Smart Tips About Statement Of Cash Flows Depreciation Expense

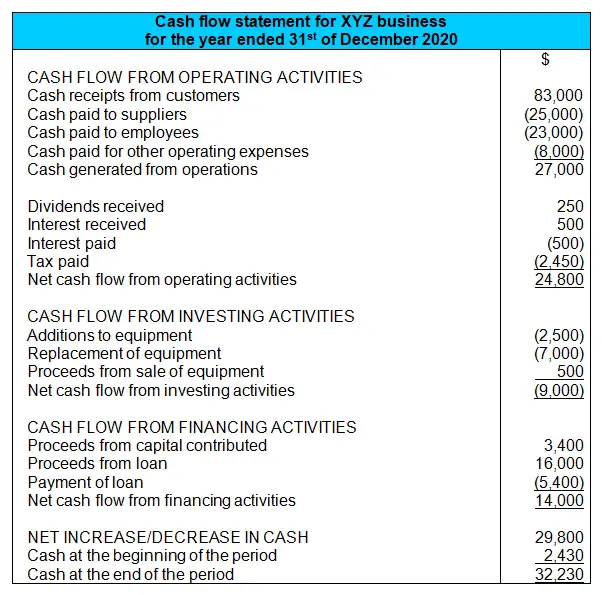

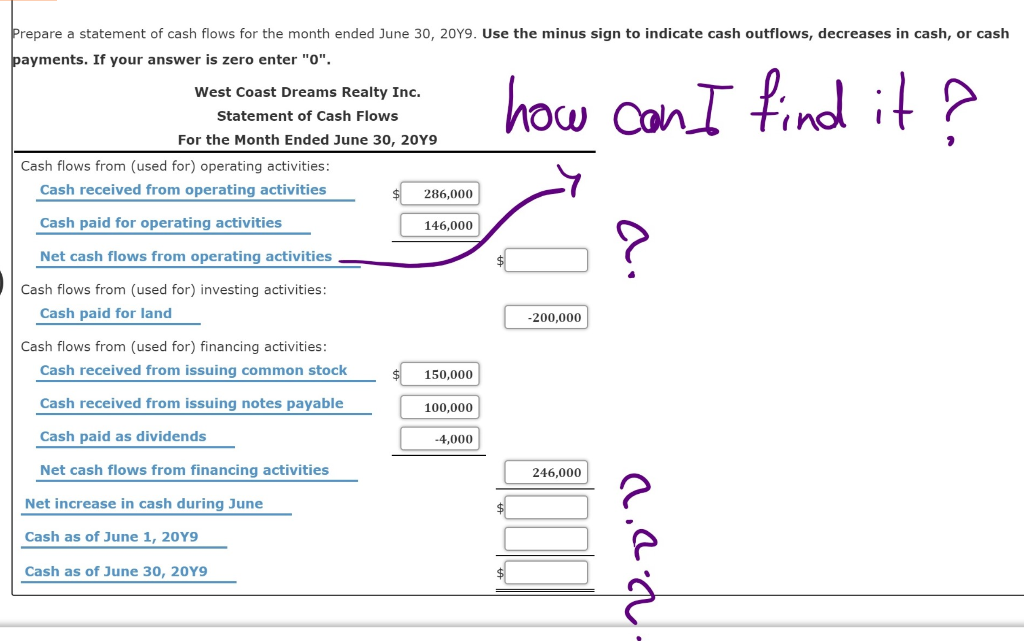

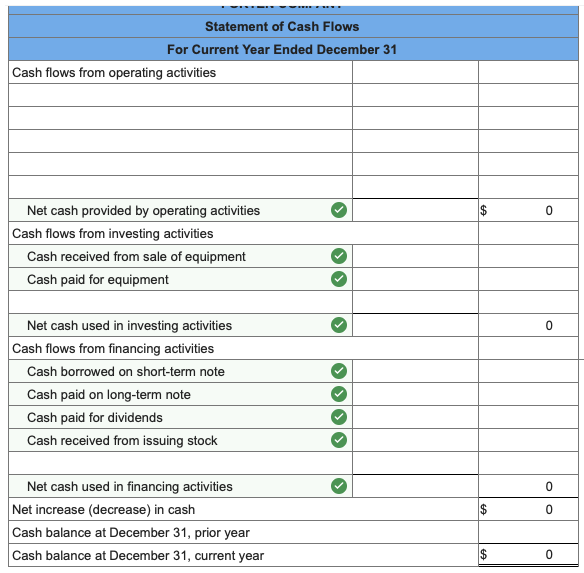

The final financial statement is the statement of cash flows.

Statement of cash flows depreciation expense. In accounting, the depreciation expense that we charge to the income statement represents the cost. It is a crucial statement, as it shows the sources of and uses of cash for the firm during the accounting period. Depreciation and cash flow.

