Recommendation Info About The Purpose Of Trial Balance Is To

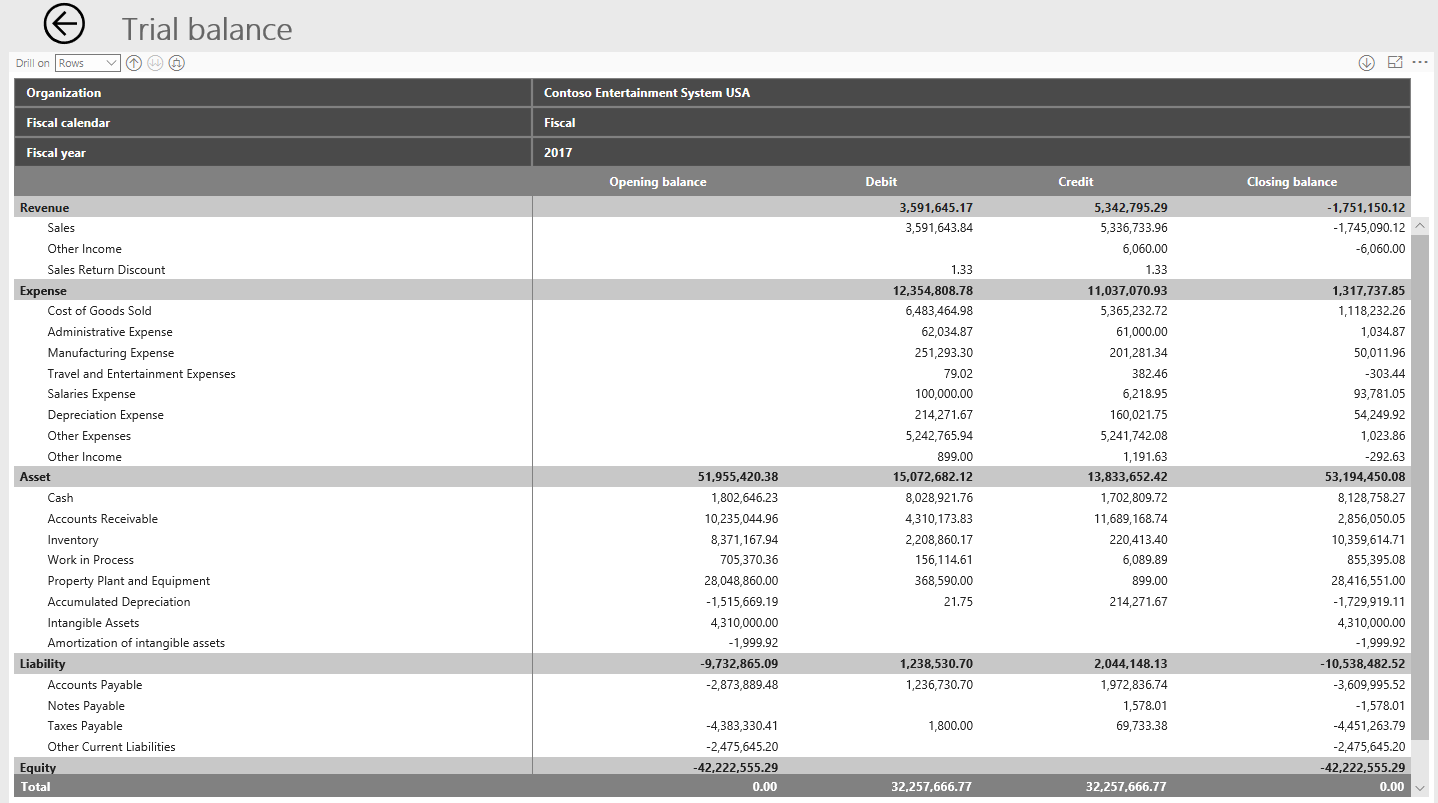

It involves listing all the general ledger accounts and totaling the debit and credit values to ascertain if they are equal.

The purpose of the trial balance is to. In other words, a trial balance shows a summary of how much cash, accounts receivable, supplies, and all other accounts the company has after the posting process. List all of the accounts in the general ledger. Purpose of trial balance in accounting systems.

