Unbelievable Info About Purpose Of Preparing Trial Balance

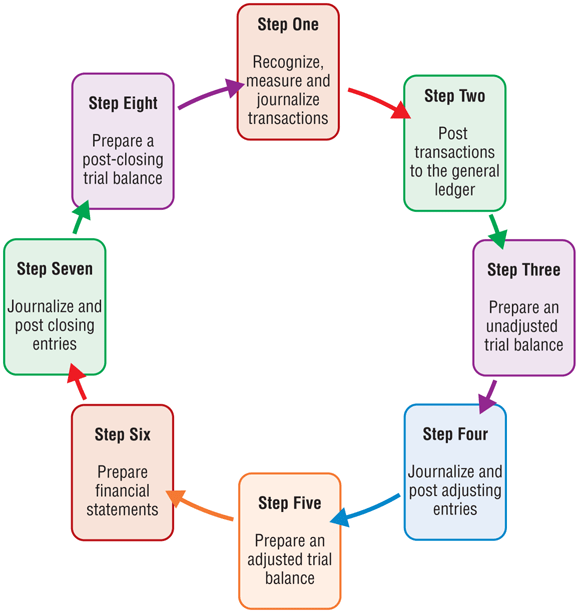

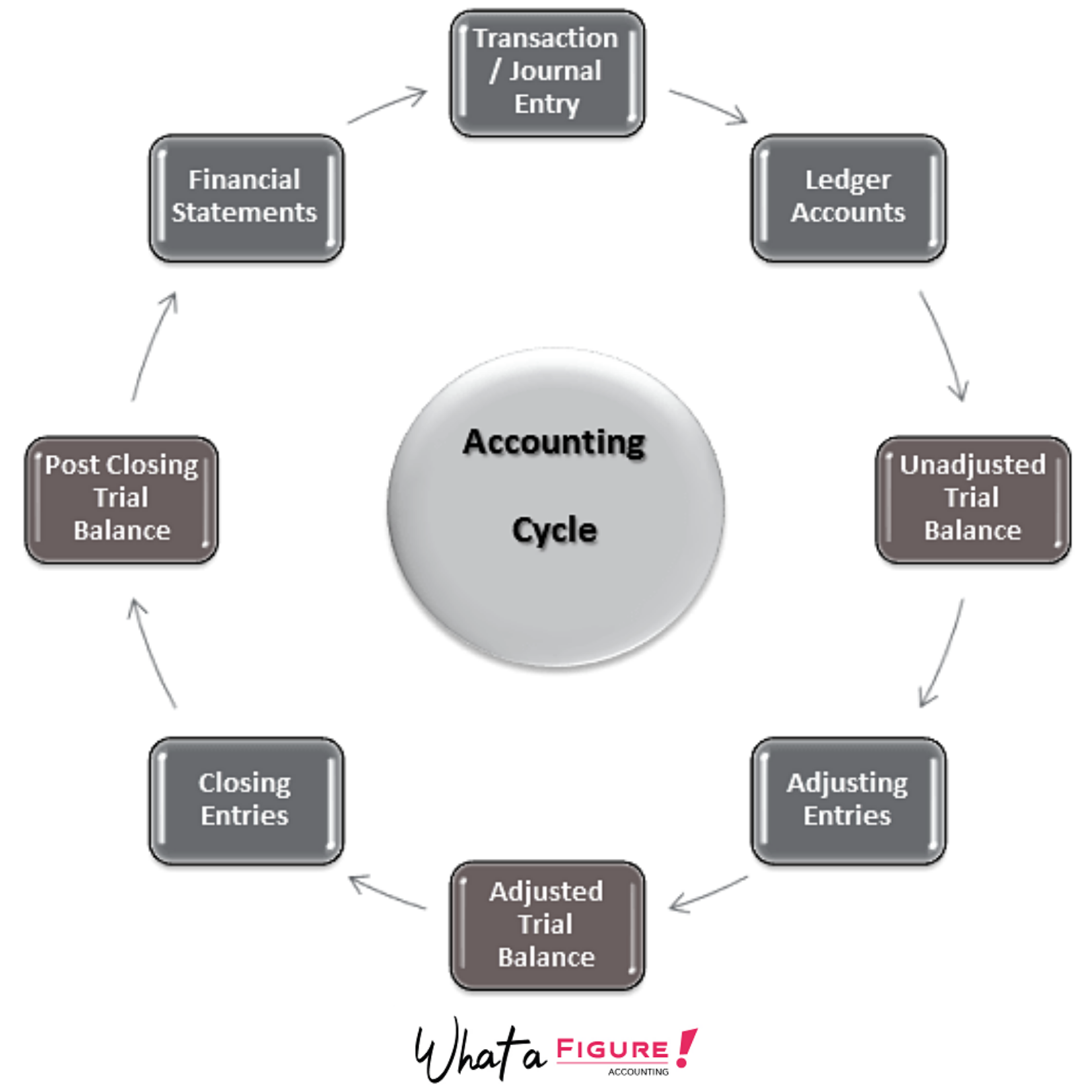

A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

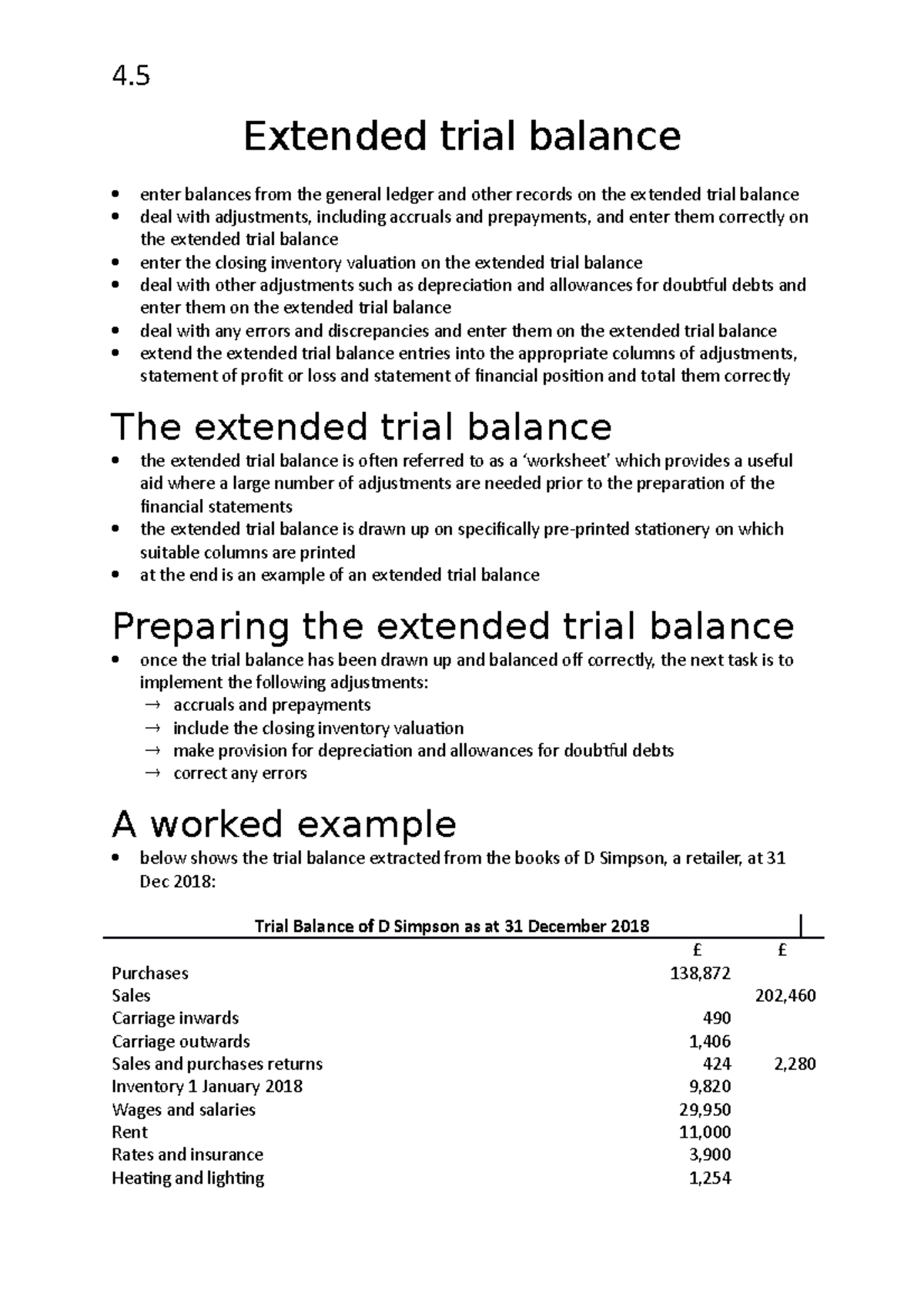

Purpose of preparing trial balance. Trial balance is prepared at the end of a year and is used to prepare financial statements like profit and loss account or balance sheet. Prepare and adjust the balances in the trial balance. Lastly, a trial balance would be helpful in making any required adjustments to account balances at the end of the accounting period which will be illustrated in chapter 3 recording adjusting entries.

