Out Of This World Tips About Accounts Payable In Cash Flow S Corporation Balance Sheet Format

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it.

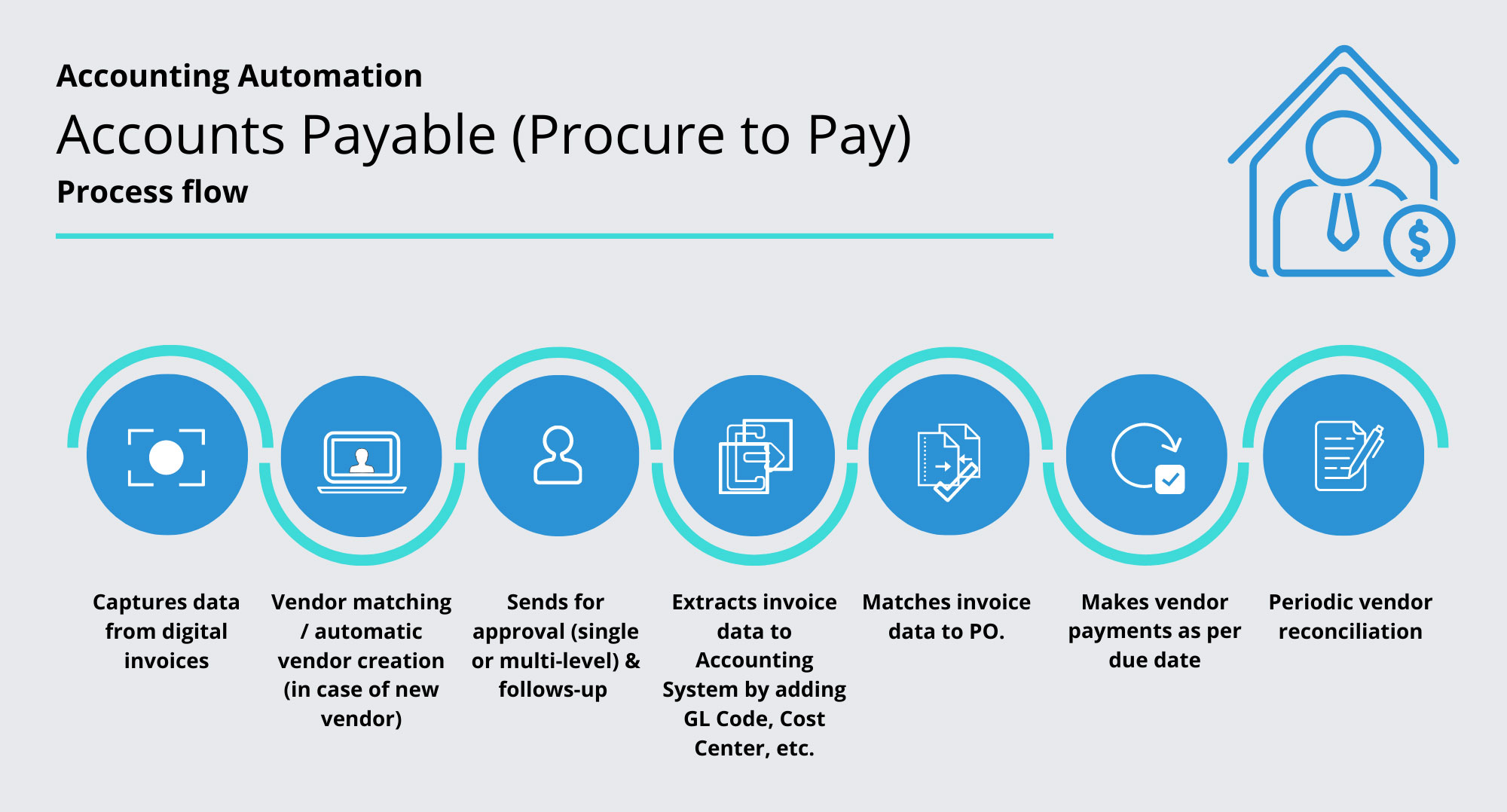

Accounts payable in cash flow s corporation balance sheet format. Accounting journal template; Here are a few examples: In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established.

The statement of cash flows is prepared by following these steps: The increase or decrease in total ap from the prior period appears on. Which is the corporation’s primary class of stock issued, with each share representing a partial claim to ownership or a share of the company’s business.

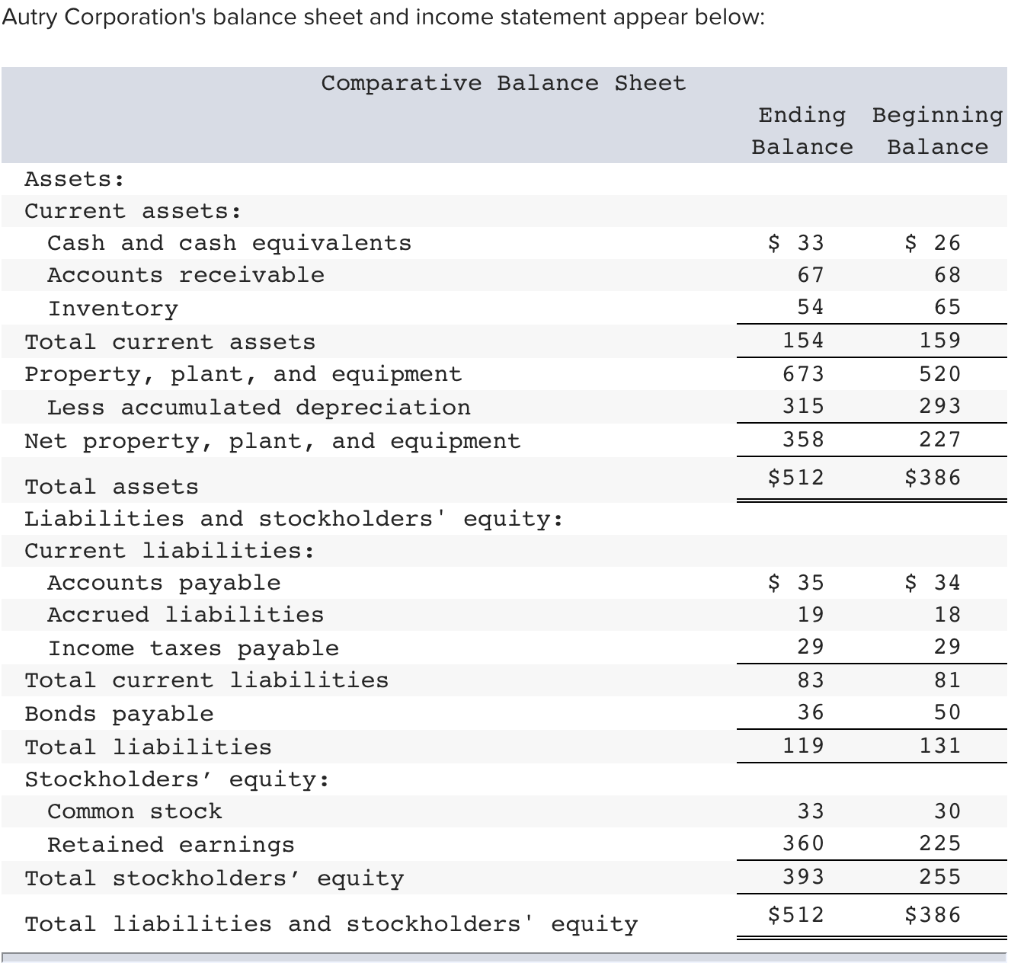

On the cash flow statement, the accounts payable is a line item under the operating activities section. It reports a company’s assets, liabilities, and equity at a single moment in time. On the balance sheet, it represents the current liability and is recorded under the current liability section.

What is an s corp balance sheet? A balance sheet shows what a company owns in the form of assets, what it owes in the form of liabilities, and the amount of money invested by shareholders listed under shareholders' equity. Not used for the cash basis or modified cash basis, since these items are charged to expense.

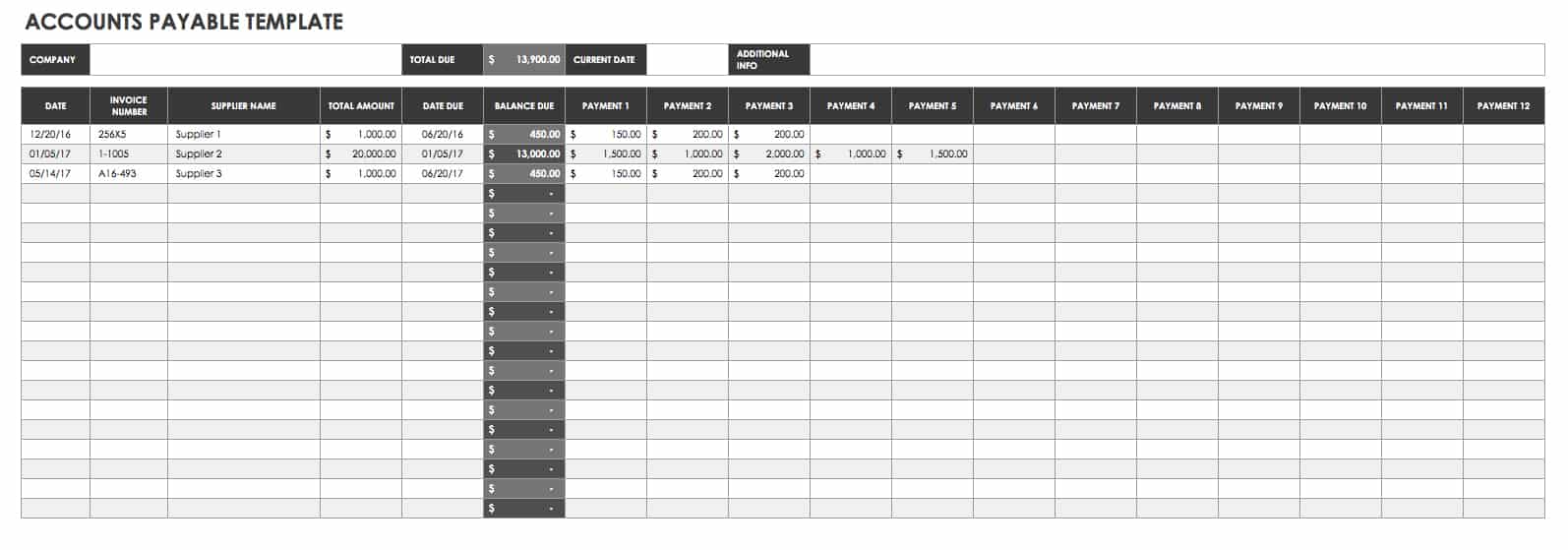

In account format, the balance sheet is divided into left and right sides like a t account. The balance sheet shows that the ending balance in accounts payable was $9,424 for the quarter. Balance sheet example below is an example of amazon’s 2017 balance sheet taken from cfi’s amazon case study course.

The income statement listed $14,108 in manufacturing costs, and $8,212 in other operating expenses. The format is similar to the format of the income statement (three lines for the heading, three columns). These sheets are required by the irs, in addition to profit and loss statements.

What is a balance sheet? But even if your firm falls below the $250,000 threshold, it’s still a good idea to maintain a balance sheet throughout the year, and include it with your filing. Begin with net income from the income statement.

Statement of cash flows, balance sheet, statement. Add back noncash expenses, such as depreciation, amortization, and depletion. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

When a corporation borrows money from its bank, 1) the corporation's assets will increase, and 2) the corporation's liabilities will increase. The income statement lets you know how money entered and left your business, while the balance sheet shows how those transactions affect different accounts—like accounts receivable, inventory, and accounts payable. The balance sheet contents under the various accounting methodologies are:

An s corp balance sheet includes a detailed list of your company's assets and liabilities. (also called accounts payable), taxes, wages, and other business costs that will be paid in the future. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)