Marvelous Info About Increase In Accounts Payable Cash Flow

They tie up your cash flow — leaving you with fewer business options, and they unnecessarily increase the amount of time and energy that.

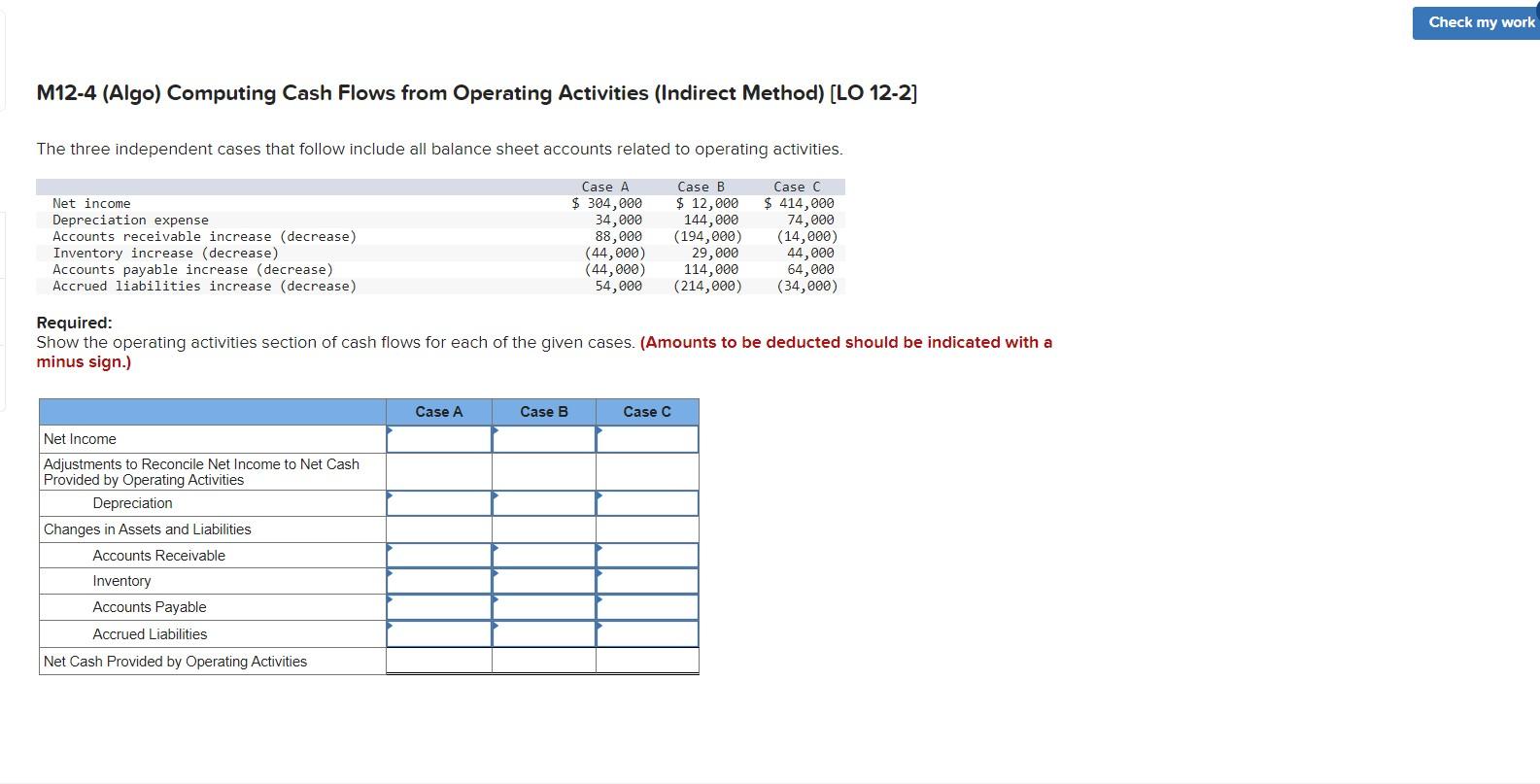

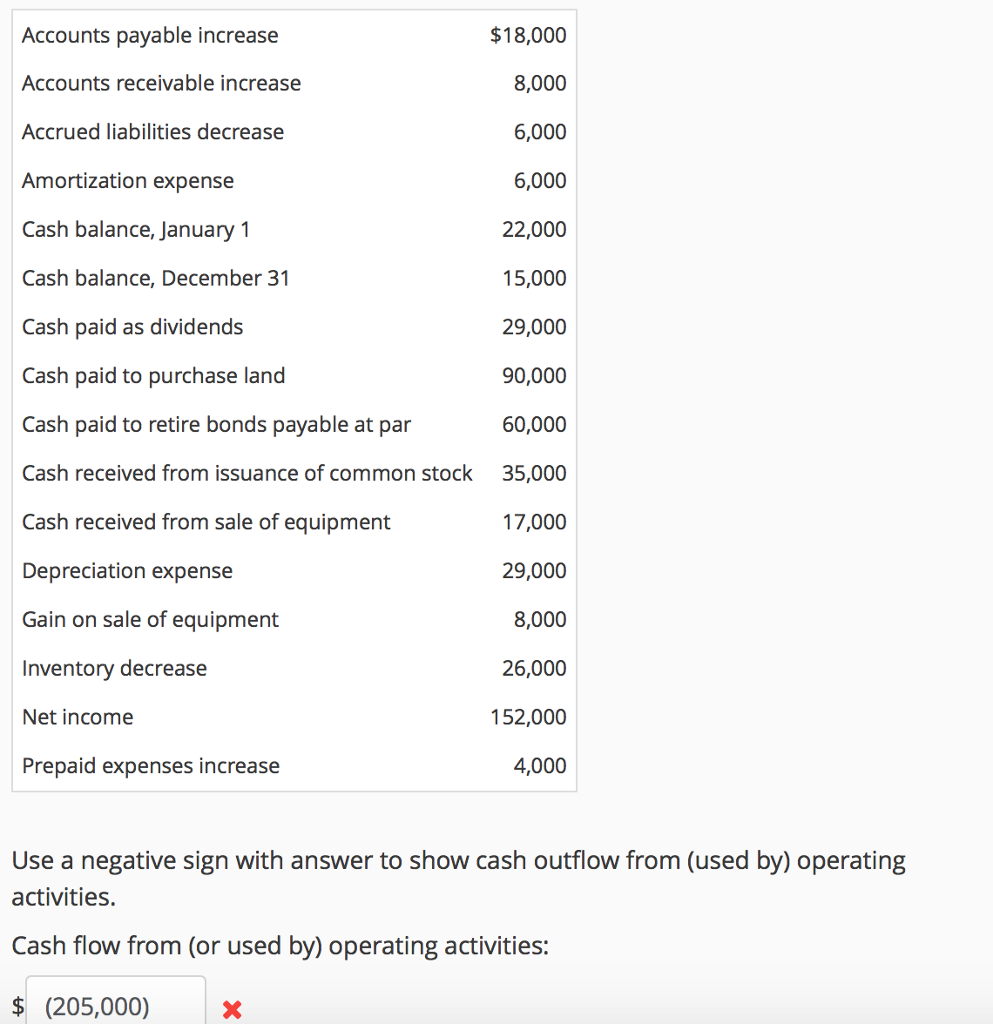

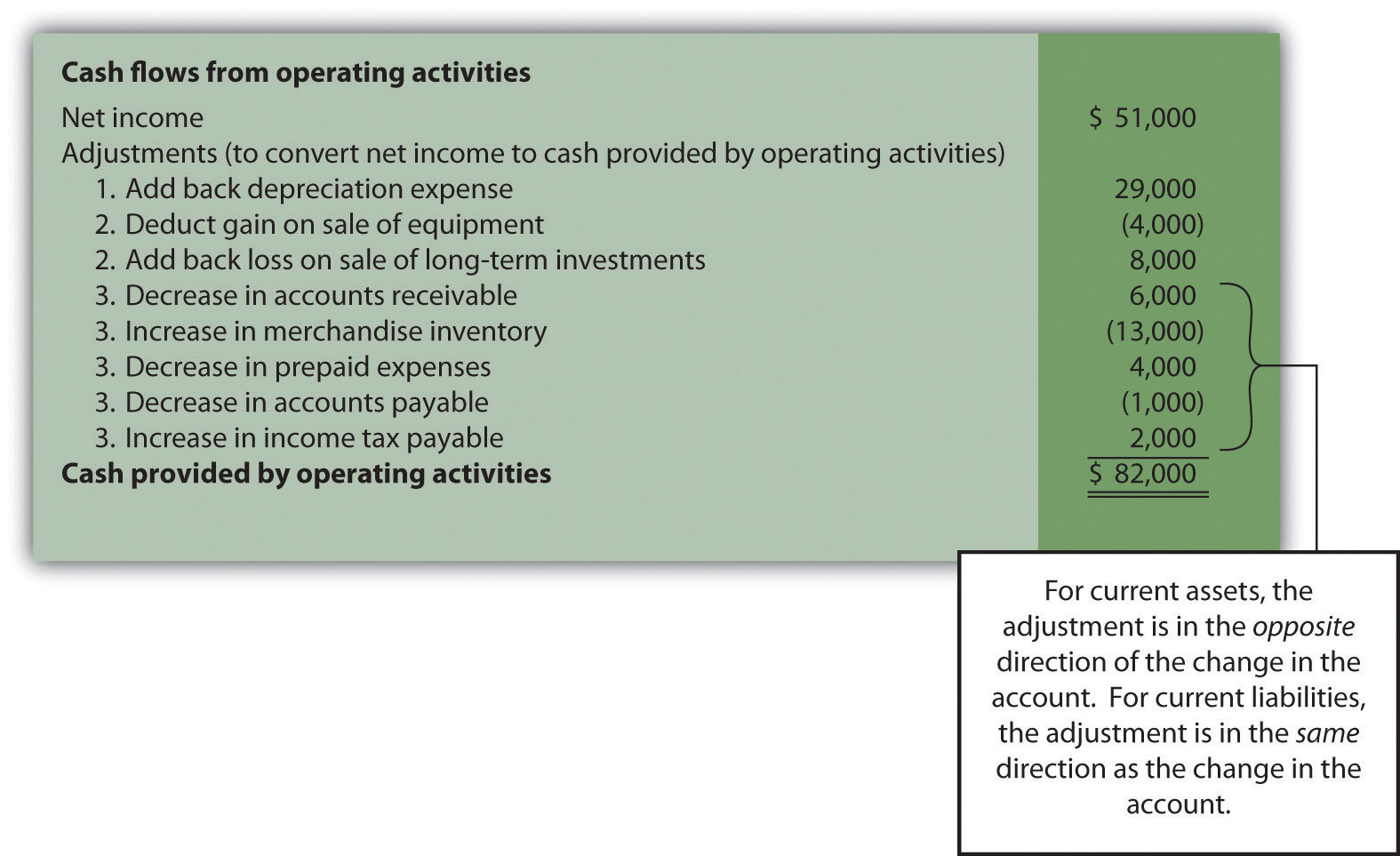