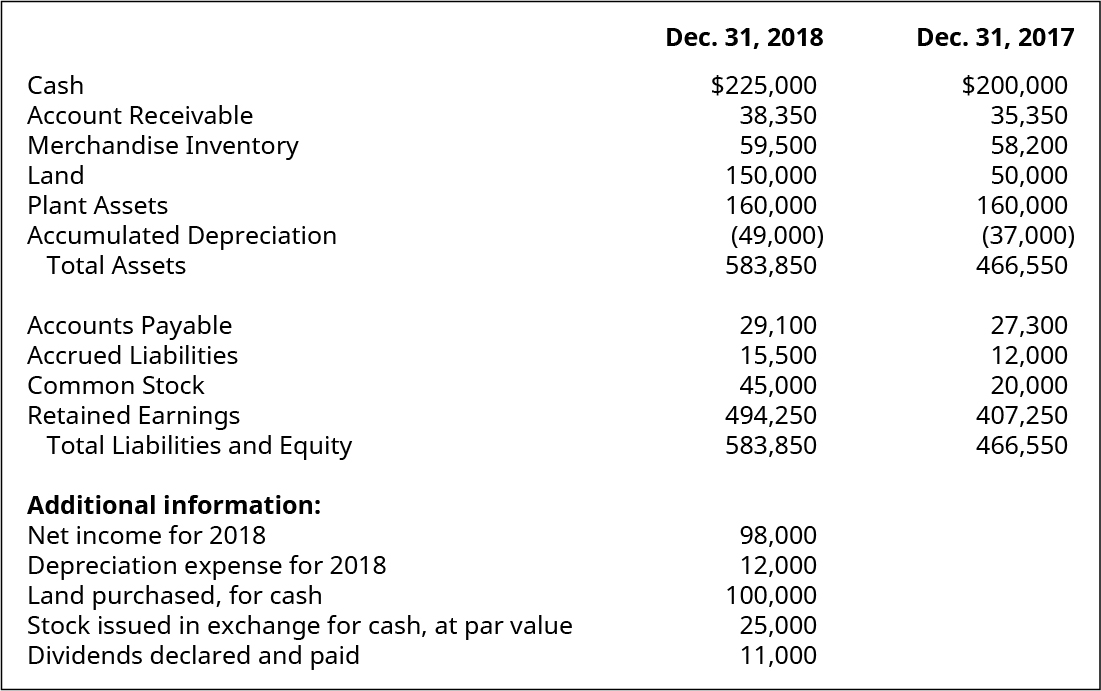

Depreciation expense is similar to other expenses such. All sales and purchasers and on account. You can find depreciation on your cash flow statement, income statement, and balance sheet.

