Brilliant Strategies Of Tips About Income Statement Using Variable Costing

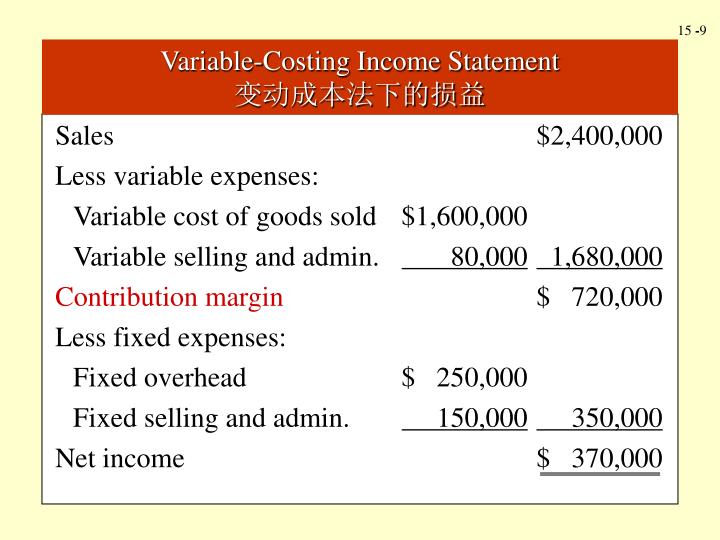

