Awesome Info About Prepaid Rent In Income Statement

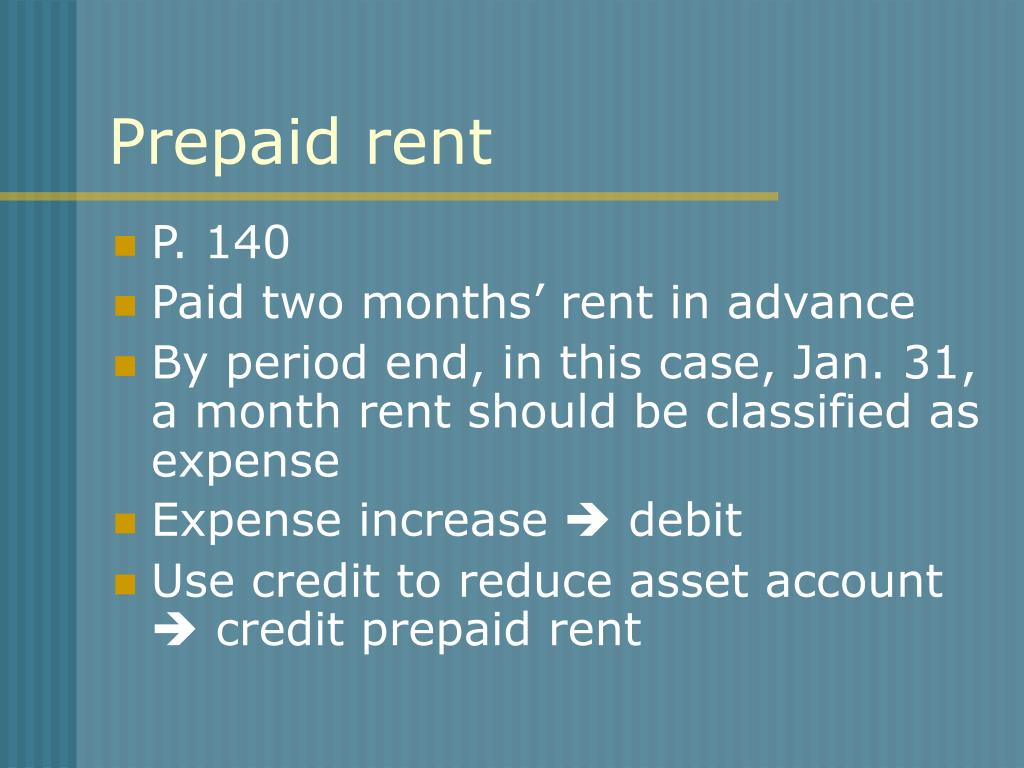

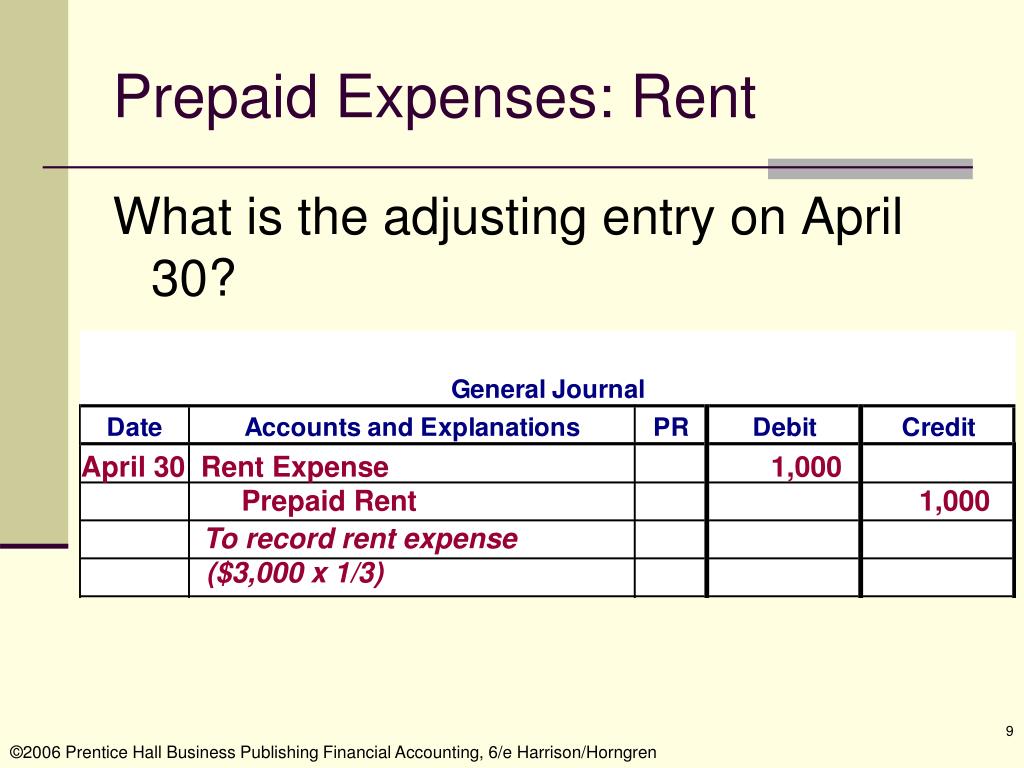

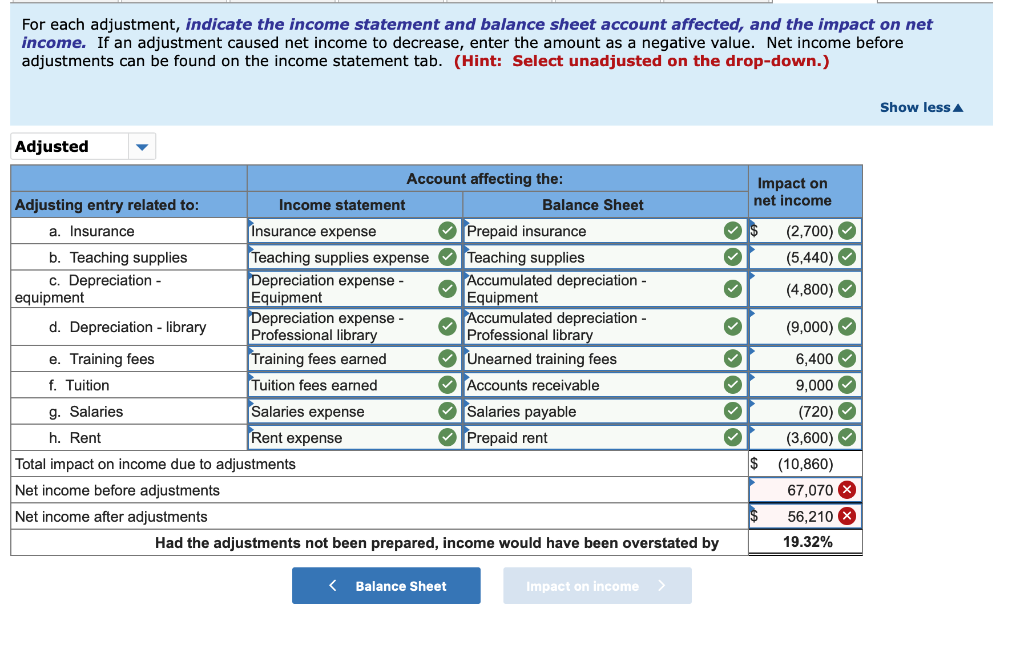

The transaction will reduce the prepaid rent balance on the balance sheet and increase expenses on the income statement.

Prepaid rent in income statement. For example, refer to the first. Prepaid rent is a balance sheet account, and rent expense is an income statement account. On the other hand, a decrease in prepaid expenses has a positive effect on cash flow as there is no cash outflow even.

Rent expense on the income statement rent expense on. Accrued rent accounting for accrued rent with journal entries 3. No, prepaid expenses are not recorded in the income.

The amount reported on the. When do prepaid expenses hit the income statement? Examples of prepaid expenses include insurance, rent, leases, interest, and taxes.

