Awe-Inspiring Examples Of Info About Debt Investments On Balance Sheet

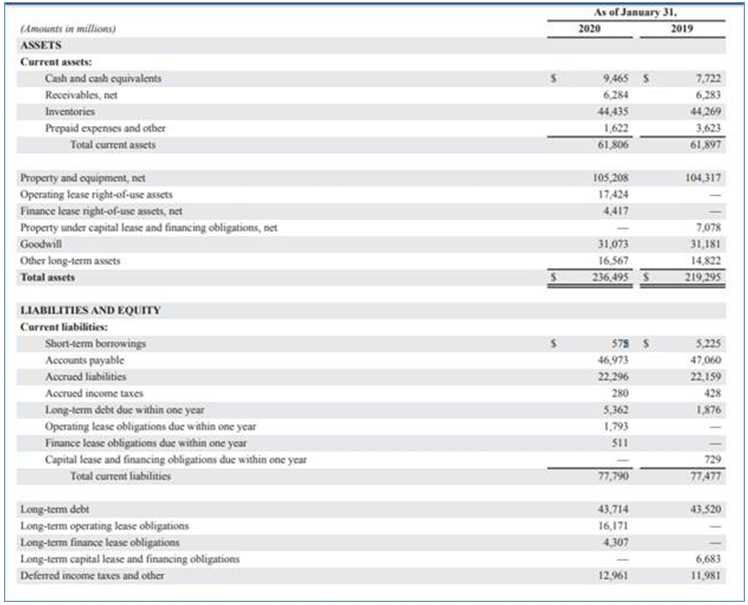

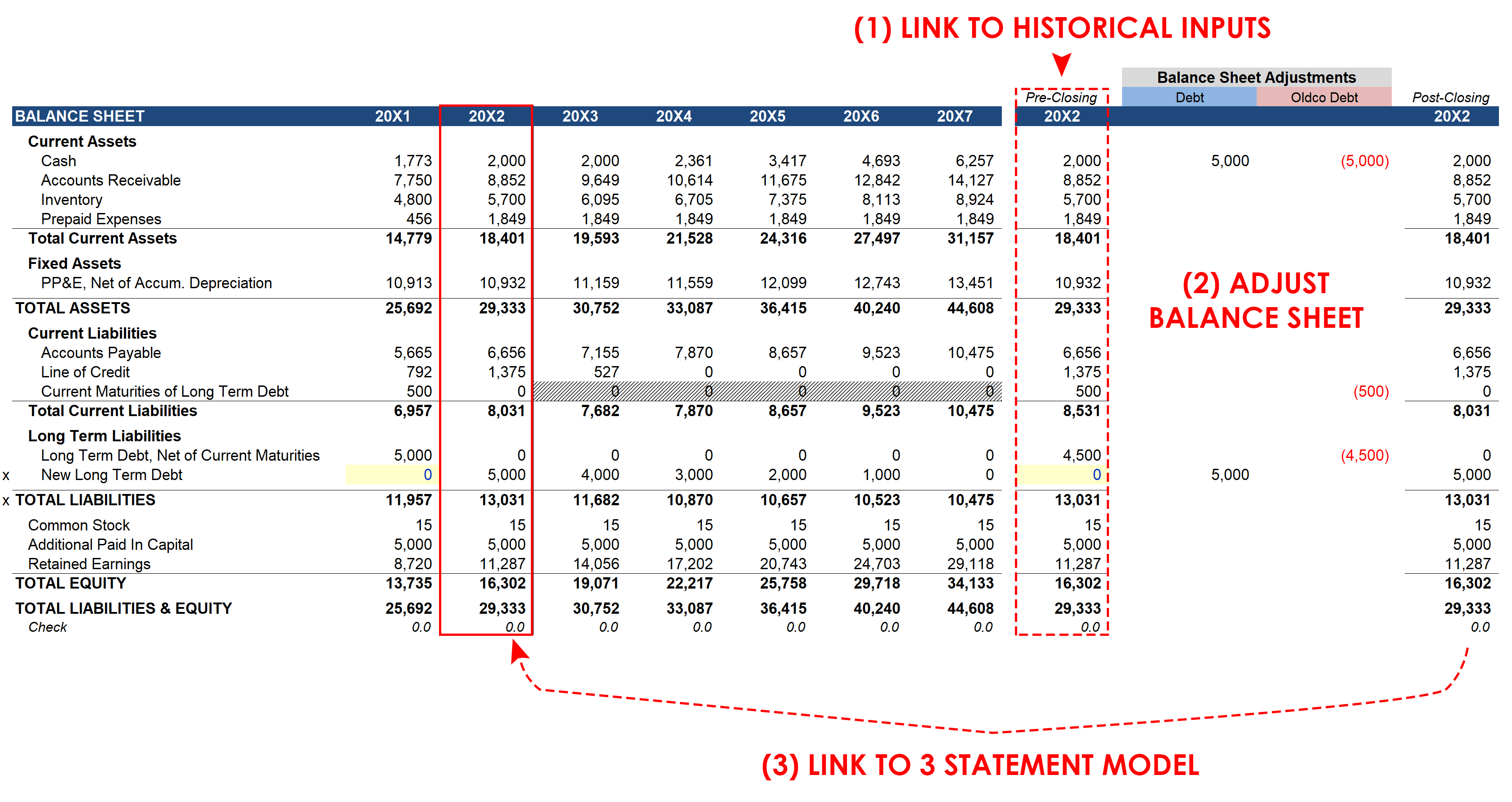

Us loans & investments guide reporting entities that present a classified balance sheet should see fsp 2.3.4 and fsp 9.4.1 for information on the presentation of loans,.