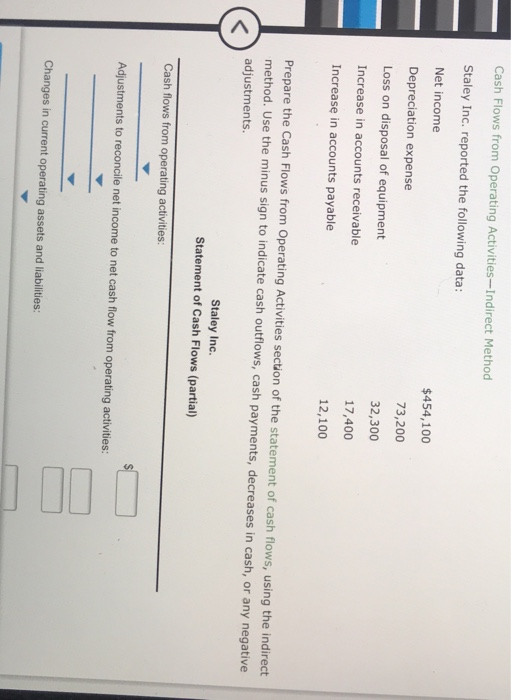

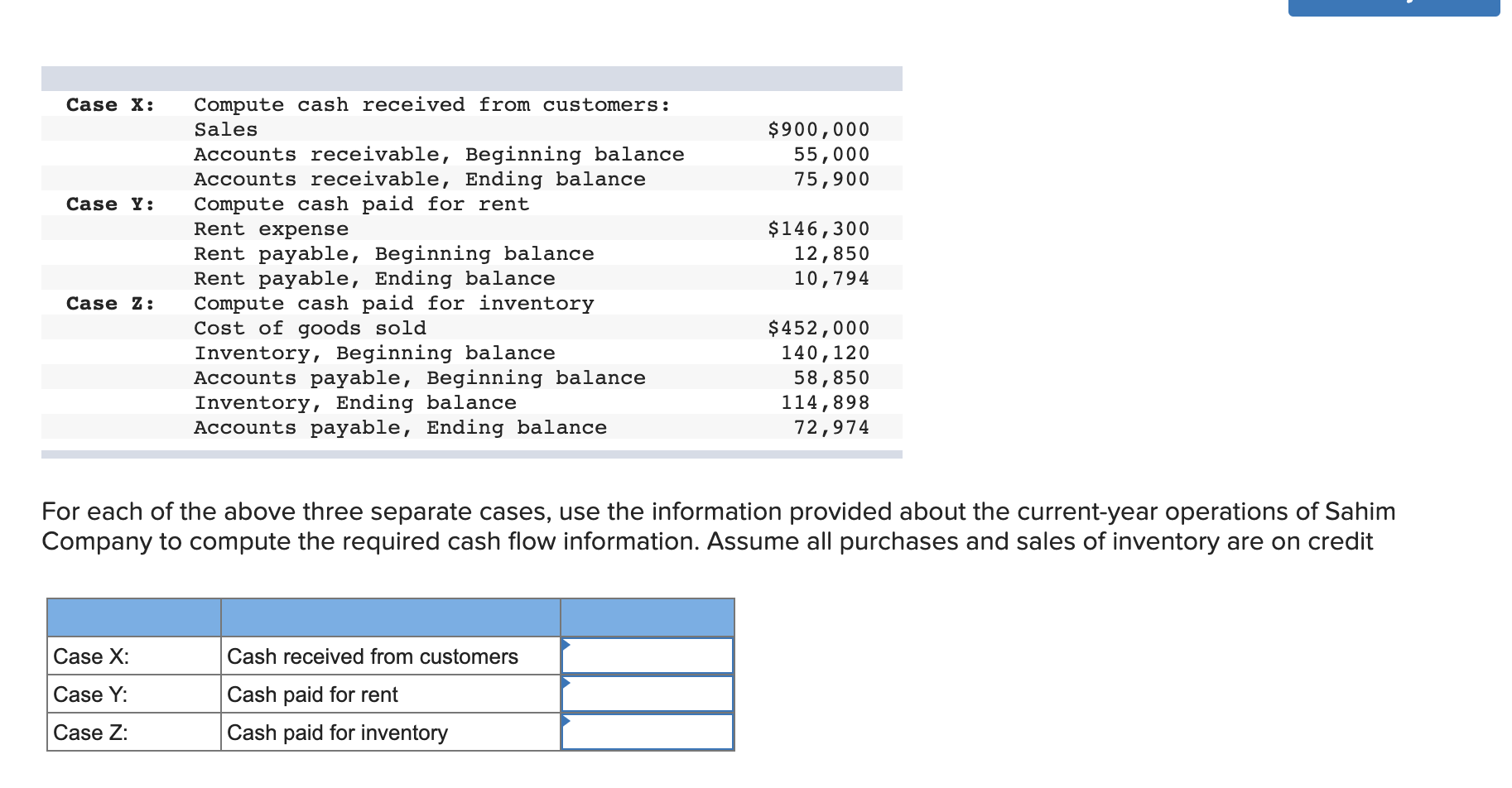

Increase in accounts payable cash flow. Pay only twice a month. You enter increase in accounts payable: To see the real impact on cash flow, the increase in accounts payable must be added back to net income.

