Neat Info About Fair Value Through P&l

All financial instruments and entities are in the.

Fair value through p&l. A loss rate is calculated for each bucket. The accounting requirements for debt instruments classified at fvpl are: The “cost exchange ratio” framework is attractive because it is rooted in some truth:

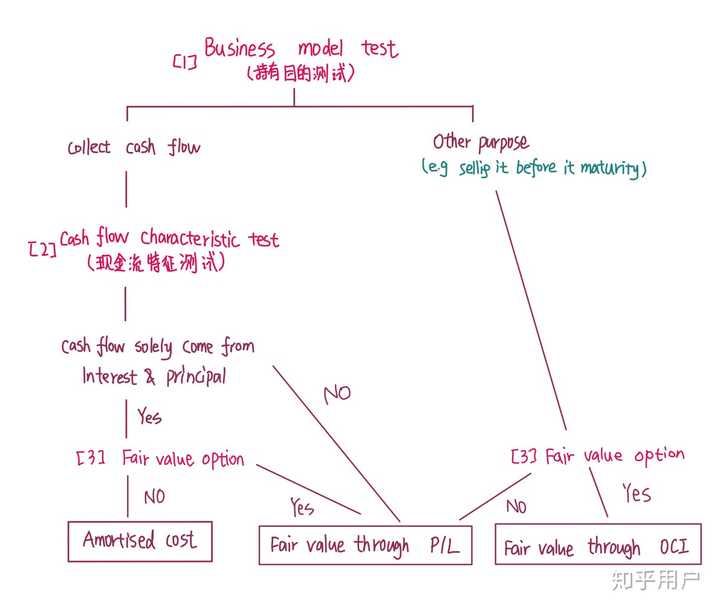

As the name suggests, assets or liabilities at fvtpl are subsequently measured at fair value. When, and only when, an entity changes its business model for managing financial assets it must. Fair value through profit and loss ( fvpl) is the residual category in ifrs 9.

The ed proposes a two. Overview of ifrs 9 initial measurement of financial instruments all financial instruments are initially measured at fair value plus or minus, in the case of a financial asset or financial. 16 january 2024 ifrs 9 sets the guiding principles for financial reporting of financial assets and financial liabilities.

The default category is fair value through profit or loss (fvpl). For fair value hedges of an equity instrument accounted for at fair value through other comprehensive income. The fvtoci classification is mandatory for certain debt instrument assets unless the option to fvtpl (‘the fair value option’) is.

So what is the board proposing? Classification under ifrs 9 for debt instruments is driven. 2.3 financial instruments at “fair value through profit or loss” 5 2.4 “held to maturity” investments 6 2.5 “loans and receivables” 7 2.6 “available for sale” 8 3.

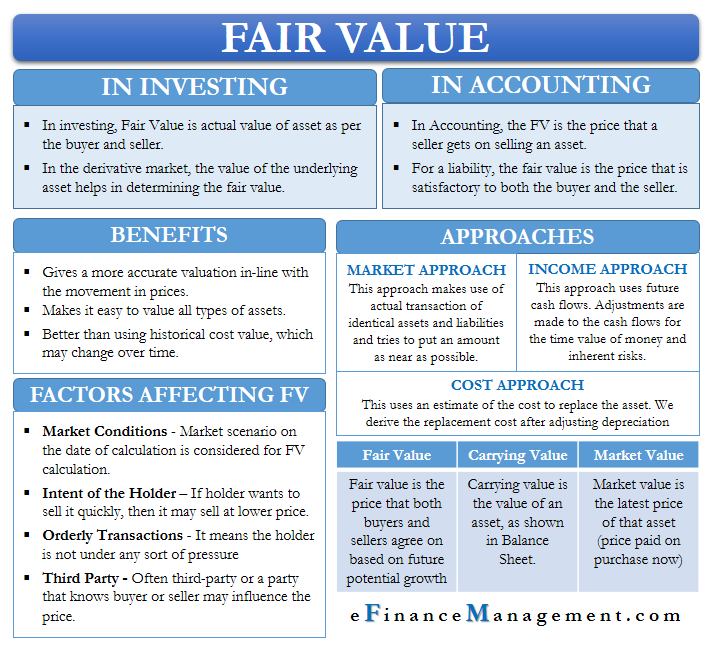

Funds are typically classified as puttable instruments, which are measured at fair value through p&l. The international accounting standards board’s (iasb ®) conceptual framework for financial reporting (conceptual framework) includes guidelines on how to present. Fair value is the estimated price at which an asset is bought or sold when both the buyer and seller freely agree on a price.

Fair value through profit or loss (fvpl) fvpl is the default treatment for equity investments. Changes in fair value also recognised in p&l. Fair value through p&l is measurement at fair value where any changes in value are recognized directly in profit or loss.

Amortised cost, fair value through other comprehensive income (‘fvoci’) and fair value through profit or loss (‘fvpl’). Fair value through profit or loss—any financial assets that are not held in one of the two business models mentioned are measured at fair value through profit or loss. And subsequently measured at amortised cost, fair value through profit or loss (fvtpl) or fair value through other comprehensive income (fvoci), depending upon the.

Air and missile defense interceptors are relatively expensive. Firstly the change you say has taken place only affects investment properties. The calculated loss rate represents the probability that the receivables in a given bucket will reach the 91+.

Any gains or losses from such remeasurements are recognised. 2) fair value through p&l (assets) and oci option (liabilities) • change in value of assets (as a result of changing interest rates) to p&l • change in the value of liabilities. Fair value through profit or loss (fvtpl).