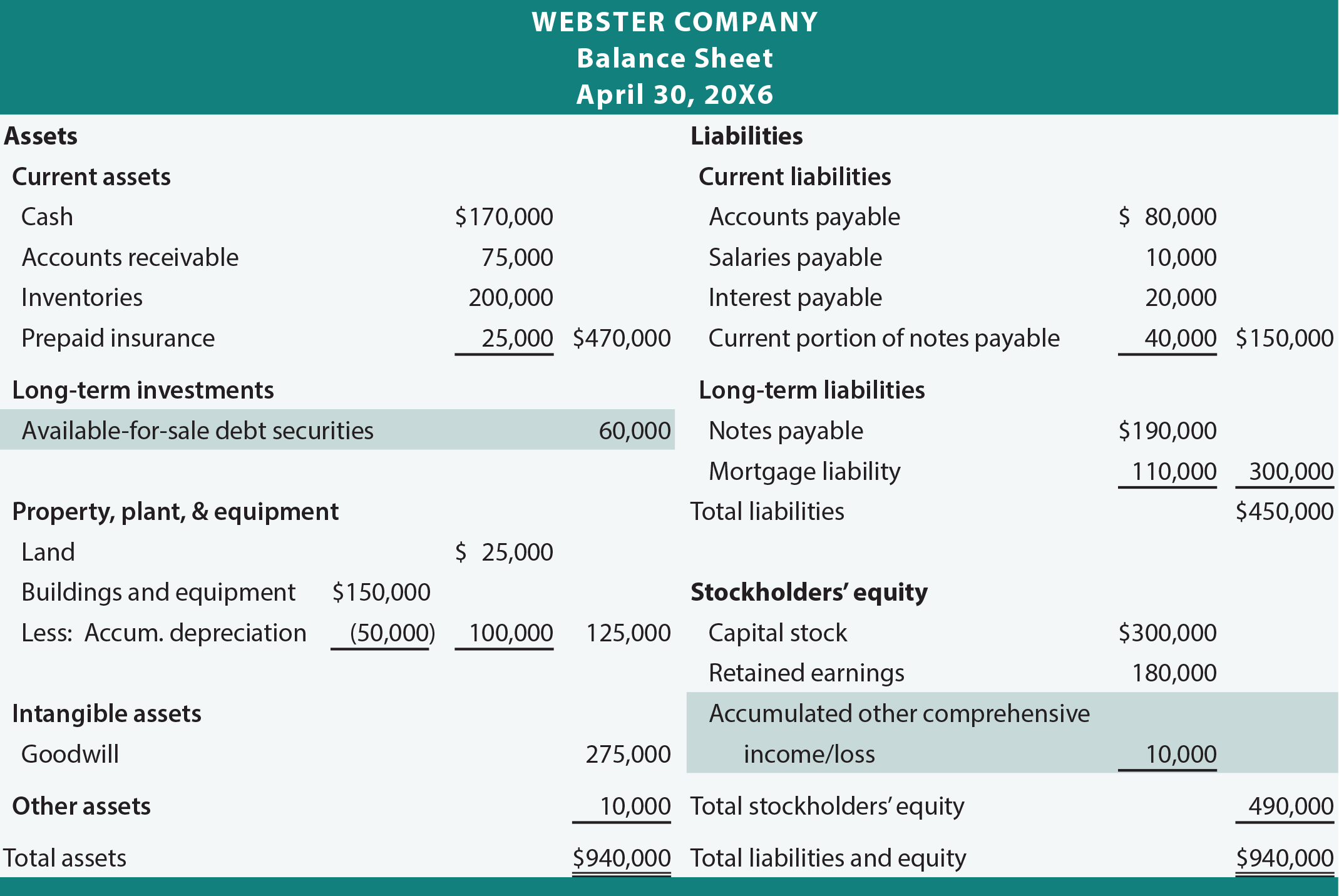

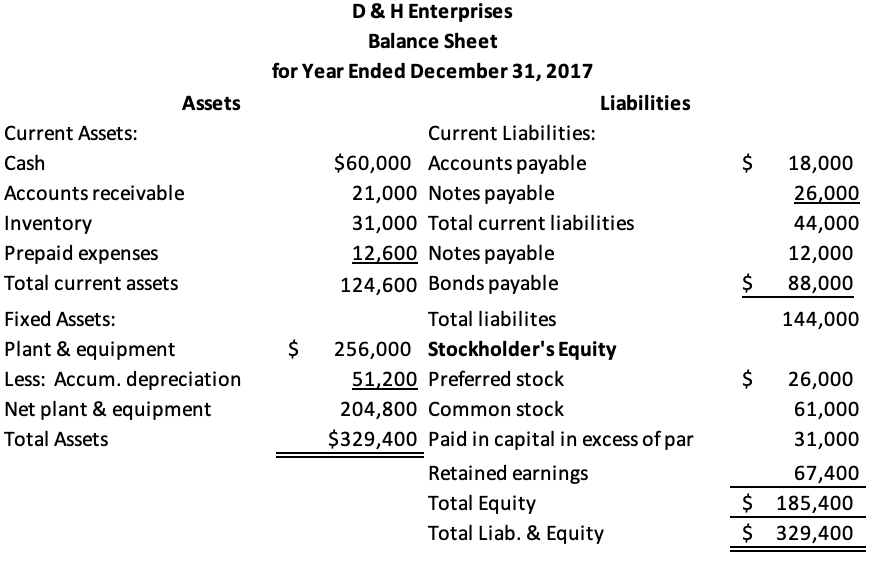

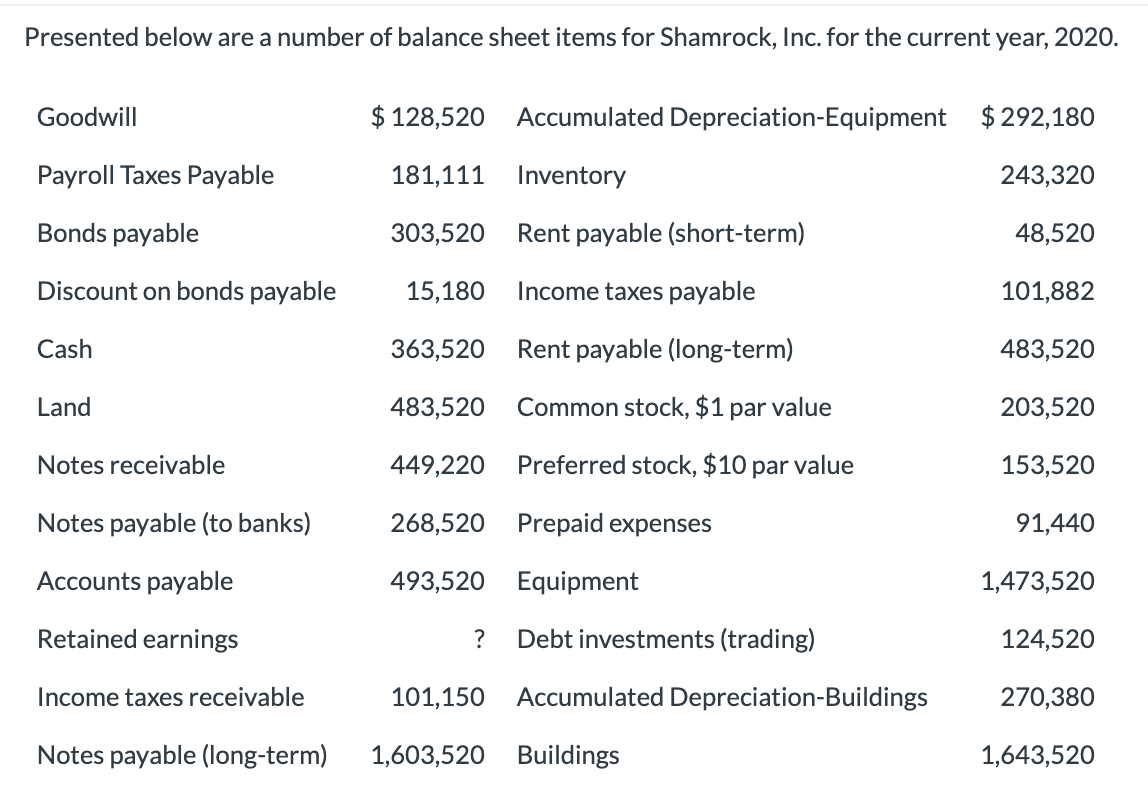