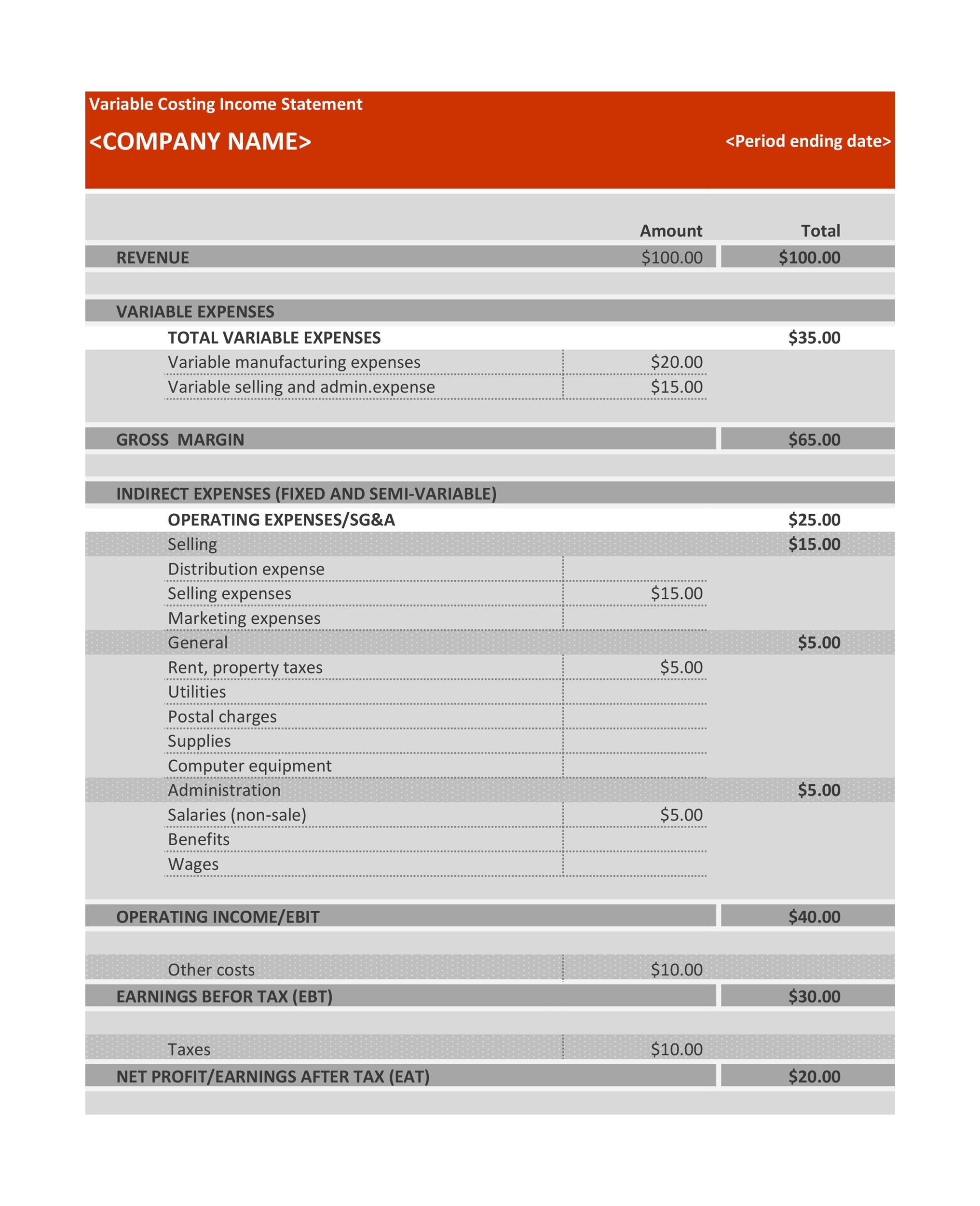

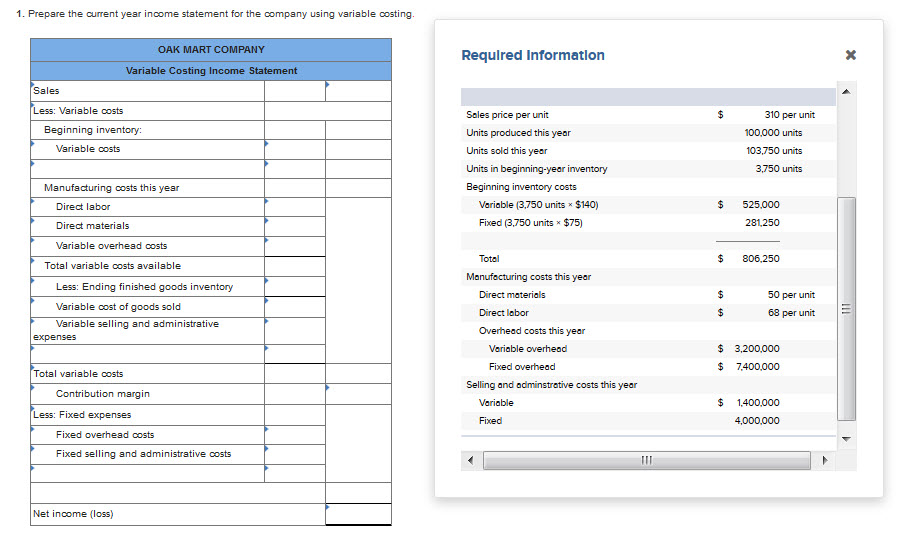

Variable costing income statement has the following line items:

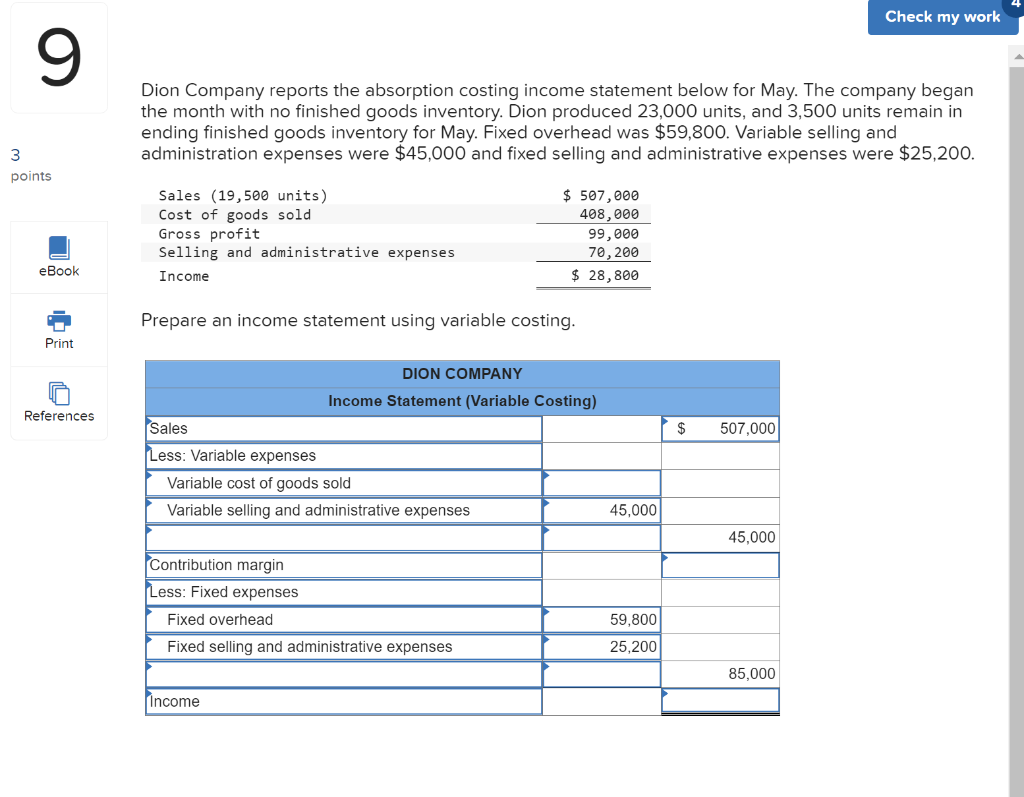

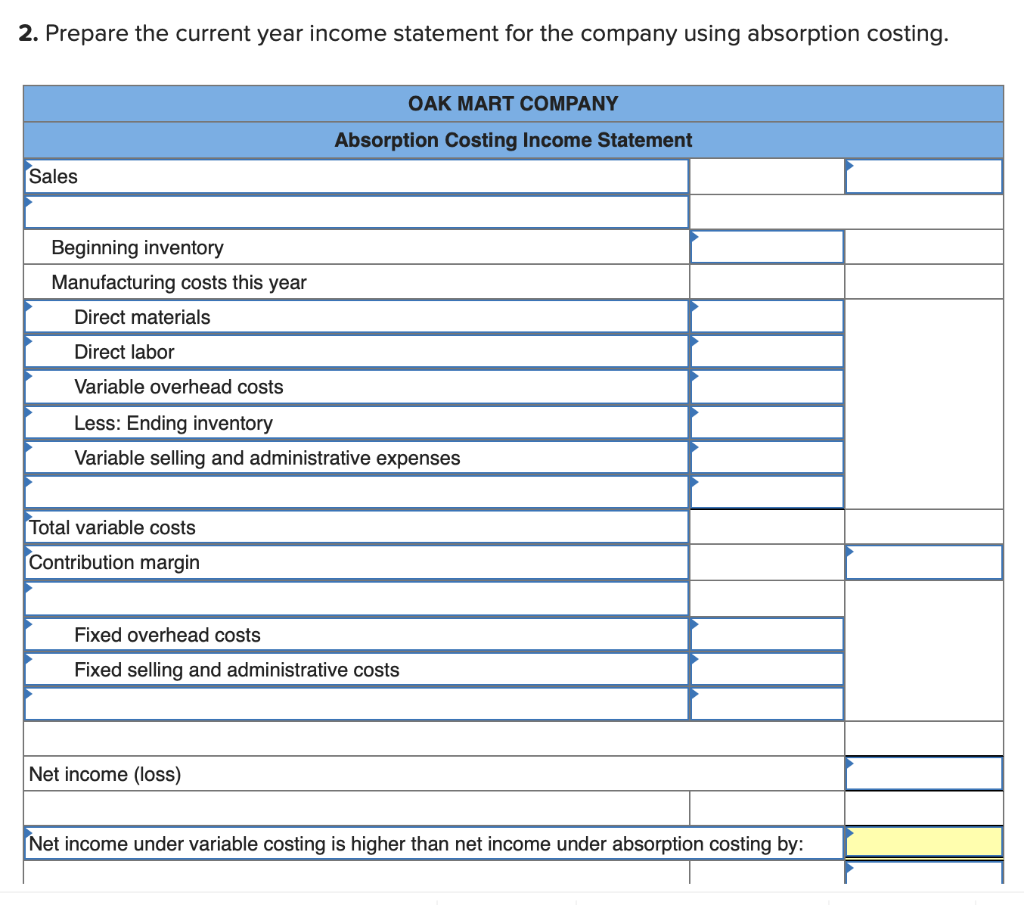

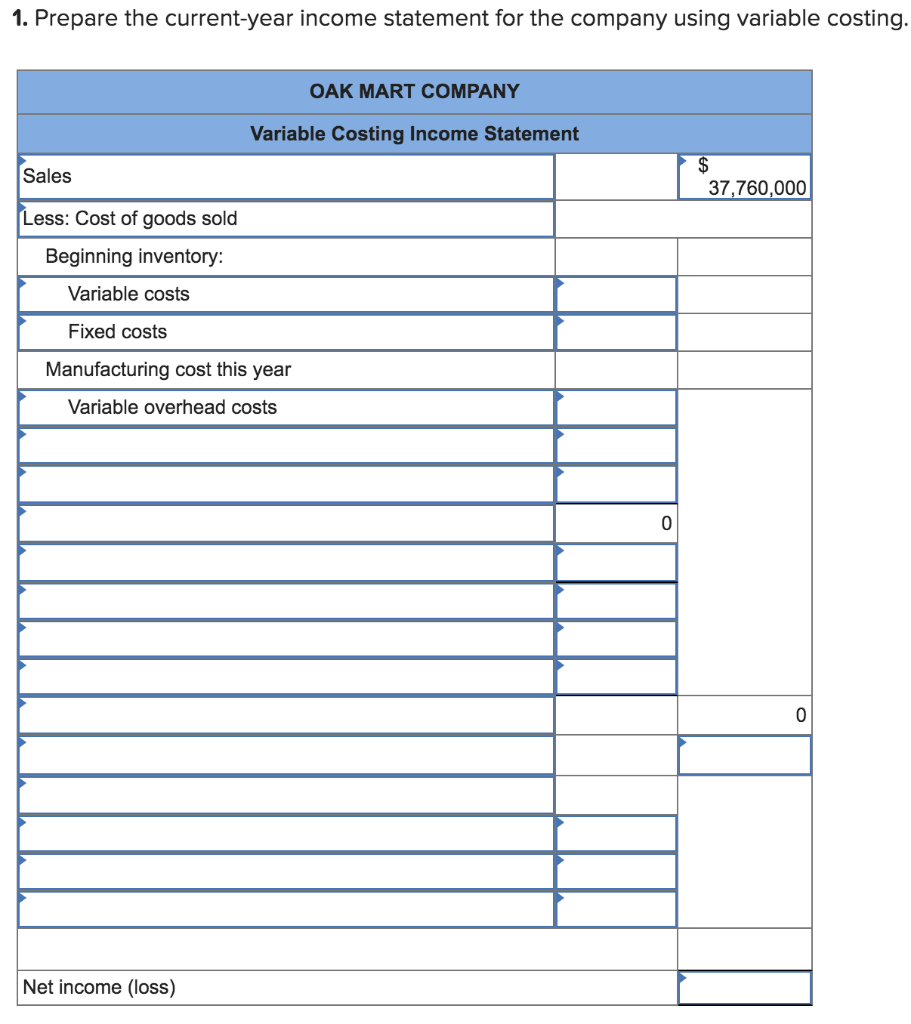

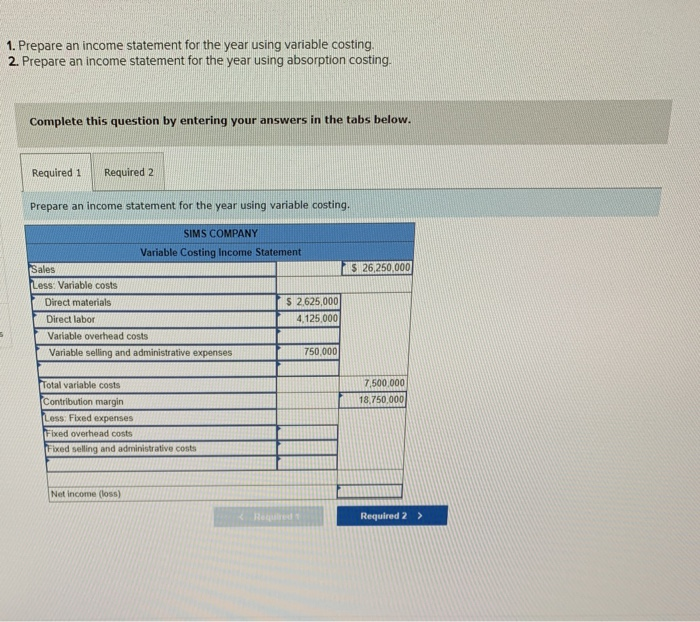

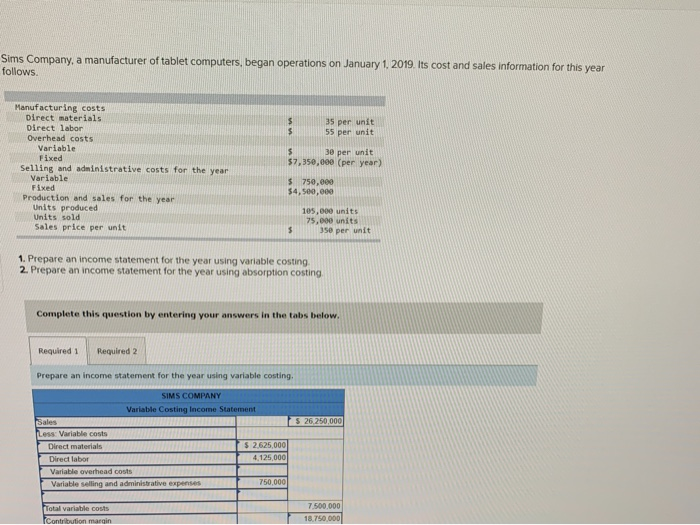

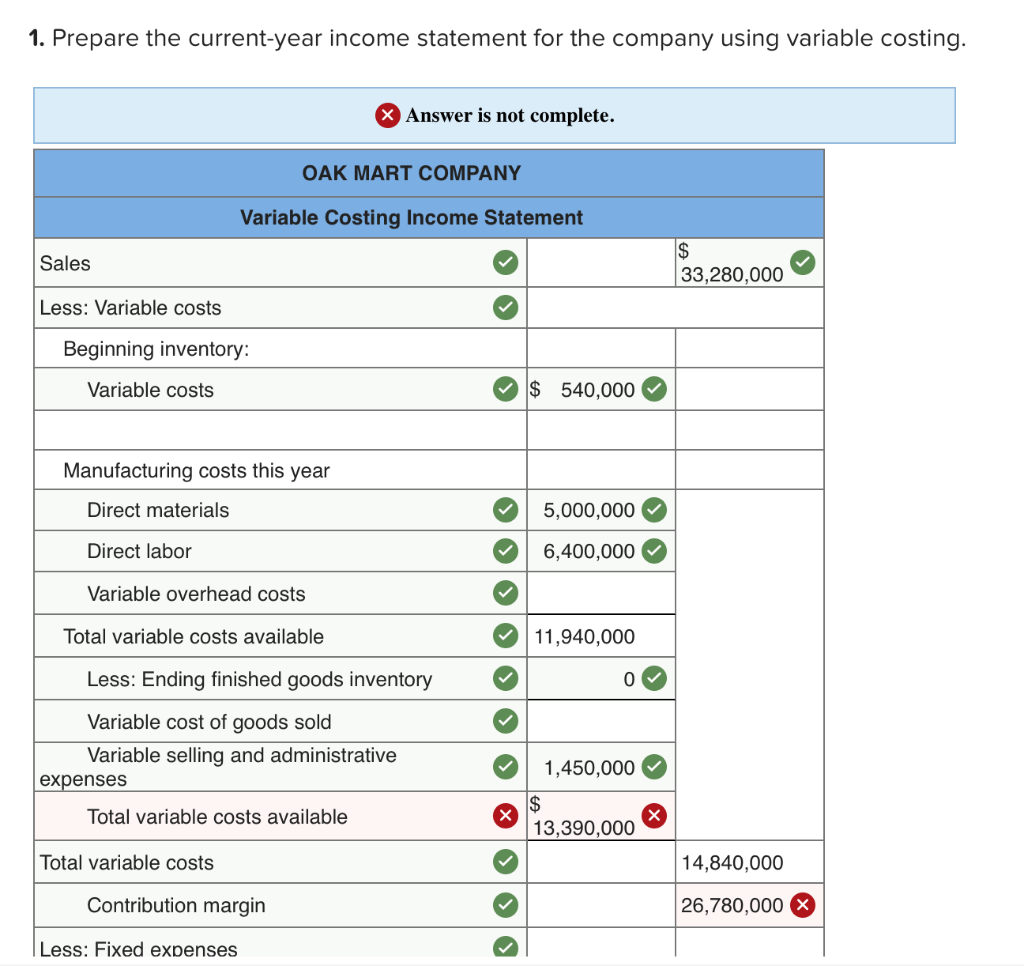

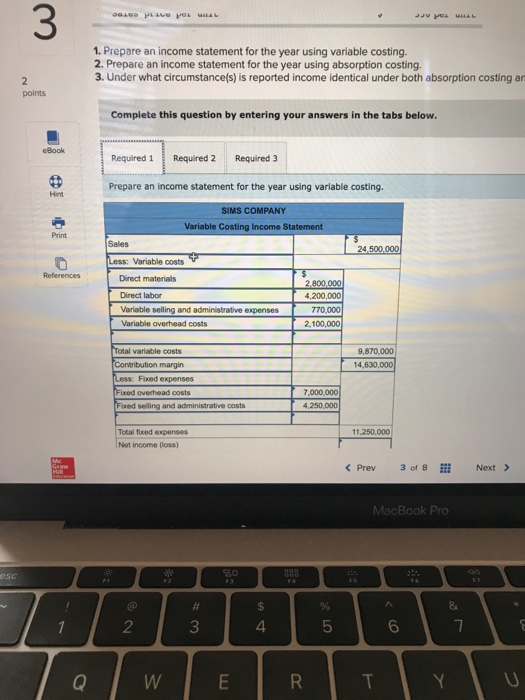

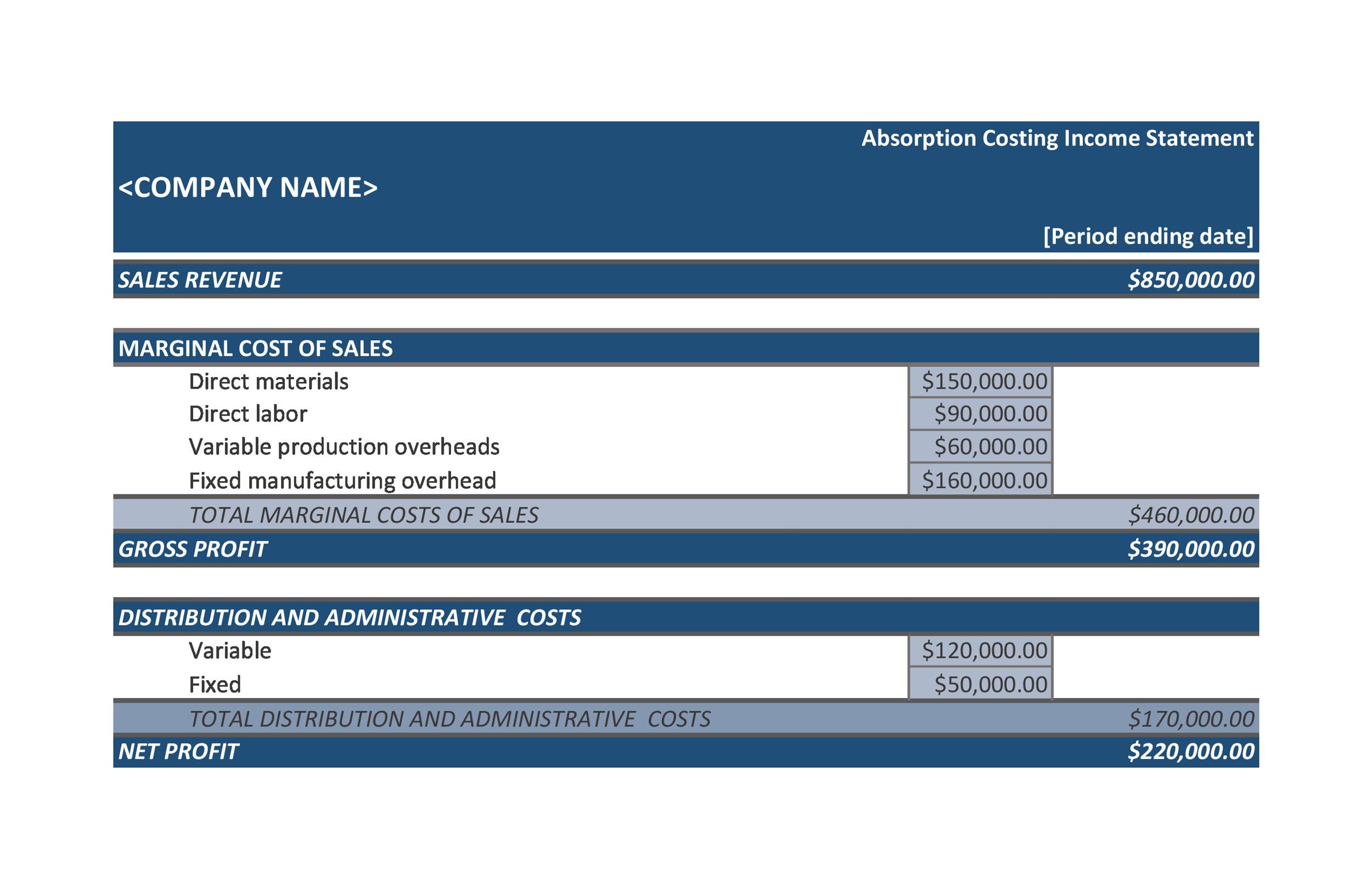

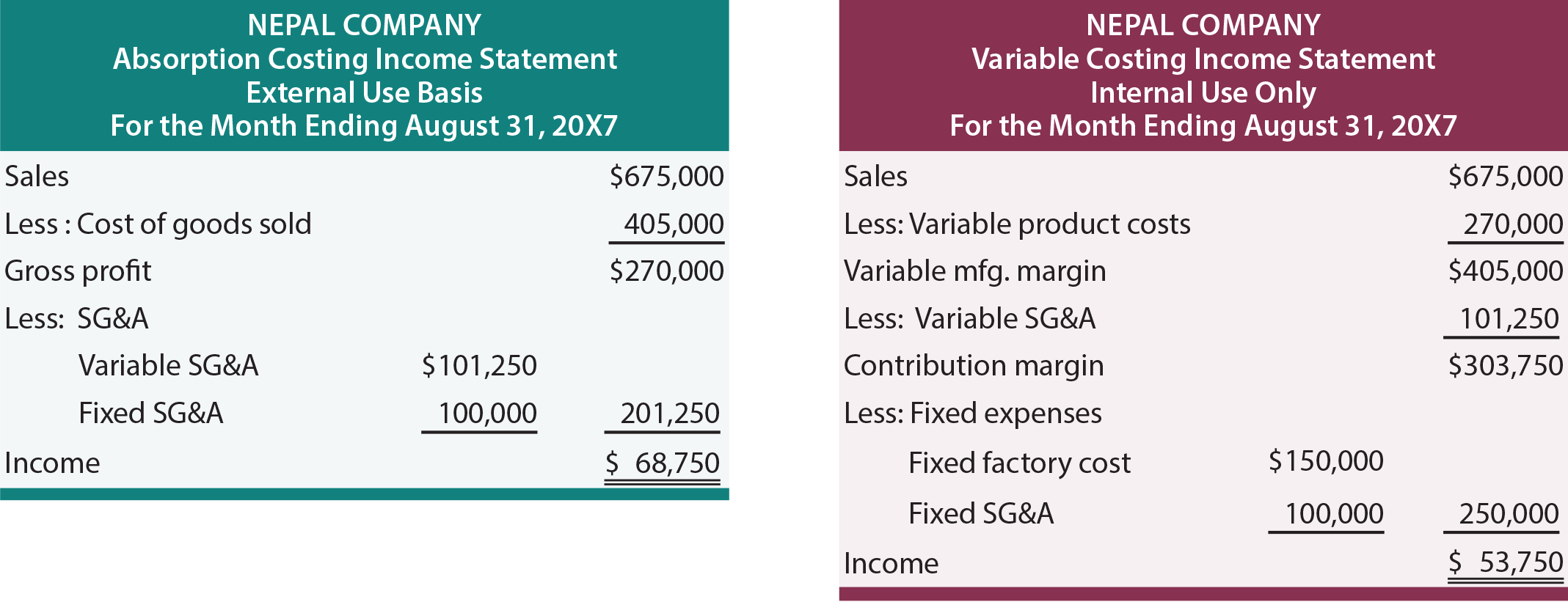

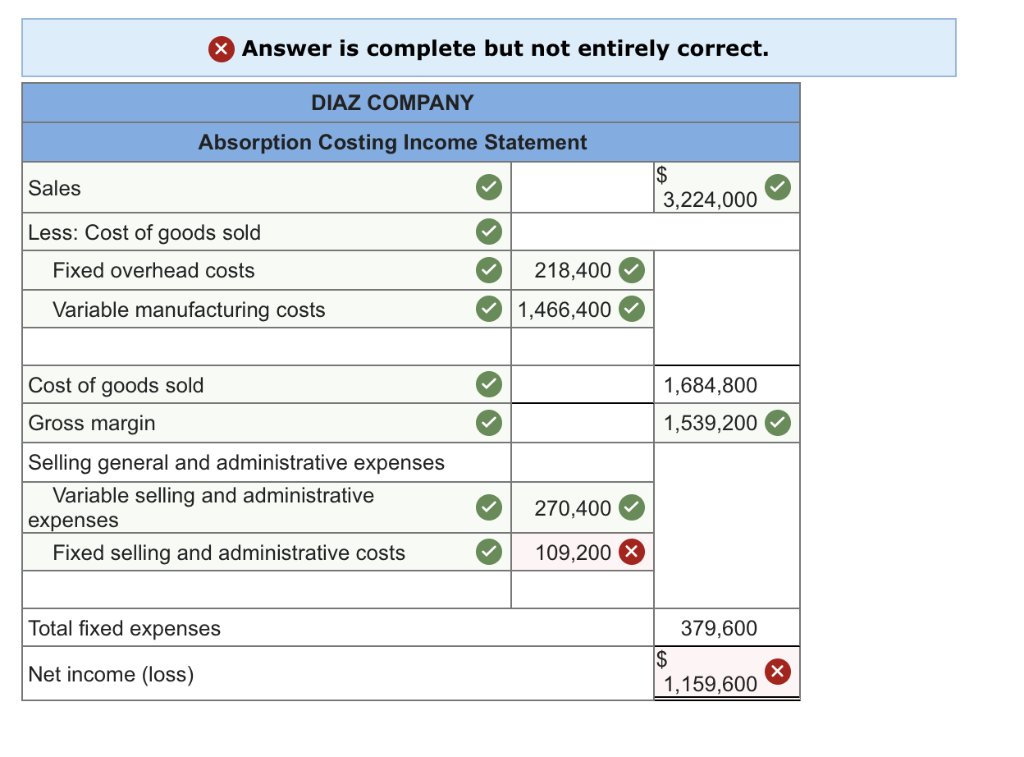

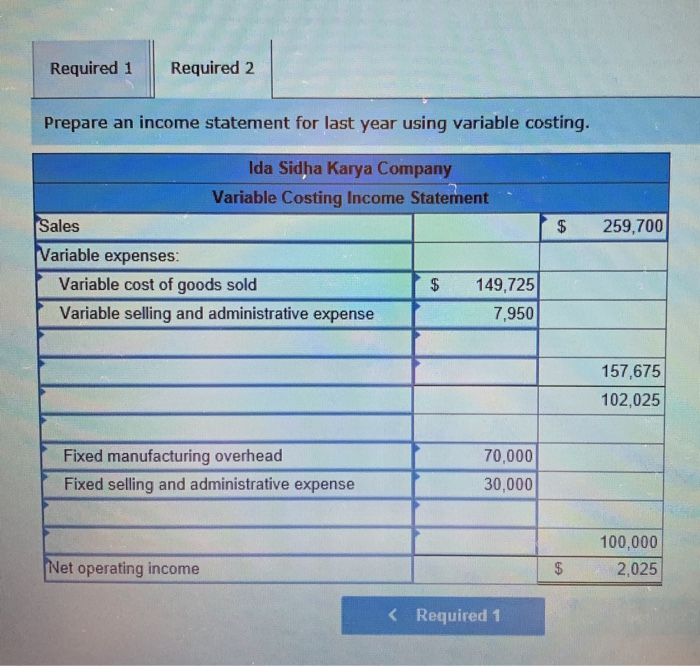

