Divine Tips About Incometaxefiling Form 26as

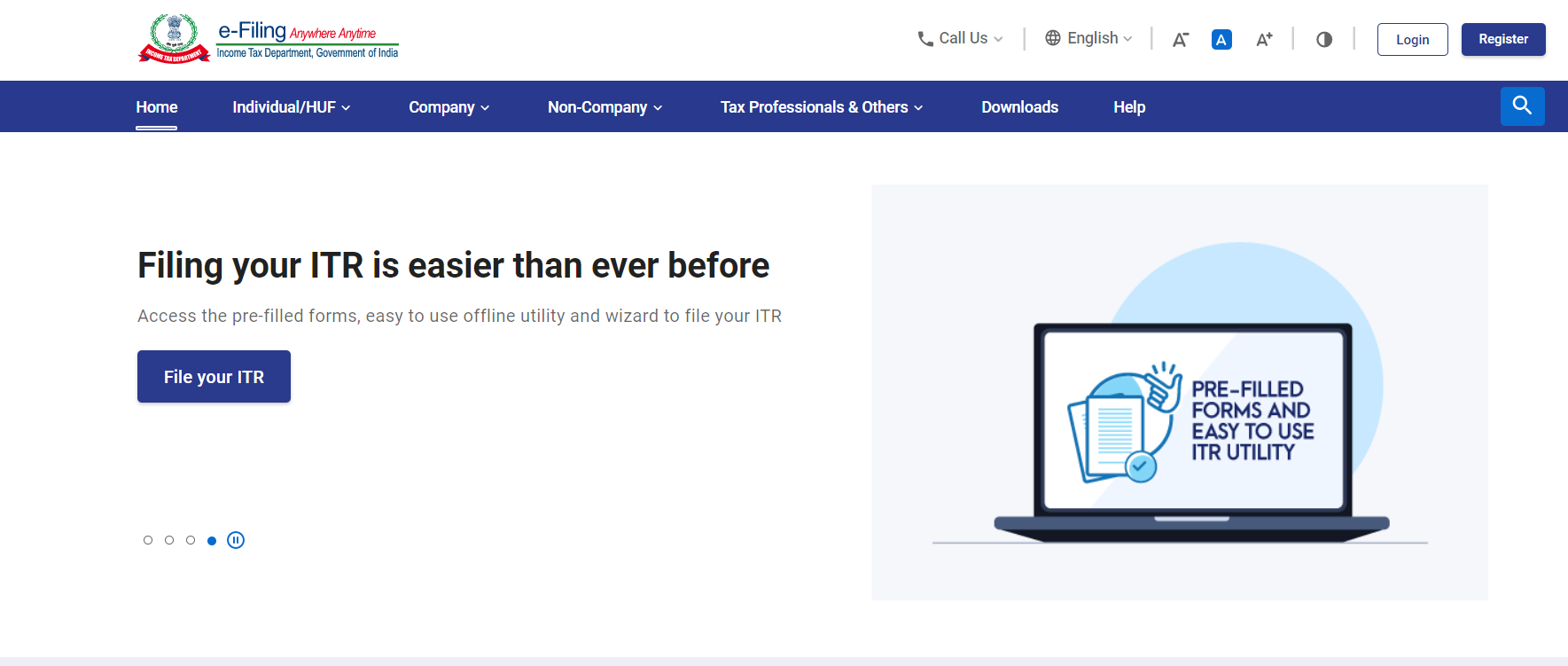

Now click on start filing and select type of.

Incometaxefiling form 26as. It is one of the important. Income tax return: Here is how to get form 26as:

The form 26as download can be done via the traces website. Form 26as, or tax credit statement, is one of the most important documents when filing taxes. 26as full form is annual information statement (ais).

Meet srishti, an indian citizen currently residing and working in the usa.recently, she checked her form 26as online and discovered a tds entry of inr. You will land on the dashboard of the new income tax portal. You can now view and download form 26as.

The website provides access to the. Click on the link view tax credit (form 26as) at the bottom of the. You can download and view form 26as from your income tax filing account on (incometaxindiaefiling.gov.in) and traces website.form 26as (tax.

Make sure to note any income that is reflected in the form 26as, but does not match the income that you have received or vice versa. Click on ‘login‘ and enter your user id (pan or aadhar number). Read the disclaimer, click 'confirm' and the user.

Follow the steps given below to download form 26as. You are accessing traces from outside india and therefore, you will require a user id with password. What is form 26as?

Alternatively, you can use your login credentials. Form 26as is a consolidated tax credit statement that contains details of all the taxes deducted or collected on behalf of a taxpayer by. Continue to the next step.

Form 26as means a tax credit statement and is an important document for taxpayers. Form 26as is a statement that provides details of any amount deducted as tds or tcs from various sources of income of a taxpayer.