Sensational Info About Other Expenses In Profit And Loss Account

It's a straightforward presentation of a.

Other expenses in profit and loss account. This enables you to see if you have a profit or loss for the period under. The p&l statement is one of three financial. What is a p&l account?

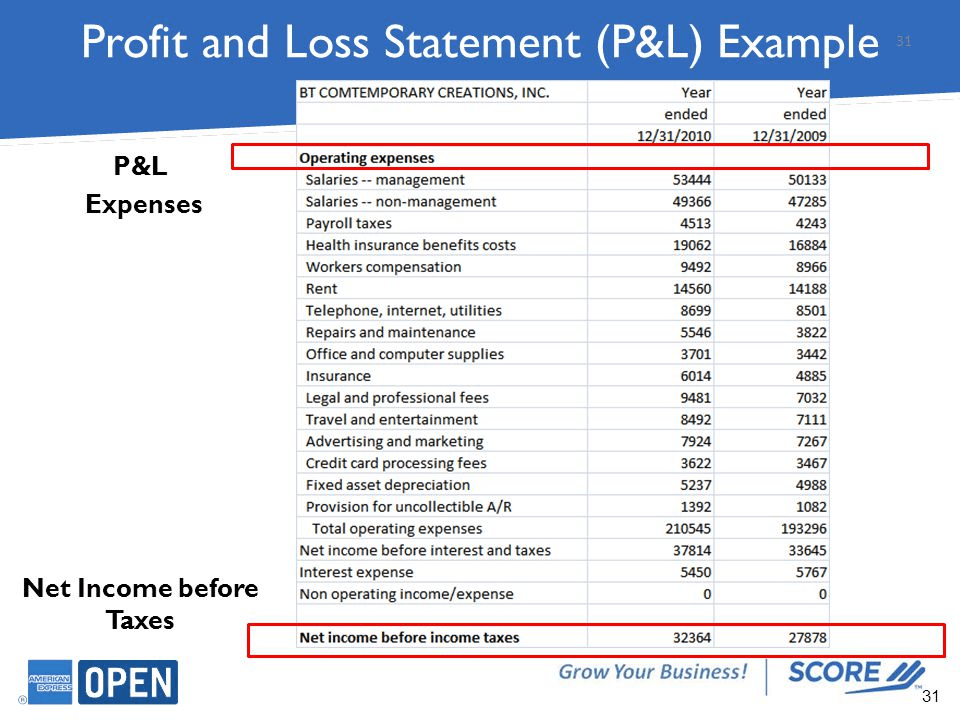

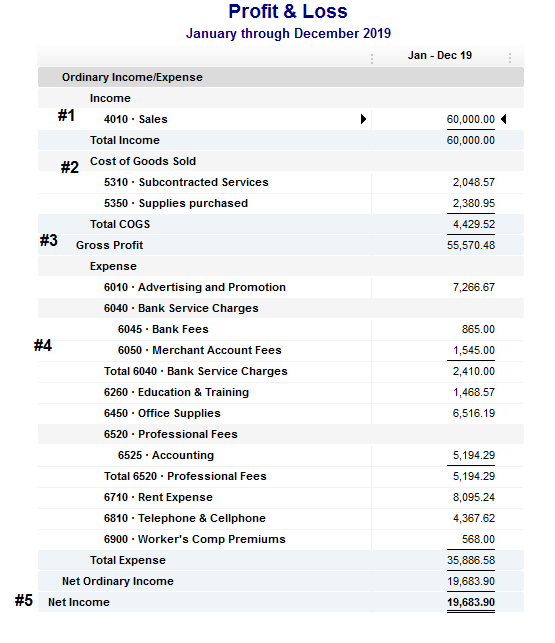

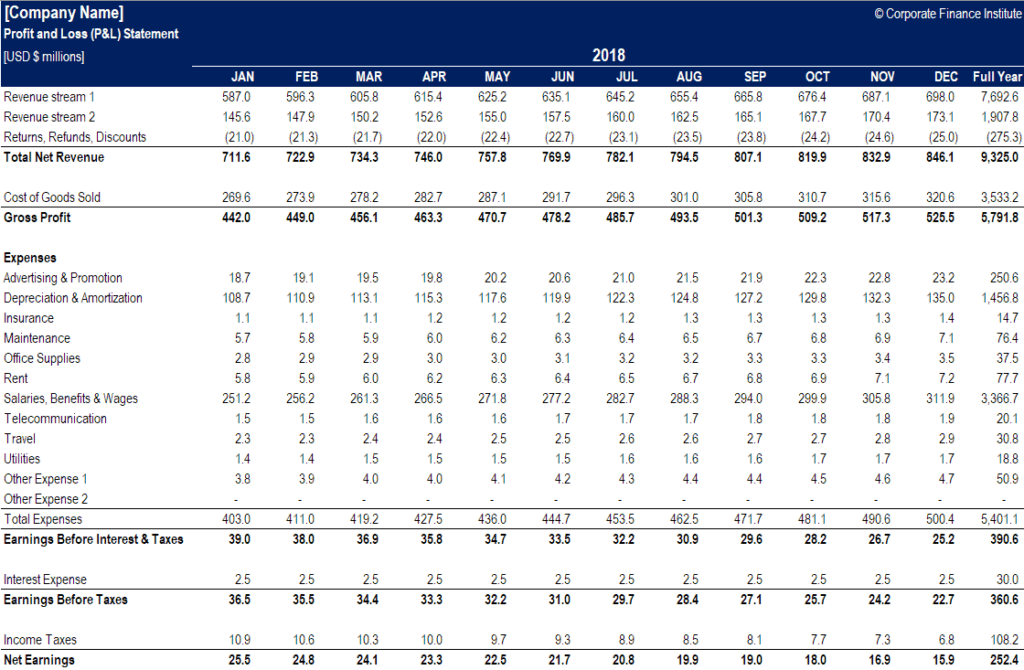

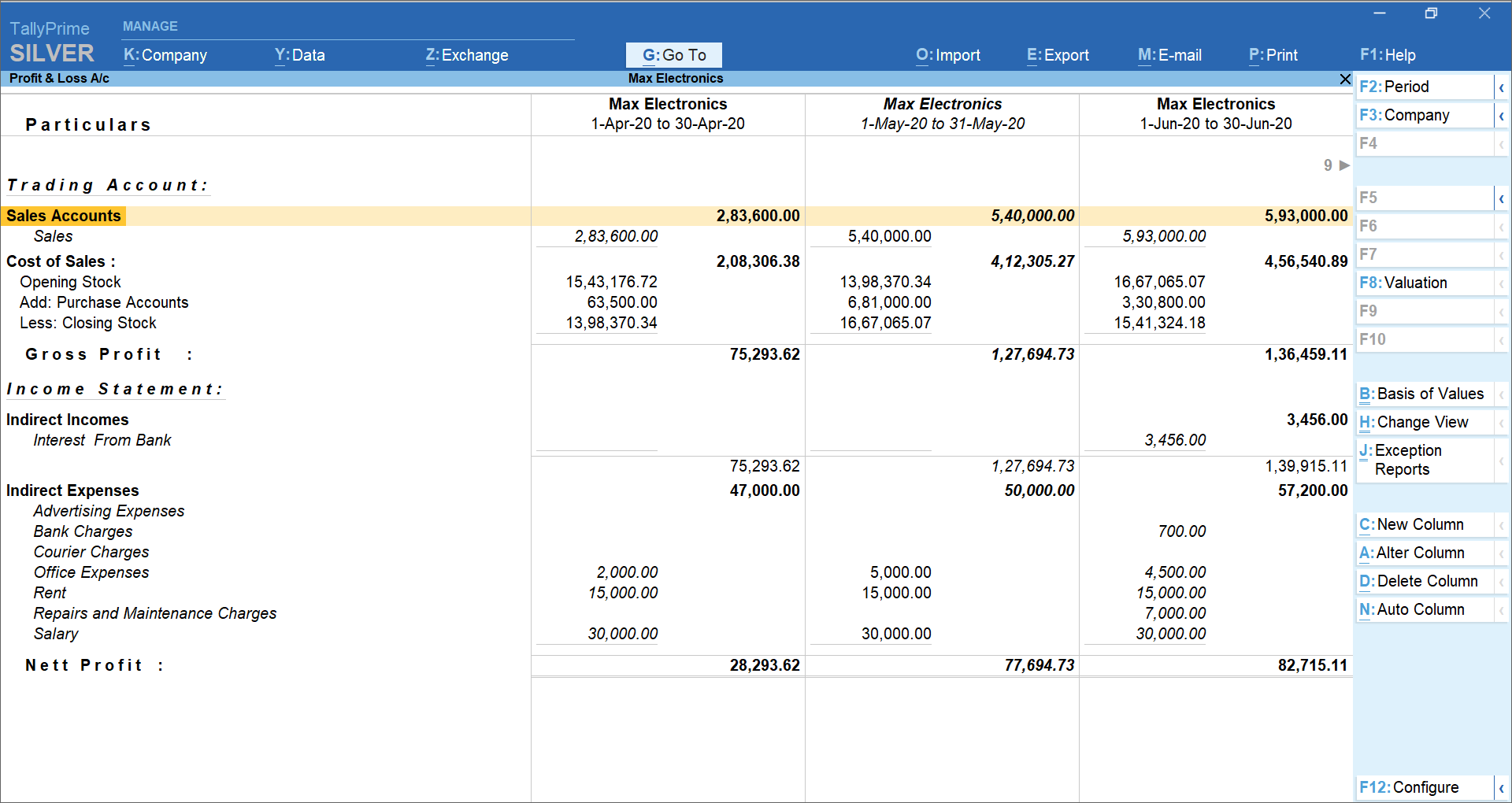

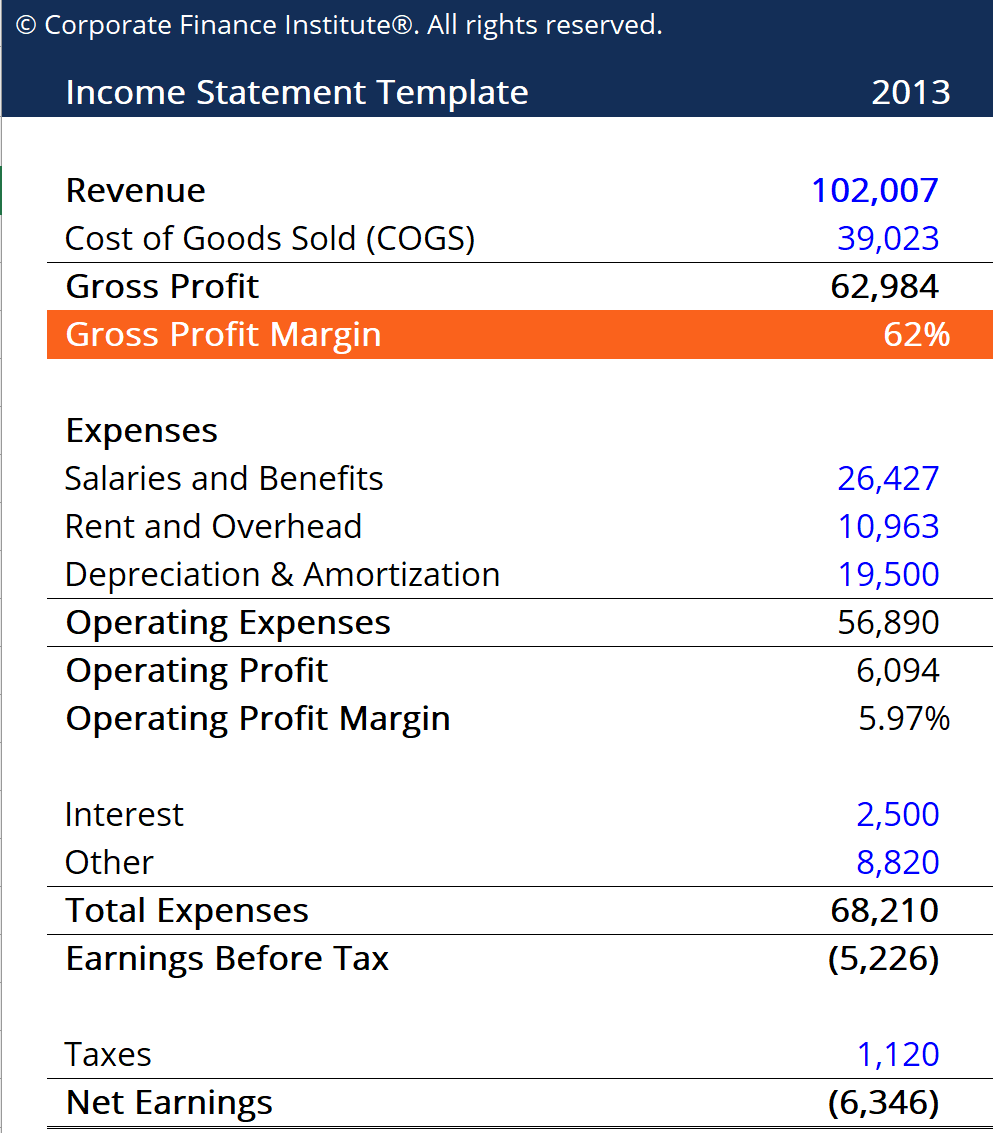

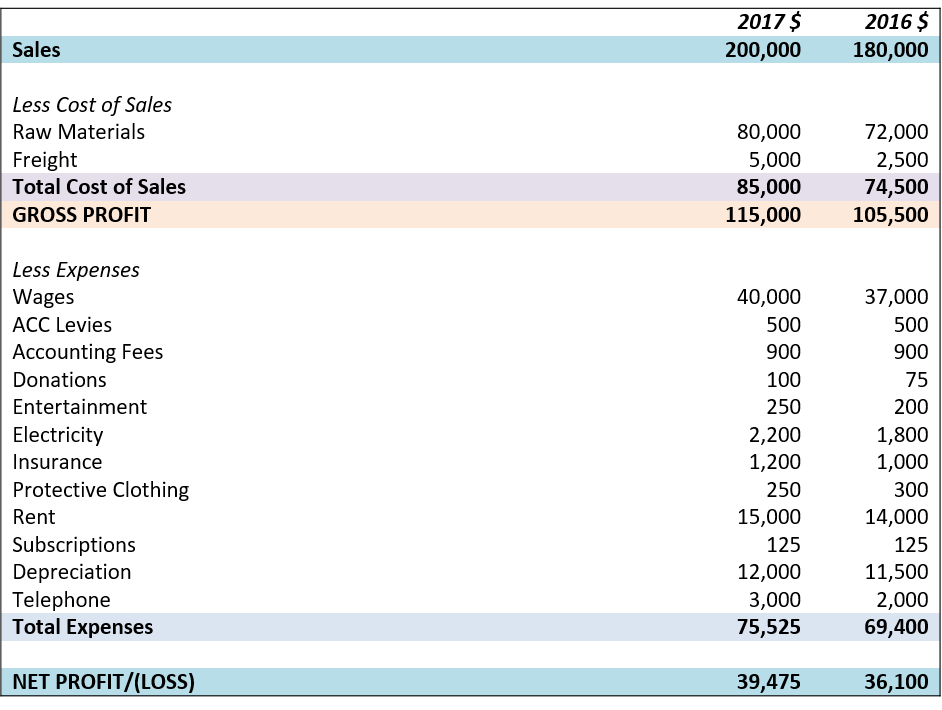

All the indirect expenses and incomes, including the gross profit/loss, are reported in the profit & loss statement to arrive at the net profit or loss. The segregated view of the financial inflows and outflows enables organizations to track their financial performance and implement ways to keep up the same or improve it. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

It shows the company’s net profit or loss during a specific time for which it is prepared. The money spent on buying products wholesale, travelling expenses to the wholesaler, fuel and gas, etc., will be the direct costs. The profit and loss account starts with gross profit at the credit side and if there is a gross loss, it is shown on the debit side.

As seen before with best buy, macy's gross profit of $2.14 billion dramatically differs from its net income of $43 million, due to sg&a costs, interest expenses, impairment and restructuring costs. By contrast, if the total amount of gross profit and other operating incomes is less than the operating expenses, then the difference is treated as a net loss. The purpose of the profit and loss account is to:

A business will incur many other. A p&l statement provides information about whether a company can. Profit and loss (p&l) accounting is the process of creating a profit and loss statement to help companies have a clear view of the revenues and expenses over a period.

This is a guide to other expenses. The money spent on ingredients, rent of the restaurant, the chef’s salary, utility bills, etc., are all direct expenses. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a specific period.

