Can’t-Miss Takeaways Of Info About Exceptional Items In Profit And Loss Account

Exceptional item arise from ordinary activity;

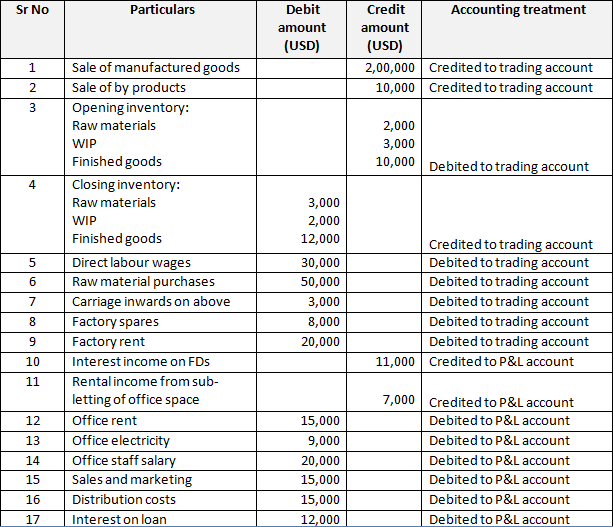

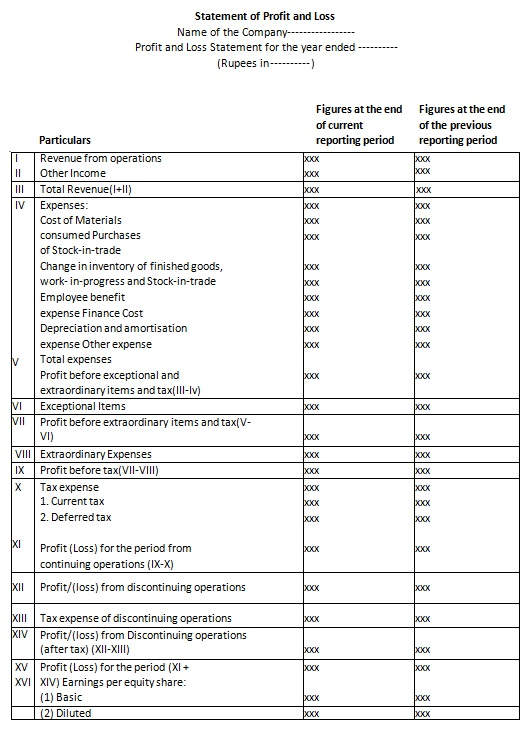

Exceptional items in profit and loss account. Exceptional items/ extraordinary items are expenses occurring. The statement of profit or loss and other comprehensive income, as the name suggests, presents profit and loss for the period as well as other comprehensive income. A detailed explanation regarding the nature of the item is given in.

An exceptional item is an unusually large and uncommon transaction charge that must be disclosed on the. The sale of a parcel of real estate could. They are not expected to be recurring;

An extraordinary item is an accounting term that refers to an abnormal gain or loss that is not generated from the ordinary business operations of a company, is infrequent in. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a. From the above, the following features of exceptional items can be deduced:

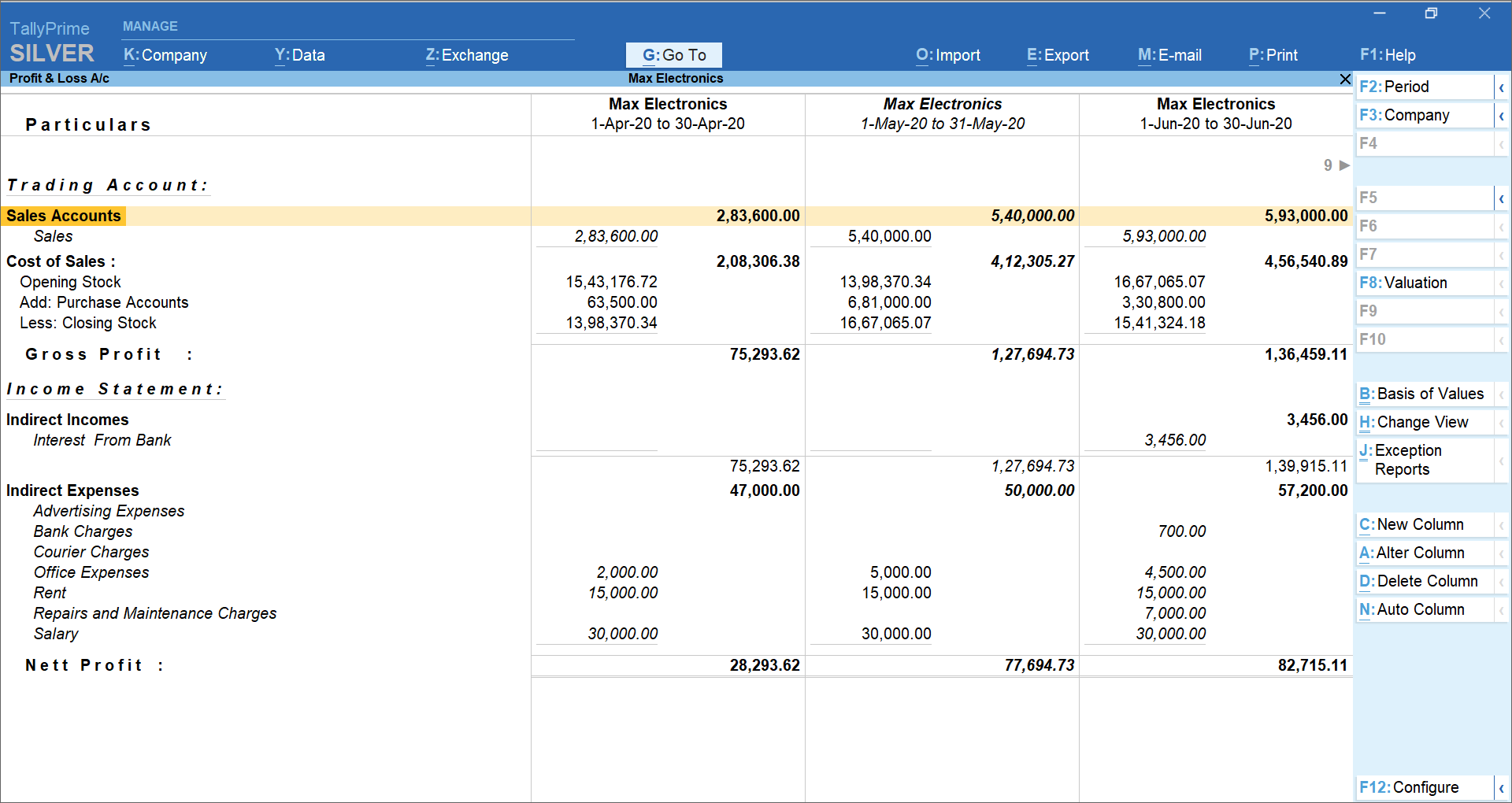

However, there seems to be an exceptional item/ extraordinary item of rs.3.8 crs, which needs to be deducted. Profit and loss account is made to ascertain annual profit or loss of business. But why are they so important?

The resulting profit or loss on disposal should also be shown as an exceptional item after operating profit and before interest and should also be shown as a. It required items of income and expense not recognised in profit or loss to be presented in the statement of changes in equity, together with owner changes in equity. All the items of revenue and expenses.

An exceptional item is a significant transaction or event listed in a company's financial statements, distinct from ordinary activities. The following minimum line items must be presented in the profit or loss section (or separate statement of profit or loss, if presented): The profit & loss account reports the incomes and expenses directly related to an organisation to measure the performance in terms of profit or loss.

Exceptional items are unusual business costs that are reported separately from ordinary expenses or receipts. It also must be material. that is, it has a significant impact on the company's profit or loss for the relevant period. An extraordinary item on a balance sheet indicates a substantial gain or loss that is unlikely to be repeated.

Disclosure of such exceptional items eg restructuring provisions, impairments etc. Exceptional items, even though are related to operations of a company, do not occur on. Frs at paragraph 14 requires turnover and operating profit to be shown separately on the face of the profit and loss account and should be split between.

Exceptional items as well as extraordinary items are reported in the profit and loss statement. Litigation settlements features of exceptional items rare occurrence: What is the profit and loss statement (p&l)?

Only indirect expenses are shown in this account.