Breathtaking Tips About Investment In Cash Flow Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

The others are the income statement and.

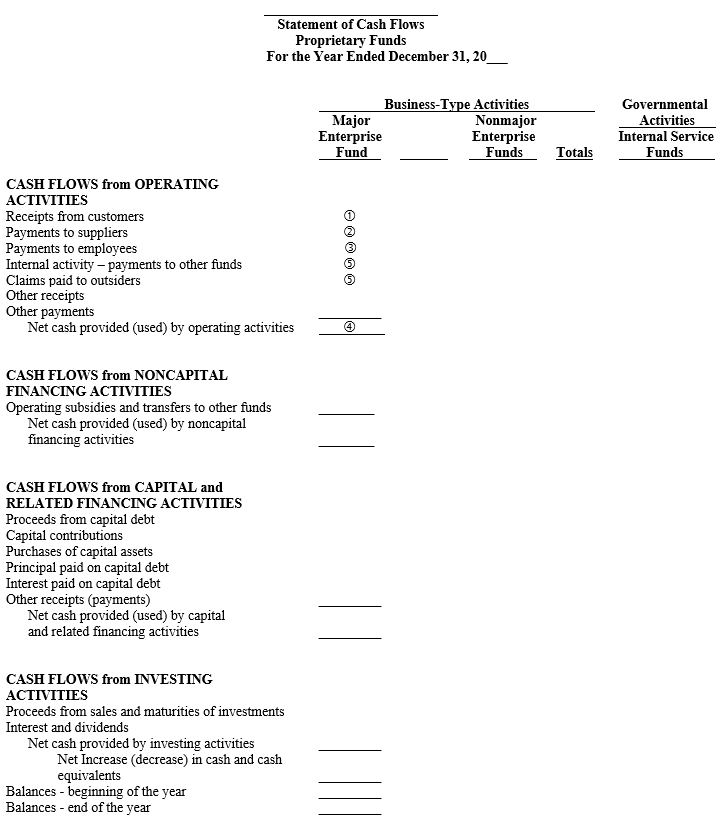

Investment in cash flow statement. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities. The largest line items in the cash flow from financing. The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through capital markets.

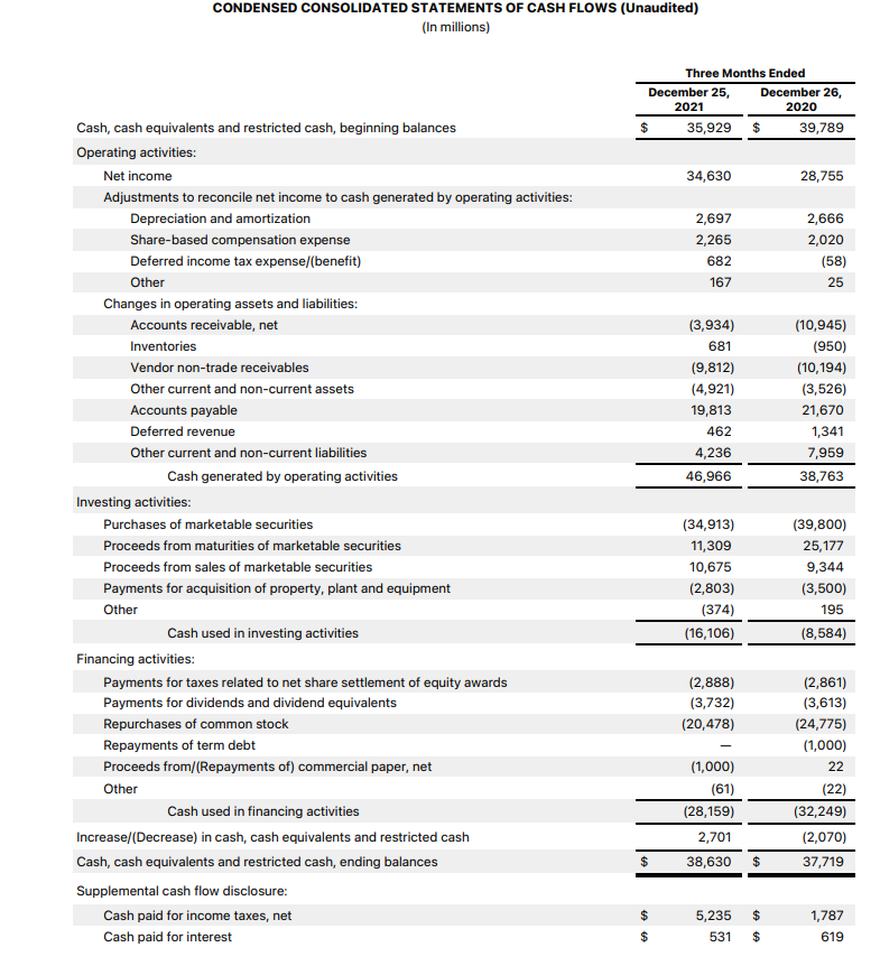

Investing activities includes cash flows from the sale of fixed asset, purchase of a fixed asset, sale and purchase of investment of business in shares or properties, etc. Written by tim vipond what is cash flow from investing activities? Thus, the net cash flow in the cash flow statement covering that period should also equal $40,000.

