Formidable Tips About Content Of Profit And Loss Account

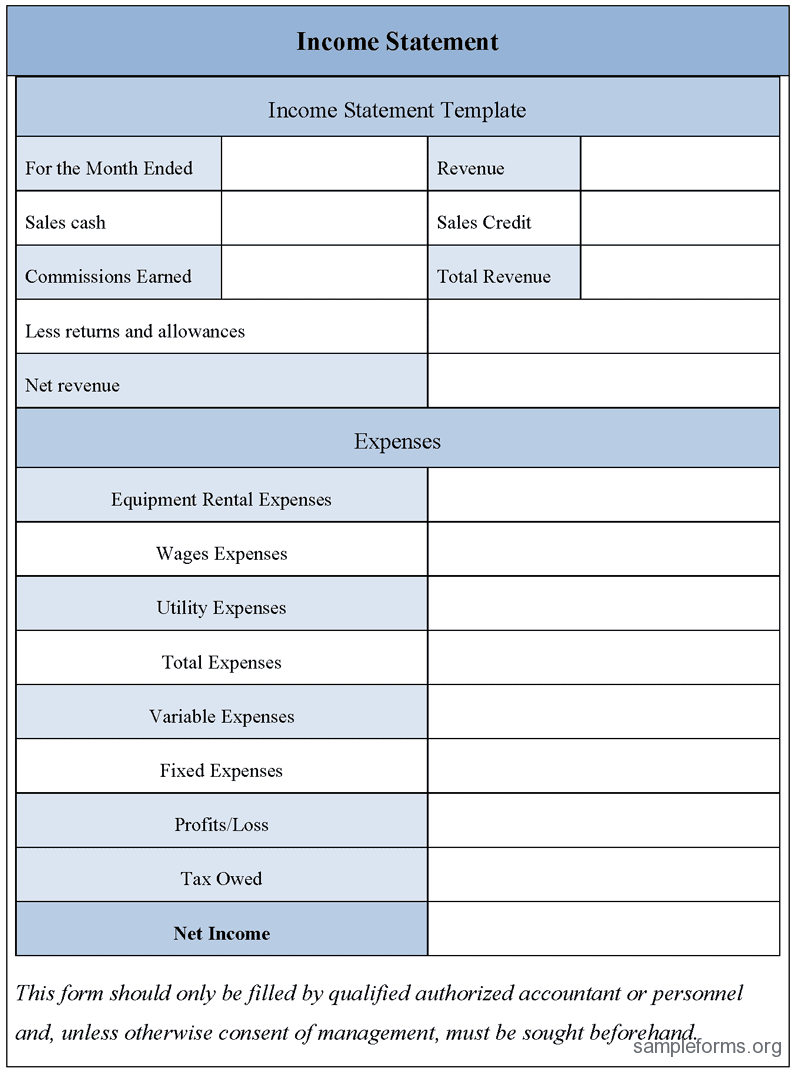

All the items of revenue and expenses.

