Painstaking Lessons Of Tips About Accounting For Impairment Losses

Recognising an impairment loss for an individual asset.

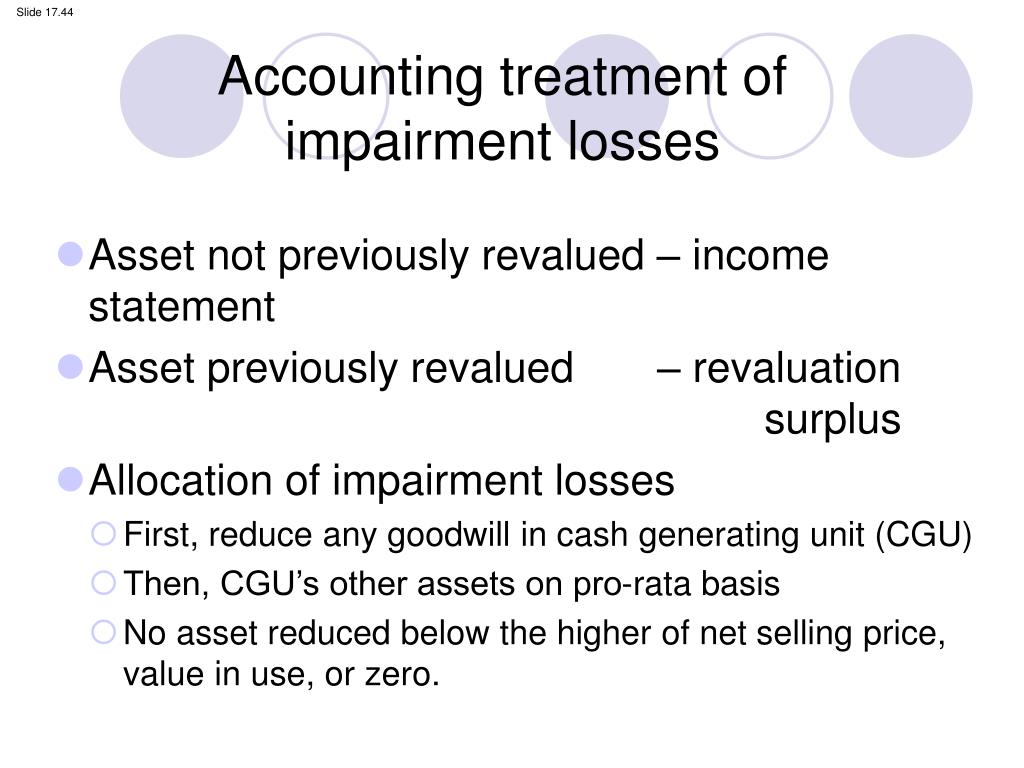

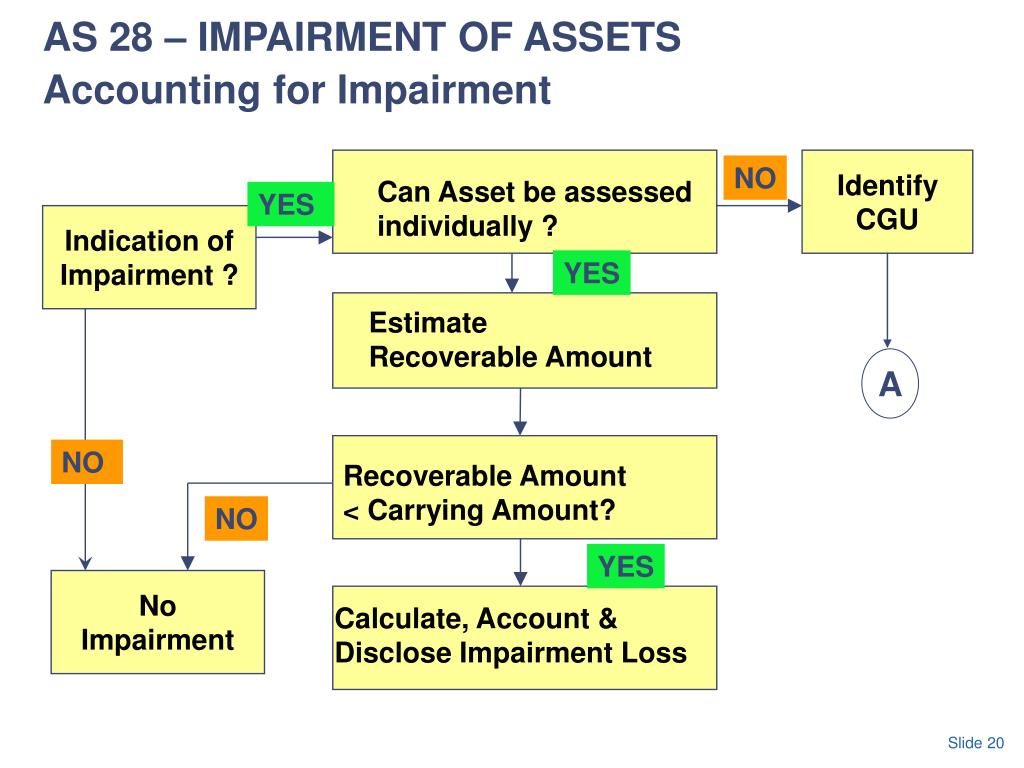

Accounting for impairment losses. Ifrs and gaap impose different rules on impaired assets. Firstly, reduce the carrying amount of goodwill allocated to the cgu, and; With the exception of goodwill and certain intangible assets for which an annual impairment test is required, entities are required to conduct.

However, due to the complex nature of the standard, the requirements of ias 36 can be challenging. Generally accepted accounting principles (gaap) assets considered impaired must be recognized as a loss on an income statement. Thus, under both standards, a “day 1 credit loss” will be recognized for most financial assets measured at amortized cost.

An impairment loss for goodwill is never reversed. The credit impairment accounting approach under both us gaap and ifrs follows an expected loss model. [ias 36.2, 4] if these assets (other than.

