfi’s balance sheet guide that assets = liabilities + equity.

Statements of cash flows for each of the three years in the period ended december 31, 2011, and a summary of significant accounting policies and other explanatory information. Income statements and balance sheets are reliable ways to measure the financial health of your business. Balance sheet reconciliation is simply a process that ensures the accuracy of a company’s financial statements.

However, an increase in loans alone may not be an accurate indicator of growth, except the creditors are credible. About the bank’s regulatory ratios. Balance sheet the balance sheet is set out on page 29 of this annual report.

Negative interest income from lending and money market business.

Frequently asked questions (faqs) a bank’s balance sheet provides a snapshot of its financial position at a specific time. We have audited the consolidated financial statements of bank of montreal (the bank), which comprise: Example of a common size balance sheet.

If the quality of creditors is low, the level of default will be high. Bank of america corporation (bac) the table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest. | find, read and cite all the research.

Bdo is a member of the sm group, one of the Managing work budget & accounting free balance sheet templates get free smartsheet templates by andy marker | january 7, 2019 (updated april 28, 2023) we’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors.

The typical structure of a balance sheet for a bank is: This statement can be prepared base on a monthly, quarterly, or annual comparative basis. 2021 2020 interest income from a) lending and money market business 11,447 13,072.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)