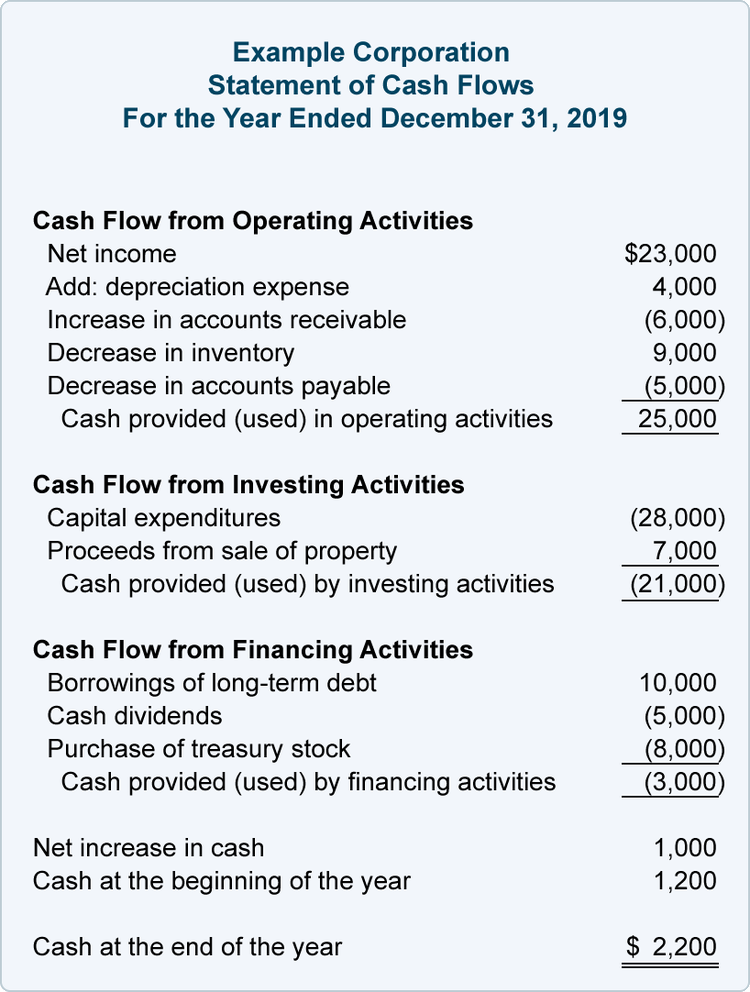

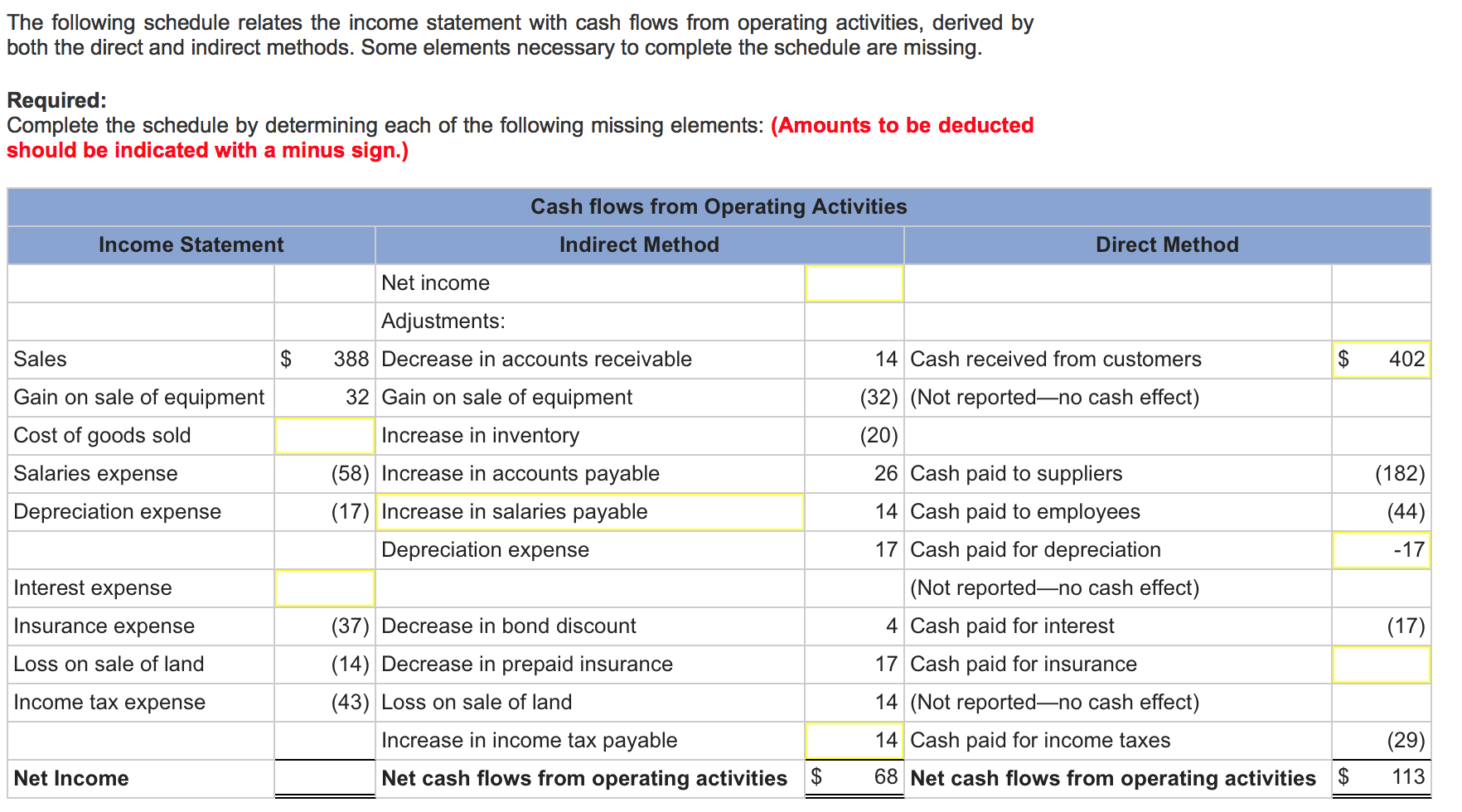

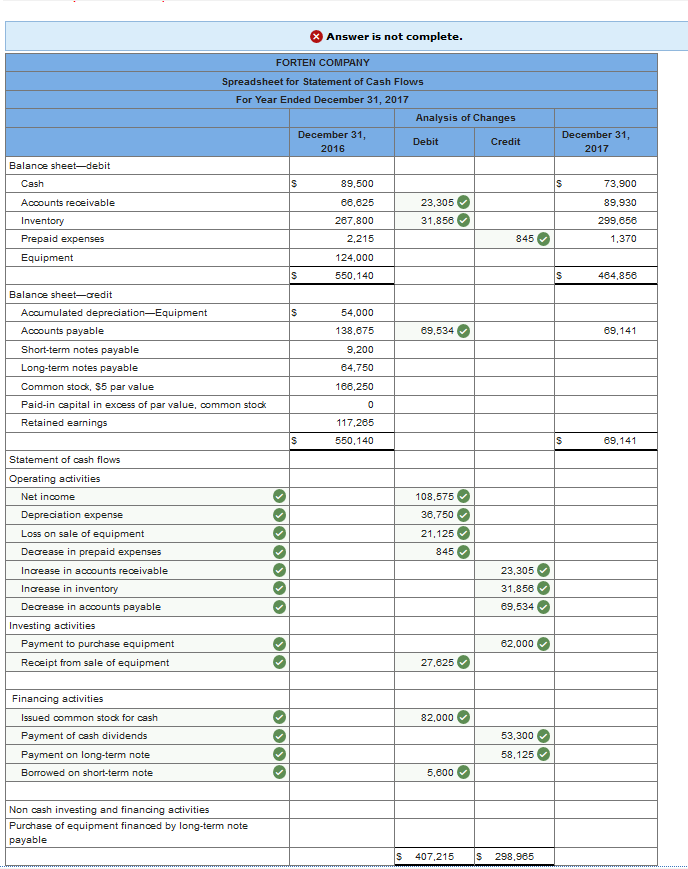

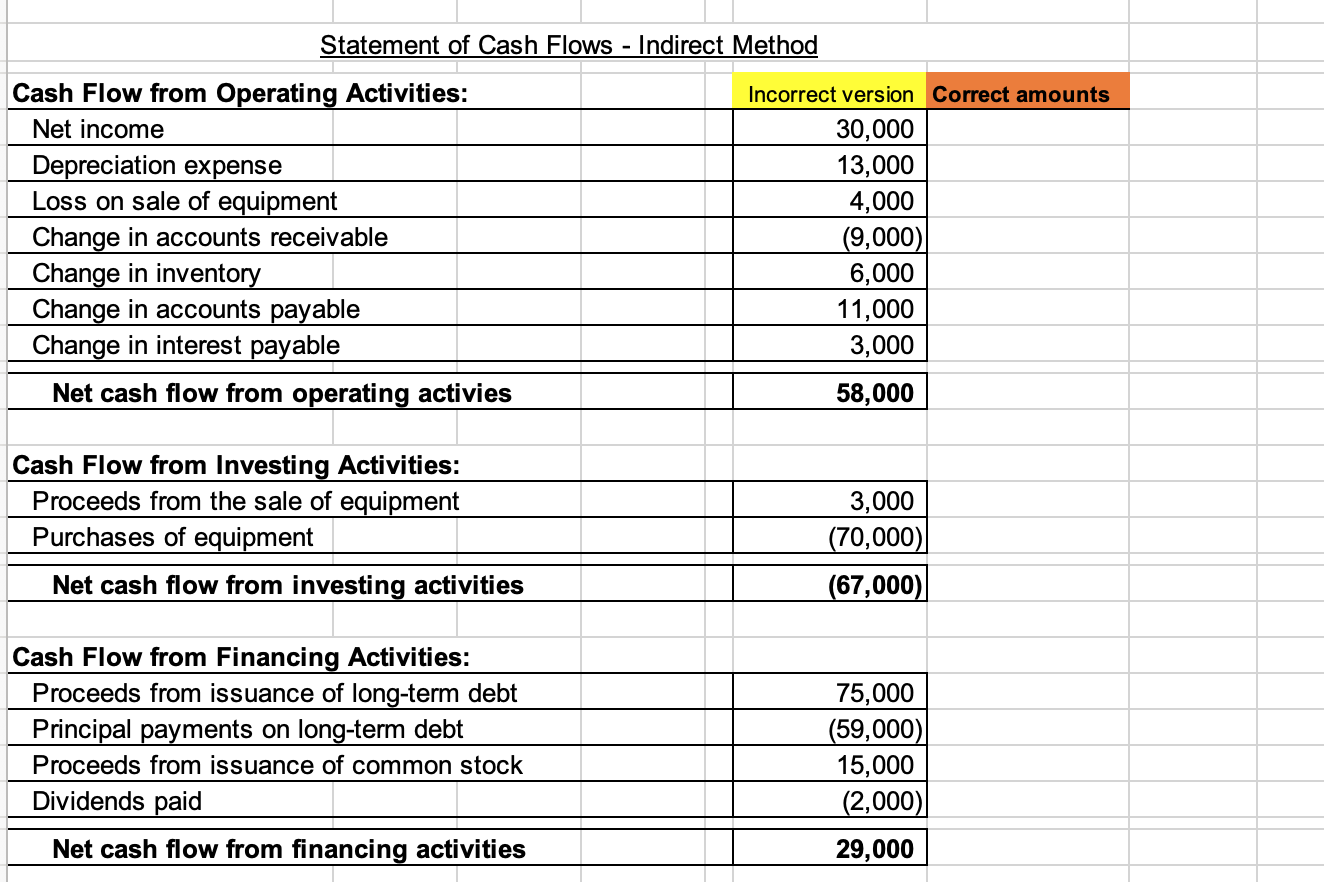

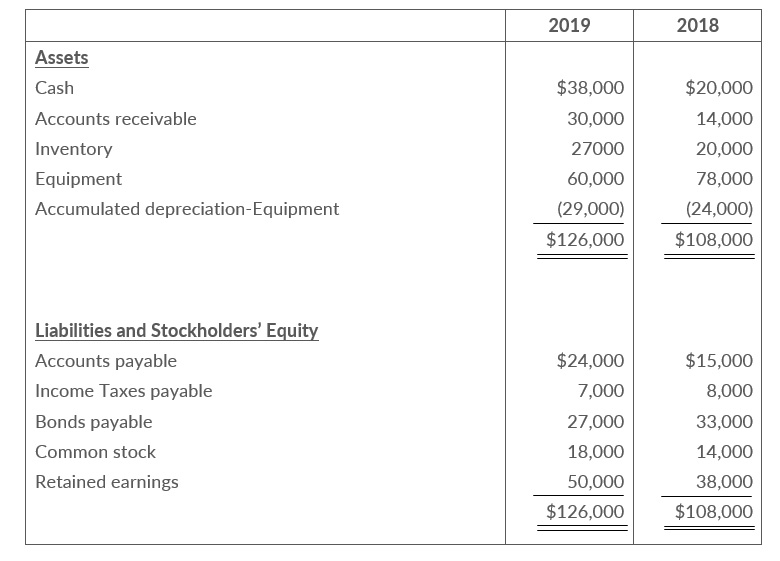

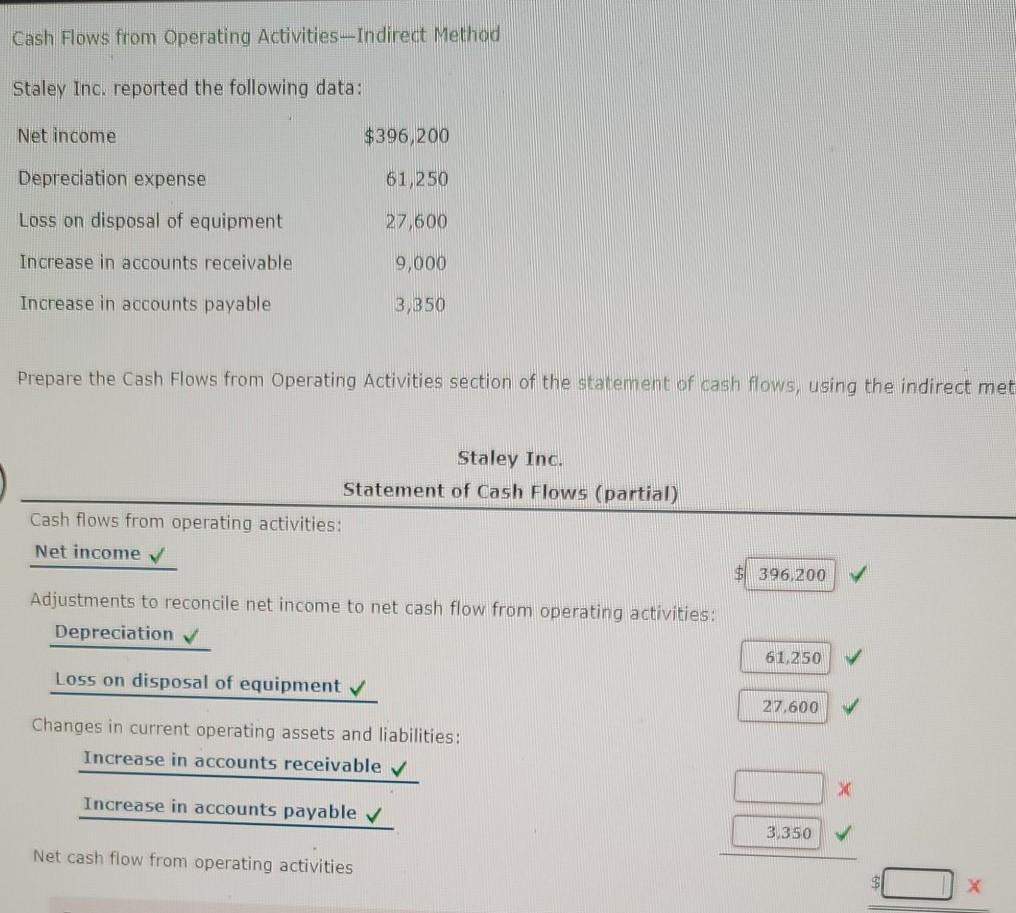

