One Of The Best Info About Statement Of Income And Expenses Template

Reform the income and expense worksheet daily.

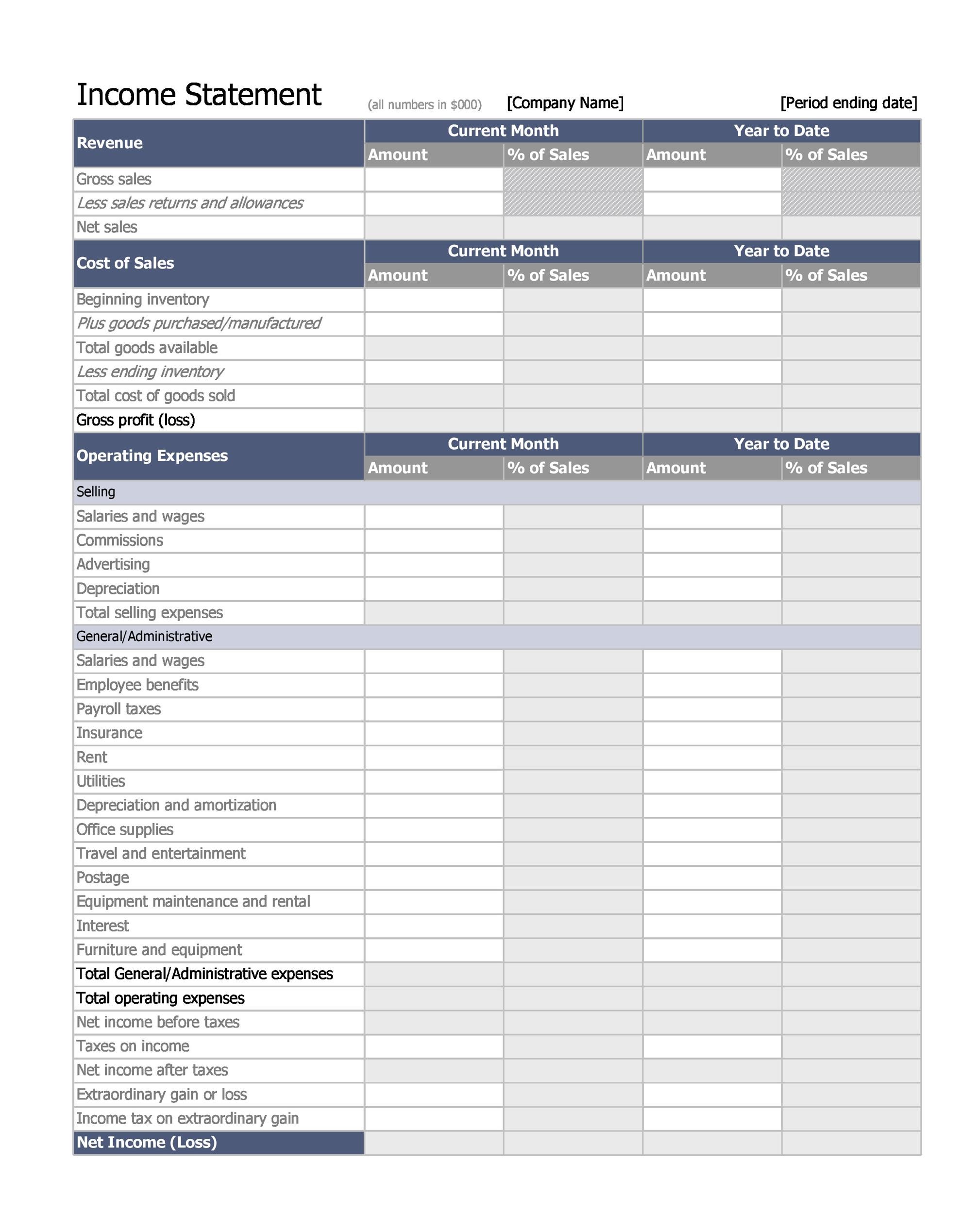

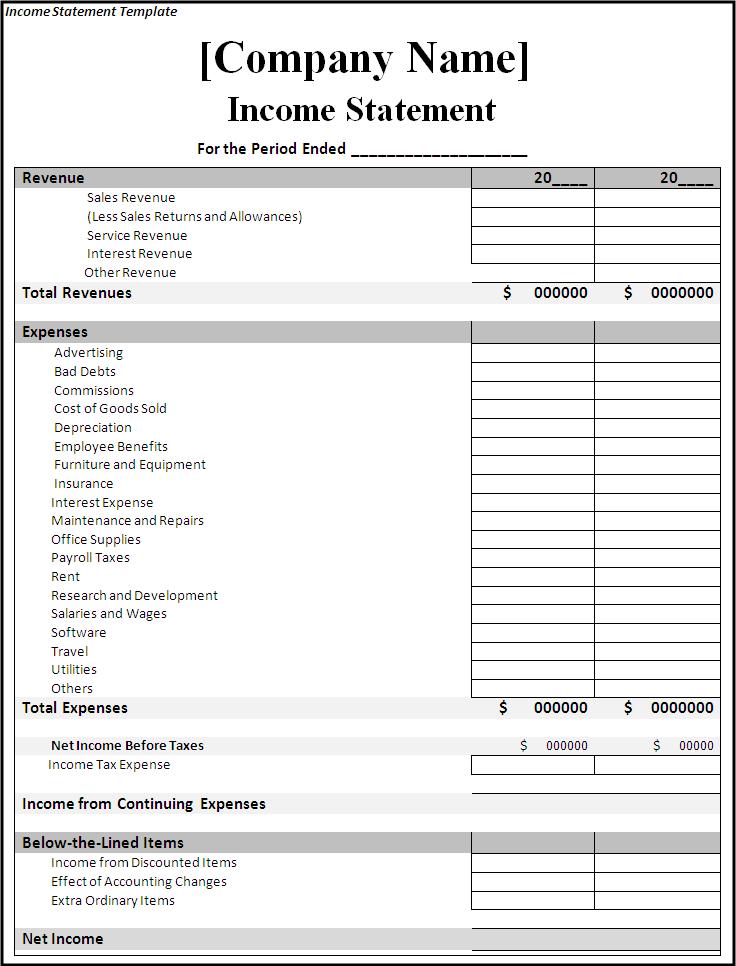

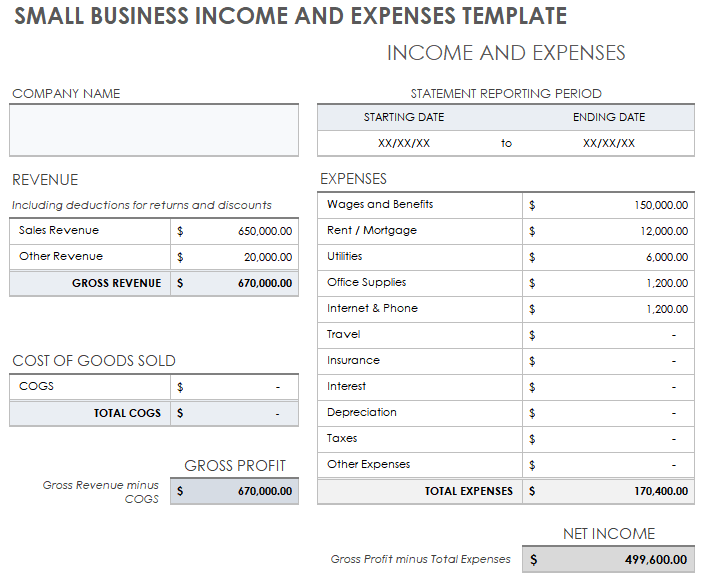