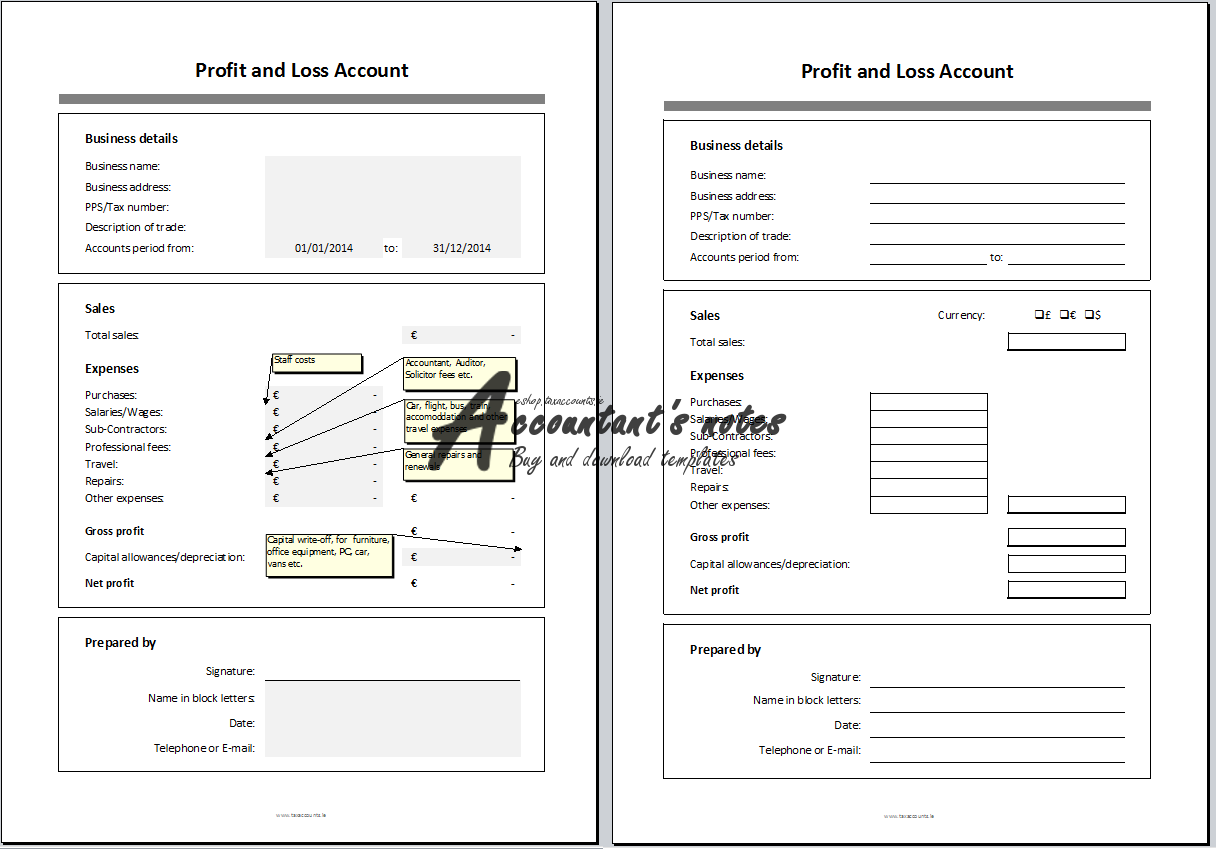

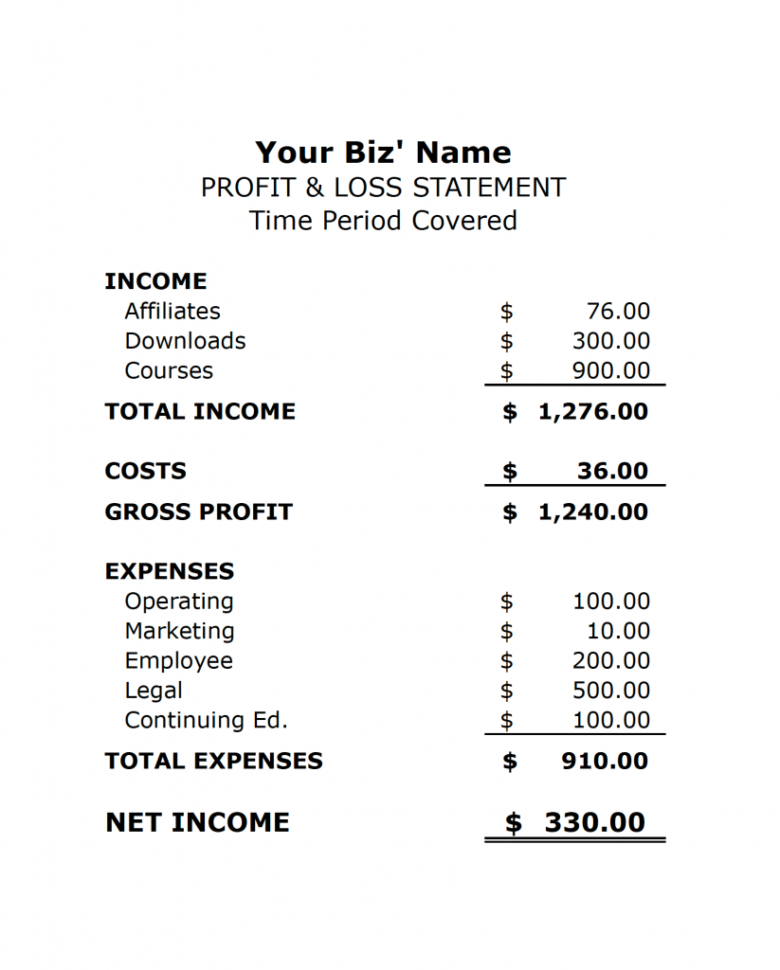

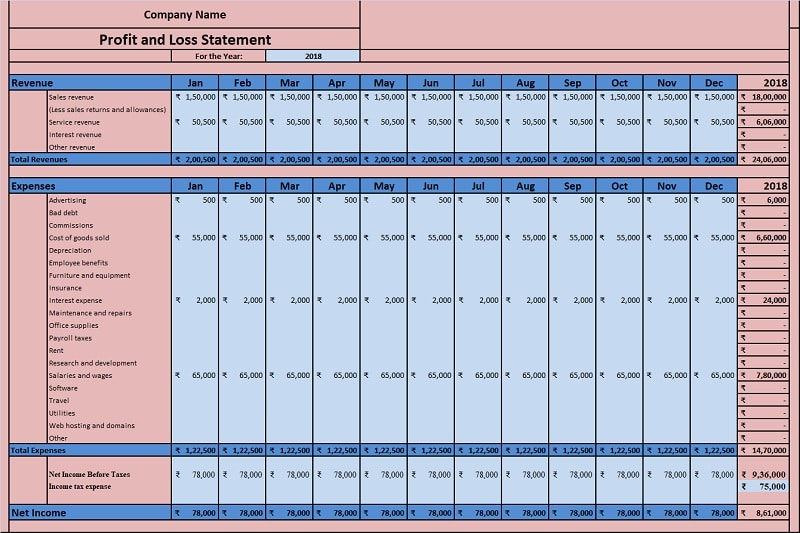

Content of profit and loss account. The final figure will show the financial performance and. It shows all the company’s income and expenses incurred over a given period. A p&l statement provides information.

What is a profit and loss statement? Comprehensive guide to the profit and loss account: This is done by producing a profit.

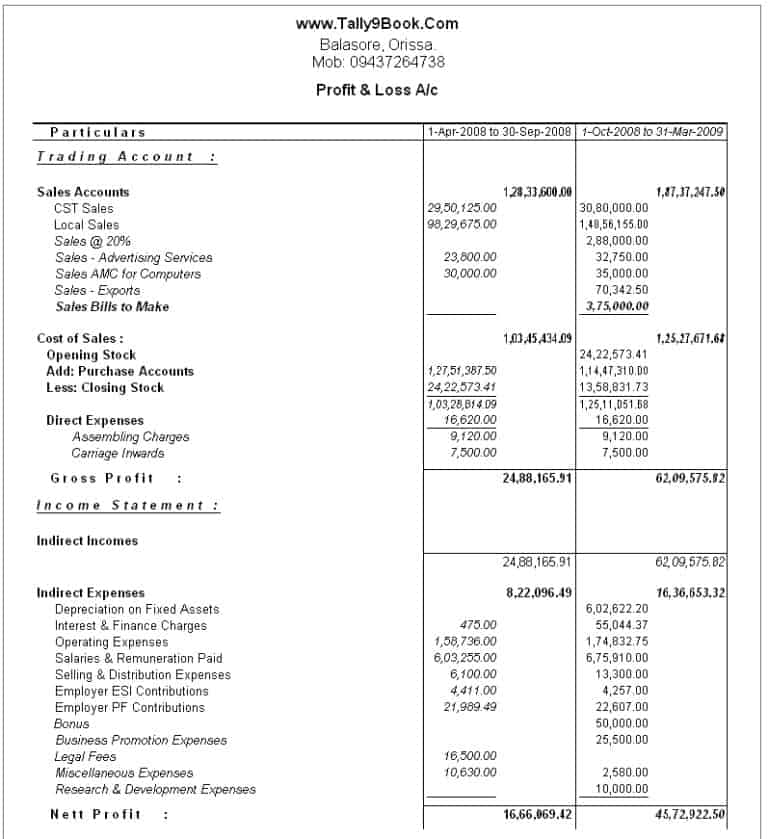

Format 1, the most commonly used format, specifies that the profit and loss account should consist of the following items (unless special circumstances require them to be. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

The statement of profit and loss account format is an integral part of the financial statement and reporting, which is not only used by the management but also other. It could be for a week, a quarter or a financial year. Learn how it helps you.

Profit and loss account is made to ascertain annual profit or loss of business. Show whether a business has made a profit or loss over a financial year.; At its core, a profit and loss account (p&l) is a financial statement that provides a snapshot of a company’s revenues, costs, and expenses over a specific.

Understand how profit relates to owner's capital in the balance sheet and the accounting equation;. A profit and loss statemen t is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. It is prepared to determine the net profit or net loss of a trader.

A profit and loss (p&l) account shows the annual net profit or net loss of a business. Mtct by the mind tools content team all organizations need to be able to assess whether they are making a profit or running at a loss. The profit and loss account is compiled to show the income of your business over a given period of time.

Explanation a profit and loss account is prepared to determine the net income (performance result) of an. Understand the difference between generating cash and making a profit; Only indirect expenses are shown in this account.

The p&l account is a component of final accounts. The purpose of the profit and loss account is to: A profit and loss account, in simplest terms, is a record of all the income and expenses of the business during a particular period of time.

Such a period can be the.