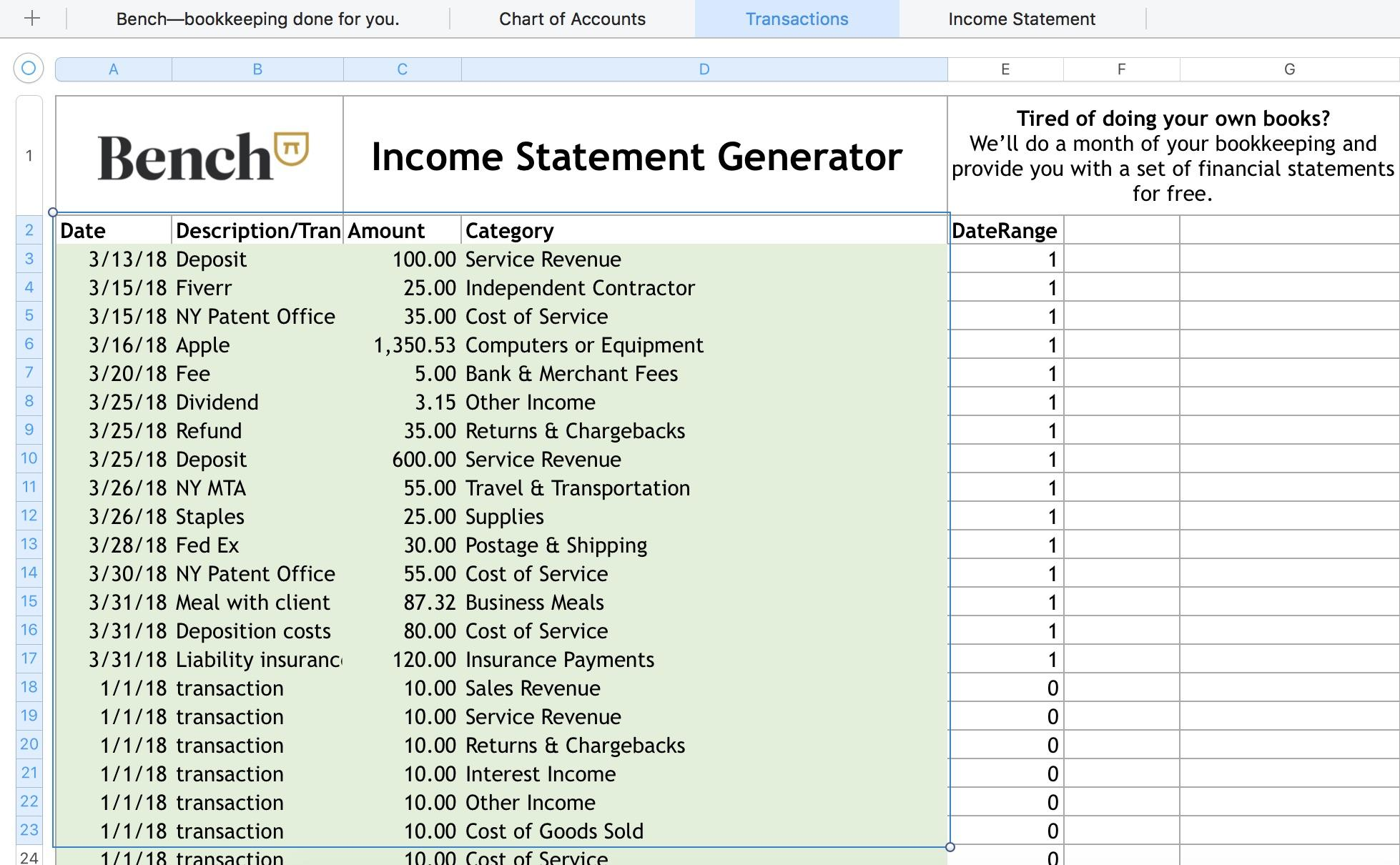

Spend less time figuring out your profitability and more time optimizing it with bench. Profit and loss account get initiated by entering the gross loss on the debit side or gross profit on the credit side. Apart from balance sheets, profit and loss (p&l) accounts are an important cornerstone and a key element of annual financial accounts, with the aid of which businesses state the sources of their income and expenses to determine the annual result.

