Supreme Tips About Capital On The Balance Sheet

Shares in pick n pay crashed nearly 14% on wednesday after the embattled retailer announced a raft of proposed measures to shore up its balance sheet, including tapping shareholders for r4 billion and separately listing value chain boxer.

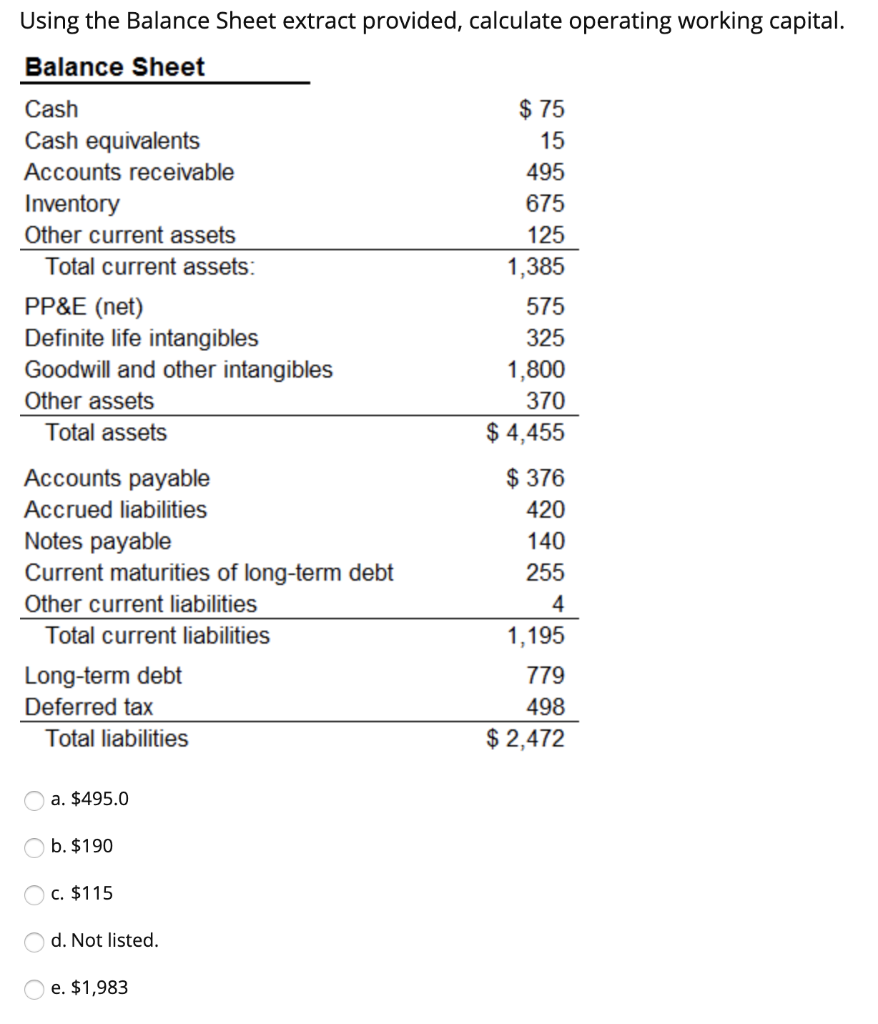

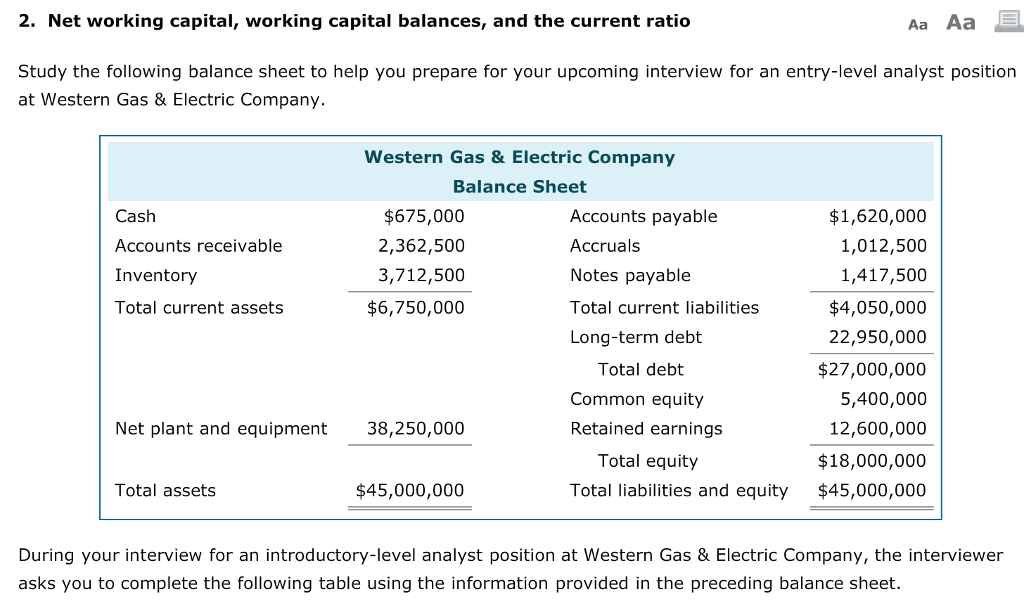

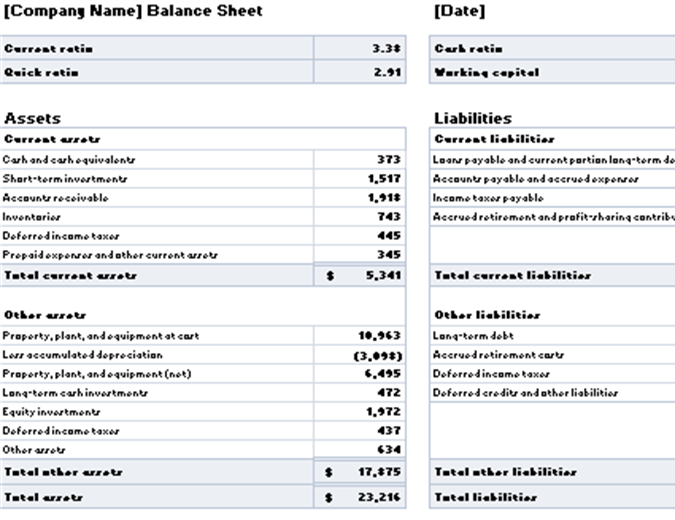

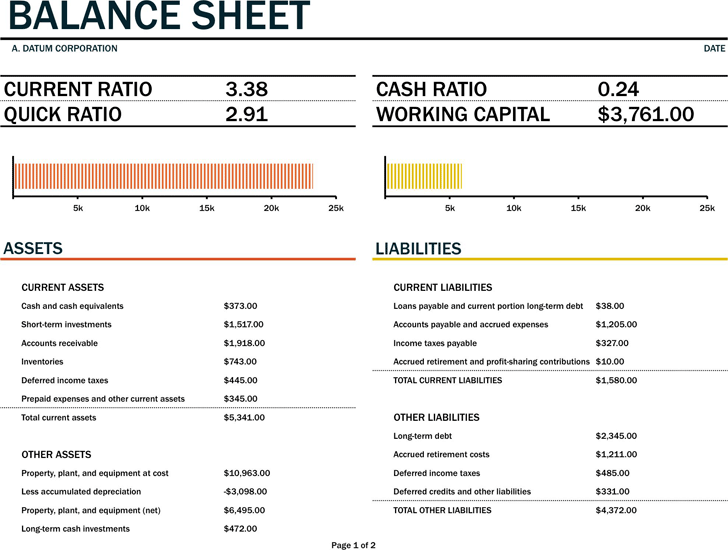