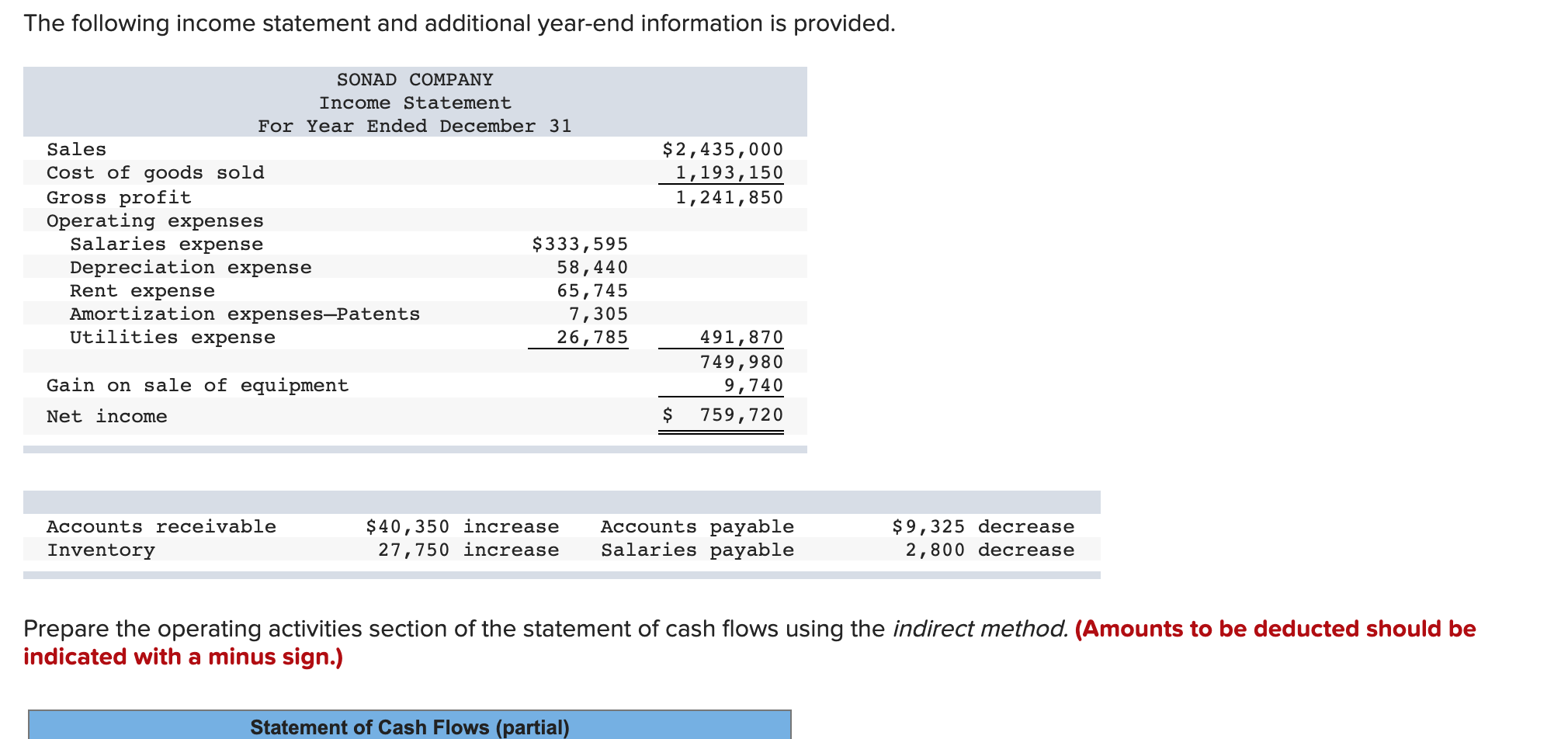

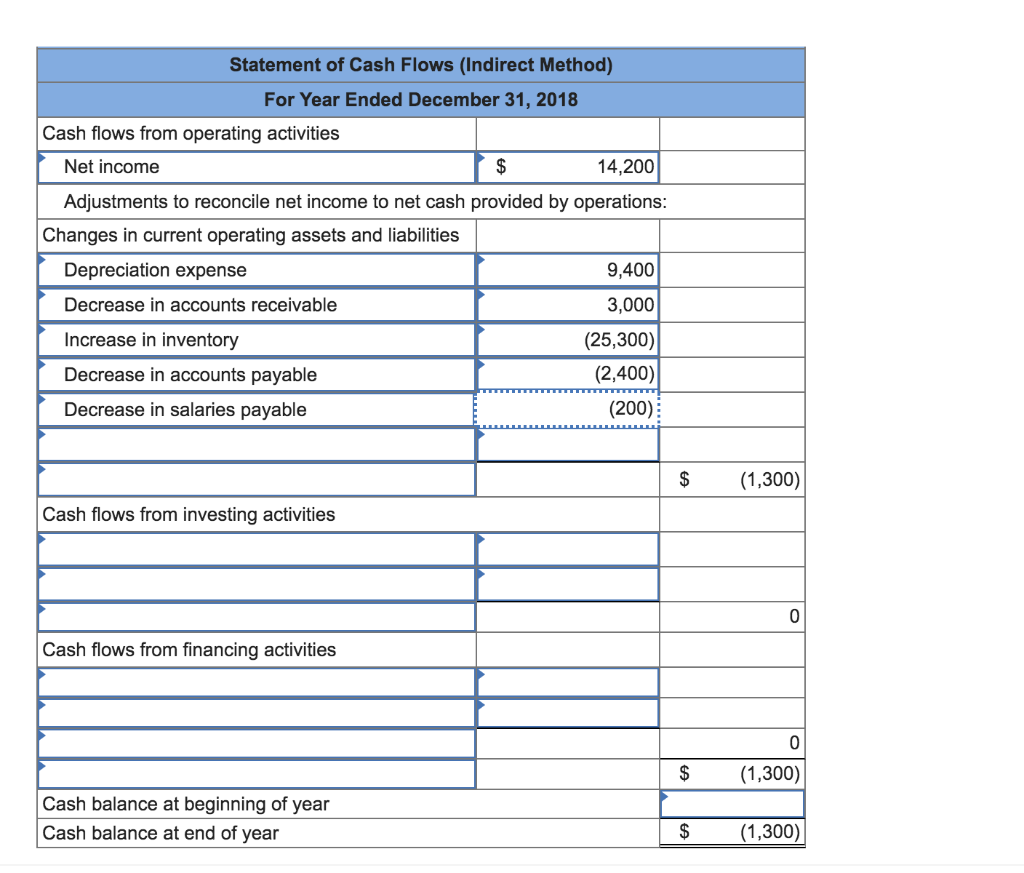

Depreciation is a component of the cost of production, but it is a different type of cost. Because of this, the statement of cash flows prepared under the indirect method adds the depreciation expense back to calculate cash flow from operations. Depreciation can only be presented in cash flow statement when it is prepared using indirect method.

Depreciation appears in all of the financial statements. Where depreciation appears in the statement of cash flows. Did you get it ⬇️樂 question:

Depreciation expense on cash flow statement. Depreciation expense on cash flow statement introduction. Deprecation (20) deprecation reduces the carrying amount of the ppe without being a cash flow.