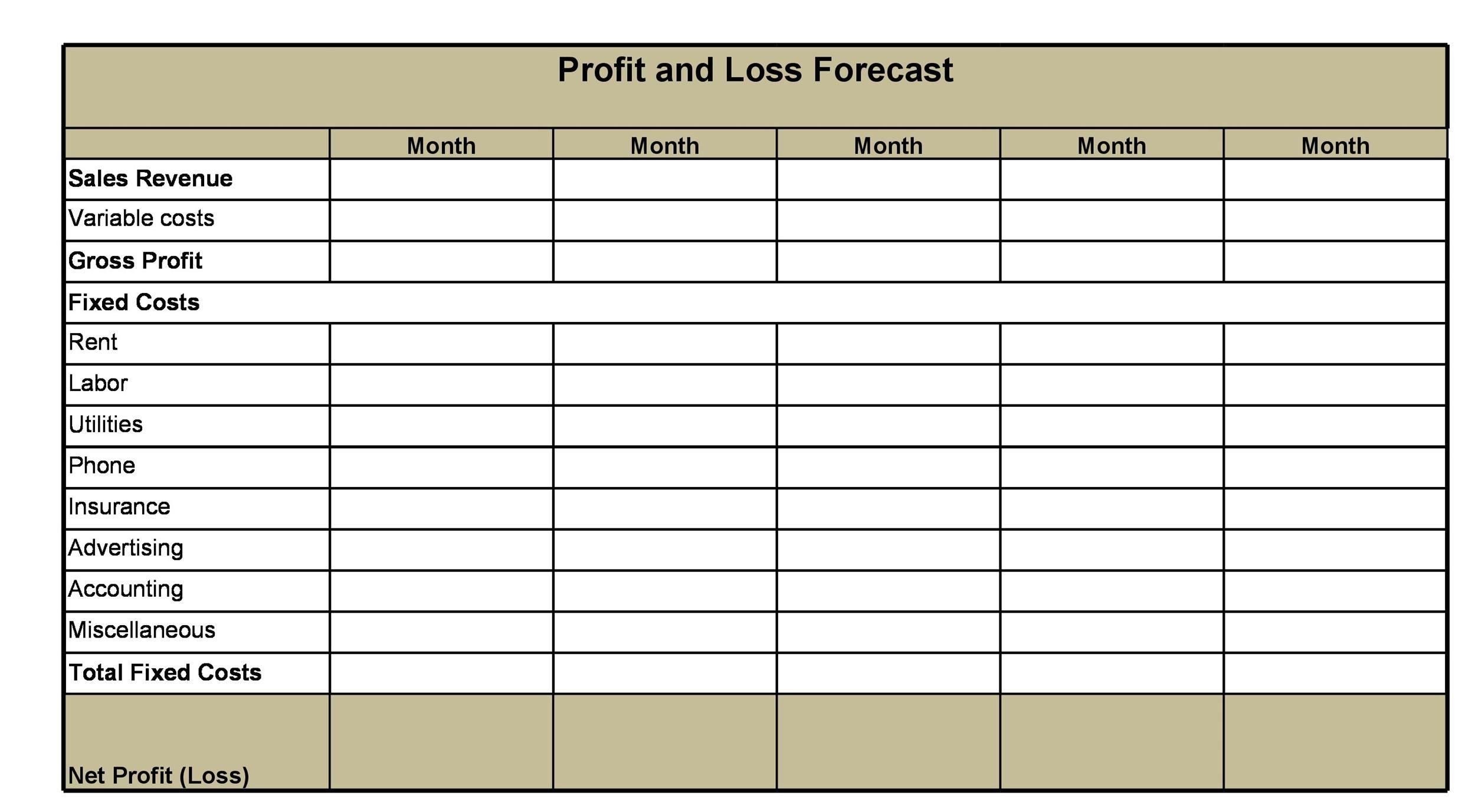

On that basic level, profit and loss is derived from taking your costs away from your sales. The starting point for any p&l is the sales and income that the organization makes and earns. On the simplest level, you create a p&l by deducting the costs of running the organization from its income.

The profit and loss statement, also called an income statement, details a company’s financial performance for a specific period of time. A profit and loss statement is calculated by totaling all of a business’s revenue sources and subtracting from that all the business’s expenses that are related to revenue. If you sold them for more, you made a profit.

Deduct any other expenses from your operating profit (plus any other income) to find your profit before tax. Then, it subtracts the costs of making those goods or providing those services, like. Only the revenue or expenses related to the current year are debited or credited to profit and loss account.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)