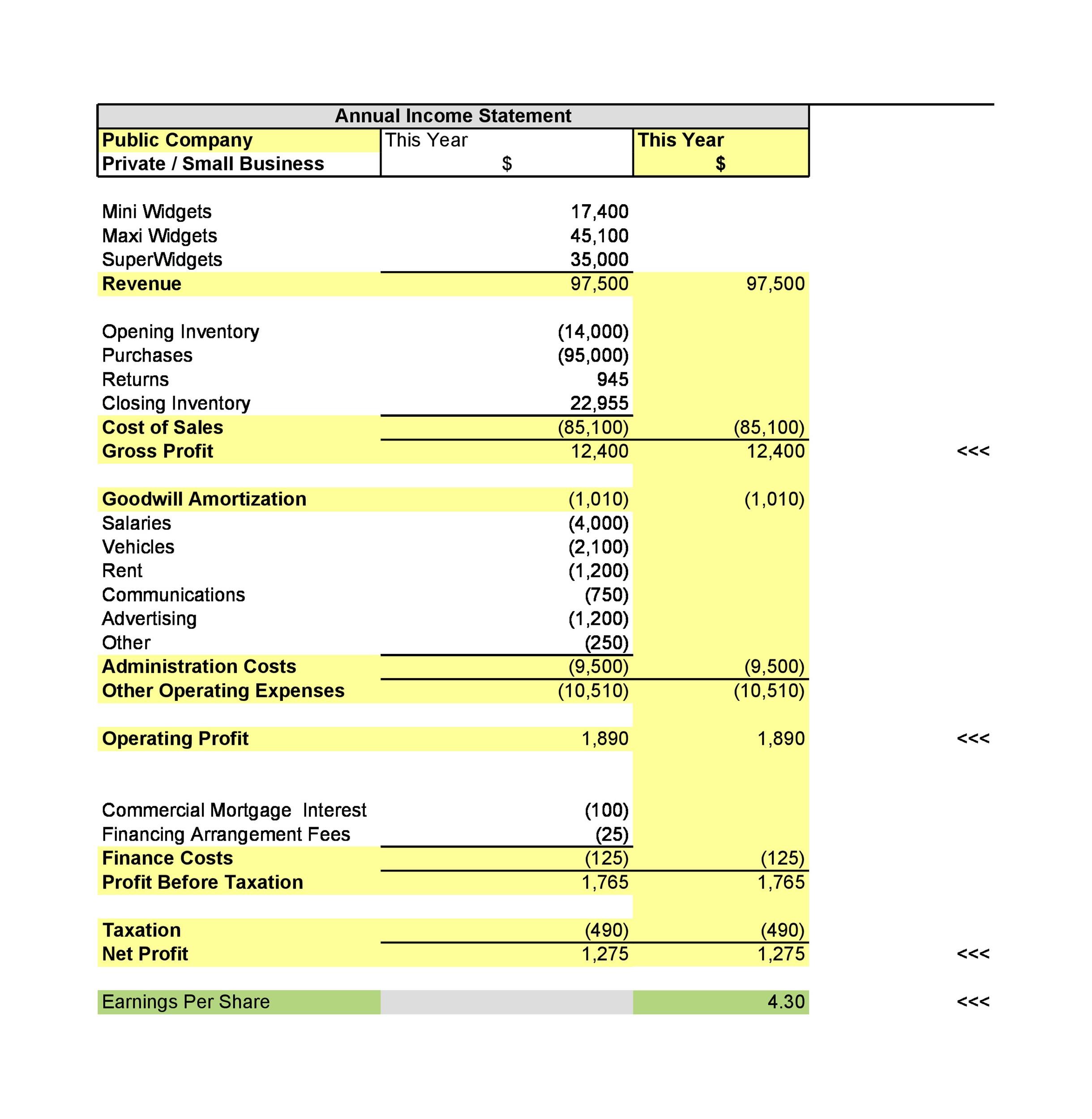

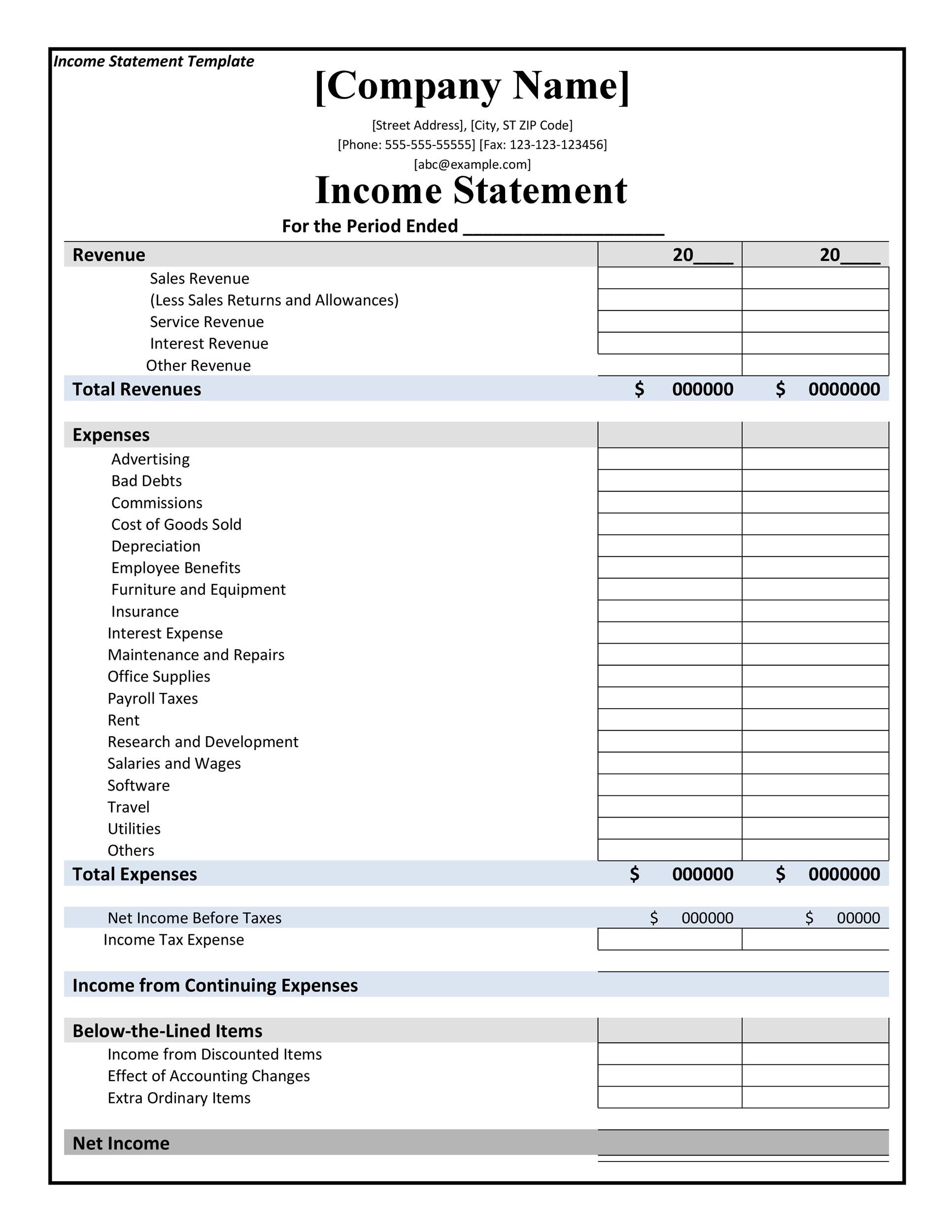

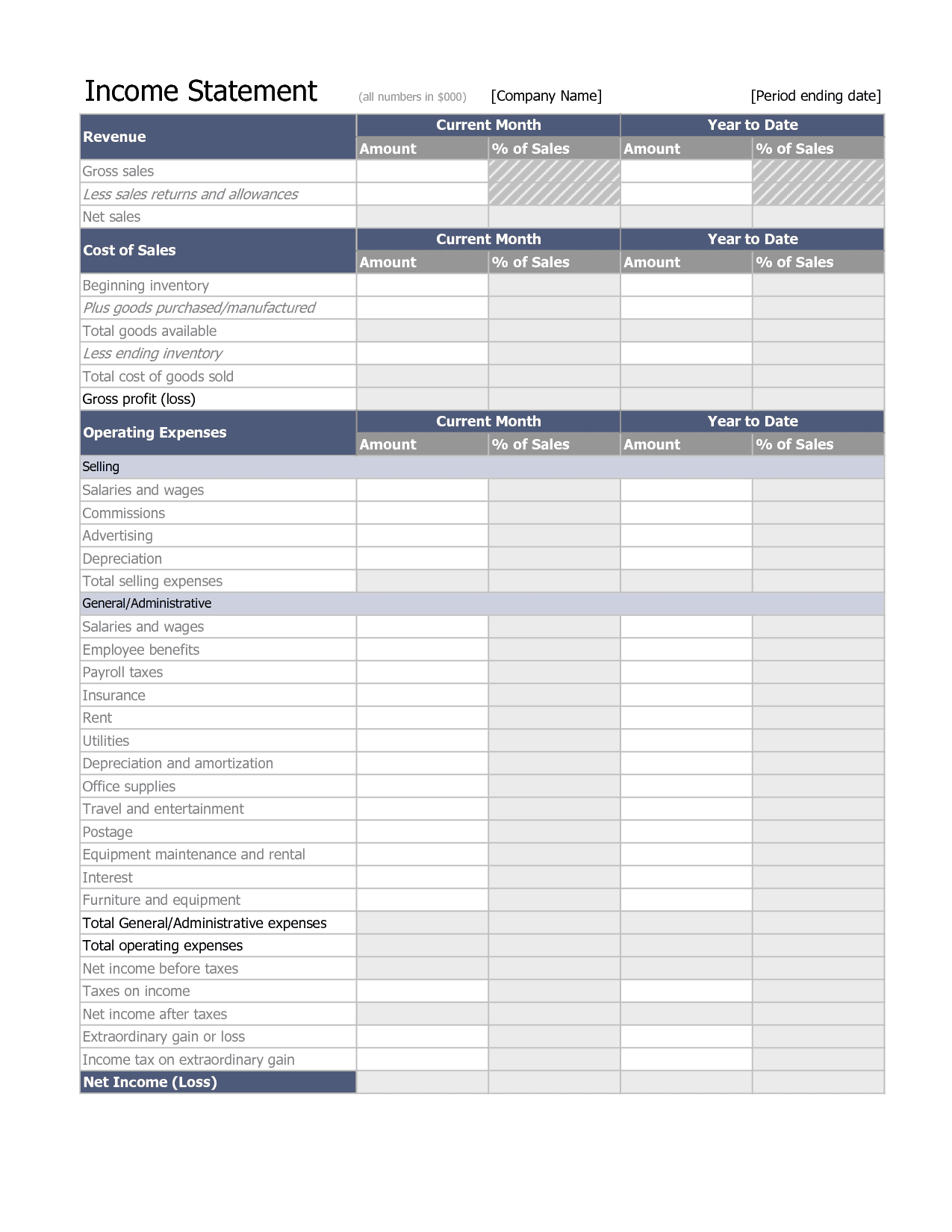