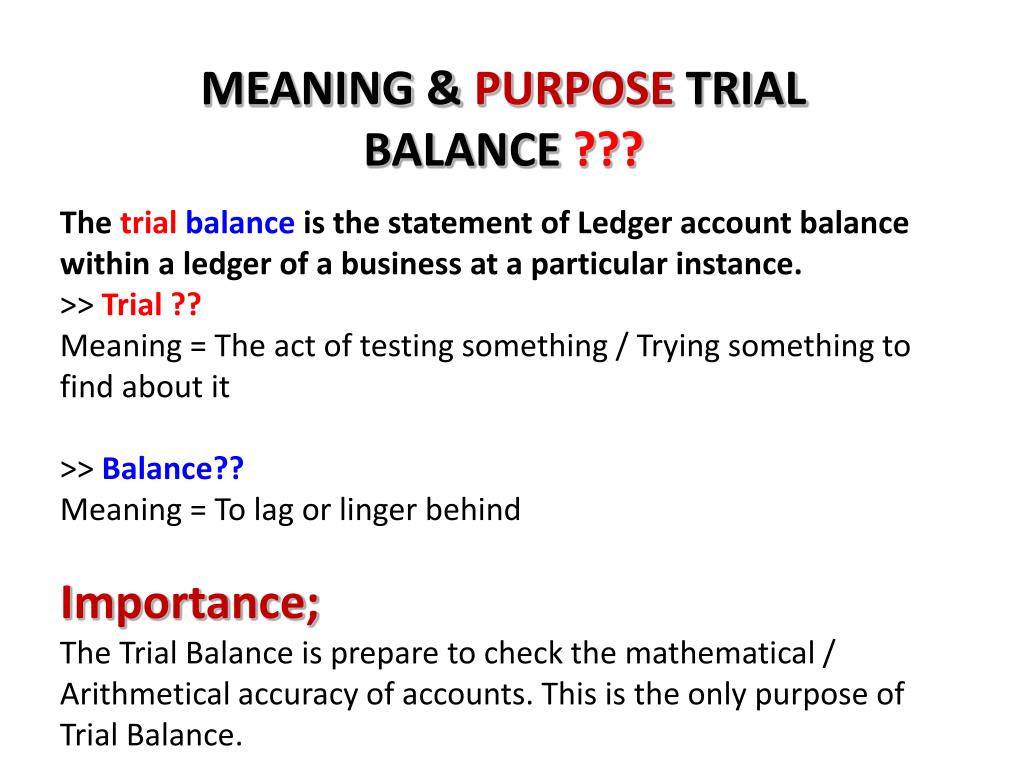

The purpose of a trial balance is to ensure that all entries made into an organization's general ledger are properly balanced. What is the purpose of a trial balance? The structure of this article is as follows, 1.

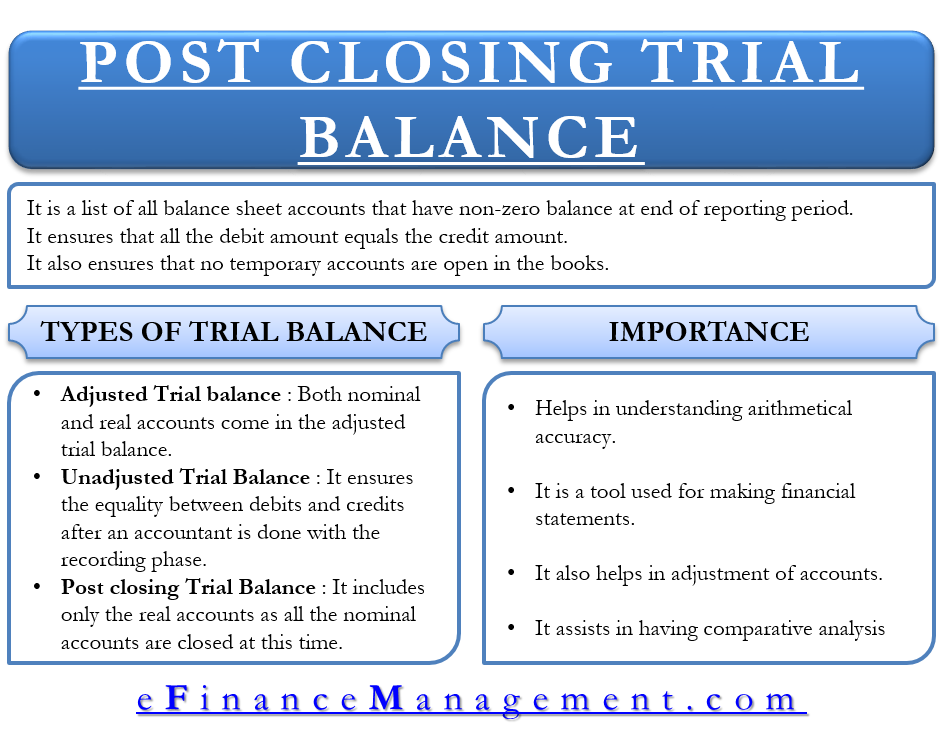

A trial balance simply shows a list of the ledger accounts and their balances. The purpose of trial balance. Trial balance is a crucial tool used in accounting to ensure that debits and credits are balanced, helping to detect errors in financial statements.