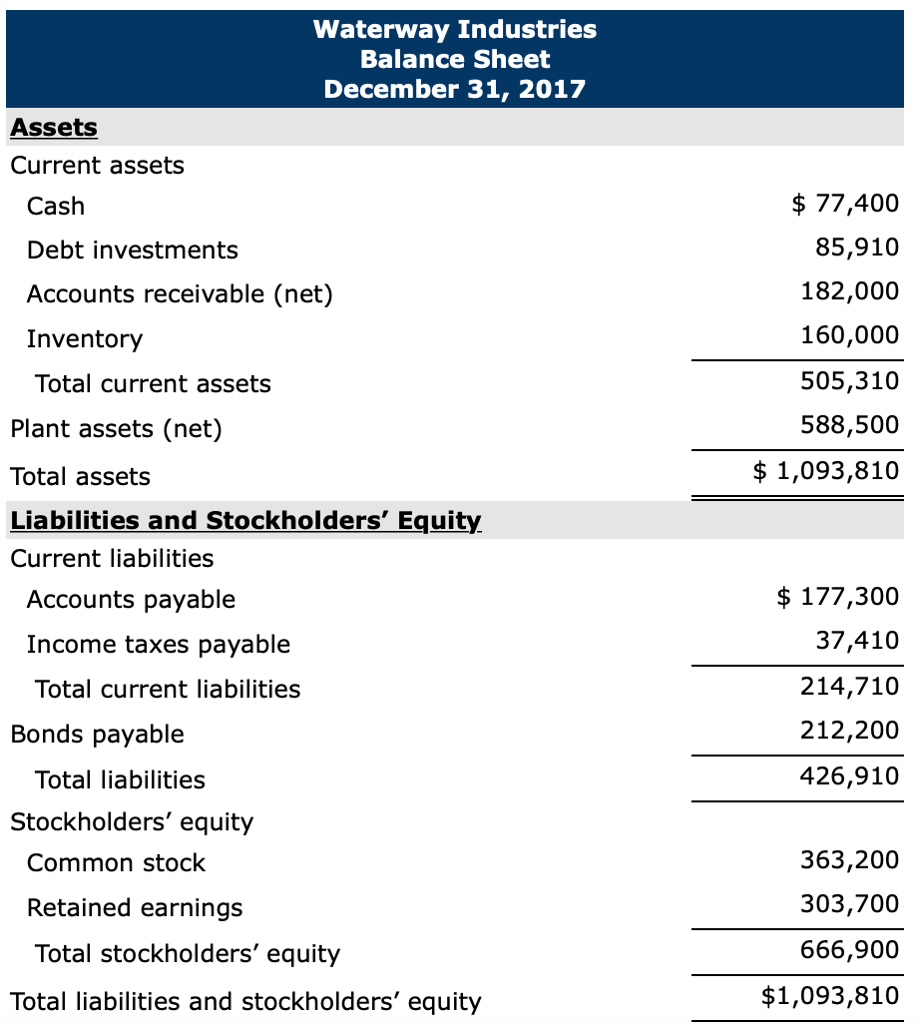

Debt investments on balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. Financial reporting washington national tax audit debt & equity. A company may list its tangible assets on its balance sheet in a few categories, such as:

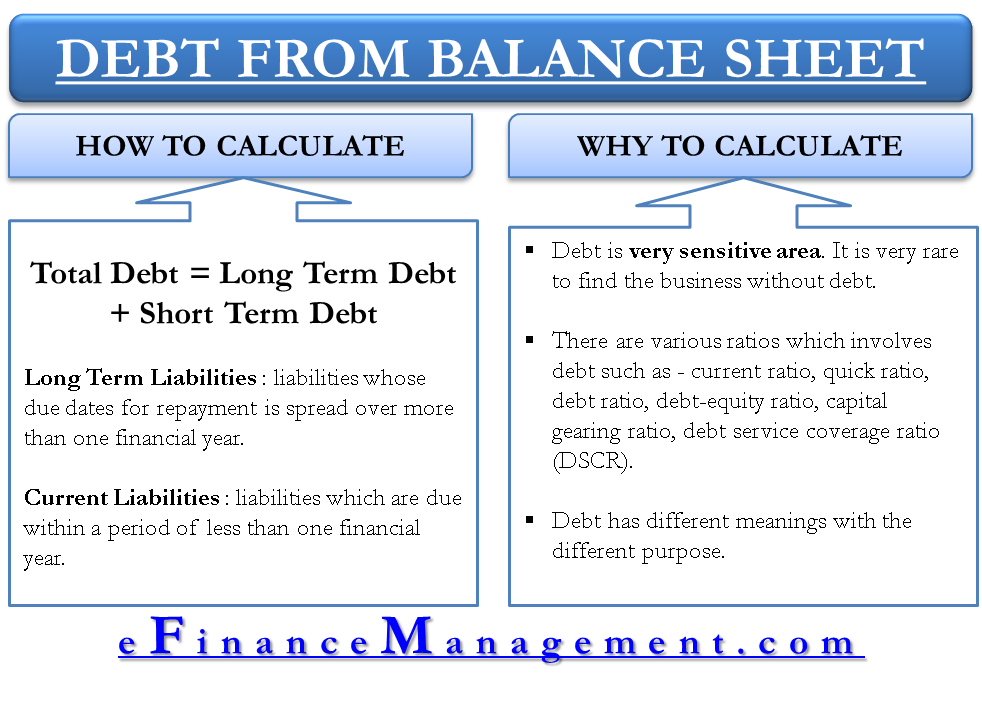

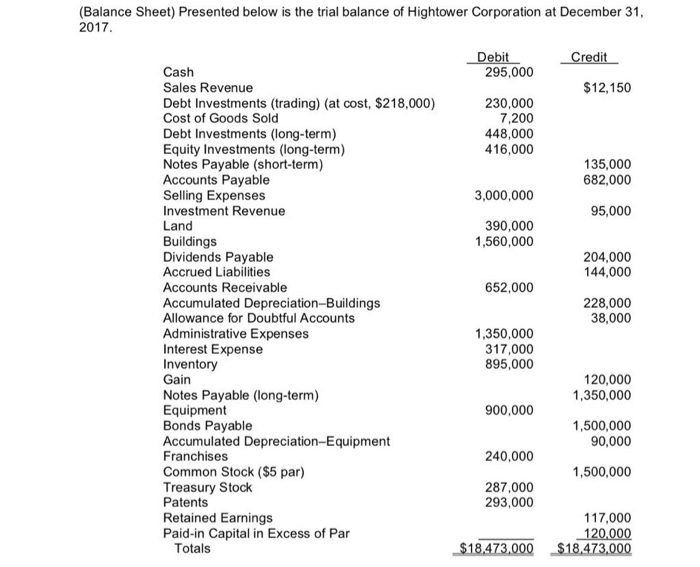

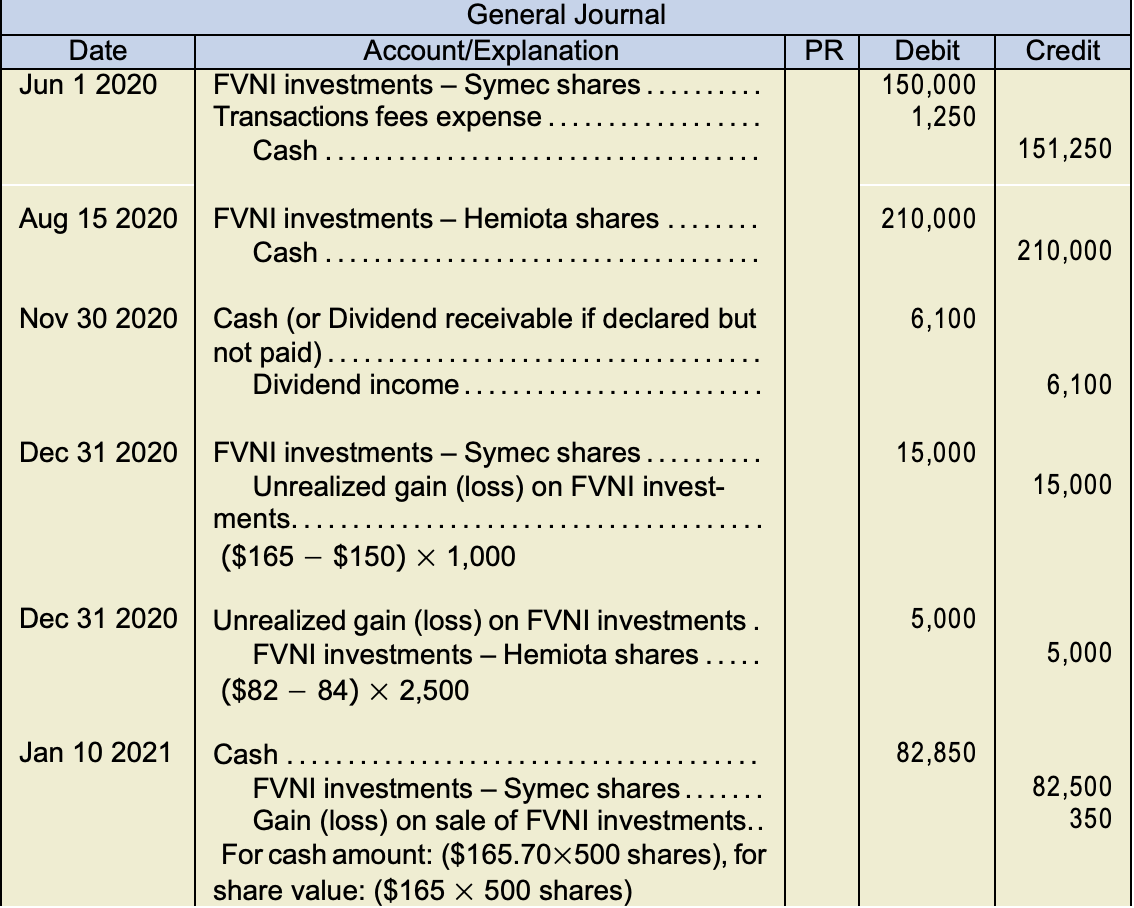

The simplest formula for calculating total debt is as follows: See examples of how to record gains and losses, adjust values, and report on the income statement and the balance sheet. The business can decide to invest in a range of financial assets, including equity securities, debt securities, or.

