First Class Info About Ias 17 Standard

A lease is classified as a finance lease if it transfers substantially all the risks and rewards incident to ownership.

Ias 17 standard. International accounting standard 17 (ias 17) 'leases' was a critical standard in financial accounting, providing guidance on the recognition,. In preparation for the adoption of ind as 117, the equivalent to ifrs 17 'insurance contracts', the insurance regulatory and development authority of. Ias 18 revenue psak 23 revenue psak 23 is consistent with ias 18 in all significant respects.

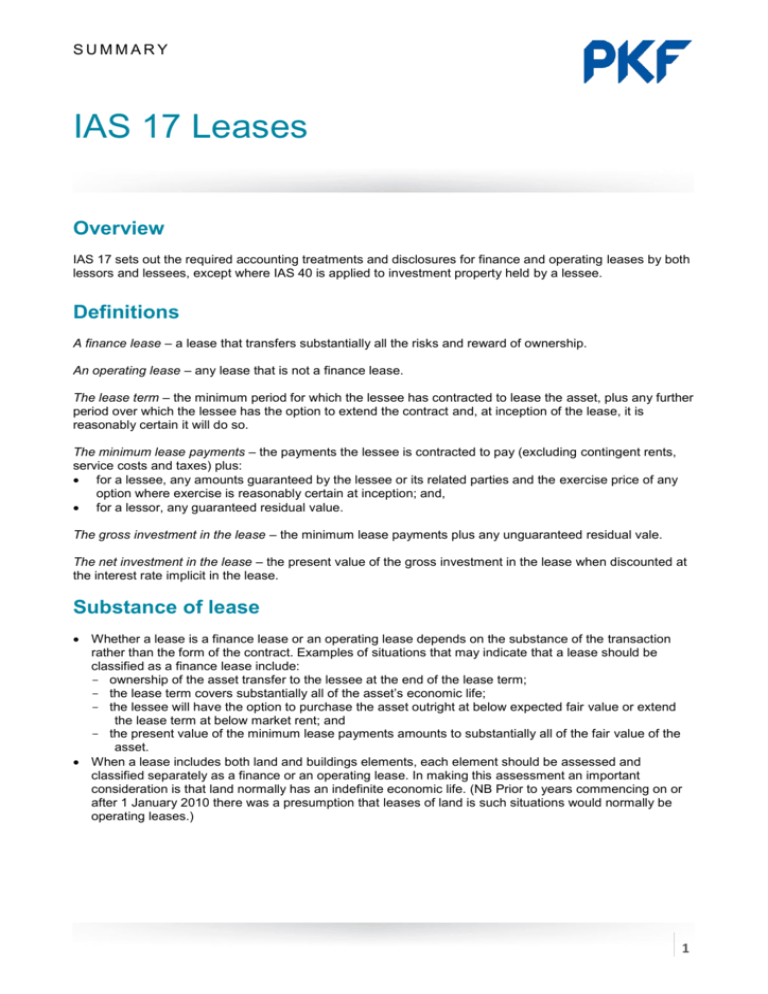

In april 2001 the international accounting standards board (board) adopted ias 17 leases, which had originally been issued by the international accounting. Classification is made at the inception of the lease. Under ias 17, lessees needed to classify the lease as either finance or operating.

19 feb 2024. 1 the objective of this standard is to prescribe, for lessees and lessors, the appropriate accounting policies and disclosure to apply in relation to leases. 16 supersedes ias 17.

Published feb 9, 2024. Ias 17 classifies leases into two types: A finance lease if the lease transfers substantially all the risks and rewards.

Disclosures in the financial statements of banks and similar financial institutions. Ifrs 17 establishes the principles for the recognition, measurement, presentation and disclosure of insurance contracts within the scope of the standard. Ifrs accounting standards are developed by the international accounting standards board (iasb).

Introduction bc1 this basis for conclusions summarises the international accounting standards board’s considerations in reaching its conclusions on revising ias 17 leases. Superseded by ifrs 7 effective 1 january 2007. Ias 17 leases the objective of this standard is to prescribe, for lessees and lessors, the appropriate accounting policies and disclosure to apply in relation to leases.

This means that nearly all leases involving land and buildings. Ifrs 17 insurance contracts in march 2004 the international accounting standards board (board) issued ifrs 4 insurance contracts. Ias 17 sets out the required accounting treatments and disclosures for finance and operating leases by both lessors and lessees, except where ias 40 is applied to.

International accounting standard ias 17 leases january 2012 (incorporating amendments from ifrss issued up to 31 december 2011, including those with an effective date after. All other leases are classified as operating leases. 45 rows international accounting standards (iass) were issued by the antecedent international accounting standards council (iasc), and endorsed and.

Operating lease where it does not transfers substantially all the. Ifrs 17 is effective for annual reporting periods beginning on or after 1 january 2023 with earlier application permitted as long as ifrs 9 is also applied. Finance lease where it transfers substantially all the risks and rewards incidental to ownership.

[ias 17.4] whether a lease is a finance lease or an operating lease depends on the substance of. If the lease was classified as operating, then the lessees did not show neither asset nor liability. Ssc cgl notes gk notes current affairs notes ncert notes 200 rs standard book notes 400 rs ssc cg.

.jpg)