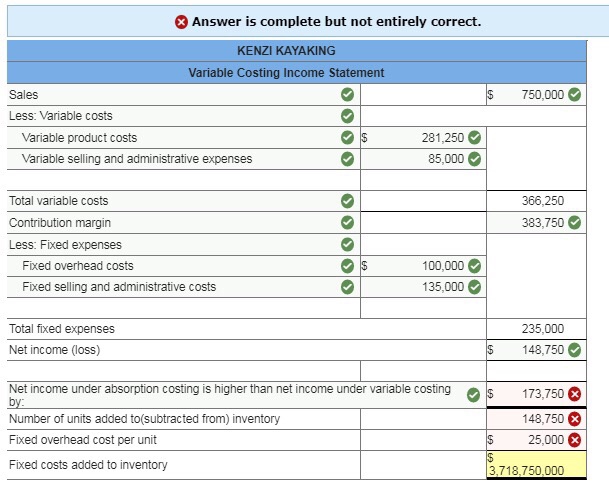

Income statement using variable costing. On a variable costing income statement, all variable expenses are deducted from revenue to determine the contribution margin, from which all fixed. Example of calculating the cost of goods sold for the traditional income statement. Reconcile variable costing and absorption costing net operating incomes and explain.

Here we discuss steps to prepare the variable costing income statement along