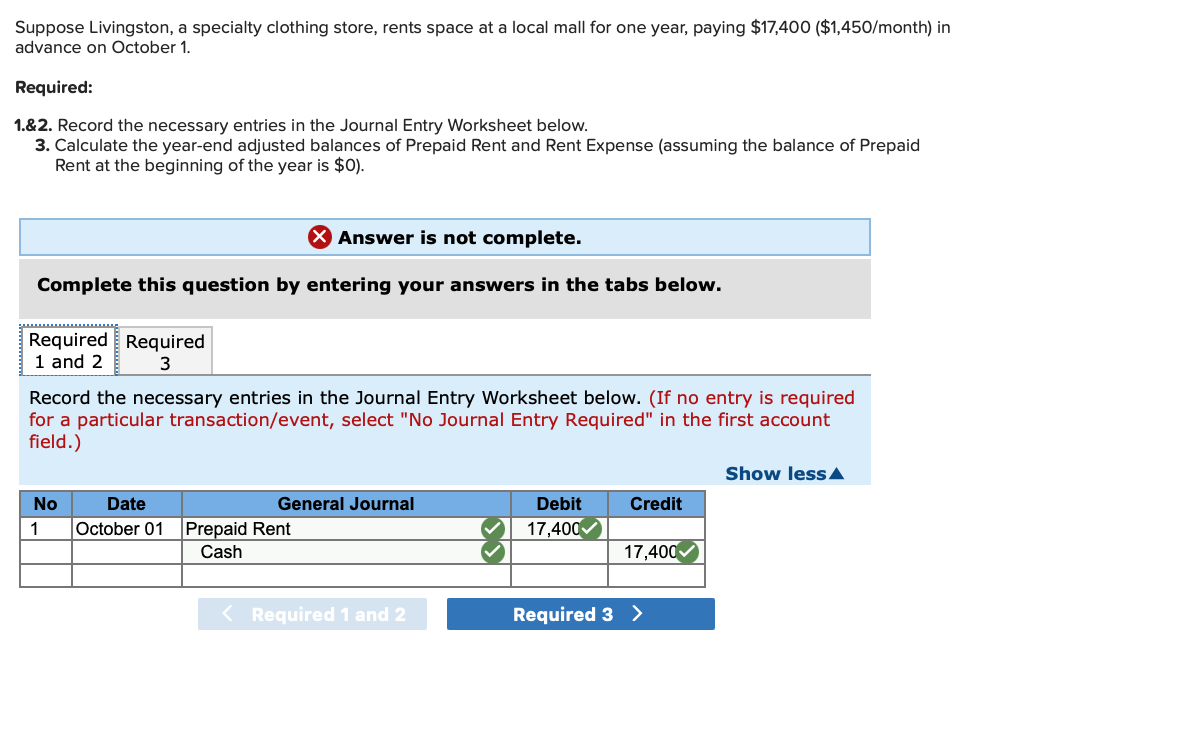

With the accrual basis of the accounting method, any revenue is listed on the income statement upon earning it, even if the cash hasn’t actually been received yet. The portion of prepaid rent that corresponds to the time period is recognized as an expense on the income statement. When a company pays rent in advance for a future period, it has a prepaid rent amount that represents.

Prepaid rent is a prepaid expense that must be recorded in the company’s financial statements. Finance lease income statement presentation. When prepaid rent is recorded, accountants adjust the balance monthly, moving expenses to the income statement according to gaap rules.

Accounting for prepaid rent with journal entries 2. The two most common prepaid expenses are insurance and rent. As noted above, prepaid expenses are payments made for goods and services that a company intends to pay for in advance but will incur sometime in the future.

Under the accrual method, no expense is recorded until it is incurred. How is rent expense presented in the financial statements? On the balance sheet, current assets decrease as prepaid.

Rent is commonly paid in advance, being due on the. Decrease in prepaid expenses on cash flow statement. Recording a prepaid expense requires a prepaid expense journal entry that accurately records the transactions in the accounting.

Is prepaid expense an income? In layman’s terms, prepaid expense. A current asset account that reports the amount of future rent expense that was paid in advance of the rental period.

We will discuss the accounting treatment for the prepaid rent on. Then, as each month ends the prepaid rent account, which is on the balance sheet, is reduced by the monthly rent amount, which is $24,000 divided by 6 months, or. On the income statement, rent expense is recorded, which increases expenses, and in turn, decreases net income.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-03-8b430eba78534c66be0eb416932fe80e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-04-59546336082445fa8db2dd9bbfcf58cb.jpg)