87% of companies don’t get paid until after their invoices are due. The relationship between accounts payable and the free cash flow (fcf) of a company is as follows: Late payment mostly results from:

The answer might seem counterintuitive, but an increase in accounts payable actually leads to a positive cash flow. $5,000 as a positive item. It may help to view the positive amounts on the scf as being favorable or good for a company's cash balance.

Even though accounts payable is a liability on your income statement, since the payment has yet to be made, an increase in accounts payable means an increase in available cash flow for that accounting period. You could use a budgeting app that links to your bank account to automatically import and categorize your transactions for you. An increase in accounts payable is a positive adjustment because not paying those bills (which were included in the expenses on the income statement) is good for a company's cash balance.

So at year end the following year, the accounts payable will double to $200,000, and the cash on hand will increase by $100,000 as well, equal to the amount it saved in its free month. Increasing the frequency of paying back vendors affects cash flow negatively, while decreasing it affects cash flow. You’ll see the difference this makes to your cash flow.

Common issues that occur during accounts payable workflow process a. Late payment poses a cash flow problem for suppliers and can rupture your client’s relationship with their suppliers. Late payment is a challenge for business.

Thus, an increase in accounts payable balance would signify that your business did not pay for all the expenses. Accounts payable represent a change in the cash flow on the cash flow statement. The premise behind working your a/p is to improve cash flow by decreasing the speed in which you pay your accounts payable.

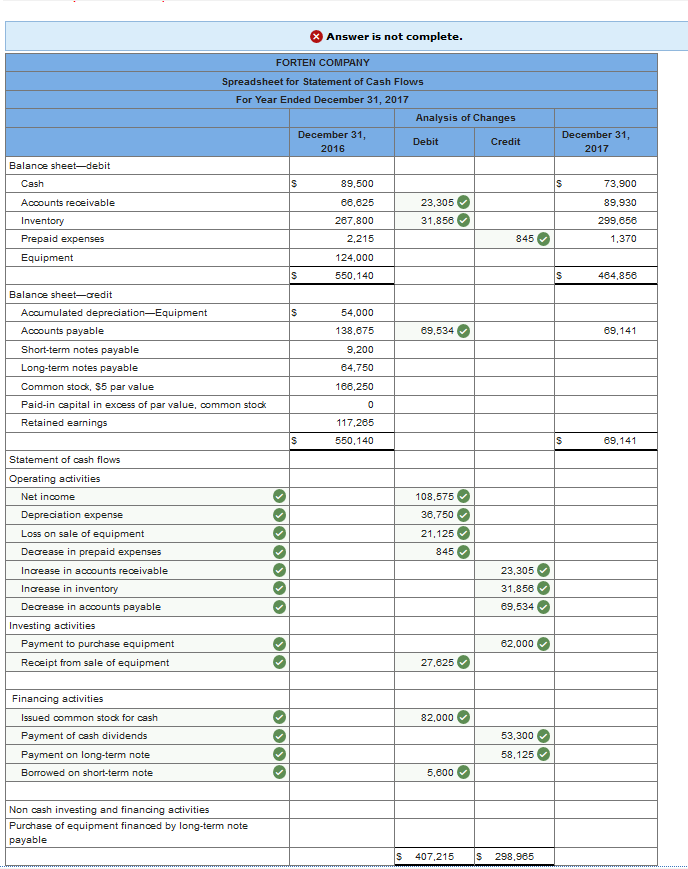

Add back noncash expenses, such as depreciation, amortization, and depletion. Then, you can see where you're spending more than you. Fasb (financial accounting standards board) favors the direct method.

Increase in accounts payable: Impact of a decrease in current liabilities After all, late payments prove a hassle to even the most successful company;

There are two key methods of preparing the statement: The reason for this is that ap is actually an accounting term, and this indicates that a company has not immediately spent cash. Thus, an increase in the accounts payable will increase the cash flow.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)