Out Of This World Info About Financial Ratios Used By Banks

Ratios provide them with a guide for drawing conclusions from the analysis they perform.

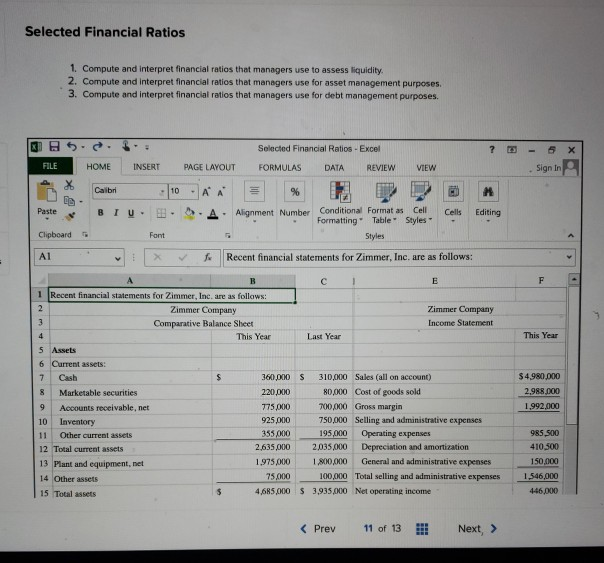

Financial ratios used by banks. Corporate finance financial ratios financial ratios to analyze investment banks by sean ross updated july 21, 2021 reviewed by chip stapleton it can be tricky for the average investor to. We will discuss some of these ratios below: A financial ratio is a relative magnitude of two financial variables taken from a business's financial statements, such as sales, assets, investments and share price.

Bank specific ratios are exclusive financial standards used by the banking sector to determine the profitability and strength of banks. Read this exciting story from financial express mumbai february 21, 2024. In rating or stock analyst reports, we will find various ratios.

