Amazing Tips About Is Unearned Revenue On The Balance Sheet

Unearned revenue is money received by a or company for a service or product that has yet to be fulfilled.

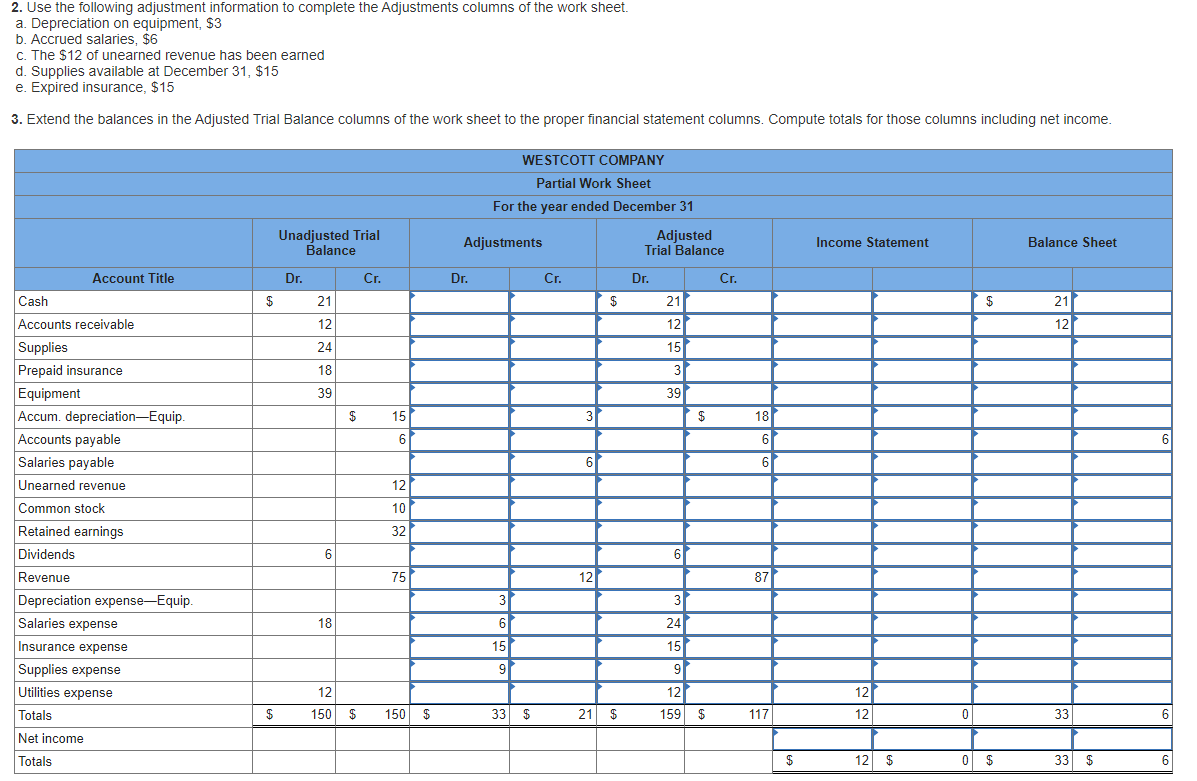

Is unearned revenue on the balance sheet. Unlike earned revenue (which shows up as an asset), unearned income shows up as a liability on your balance sheet. As the prepaid service or product is gradually delivered over time, it is recognized as revenue on. In simple terms, it is the prepaid revenue from the customer to the business for goods or services that will be supplied in the future.