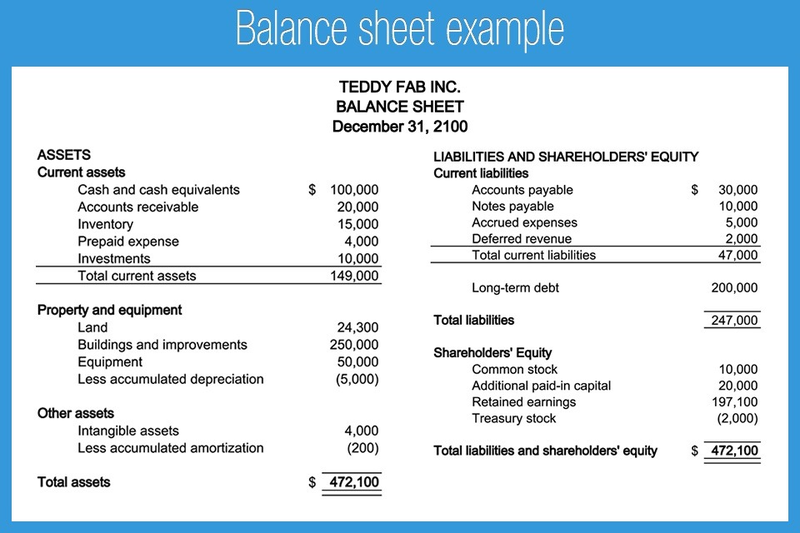

Capital on the balance sheet. The balance sheet is a snapshot of the company’s assets,. Understanding the different types of capital and how to calculate them can help you properly manage your company's finances. Asc 840 capital leases and asc 842 finance leases are substantially the same.

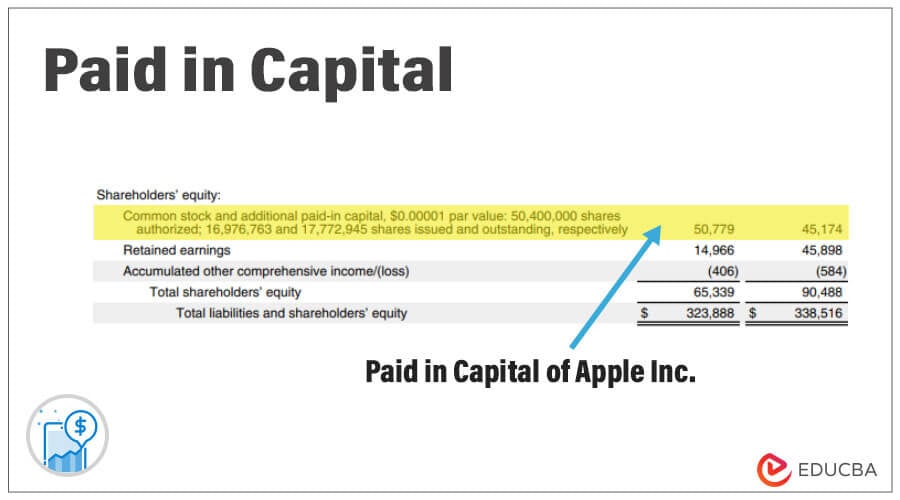

Contributed capital is reported in the shareholder’s equity section of the balance sheet and usually split into two different accounts: A finance lease (previously called a capital lease in asc 840) is a lease that’s effectively a purchase arrangement. Using the amounts from the above balance sheet, we have:

Capital = share capital + retained earnings + reserves. This leftover money belongs to the shareholders, or the owners, of the company.” beginners’ guide to financial statements (source: The latter is also known as the ‘book value’, and is the difference.