Objective 1 scope 2 definitions 6 identifying an asset that may be impaired 7 measuring recoverable amount 18 measuring the recoverable amount of an intangible asset with an indefinite useful life 24 fair value less costs of disposal 28 value in use 30 recognising and measuring an impairment. Yet, reference is made to ias 36 impairment of assets as regards impairment losses measurement and recognition. How goodwill accounting has evolved.

The technical definition of impairment loss is. It is allocated in the following order: According to the original accounting schedule above, the bond’s carrying value on 1 january 20x6 is $7,113.

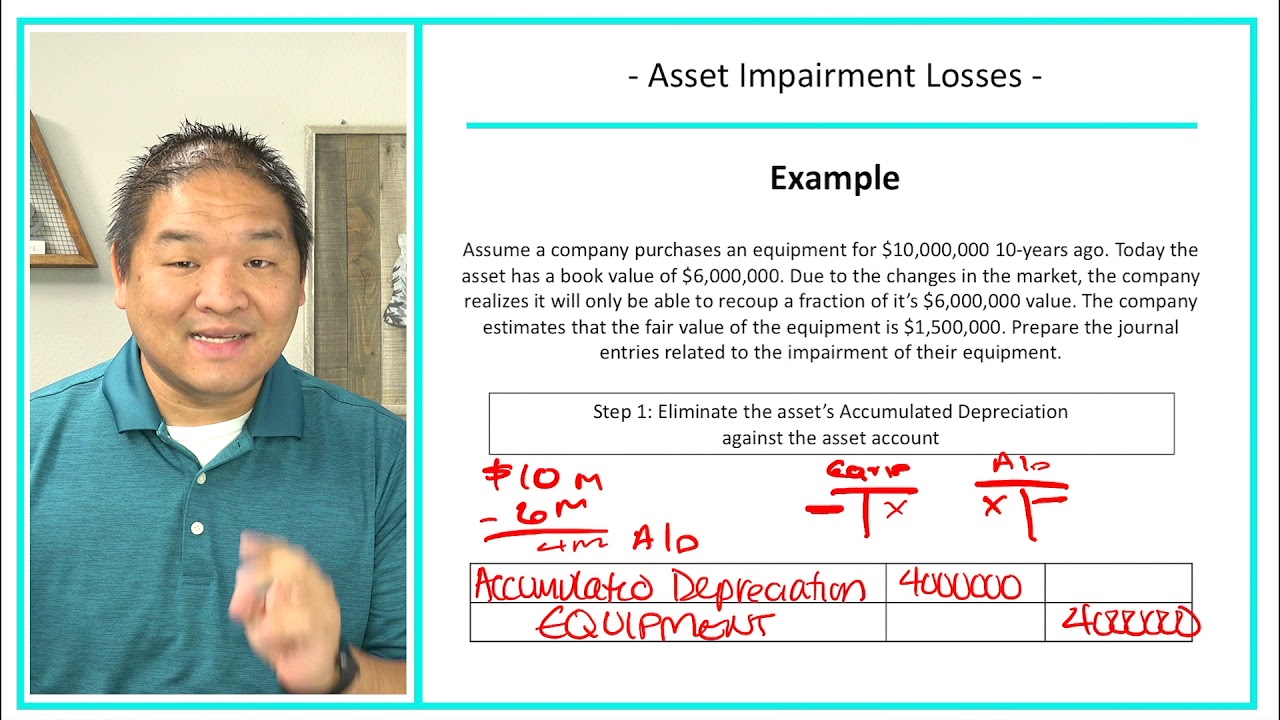

The following provides an overview of generally accepted accounting principles (gaaps) for loan impairment: This loss will be as below. The loss on impairment flows through the income statement to calculate net income.