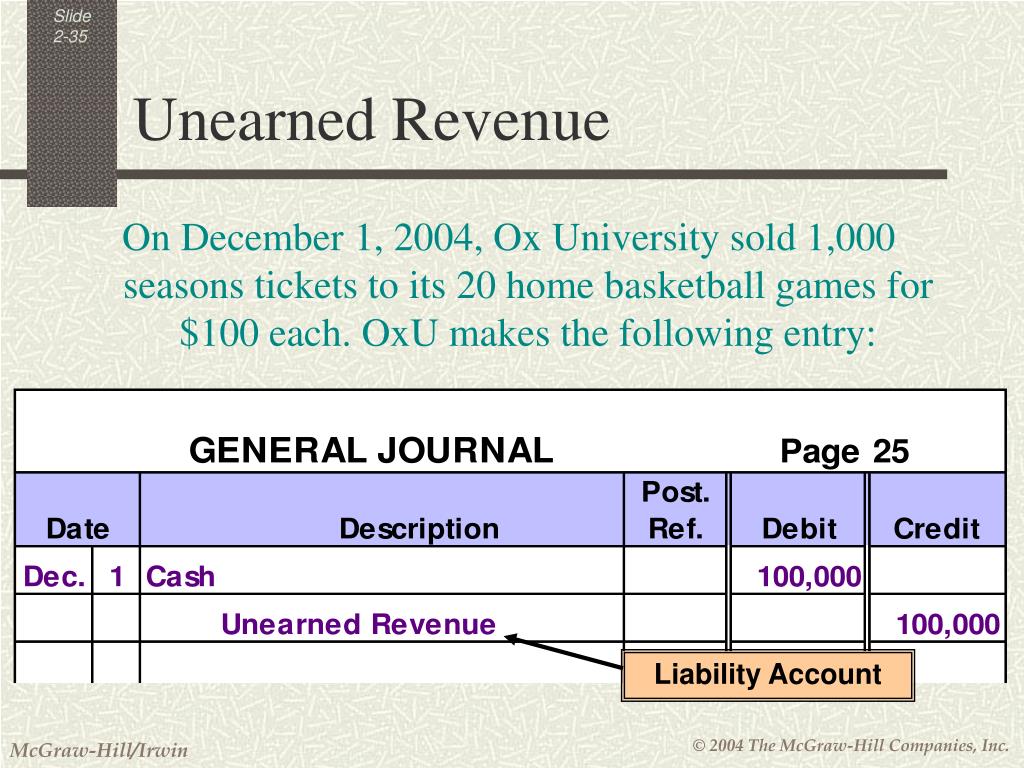

Unearned revenue is placed on a balance sheet as a liability to be solved, whereas unrecorded revenue is delayed in this process. But, what are the accounting ramifications of customers paying you before you render services? As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the balance in the revenue account (with.

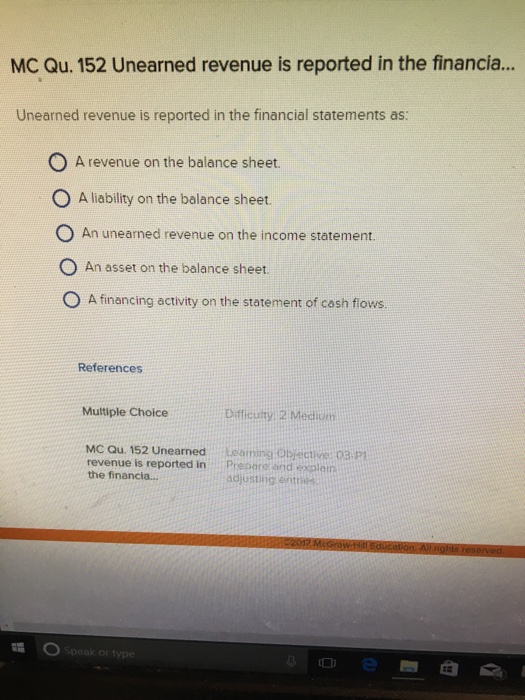

Discuss how unearned revenues are reported on the balance sheet. So, what type of account is unearned revenue, exactly? You report unearned revenue on your business' balance sheet, a significant financial statement you can.

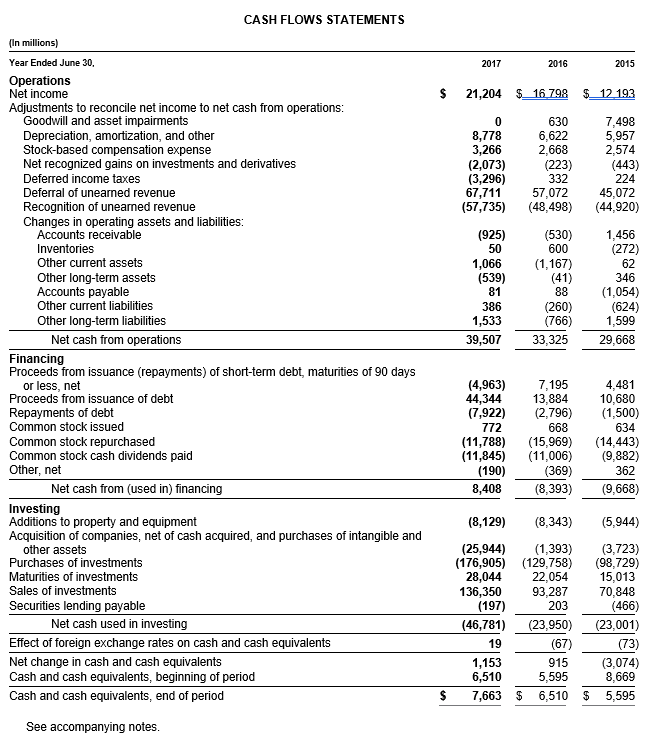

Generally, when a corporation earns revenue there is an increase in current assets (cash or accounts receivable) and an increase in. In accounting, unearned revenue has its own account, which can be found on the business’s balance. Effect of revenue on the balance sheet.

It represents an obligation to deliver goods or services in the future, for. Finding unearned revenue on a balance sheet. It represents the company’s obligation to provide goods or services in the future.

Unearned revenue is recorded on a company’s balance sheet as a liability. Any business that accrues unearned revenue should record. What you need to know ☰ how cube works sync data, gain insights, and analyze business performance right in excel, google sheets, or the cube.

Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and thus has unfulfilled obligations. Unearned revenue can also be. Unearned revenue is a type of liability that is recorded on the balance sheet of a business.

Usually, things work out fine. It is treated as a liability because the revenue has still not been earned and represents products or services owed to a customer. This puts you in the position of having.

On the balance sheet, unearned revenue is classified as a liability.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)