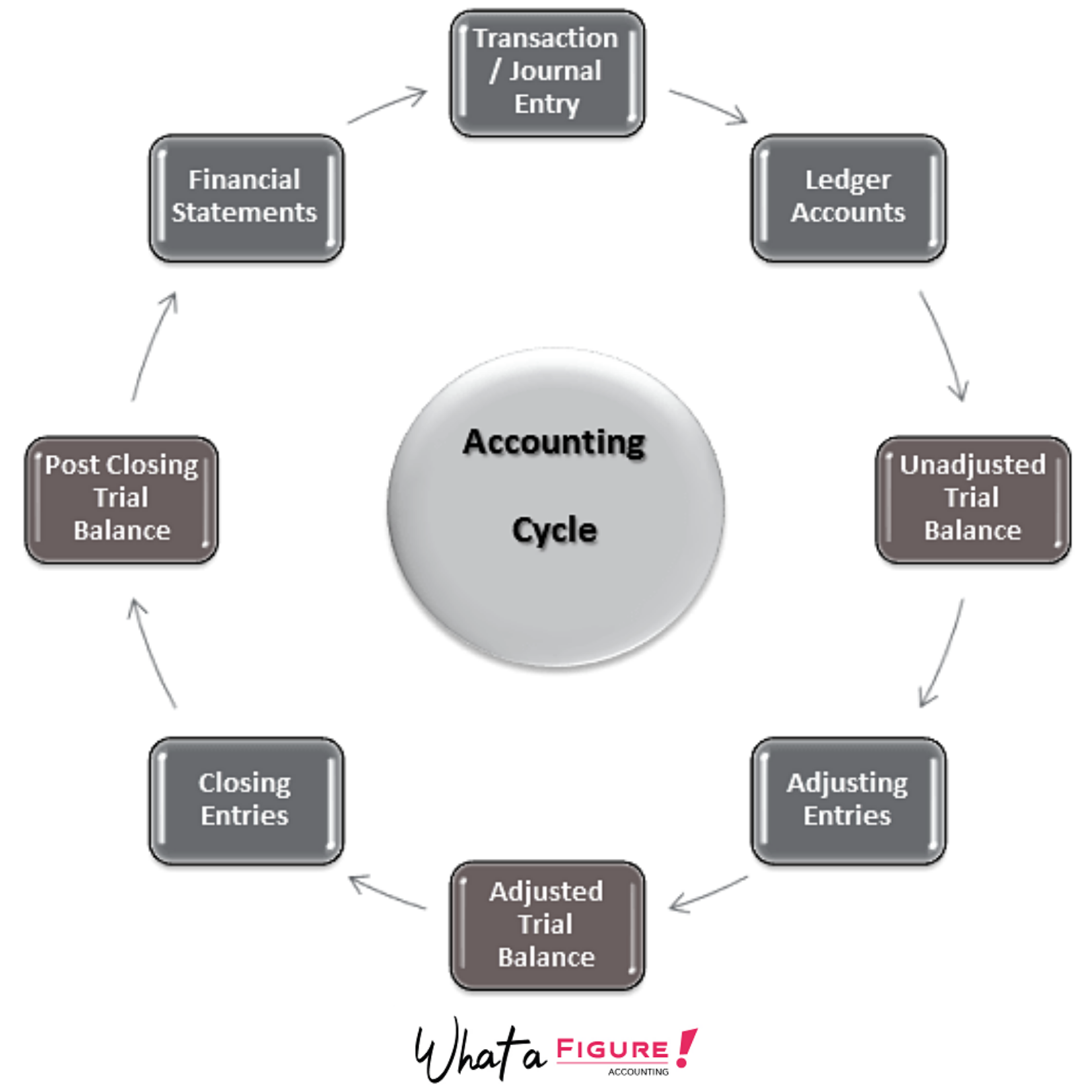

List all of the accounts in the general ledger that have a balance. An adjusted trial balance takes the place of financial statements. Essentially, recording a trial balance is the first step when preparing official financial statements.