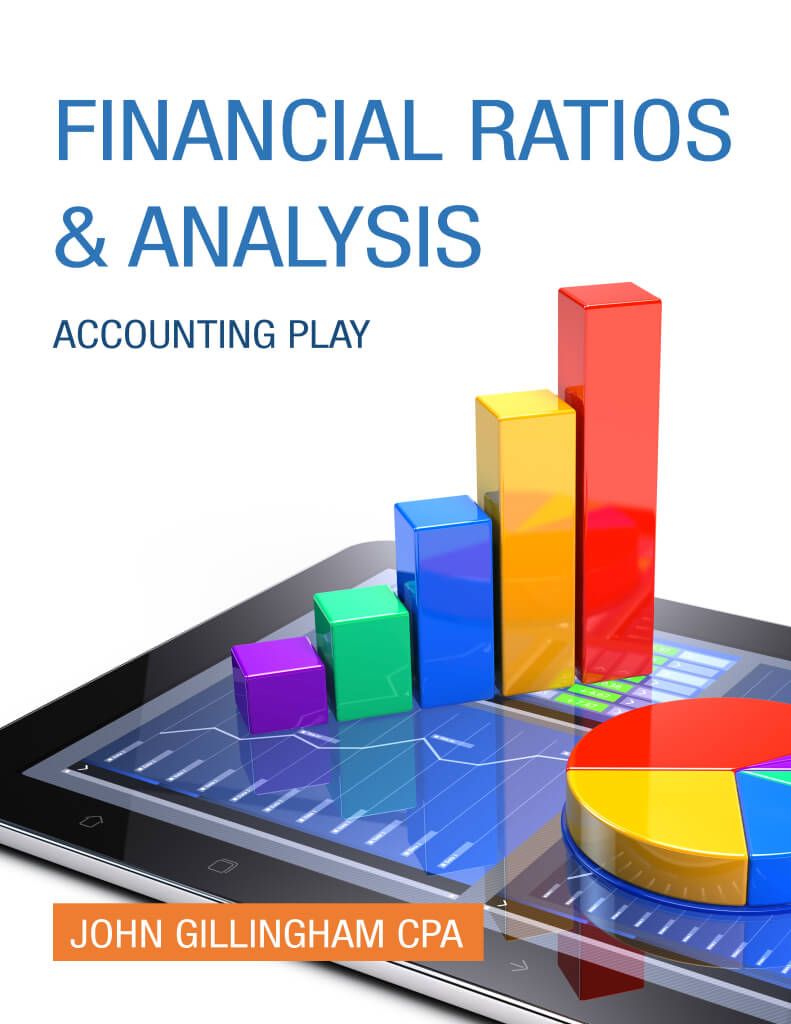

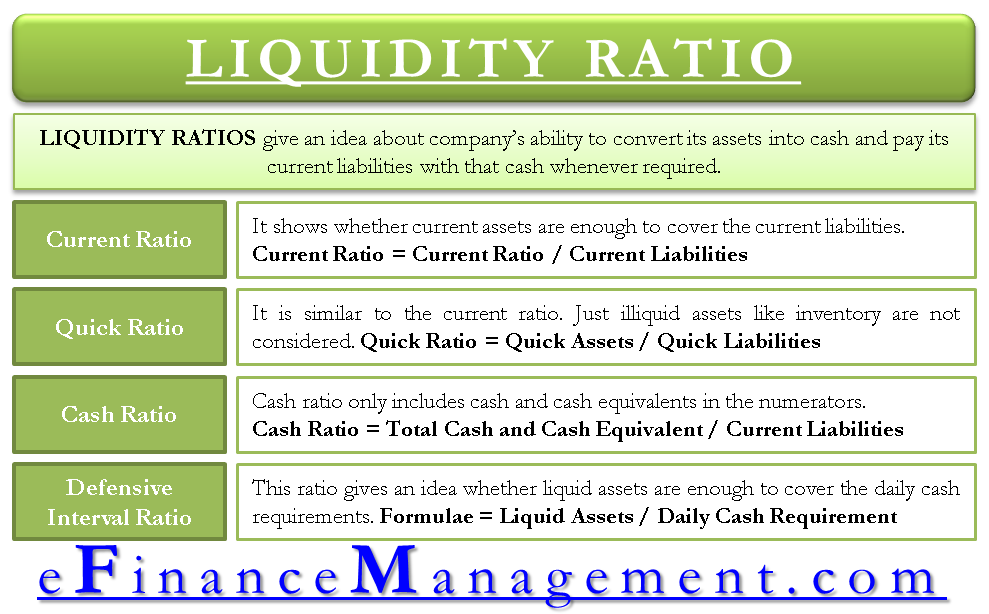

Liquidity ratios are utilized by banks, lenders, and providers to decide whether a client can respect their monetary commitments. Financial ratios are widely used to analyze a bank's performance, specifically to gauge and benchmark the bank's level of solvency and liquidity. This study aims to examine the capital adequacy ratio (car), bopo and loan to deposit ratio (ldr) partially and simultaneously to return on assets (roa) in banking companies listed on the.

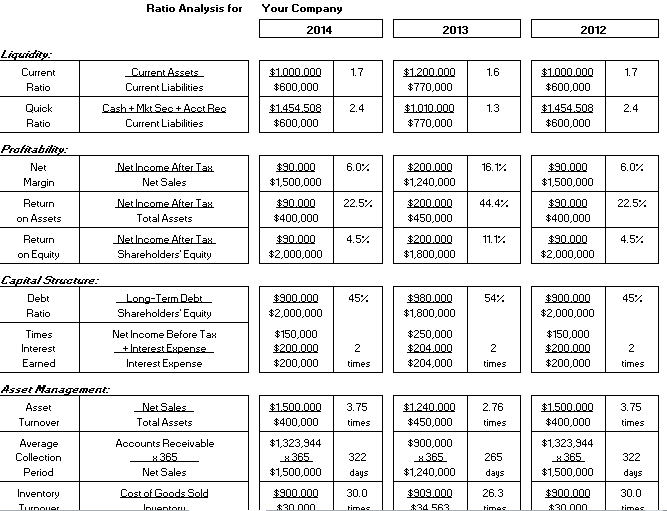

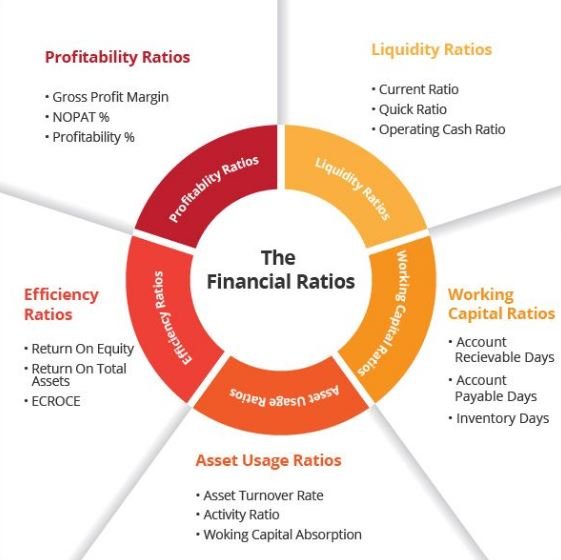

Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc. Bank of baroda, bank of india, yes bank, idfc first bank, punjab & sind. Financial institutions assign a credit score to borrowers after performing due diligence, which involves a comprehensive background check of the borrower and his financial history.