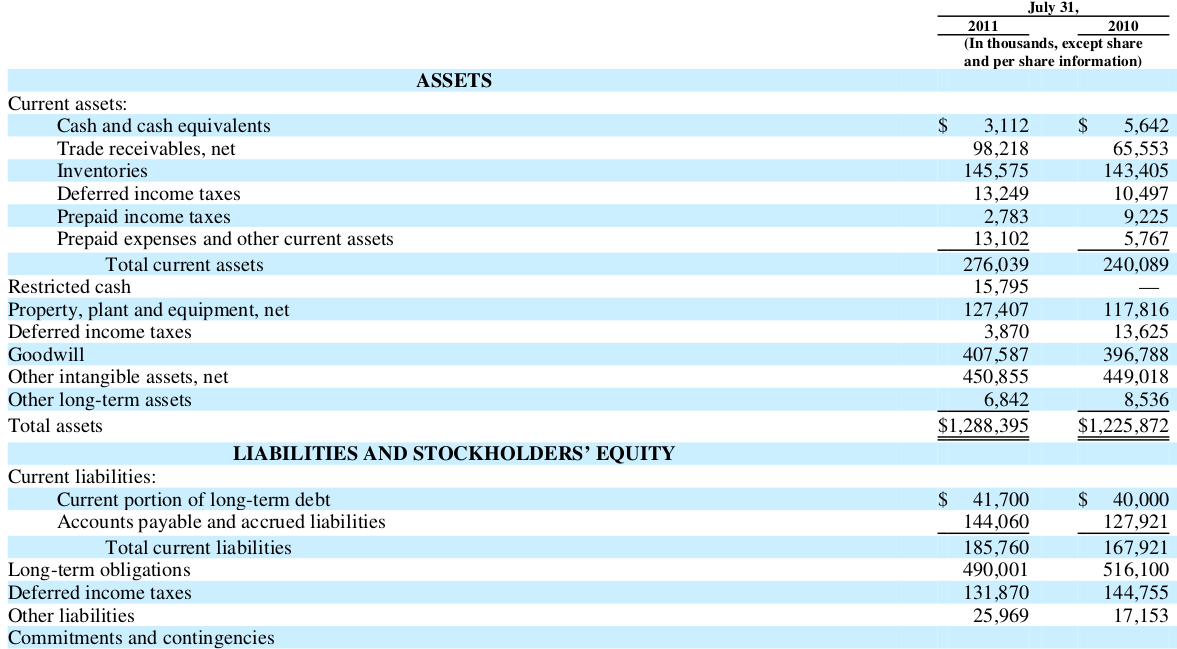

How to calculate total debt from balance sheet? Learn how to classify and value debt and equity investments on the balance sheet using the cost method or the market method. Us loans & investments guide.