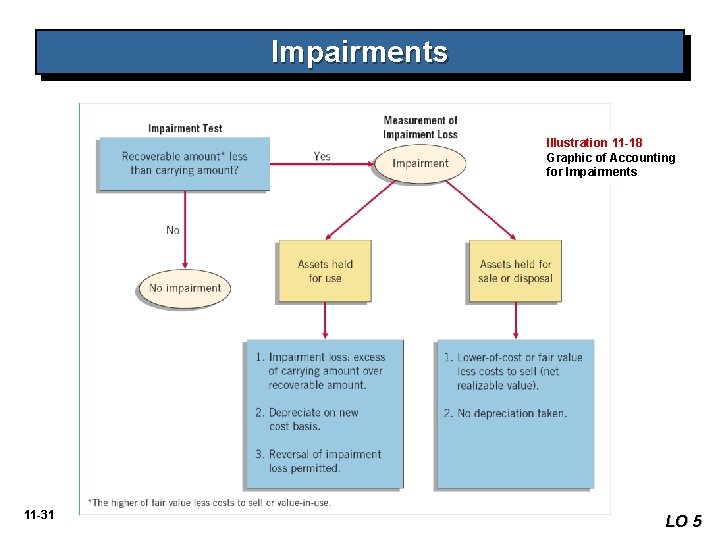

Can calculate the impairment loss. This standard does not apply to inventories and assets arising from construction contracts because existing international public sector accounting standards applicable to these assets contain requirements for An impairment loss is only recognised for a cgu if its recoverable amount is less than its carrying amount.