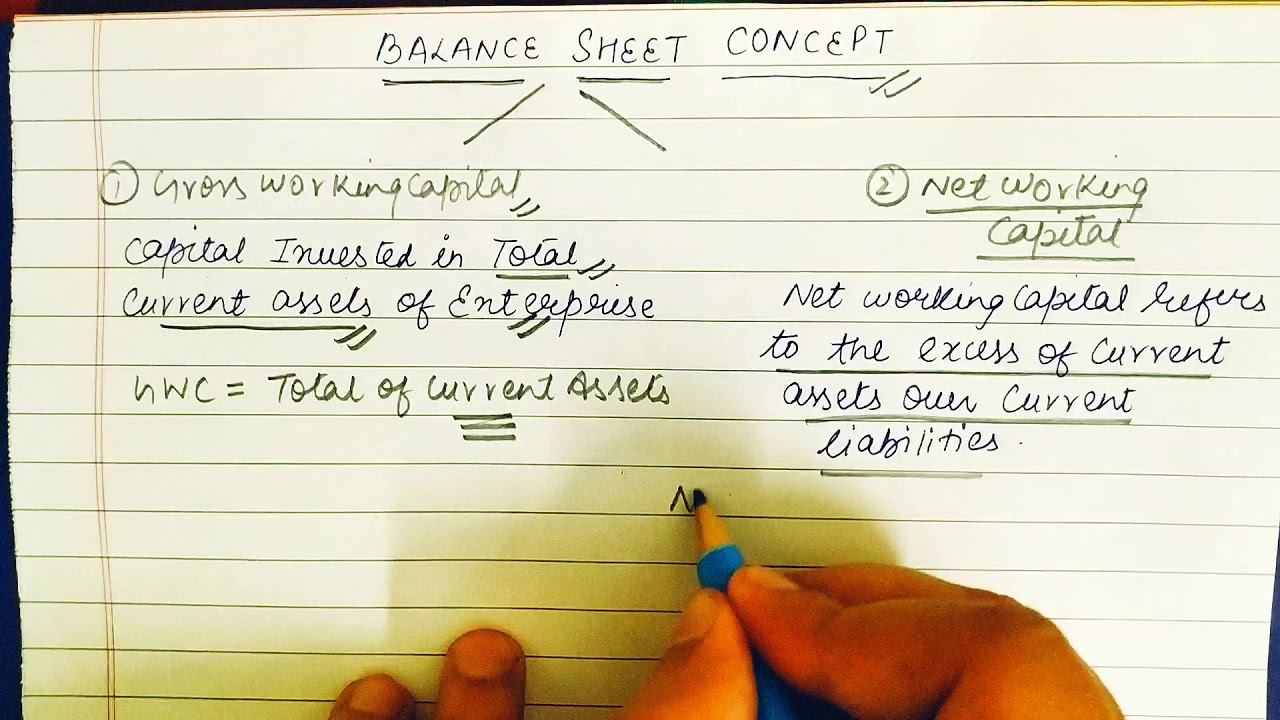

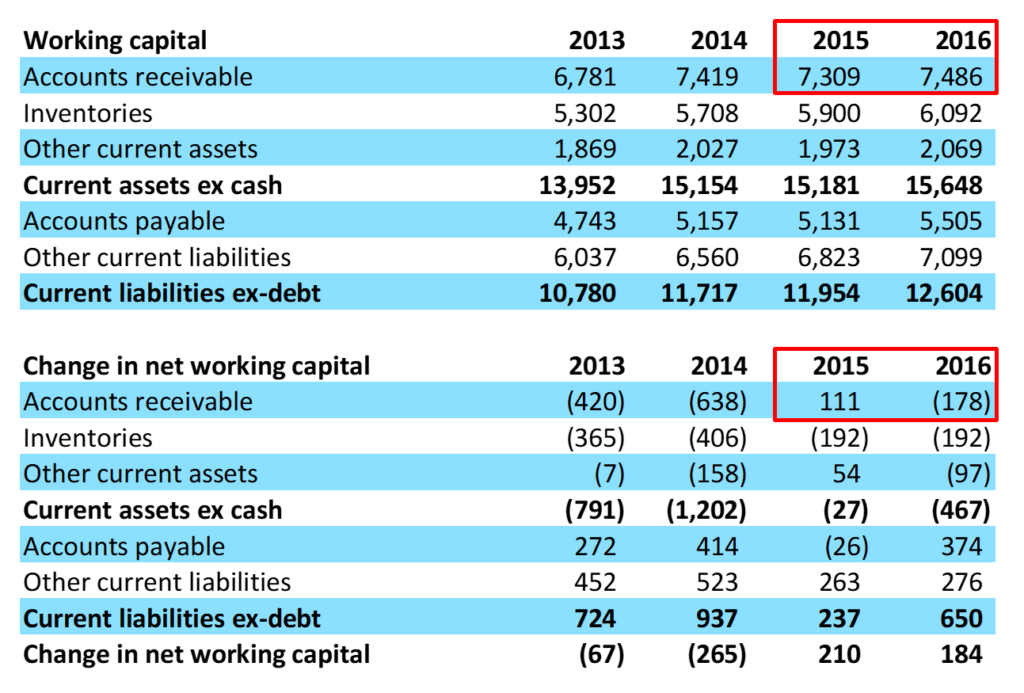

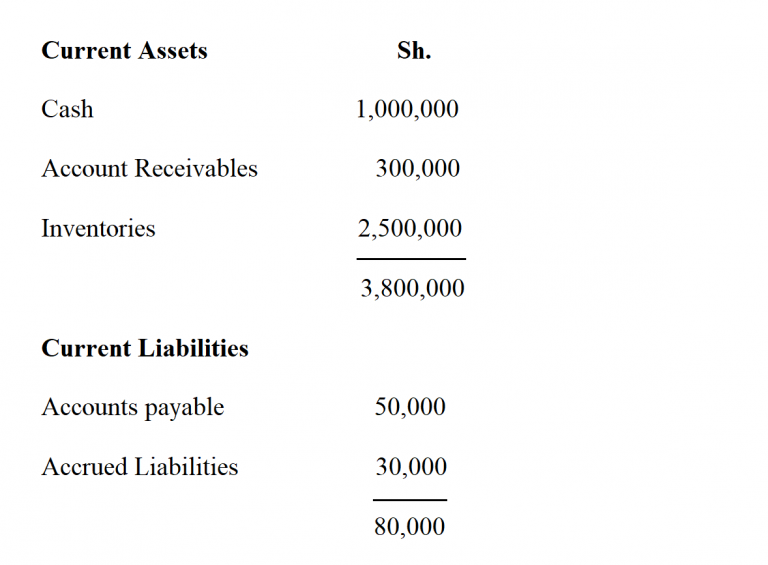

Key takeaways working capital is calculated by subtracting a company's current liabilities from current. The news about boxer and the capital raise rattled the market. A balance sheet summarizes the assets, liabilities, and capital of a company.

According to the last reported balance sheet, fastenal had liabilities of us$661.3m due within 12 months, and liabilities of us$452.8m due beyond 12 months. Liabilities are obligations to creditors, lenders, etc. Asc 842 lease accounting example

These assets may include cash, cash equivalents, and marketable securities as well as. The classified balance sheet allows users to quickly determine the amount of the company's working capital. Hazardous substance tax (february 2024 forecast) other revenues (cost recovery, penalties, etc.) fund transfers.

The federal reserve’s internal debate over the fate of its balance sheet reduction effort is set to quicken at its march policy meeting, with policymakers first setting the stage for how they’ll likely slow the drawdown, likely deferring a decision on when to stop the process altogether to a later date. Let's take an example to illustrate this formula. A company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth).

The balance sheet is based on the fundamental equation: To calculate capital on the balance sheet, you need to add up the value of all the components mentioned above. The balance sheet, together with the income.

In the above example, the contents of the balance sheet pertain to the financial condition of the company on december 31, 2021. Offsetting these obligations, it had cash of us$221.3m as well as receivables valued at us$1.09b due within 12 months. The other two are the income statement and cash flow statement.

Once capitalized, the value of the asset is slowly reduced over time (i.e., expensed) via depreciation expense. Balance sheets are the best way to periodically review a company's financial status, and capital is one of the most important elements on a balance sheet. It's easy to assume that negative working capital spells disaster.