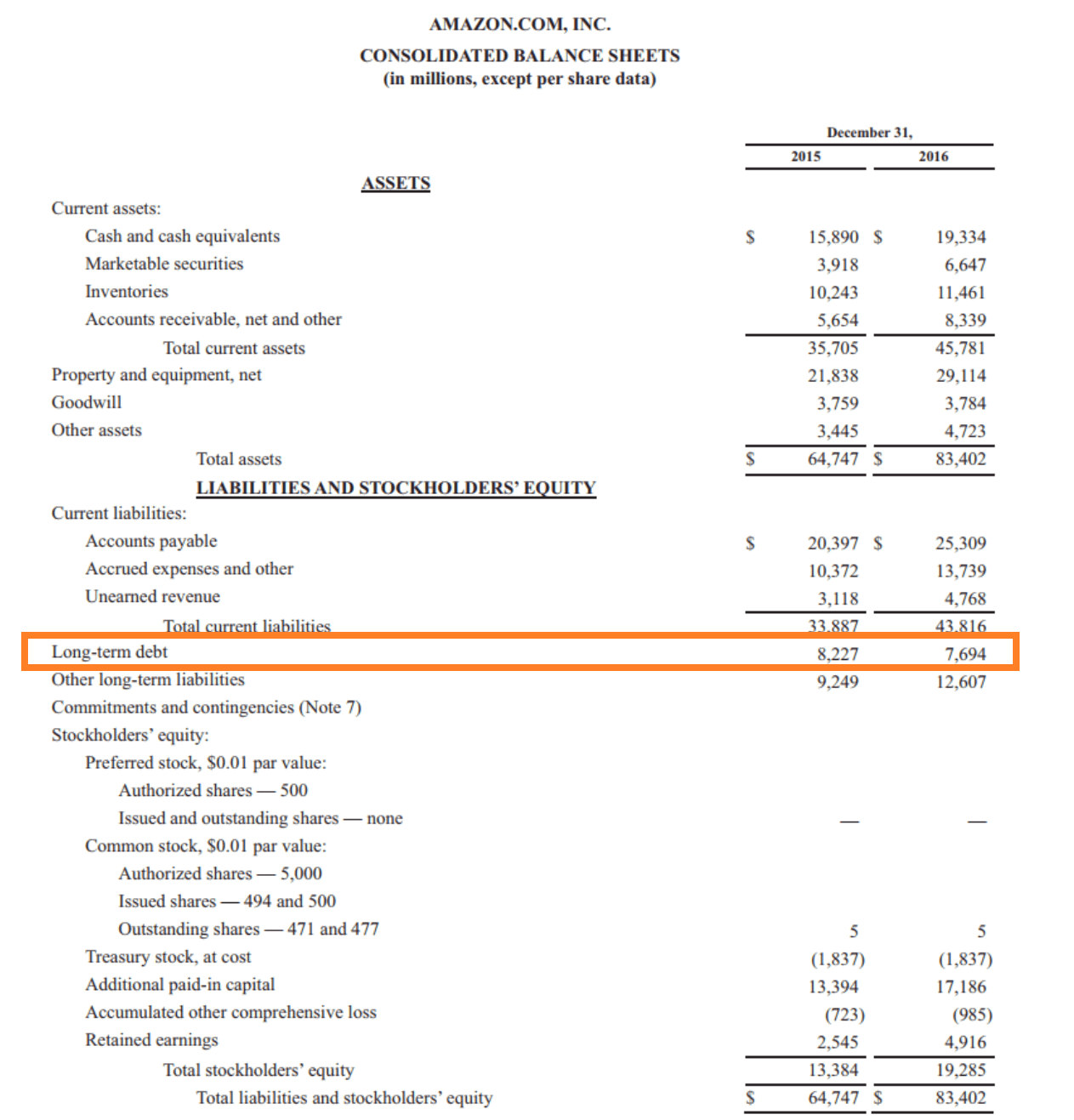

12.3 balance sheet classification — term debt publication date: At the same time, bank reserve balances — another large liability on the central bank’s balance sheet — are $3.54 trillion, according to the latest data. Liabilities may represent debt investments on a balance sheet, leading to a negative balance sheet valuation if shareholder equity does not surpass the debt.

The balance sheet shows the carrying values of a company’s assets, liabilities, and shareholders’ equity at a. In this article, we will delve. What are the 3 components of the balance sheet?

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Total debt = long term. Fundamentals of debt classification.

This article has been updated and was. Us loans & investments guide. Investment is a crucial item in the balance sheet of the business.

Debt security refers to a debt instrument , such as a government bond , corporate bond , certificate of deposit (cd), municipal bond or preferred stock , that can. 31 may 2022 us financial statement presentation guide 12.3 accurate debt classification is. The latest balance sheet data shows that intel had liabilities of us$28.1b due within a year, and liabilities of us$53.6b falling due after that.

When a reporting entity acquires a debt security, it should be classified into one of three categories and. 3.3 classification of debt securities. On the other hand, it had.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)