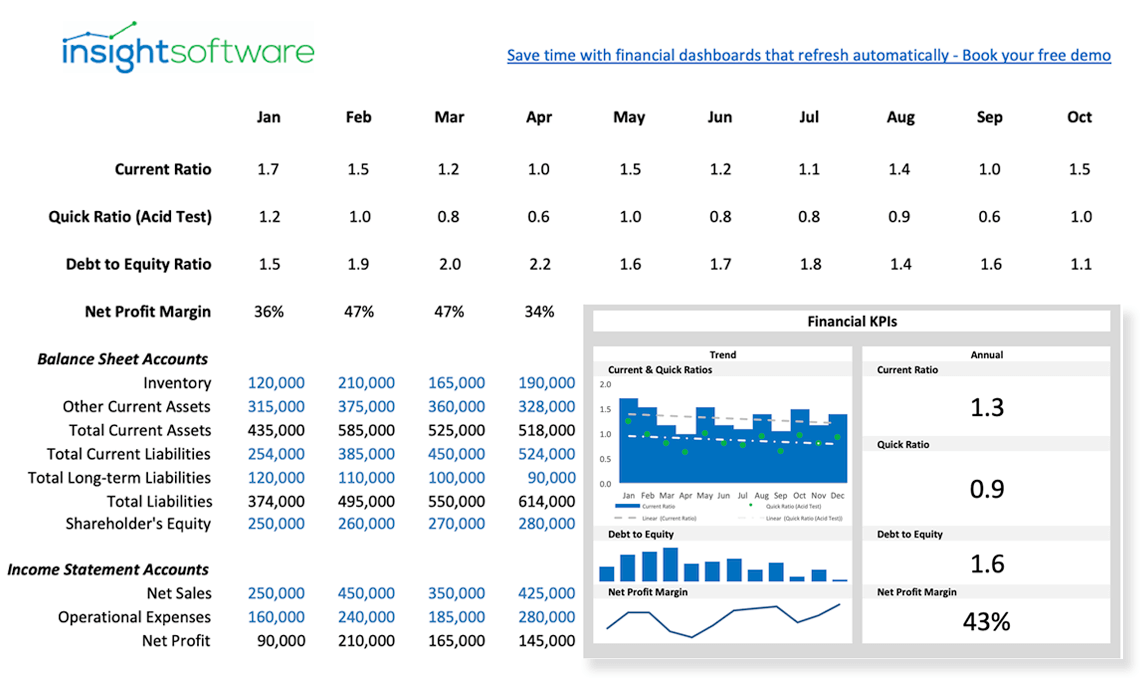

Some commonly used liquidity ratios are the quick ratio, the cash ratio, and the current ratio. Key financial ratios to analyze retail banks the retail banking industry. They show how well a company

Similar to companies in other sectors, banks have specific ratios to measure profitability and efficiency that are designed to suit their unique business operations. Common financial ratios come from a company’s balance sheet, income statement, and cash flow statement. Tamilnad mercantile bank has seen the biggest rise of 200 basis points in its casa ratio while punjab & sind bank has improved the same by 158 bps.

The retail banking industry includes those banks that provide direct services such as. Uses and users of financial ratio analysis. By adopting these standards, financial institutions can enhance their operational.

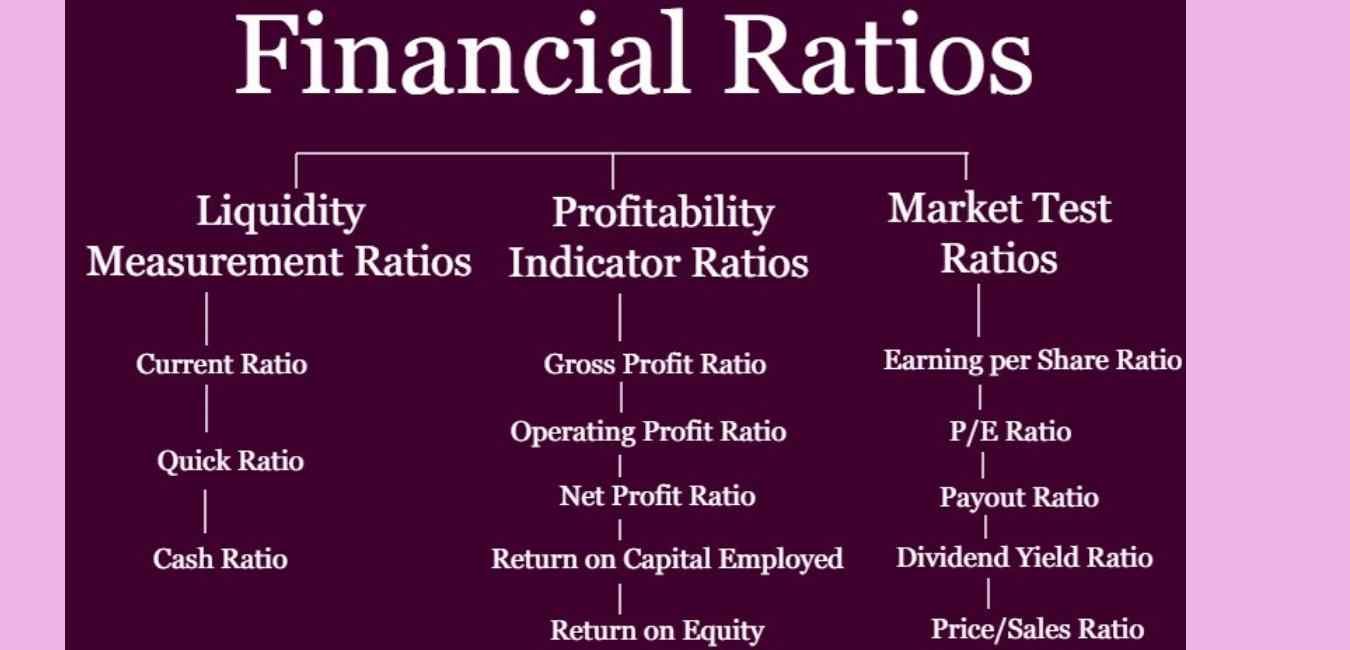

Financial ratios are grouped into the following categories: Therefore, talking specific ratios are considered when discussing bank prosperity and advancement. Financial ratios can be used to assess a company's capital structure and current risk levels, often in terms of a company's debt level and risk of default or bankruptcy.

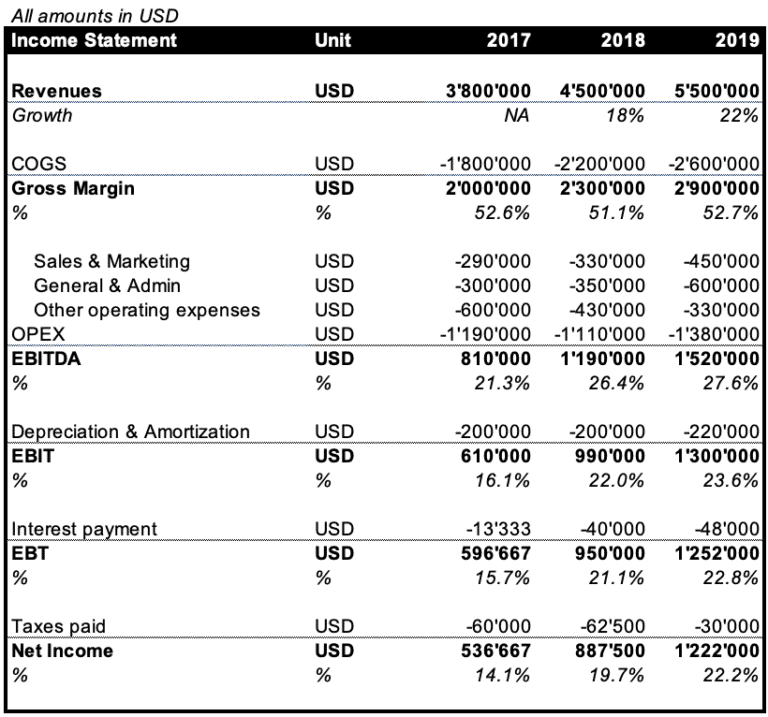

Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income (profit) relative to revenue, balance sheet assets, operating costs, and shareholders’ equity during a specific period of time. There are a number of different financial ratios that can be calculated, measured and monitored. Banking financial model templates normally should include those.

Tamilnad mercantile bank has seen the biggest rise of 200 basis points in its casa ratio while punjab & sind bank has improved the same by 158 bps. A company’s stock is trading at $50 per share. These ratios look at the.