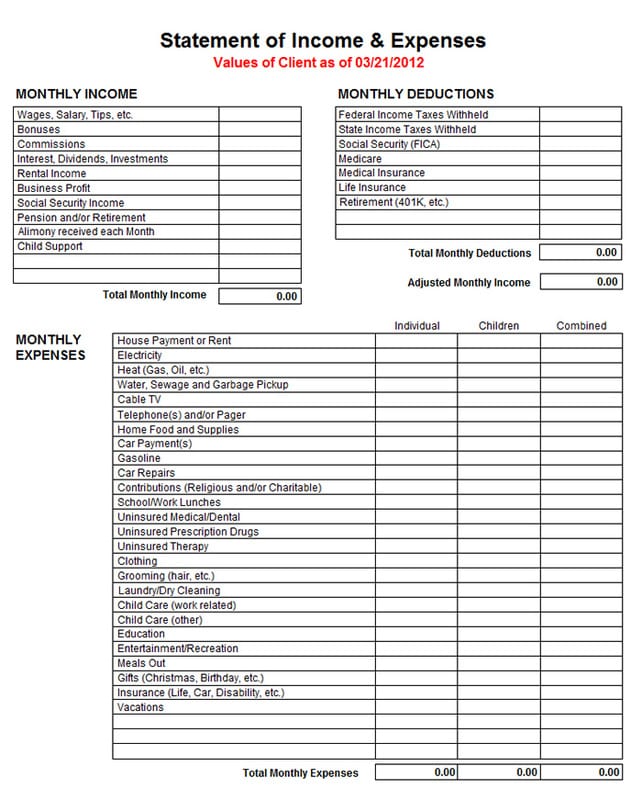

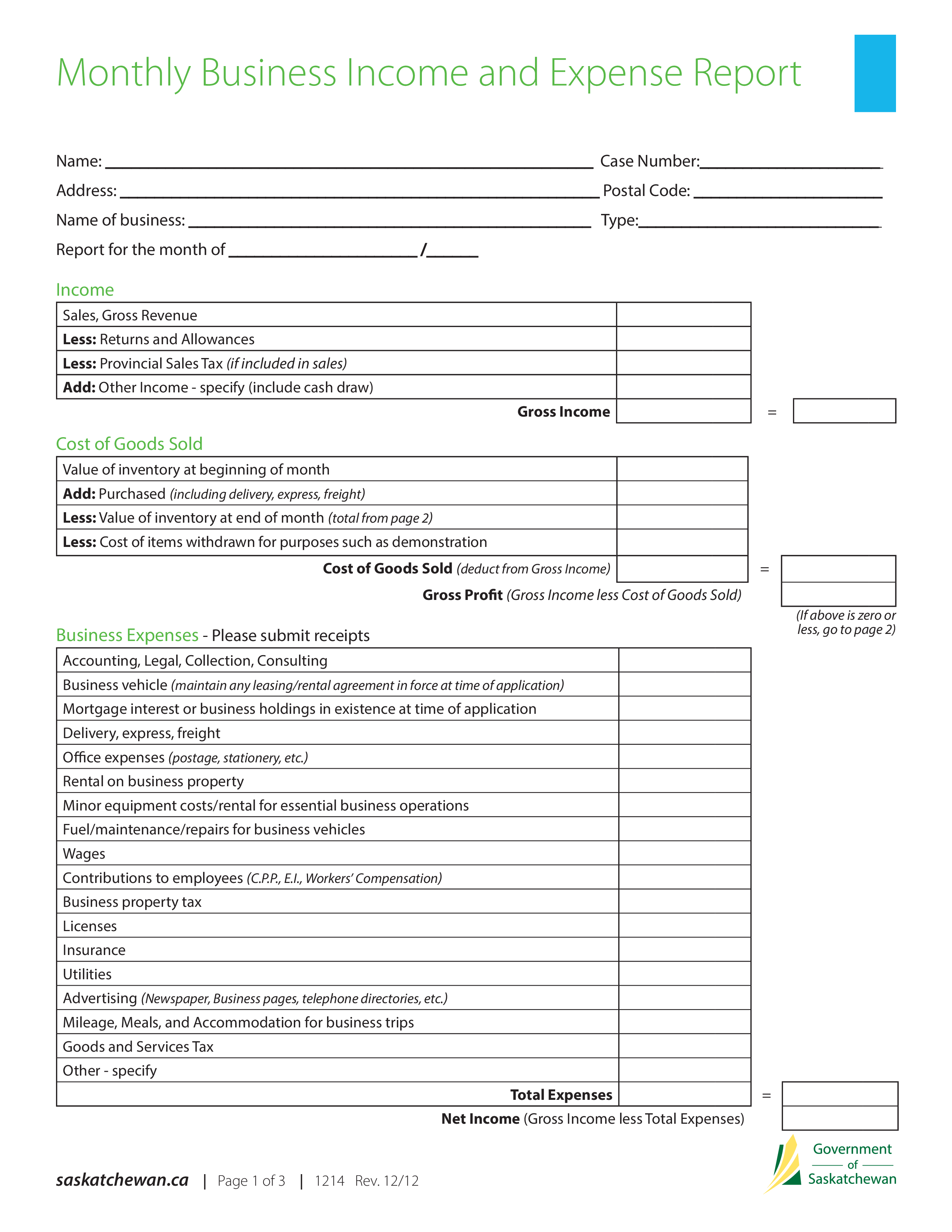

Statement of income and expenses template. Identify income sources identify all sources of income for tracking purposes. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. It is categorised into different line items such as revenue by type, or costs.