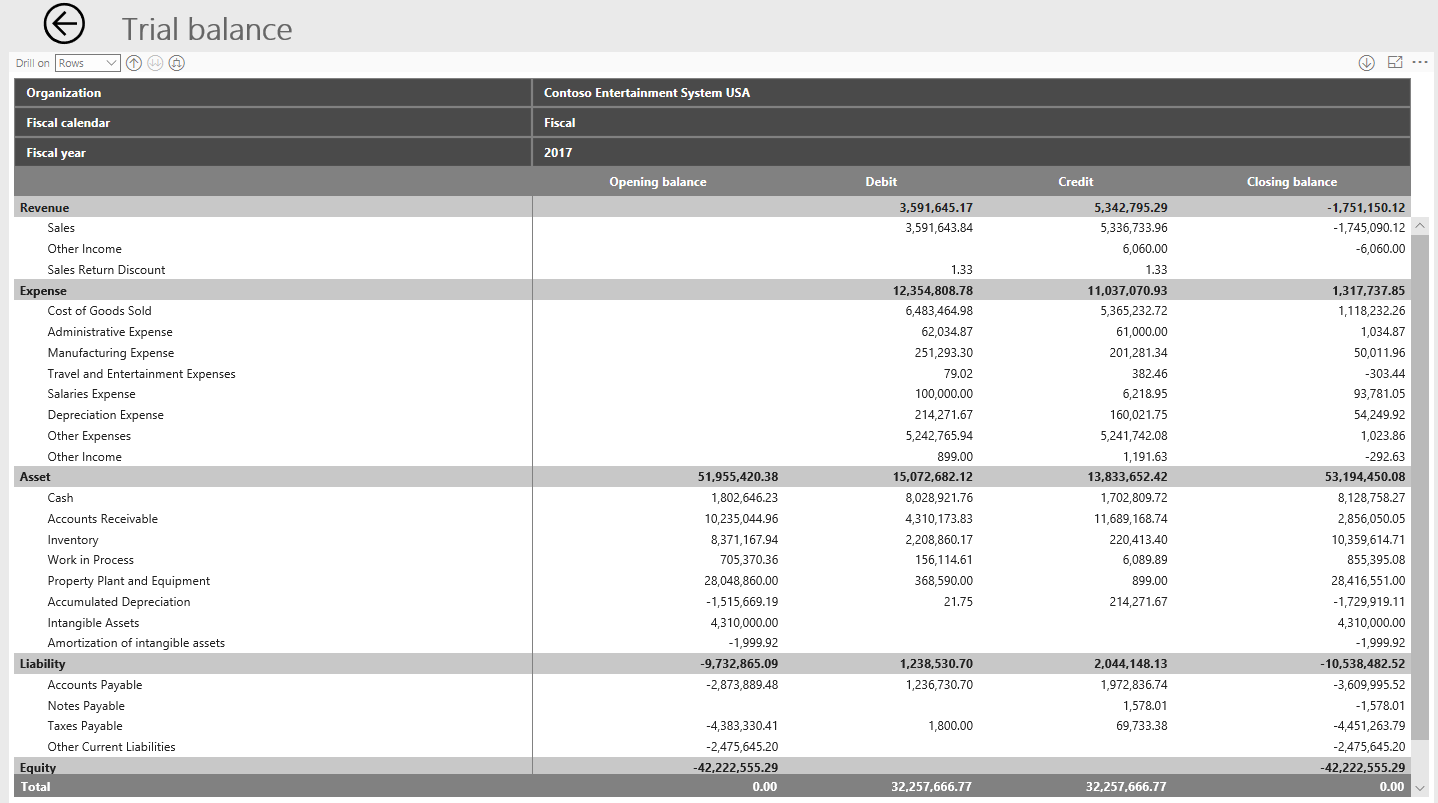

The general purpose of producing a trial balance is to ensure that the entries in a company’s bookkeeping system are mathematically correct. Preparing an unadjusted trial balance is the fourth step in the accounting cycle. The trial balance is prepared after posting all financial transactions to the journals and summarizing them on the ledger statements.

Purpose of preparing a trial balance; In short, trial balance is prepared for the purpose of identifying and detecting errors that enter in general ledgers. We will add the remaining column titles later.

