Brilliant Strategies Of Tips About Advertising Expense Financial Statement

![[Solved] Please check answers and if not correct, please provide](https://www.ignitespot.com/hubfs/undefined-May-26-2021-10-13-01-21-PM.png)

The advertising budget is where a company’s.

Advertising expense financial statement. Advertising expense is a general ledger account in which is stored the consumed amount of advertising costs. Us gaap the costs of other than direct response advertising should be either expensed as Advertising expenses will be recorded on the company income statement and it depends on the occurrence rather than cash paid.

An advertising budget is a company’s allocation of promotional expenditures over a specified time period. This includes any expenses related to creating, designing, and distributing advertising materials such as billboards, print ads, radio spots, television commercials,.

Definition advertising expense refers to cost incurred in promoting a business, such as publications in periodicals (newspapers and magazines), television, radio, the internet, billboards, fliers, and others. Set time aside for upkeep. Classification and presentation of advertising expense.

The balance in this account is reset to zero at the end of each fiscal year, so that it can be populated in. Marketing agency abc runs a social media campaign for a client and the estimated expense is $15,000. Under ifrs, advertising costs may need to be expensed sooner.

If you’re handling any aspects of your. It usually happens when the supplier completes the work and issues an invoice to the company. Keep track of all of your cash flow and expenses.

Advertising expense refers to the amount incurred by a business for promoting its products or services. That includes receipts, contracts, deposit slips and more. It is a measure of a company’s planned expenditure on accomplishing marketing objectives.

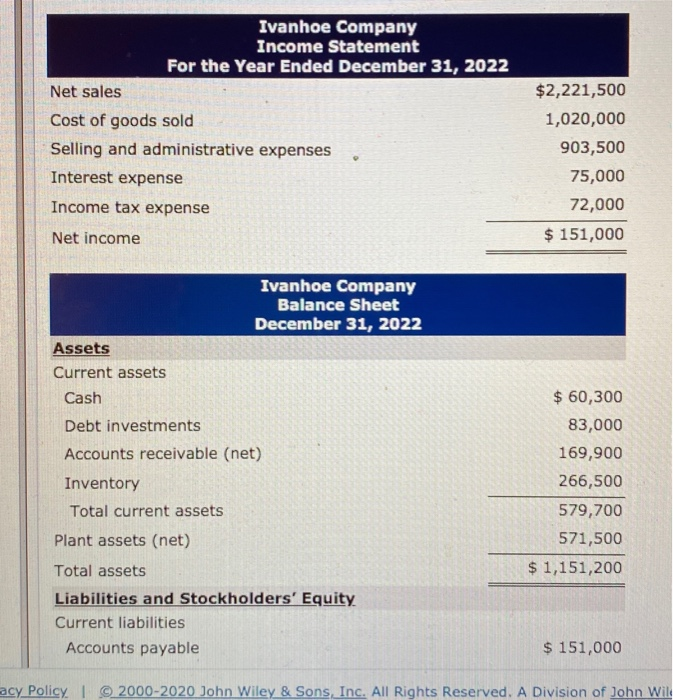

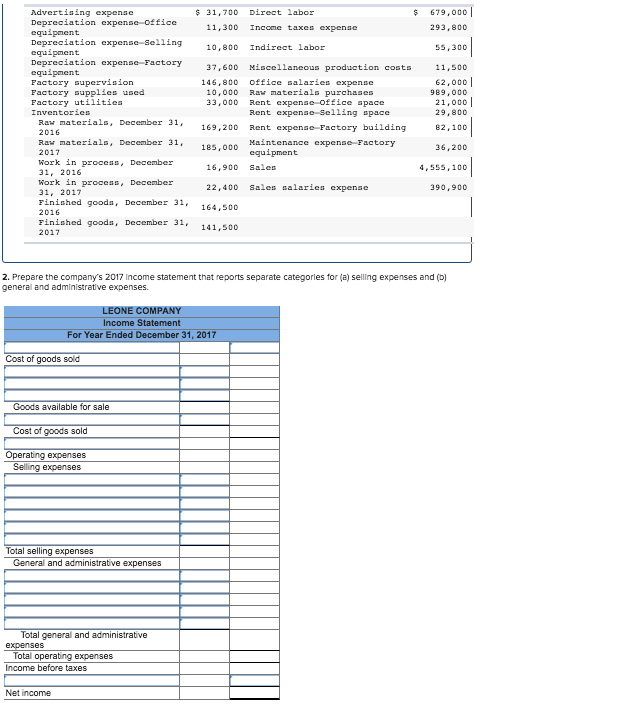

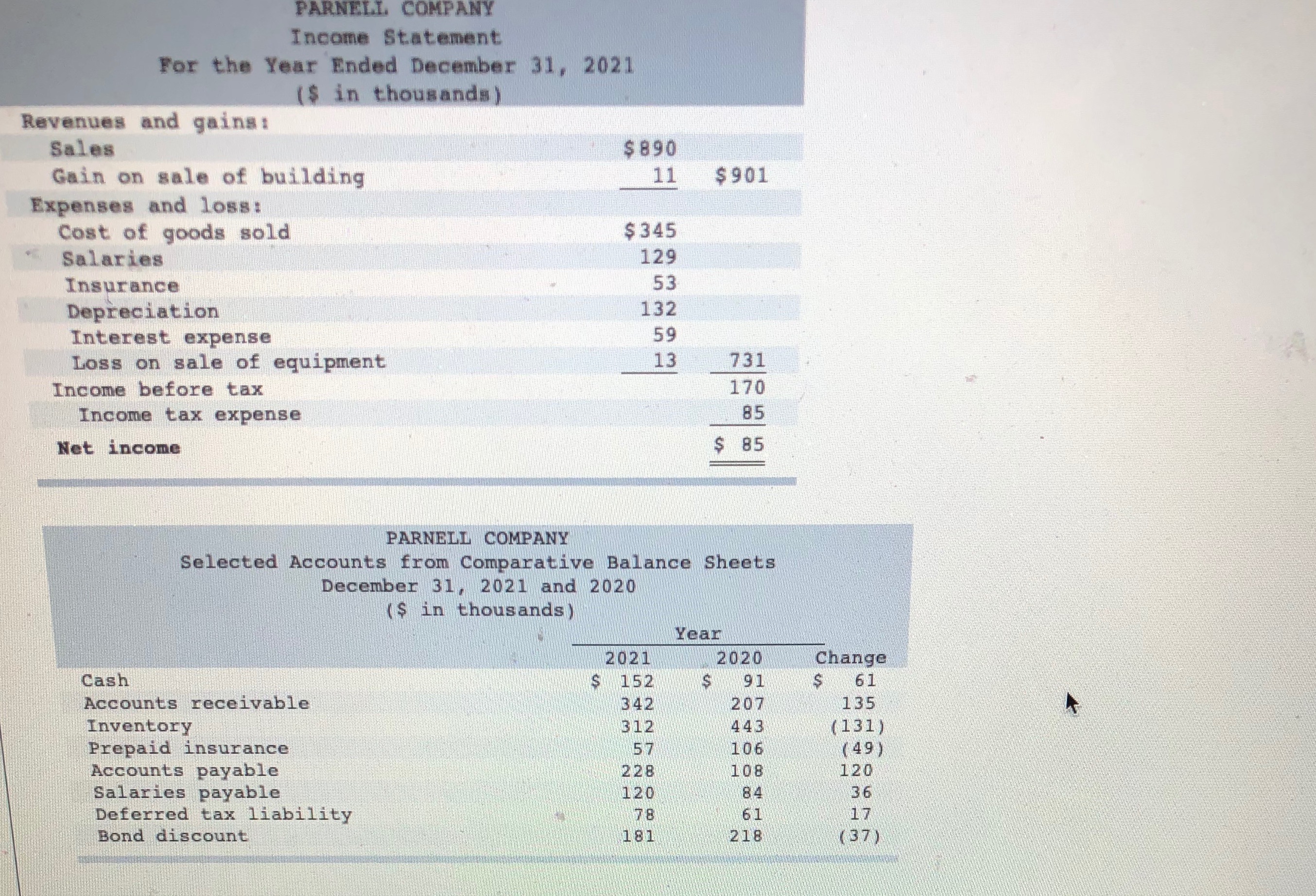

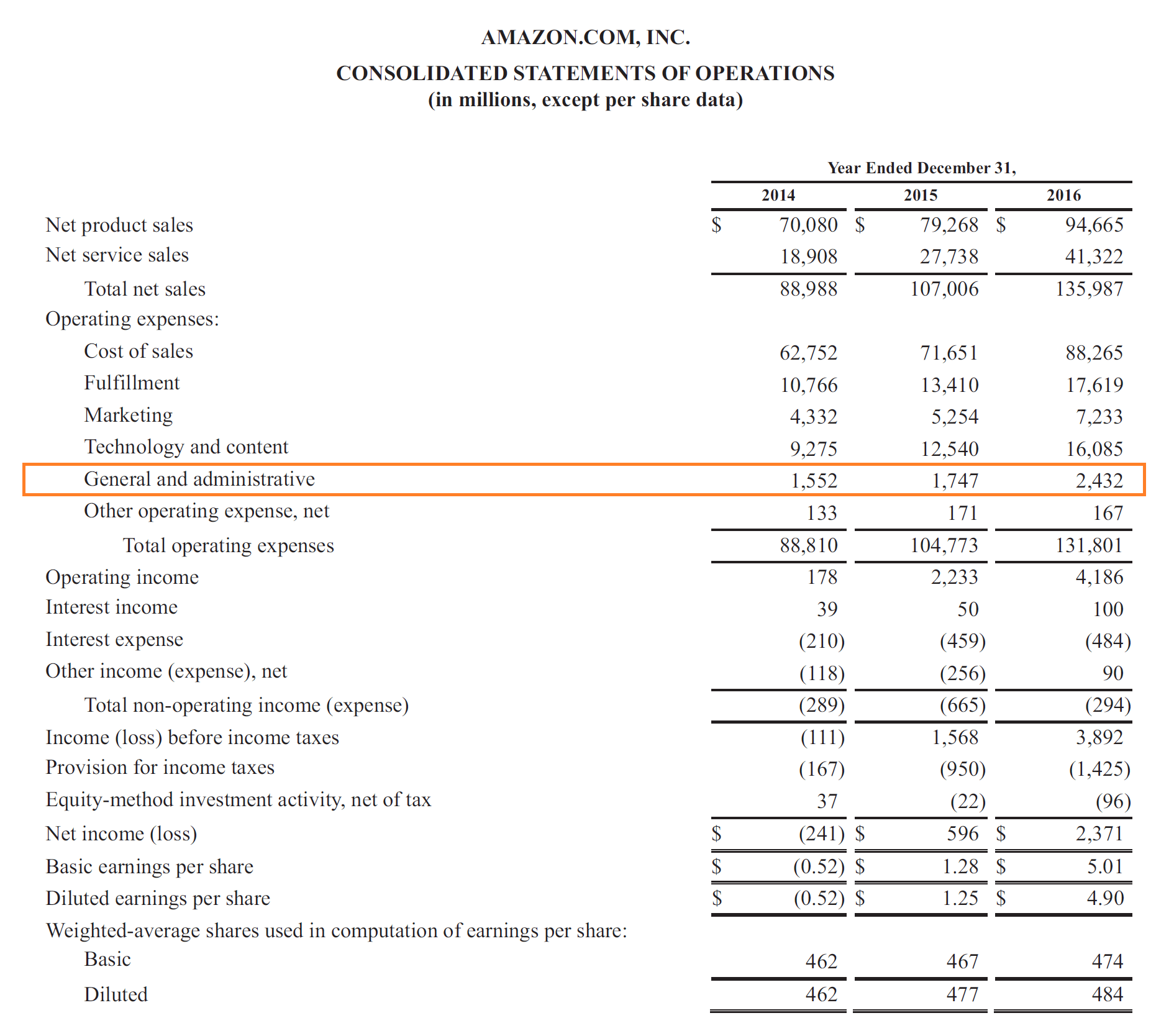

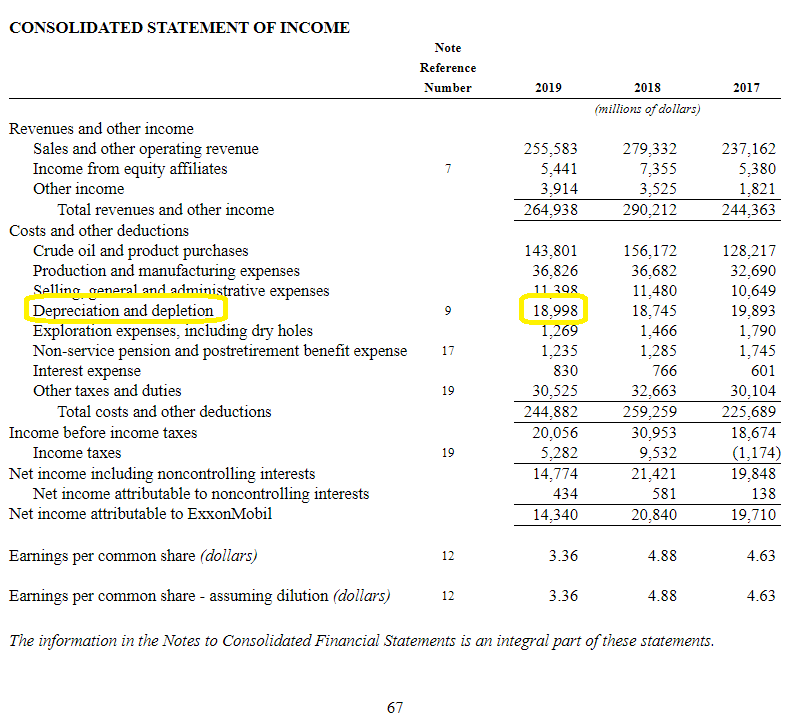

Income statement an income statement shows the organization’s financial performance for a. When the ad is aired, the amount must be transferred from prepaid advertising to advertising expense. Advertising costs are generally presented as part of selling, general, and administrative (sg&a) expenses in a reporting entity’s income statement.

In 1967, the national expenditure on advertising in the united states amounted to 16.8 billion dollars or more than 2% of gnp and 15% of gross private domestic investment (of reproducible assets). The total amount charged to advertising expense for each income statement presented. It includes all costs related to promoting and advertising the company’s products or services to potential customers.

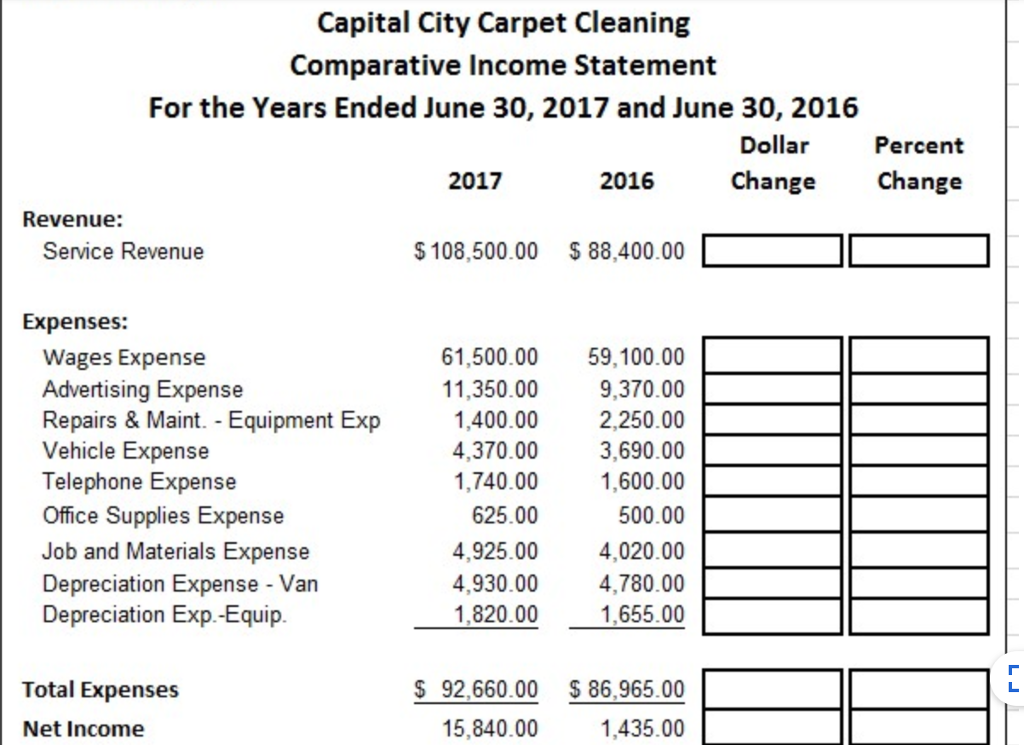

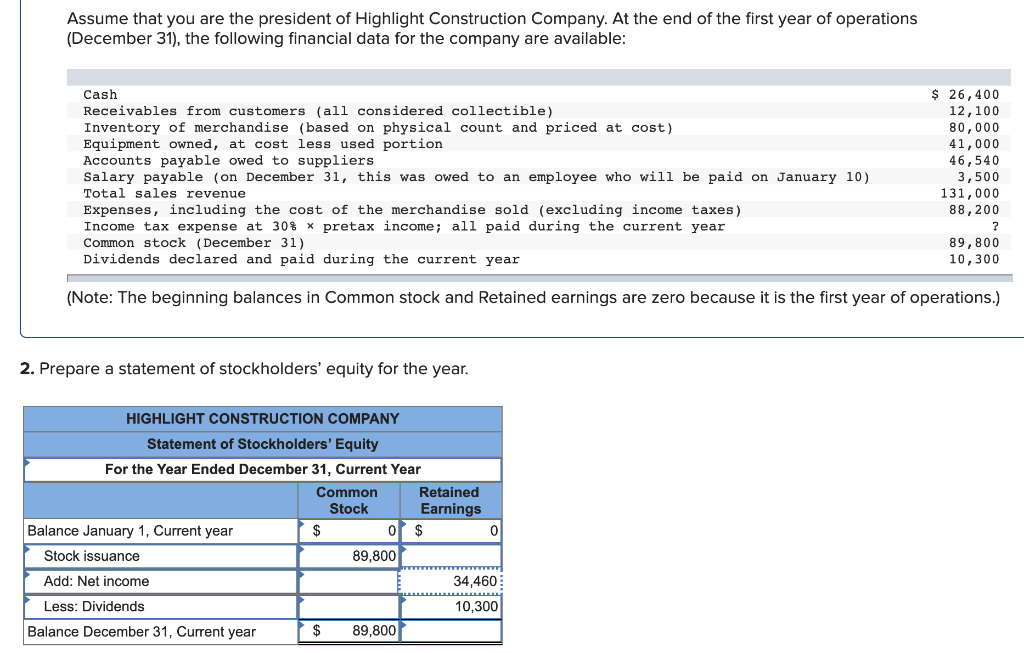

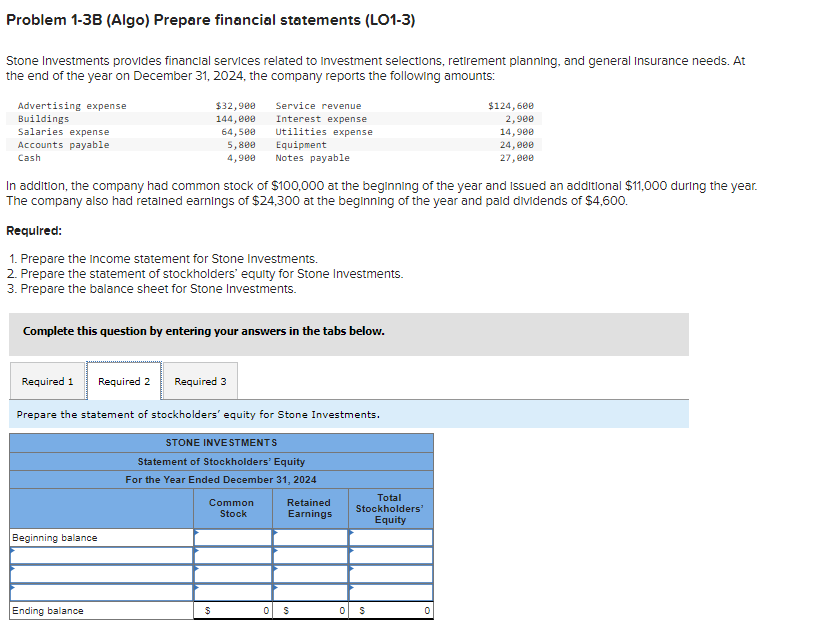

Lawn mowing revenue, gas expense, advertising expense, depreciation expense (equipment), supplies expense, and salaries expense. An income statement compares revenue to expenses to determine profit or loss. Here are a few more:

What is advertising expense? Advertising is any communications with a target audience that is designed to persuade that audience to take some type of action, such as. A prepayment of the cost of ads that will air in the future should be recorded in a current asset account such as prepaid advertising.