Fun Info About Profit Distribution Account

Delta pays out $1.4 billion in profit sharing.

Profit distribution account. Then you do a journal entry to distribute net profit to the partners. Then that profit is distributed. Typically, partners receive a share of the profits based on.

Paulo ferreira, the president of luna brazil, has an ambitious plan to turn around the dismal performance of the plant he oversees in campinas. D.un) (“dream office” or the “trust”) today announced its february 2024 monthly distribution of 8.333. Mutual fund distributions consist of net.

A distribution generally refers to the disbursement of assets from a fund, account, or individual security to an investor. A distribution is a transfer of cash or property by a partnership to a partner with respect to the partner’s interest in partnership capital or income. Payments will be made to local.

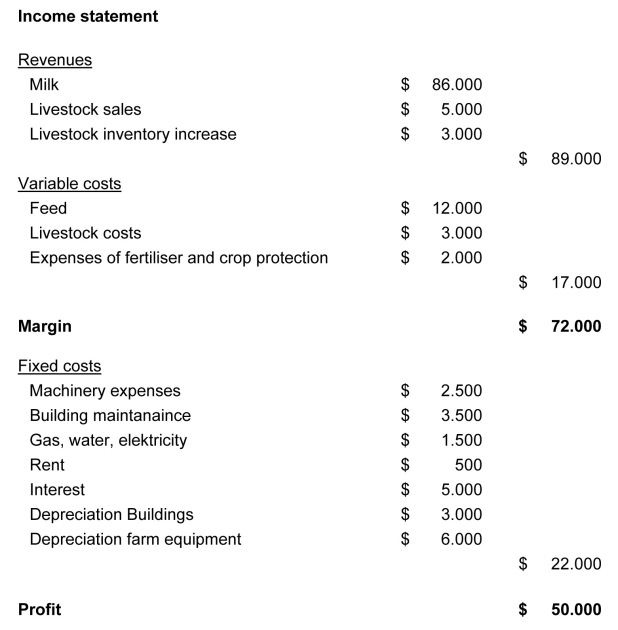

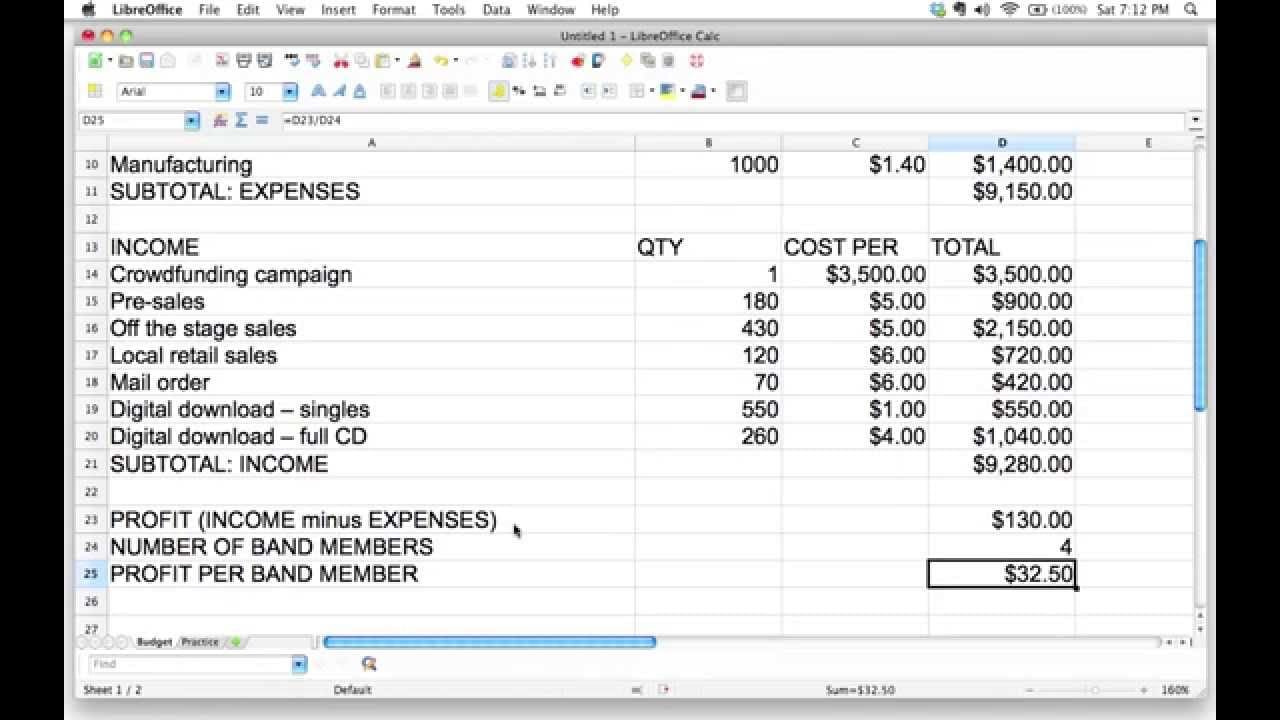

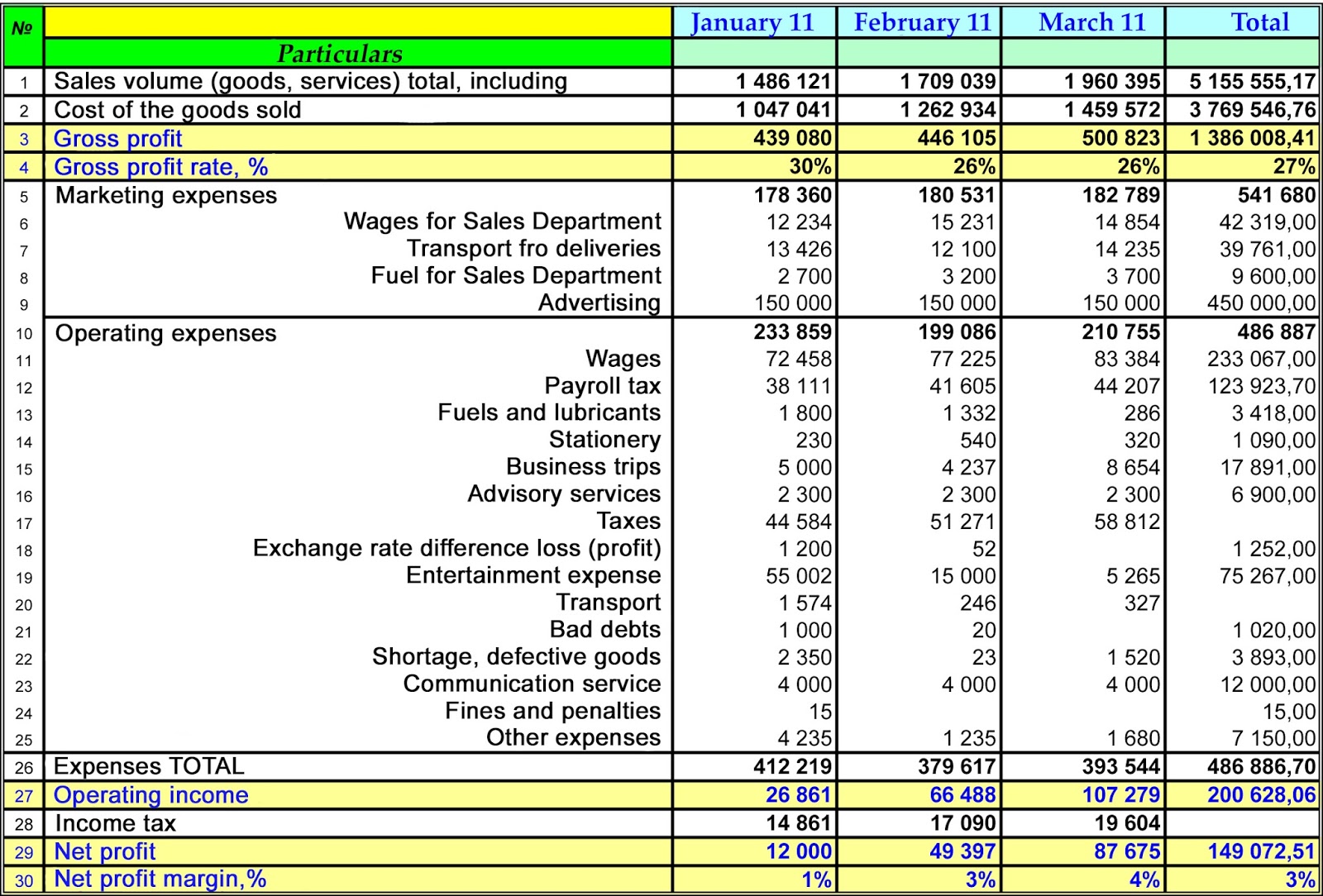

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. A private company is a company owned by only one. Toronto — dream office reit (tsx:

1 before you start 2 set up accounts for distribution of income 3. By december 31 at the end of the first year, the partnership realized. Transfer of the balance of profit and loss account to profit and loss appropriation account.

Open your first relay account from anywhere 🌎 2. The purpose of this article is to assist candidates to develop their understanding of the topic. Journal entries for distribution of profit.

Updated may 4, 2022: Profit distribution amount partner is the process which businesses share the profit with all partners base on their share ownership. Llc profit distribution is a complicated topic.

The final figures of loss or profit to be distributed among the partners are adjudged by the profit and loss appropriation account. This table sets out allocations for the distribution of the levy account surplus for the 2023 to 2024 financial year. Fa2 maintaining financial records.

Profits in a partnership are distributed based on the terms agreed upon in the partnership agreement. The company can be found in various types such as private, partnership, and corporate. Additionally, the model takes into account the size of the electric vehicle (ev) fleet as a crucial planning factor for ev aggregation that depends on the energy pricing.

In the case of partnership companies, the profit and loss appropriation account (p/l appropriation account) is debited for goods. A process in which a company pays its shareholders money from its accumulated profits is the distribution of profits. What are profit distribution and dividend.