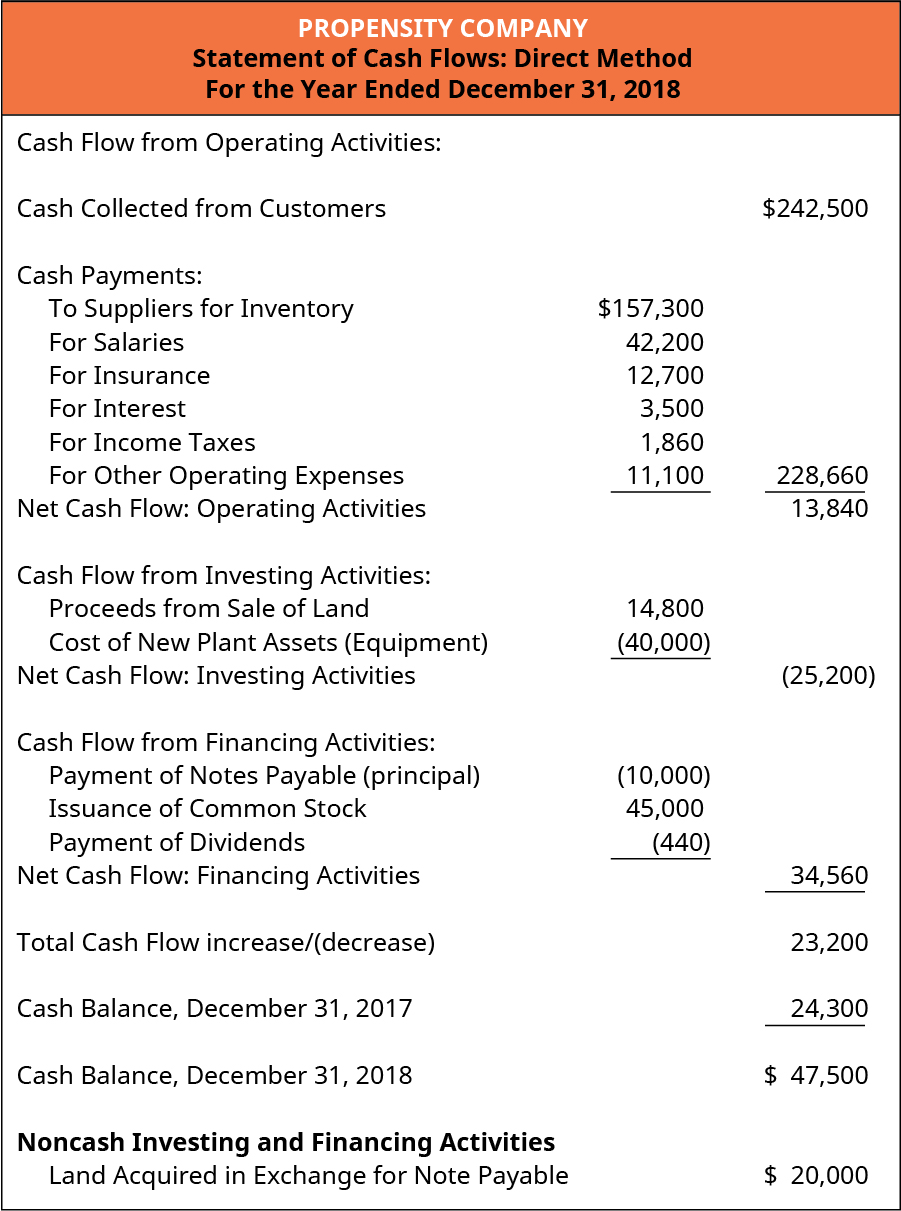

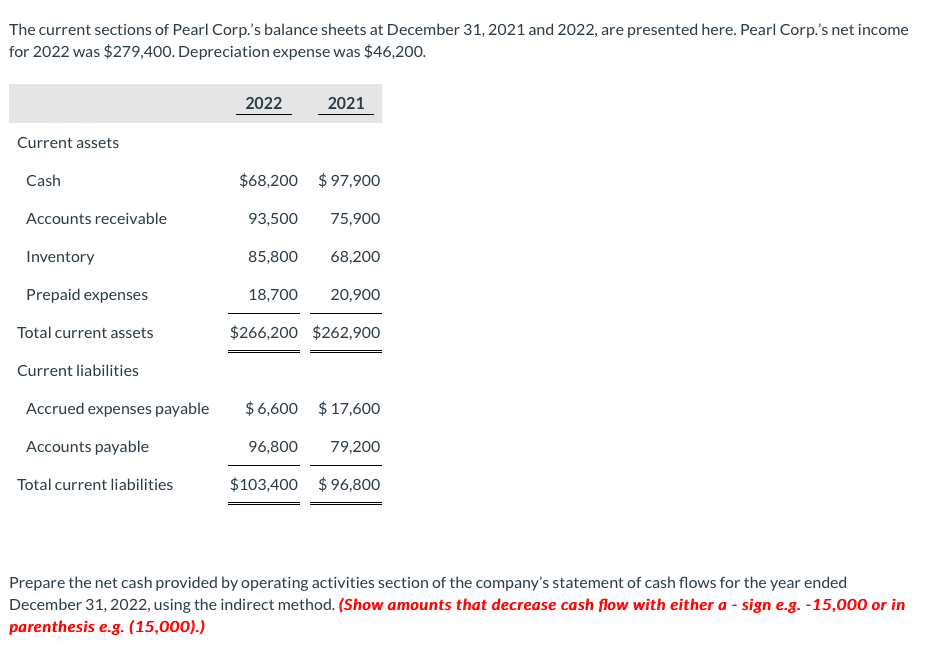

And here is the information we need to complete the cash flows from operations section of the statement of cash flows (all numbers represent millions of dollars): In this video, learn why depreciation expense is excluded from the computation of operating cash flow, including how to deal with depreciation on the statement of cash. Add back noncash expenses, such as depreciation, amortization, and depletion.

Remove the effect of gains and/or losses. All depreciation expense $14,500 is in the operating expenses; With the help of useful life of asset and the appropriate rate, the.