Even though the cash flow from investing activities offers a clear picture of a company’s investments, it's necessary to consider both the income statement and balance sheet. Department of the treasury’s financial crimes enforcement network (fincen) issued a notice of proposed rulemaking (nprm) to keep criminals and foreign adversaries from exploiting the u.s. Cannabis anchor tenant misty pc ii llc on south main street.

The cash flow statement shows the sources and uses of a company's cash. Elevator access, modern amenities, 3 additional tenants, spacious layouts, exposed beams, hardwood floors, brick walls, natural light. Taking into account the profit and cash generation in 2023, as well.

The company continues to invest in expansion, with a net free cash flow of 12.7 eur per share after including growth capex. This proposed rule, which complements treasury’s other. Open an account 2 interactive brokers low commission rates start at $0 for u.s.

Sap s/4hana cloud for finance. Cash flow from investing activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments during a. The first section of the statement of cash flows is described as cash flows from operating activities or shortened to operating activities.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Washington—today, the u.s. The difference in cash balance between them is $40,000.

The net cash used in investing activities was calculated by subtracting the positive cash flow of $1,395 million from the negative cash flow of $25,431 million. If you’re not sure whether an investment is right for you please seek advice. Financial system and assets through investment advisers.

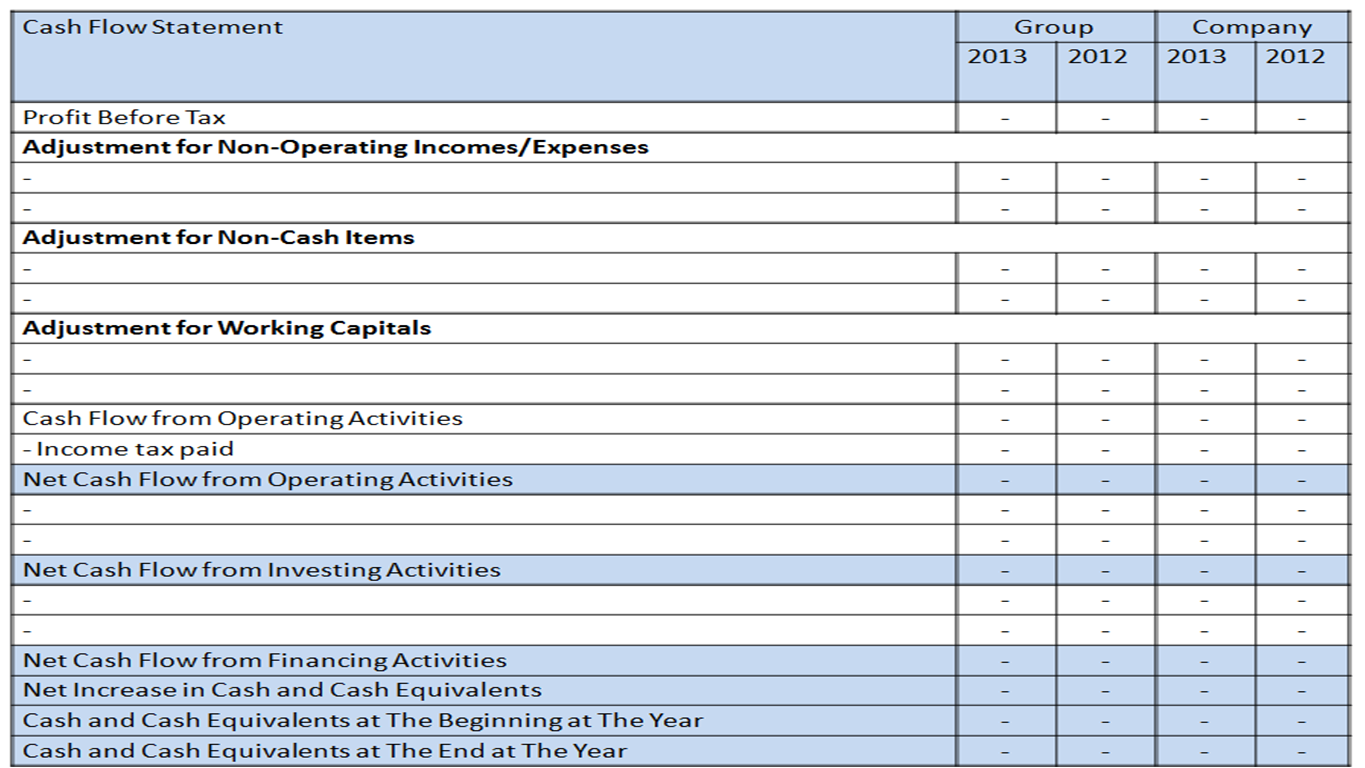

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. In this issue, we highlight four essentials for reading and using the cash flow statement.

Cash flow from investing activities is the second of the three parts of the cash flow statement that shows the cash inflows and outflows from investing in an accounting year; Please suggest list of best practices that should be activated to prepare cash flow statement both direct and indirect methods for the purposes of statutory reporting and managerial reporting and planning. The starting cash balance is necessary when leveraging the.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)