with. What is a variable costing income statement? Prepare income statements using both variable and absorption costing.

Variable production costs include direct materials, direct labor and variable manufacturing. Comparative variable costing income statements : For now, assume that nepal.

Variable costing statements provide data that are immediately useful for cvp analysis because fixed and variable overhead are separate items. Variable costing provides managers with the information necessary to prepare a contribution margin income statement, which leads to more effective cost. Using the cost per unit that we calculated previously, we can calculate the cost of goods sold.

Each has its own benefits. In this statement, companies only deduct variable expenses for a specific. Under absorption costing, the amount of fixed overhead in each unit is $1.20 $ 1.20 ( $12, 000/10, 000 $ 12, 000 / 10, 000 units);

Ifc is a manufacturer of phone cases. Variable cost of goods sold. Variable costing statements provide data that are immediately useful for cvp analysis because fixed and variable overhead are separate items.

A variable costing income statement is a type of income statement in which you subtract variable expenses from total sales revenue to arrive at a separate. A variable costing income statement is a report prepared under the variable costing method. Examples variable costing vs absorption costing recommended articles:

Variable costing does not include. Example of variable costing. Variable costing will only be a factor for companies that expense costs of goods sold (cogs) on their income statement.

A variable costing income statement is one in which all variable expenses are deducted from revenue to arrive at. An example of an income statement using variable and absorption costing variable costing is a managerial accounting cost concept.