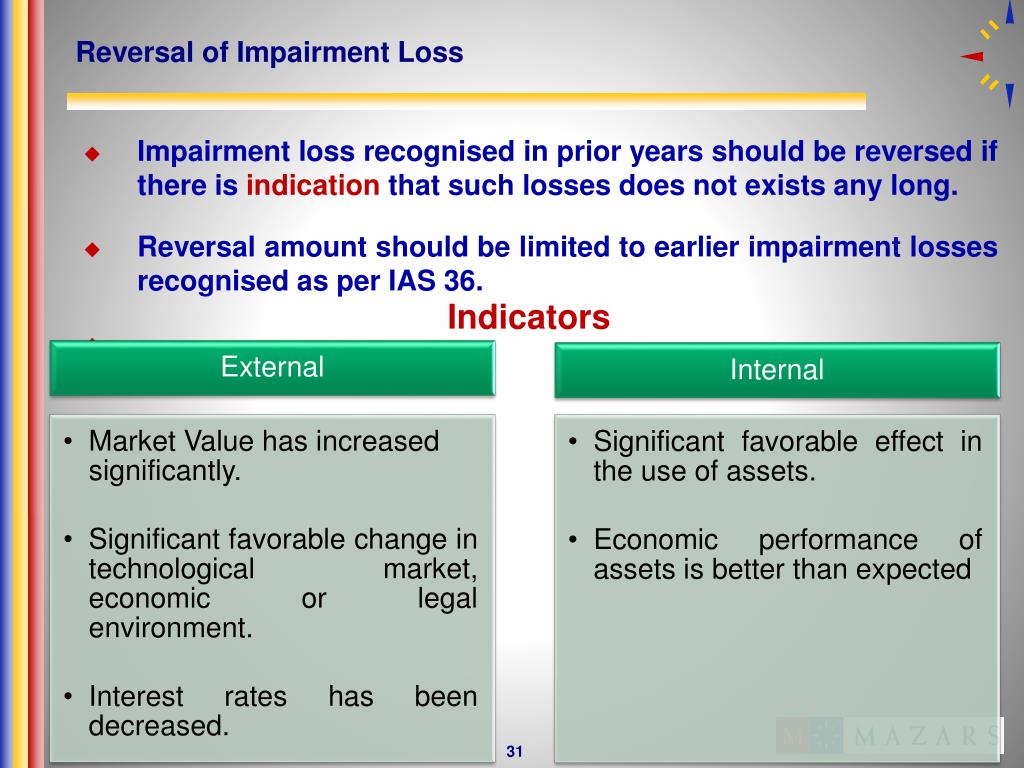

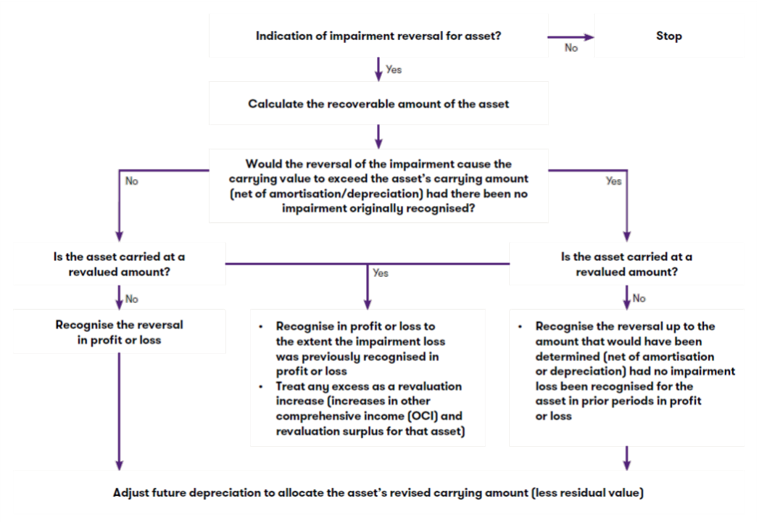

Under the u.s. This reduces the carrying amount of the production line to $200,000, so the accountant also reduces the periodic depreciation charge against the production line, to. Triggers for reversing an impairment loss.

(a) […] the concept in gaap is that impairment of receivables shall be recognized when, based on all available information, it is probable. An impairment loss is a recognized reduction in the carrying amount of an asset that is triggered by a decline in its fair value. Follow us on facebook.

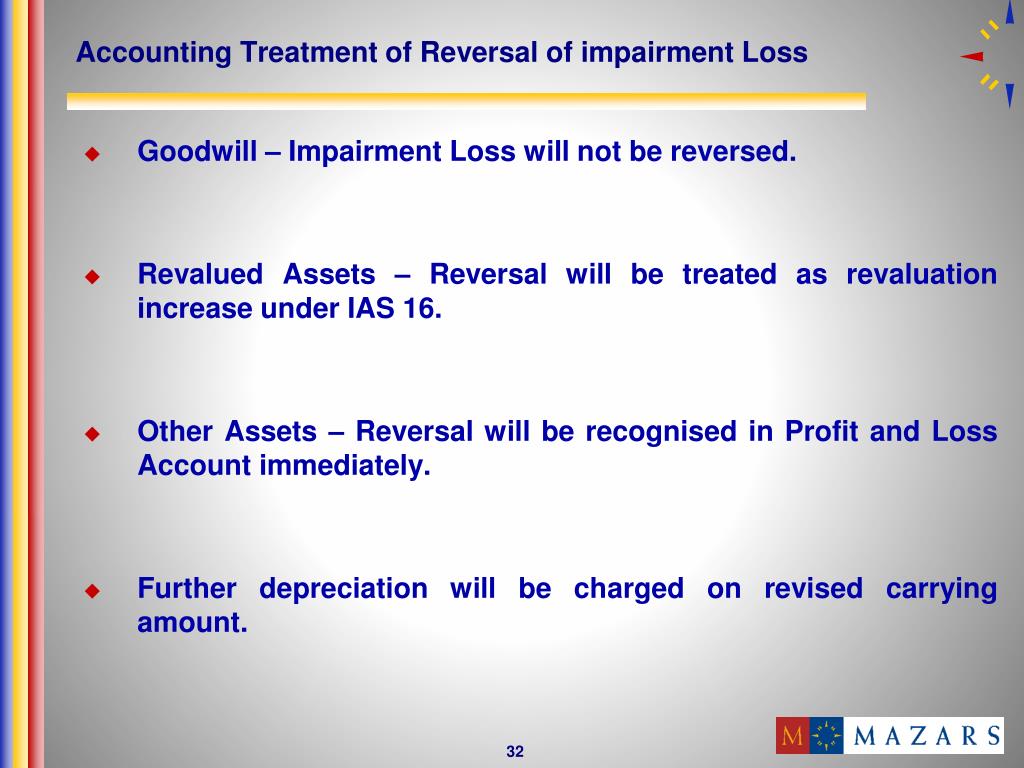

For other assets, when the circumstances that caused the impairment loss are favourably resolved, the impairment loss is reversed immediately in profit or loss (or in comprehensive income if the asset is revalued under ias 16 or ias 38). In accounting, impairment is a permanent reduction in the value of a company asset. November 17, 2023 what is an impairment loss?

:max_bytes(150000):strip_icc()/Impairment-Final-971b3c0742074160985263dd9eb329c2.jpg)