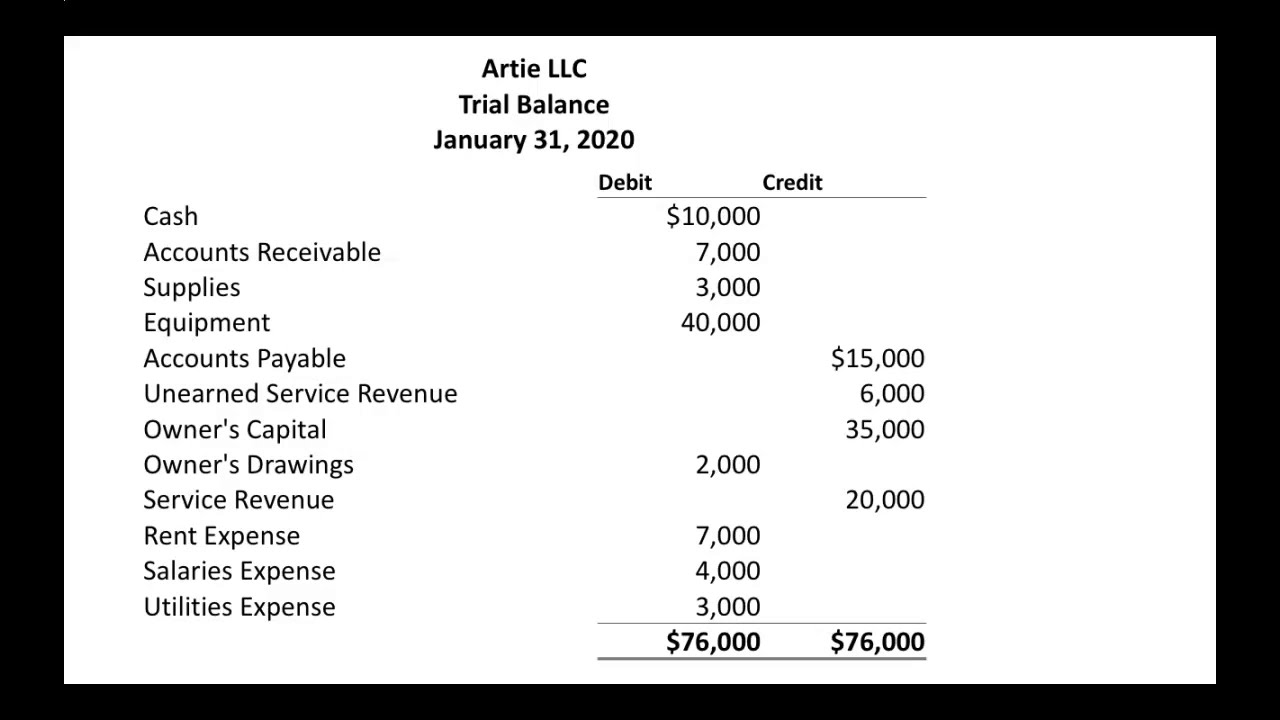

The total dollar amount of the debits and credits in each accounting entry are supposed to match. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Although you can prepare a trial balance at any time, you would typically prepare a trial balance before preparing the financial statements.

Companies prepare a trial balance is to maintain a balance between credit and debit sum on a balance sheet. Essentially, a trial balance is to be used internally, and the balance sheet is to share with external shareholders. What are the uses of a trial balance?

A trial balance is a list of all accounts in the general ledger that have nonzero balances. The following are the three simple steps that you can use to prepare bt at the end of your organization. While it is not a financial statement, a trial balance acts as the first step in preparing one.

| 6 min read contents [ show] trial balance is the heart of a business. If they are unequal due to any reason, it will indicate an error that needs to locate. It is usually prepared at the end of an accounting period to assist in the drafting of financial statements.

To prepare a trial balance, list the. Eliminate any expense or revenue accounts as they are not a part of the balance sheet. The trial balance is made to ensure that the debits equal the credits in the chart of accounts.

Aggregate the amounts of the remaining account in two separate headings that is,. The main purpose of the trial balance is the ensure that the financial statements are correctly prepared by ensuring that all of the accounting entries that are recorded during the period are correctly recorded in accordance with the rule of debit and credit. If all debit balances listed in the trial balance equal the total of all credit balances, this shows the ledger's arithmetical accuracy.

This means that for every entry. The main objective of a trial balance is to ensure the mathematical accuracy of the business transactions recorded in a company’s ledgers. To prepare a trial balance, follow these steps:

![Procedure for Preparing a Trial Balance [Notes with PDF] Trial Balance](https://everythingaboutaccounting.info/wp-content/uploads/2020/01/Procedure-for-Preparing-a-Trial-Balance-1.png)