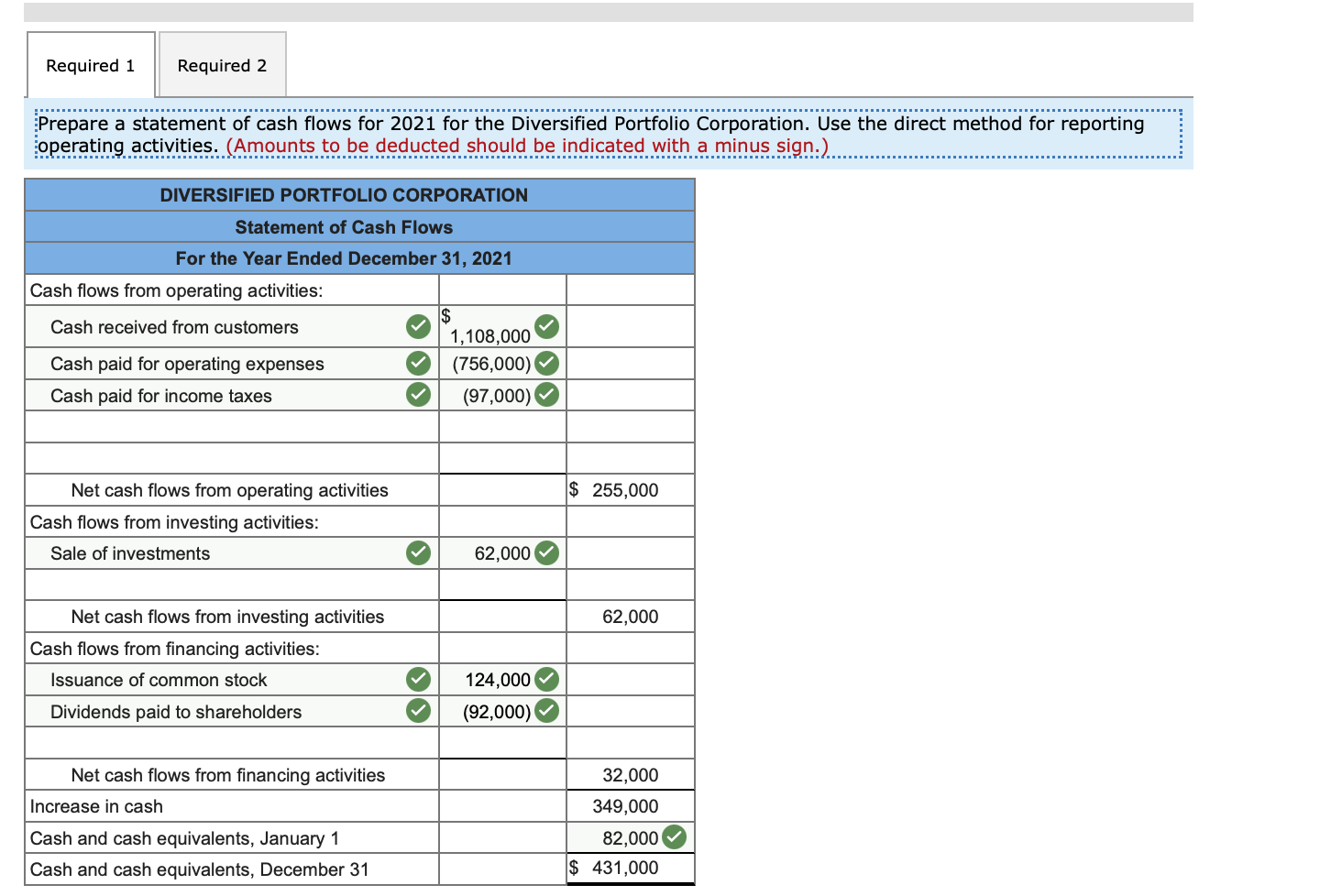

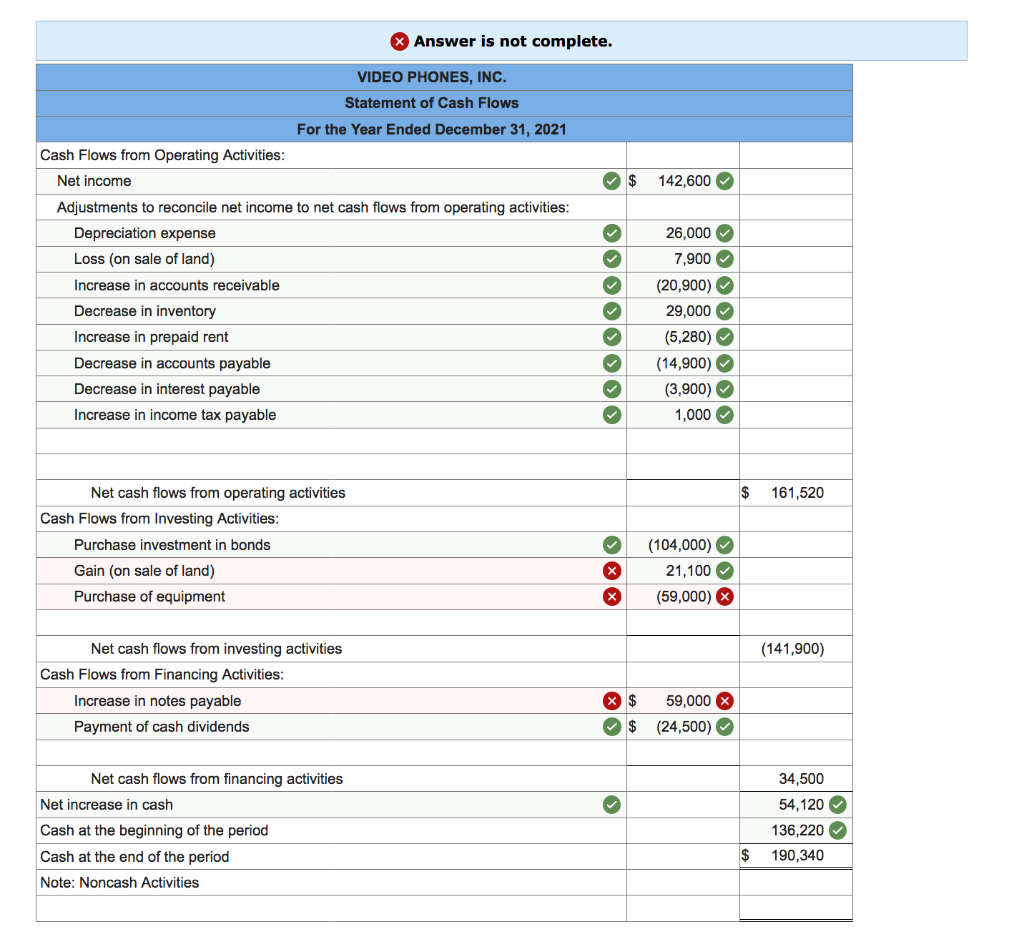

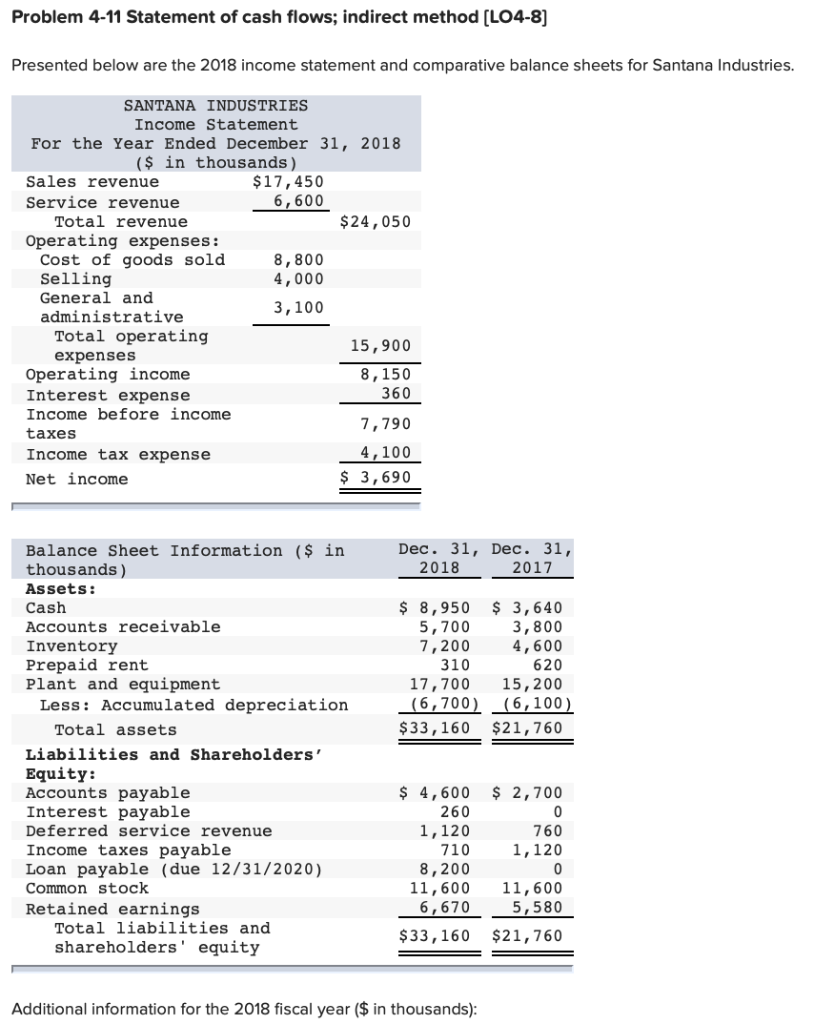

Depreciation expense refers to the allocation of the cost of tangible assets over their estimated useful lives. Prepare a statement of cash flows using the indirect. Begin with net income from the income statement.

Depreciation in cash flow statement. Why is depreciation added in cash. The indirect method presents the statement of cash flows beginning with net income or loss, with subsequent additions to or deductions from that amount for non.

It represents the wear and tear, obsolescence, or other. Under the indirect method, since net income is a starting point in measuring cash flows from operating activities, depreciation expense must be added back to net income. Depreciation actually does not come under any of the categories of the cash flow statement, at least when you're using the direct method: