Outrageous Tips About Debt In Balance Sheet

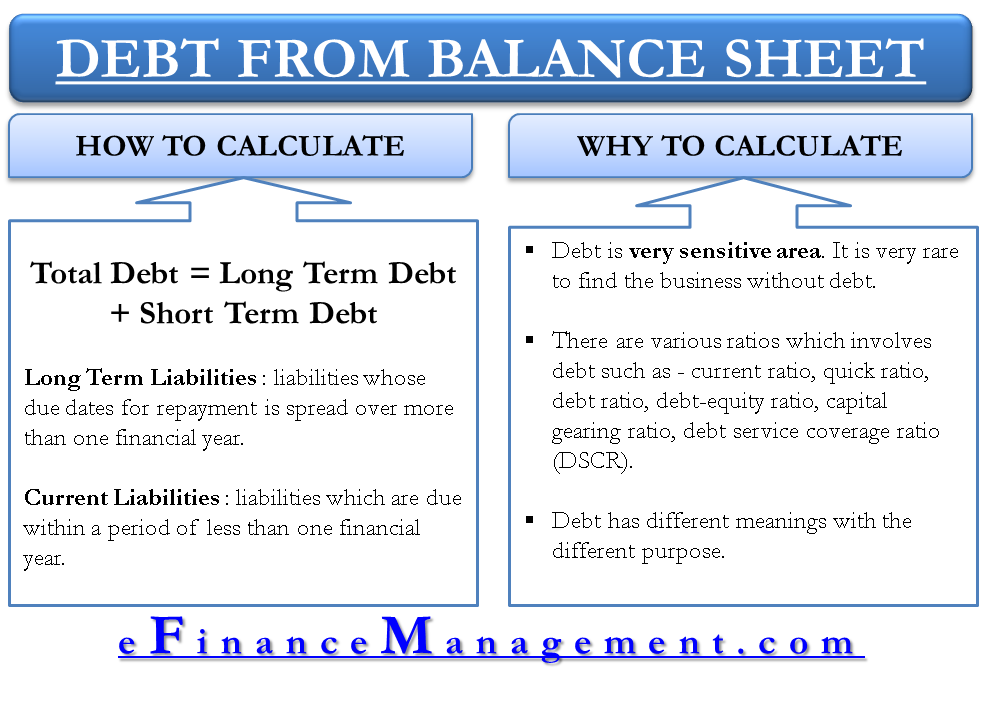

When analysing debt levels, the balance sheet is the obvious place to start.

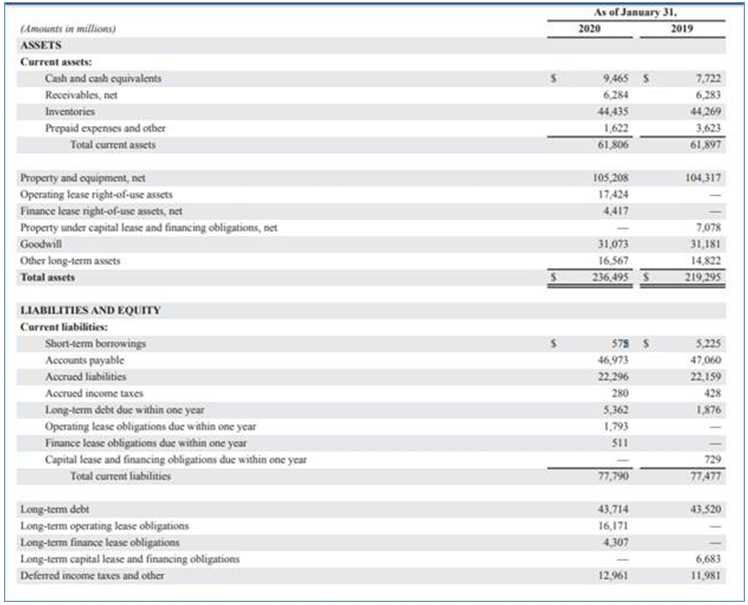

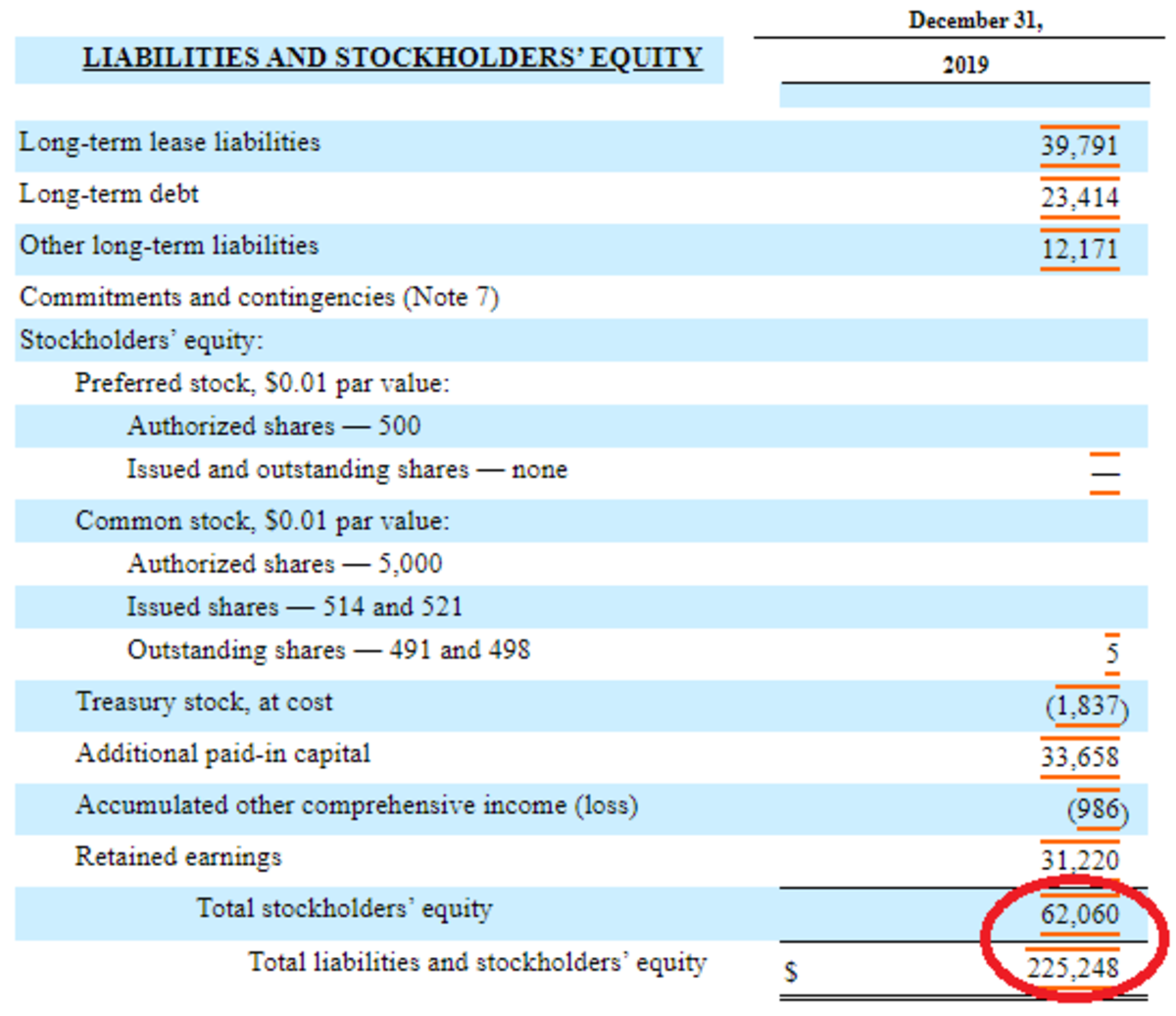

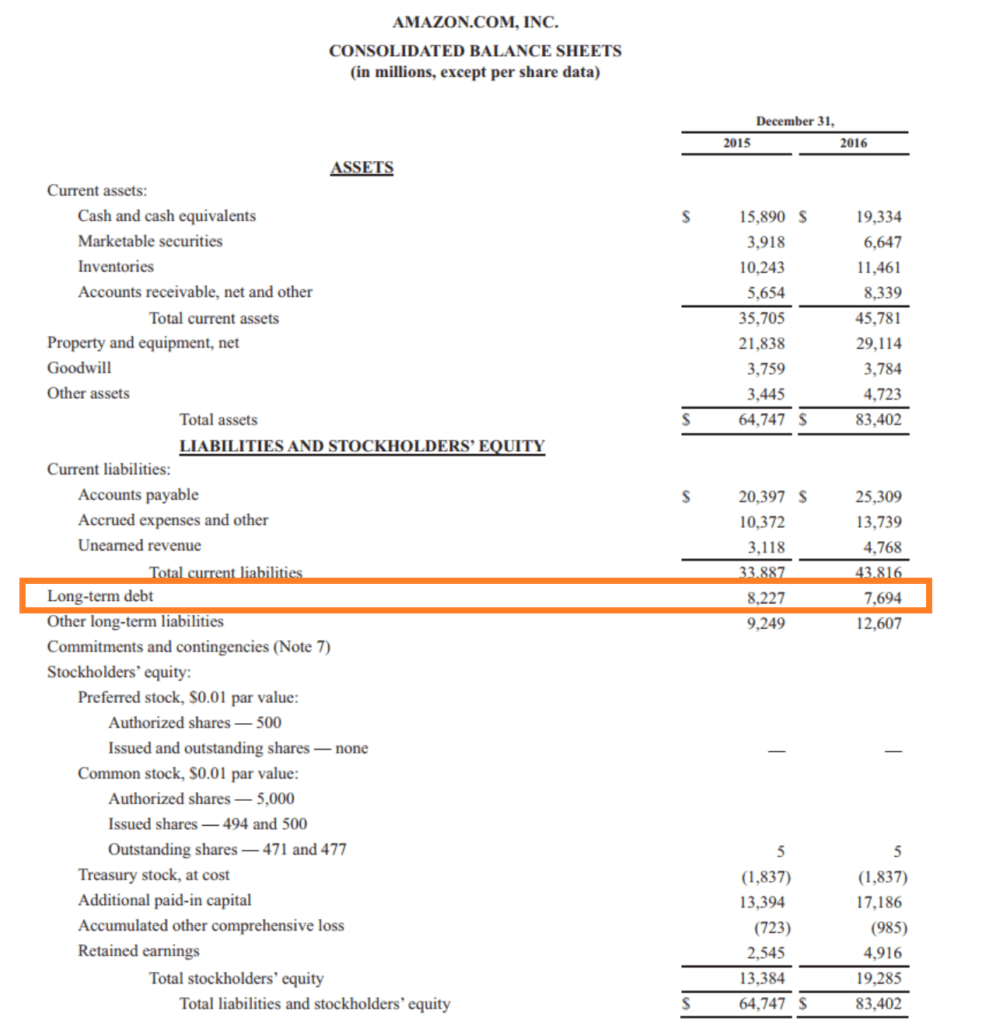

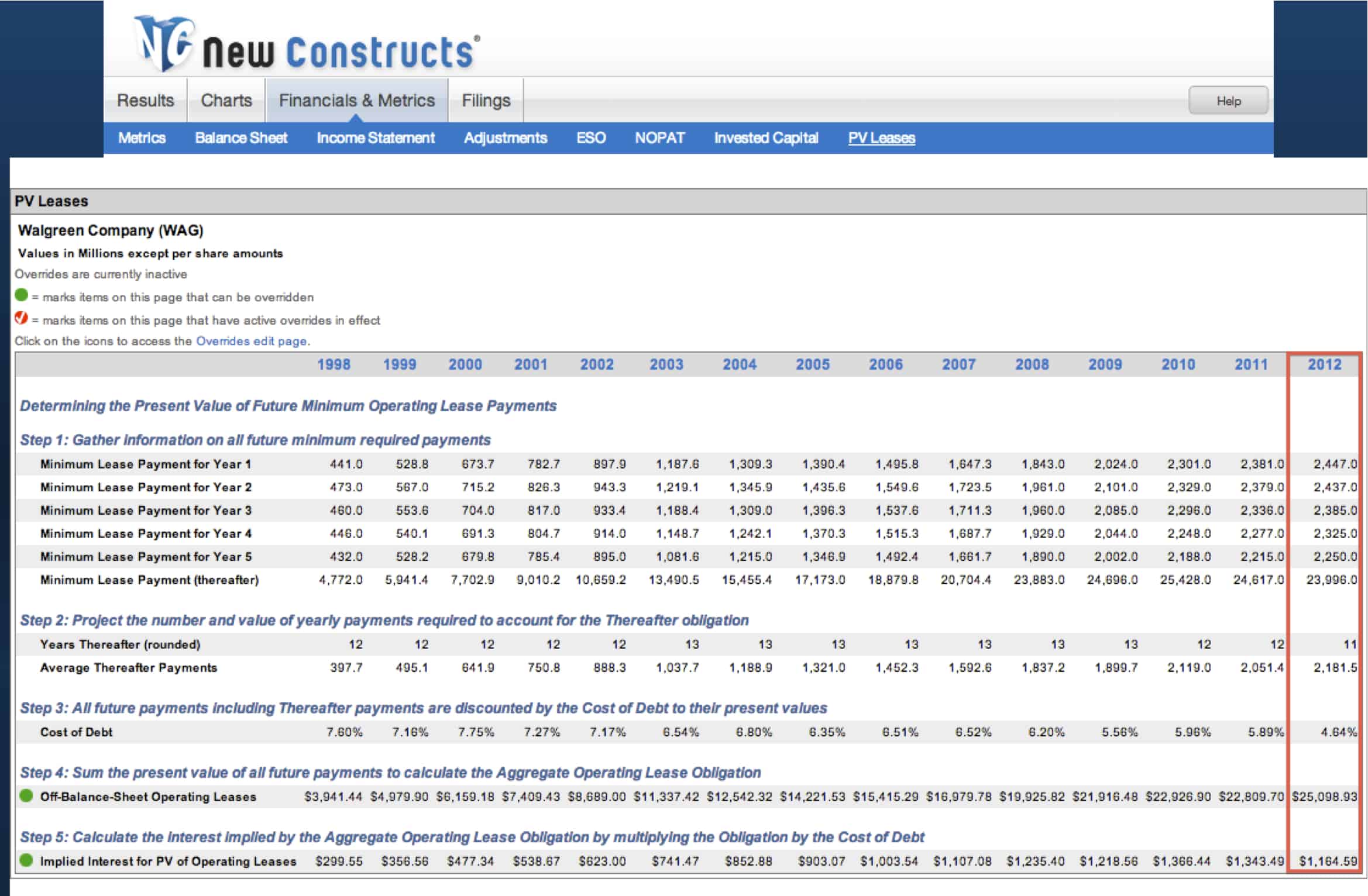

Debt in balance sheet. Various definitions of debt total debt. A company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth). Telekom malaysia bhd’s (tm) net debt to earnings before interest, tax, depreciation and amortisation (ebitda) may fall to 0.4 times for the financial year 2025 (fy25) and 0.2.

In a balance sheet, total debt is the sum of money borrowed and is due to be paid. · have a market value of $5 billion or more. Or you could enter the values for total liabilities and.

Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable education (save) repayment plan. It can also be referred to as a statement of net worth or a statement of financial position. This ratio is calculated by taking total debt and dividing it by total assets.

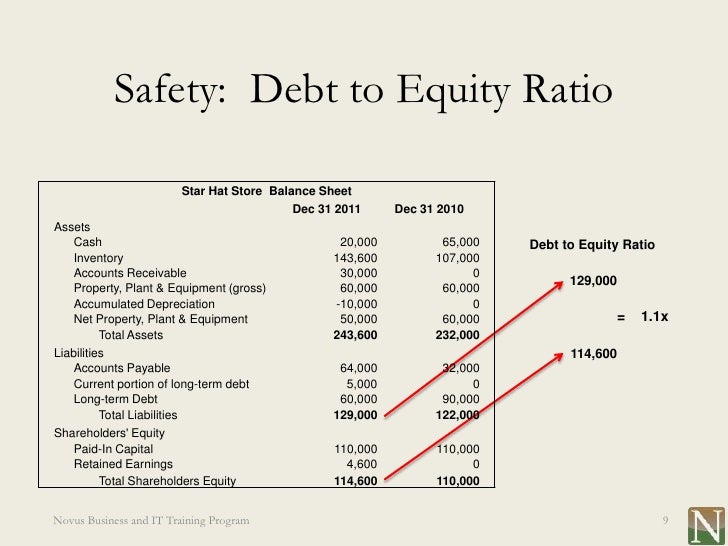

The formula to calculate the debt to capital ratio is as follows. In this scenario, the company has a debt ratio of 60%, implying that 60% of its assets have been financed through borrowed funds. This study examines whether firms with debt contacts that contain more restrictive balance sheet covenants are more likely to conduct seasoned equity offerings.

Assets = liabilities + equity. The net change in cash of $14m is then added to the beginning cash balance of $50m to get $64m as the ending cash balance in year 1. In the final section of our debt schedule, we’ll calculate the ending debt balances for each tranche, as well as the total interest expense.

Both figures can be obtained from the balance sheet. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. Beginner’s guide (sec.gov) “a balance sheet provides detailed information about a company’s assets, liabilities and shareholders’ equity.

Debt to capital ratio = total debt ÷ total capitalization. A company may owe $200,000 with $40,000 due for payoff in the current year. Assets are things that a company owns that have value.

The total debt of a company is found by adding the amount owed in. Hence, as an alternative we can use the following formula: To make my balance sheet powerhouses list, a company must:

What is the definition of the balance sheet? Net debt is a liquidity measure that determines how much debt a company has on its balance sheet relative to its cash on hand. Balance sheets provide the basis for.

But ultimately, every company can contain risks that exist outside of the balance sheet. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Balance sheets serve two very different purposes depending on the audience reviewing them.