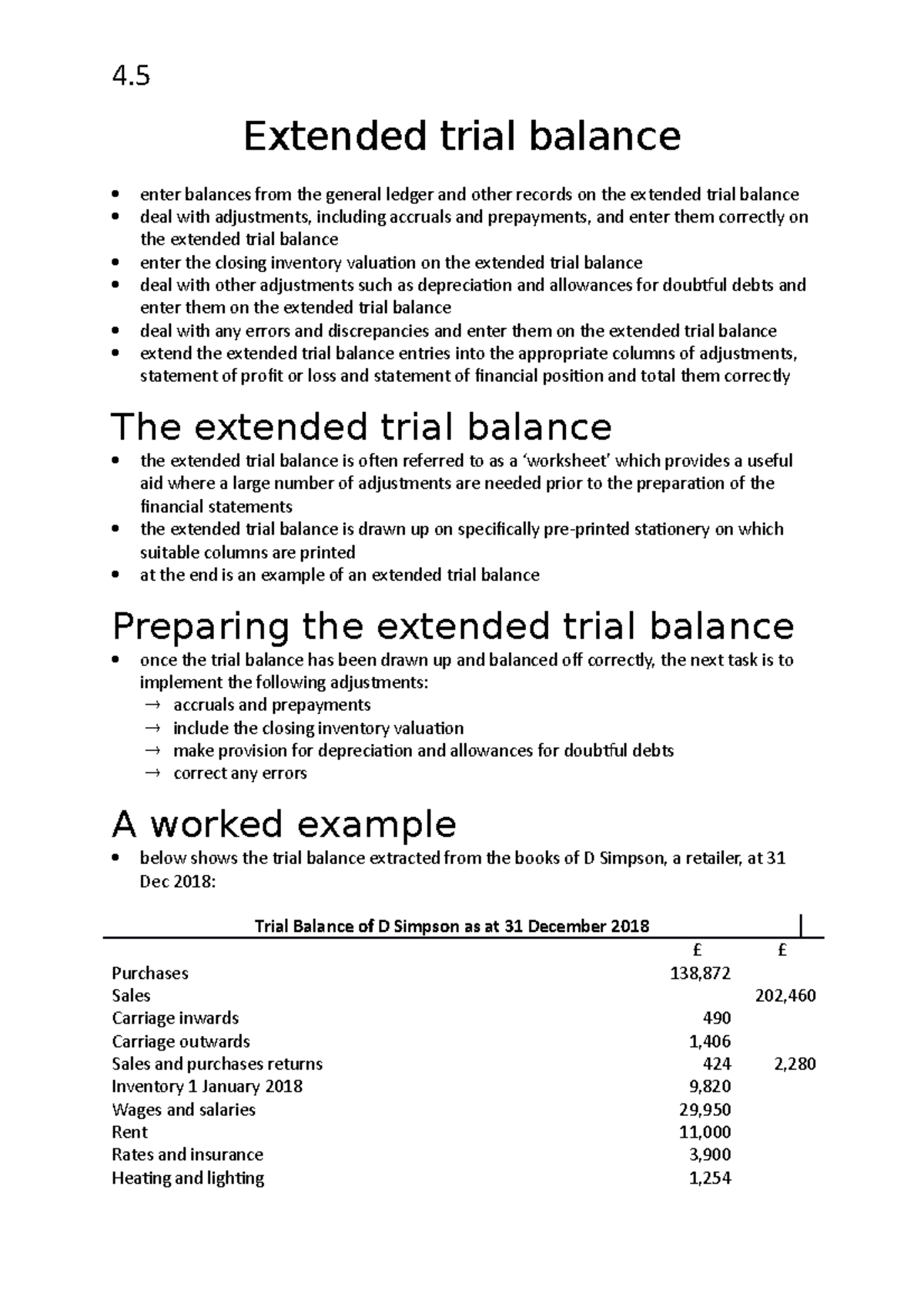

Using the trial balance, all the income and expenses related ledger accounts are compiled to create profit and loss account and rest are used for preparing a balance sheet. The purpose of the trial balance is to identify any errors or discrepancies in the accounting records before creating the financial statements. The main objective of a trial balance is to ensure the mathematical accuracy of the business transactions recorded in a.

Be sure that all journal entries have been recorded. While it is not a financial statement, a trial balance acts as the first step in preparing one. The trial balance serves several.

However, before going into more detail about the purpose of a trial balance, let’s briefly look at what a trial balance is. It’s a work in progress to verify your credits and debits. Verify that the total credits equal the total debits.

If all debit balances listed in the trial balance equal the total of all credit balances, this shows the ledger's arithmetical accuracy. The purpose of a trial balance sheet is to detect errors so that they can be addressed before the formal balance sheet is presented to shareholders. A trial balance lists the ending balance in each general ledger account.

What are the uses of a trial balance? The main purpose of the trial balance is the ensure that the financial statements are correctly prepared by ensuring that all of the accounting entries that are recorded during the period are correctly recorded in accordance with the rule of debit and credit. An adjusted trial balance is prepared to check that the accounting records are still in balance, after having posted all adjusting.

Its purpose is to test the equality between total debits and total credits. The general purpose of producing a trial balance is to ensure that the entries in a company’s bookkeeping system are mathematically correct. First things first, let’s define what a trial balance is.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)