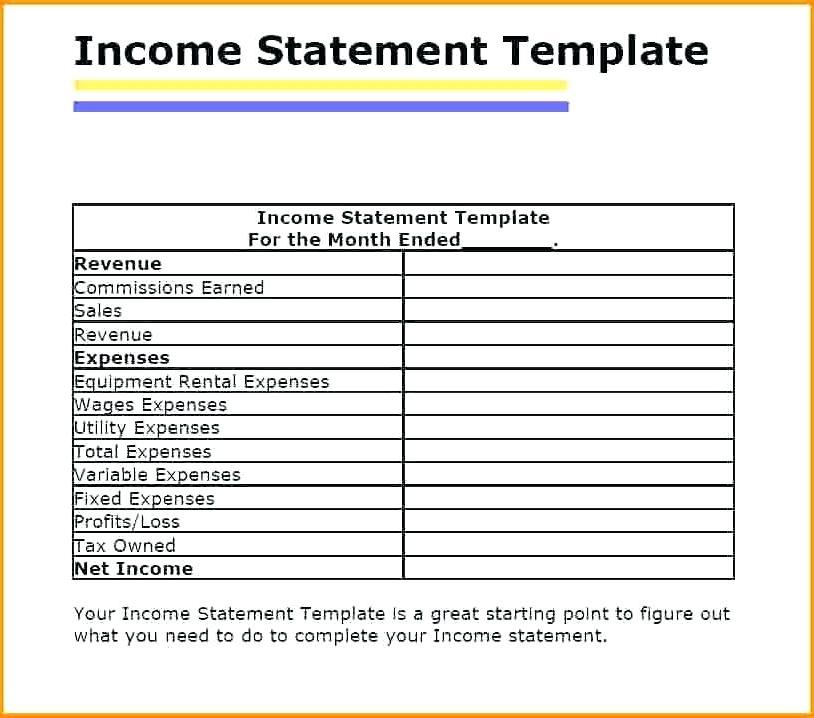

You can use it to construct the income statement of a company. This refers to the money your business has at. A budget is a spending plan for your business based on your estimated income and expenses.

Written by cfi team what is the income statement? This is usually the most closely examined of the financial statements, since it reveals the operating performance of an entity. Prepare the income statement header.

An income statement is a financial report detailing a company’s income and expenses over a reporting period. Consider both primary and secondary sources, such as salary, freelance work, rental income, or investments. Click on the cell “ b3 “.

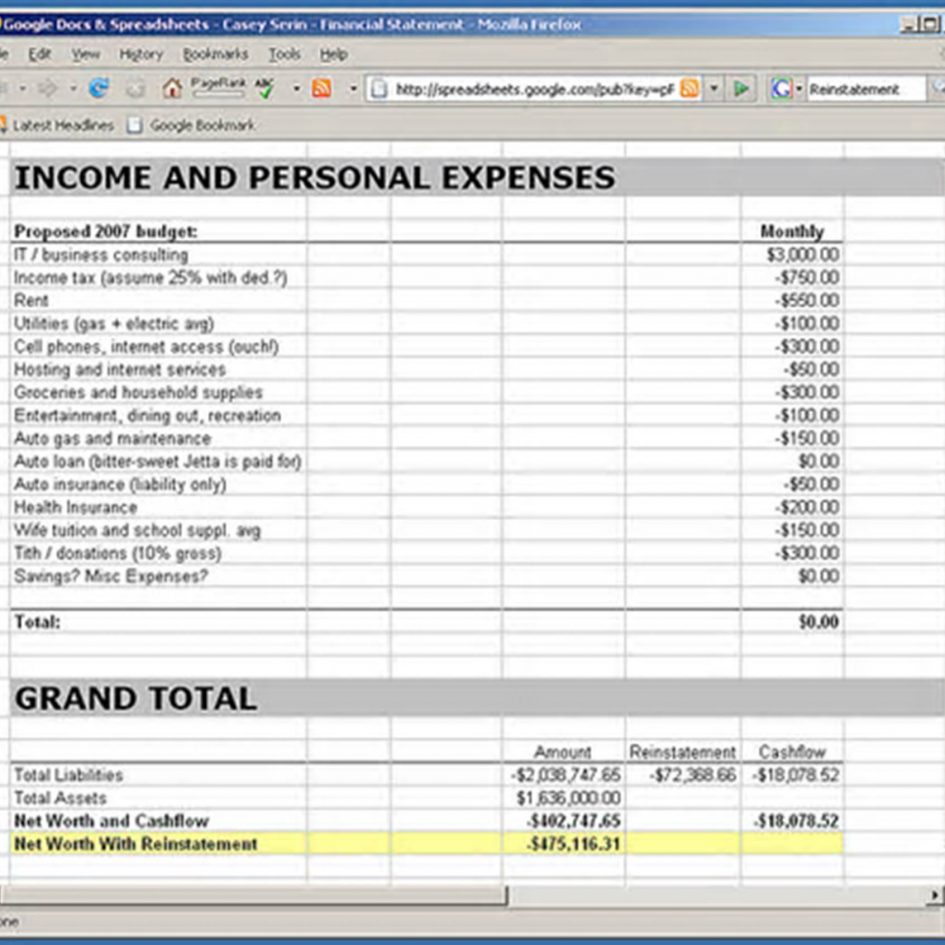

This task is crucial as it lays the foundation for accurately tracking and analyzing income. Example of an income and. Net income is the profit that remains after all expenses and costs, such as taxes.

Free income and expenditure statement template; Download your financial management template so that you can access it and edit it as you need. Free comprehensive income and expenditure statement;

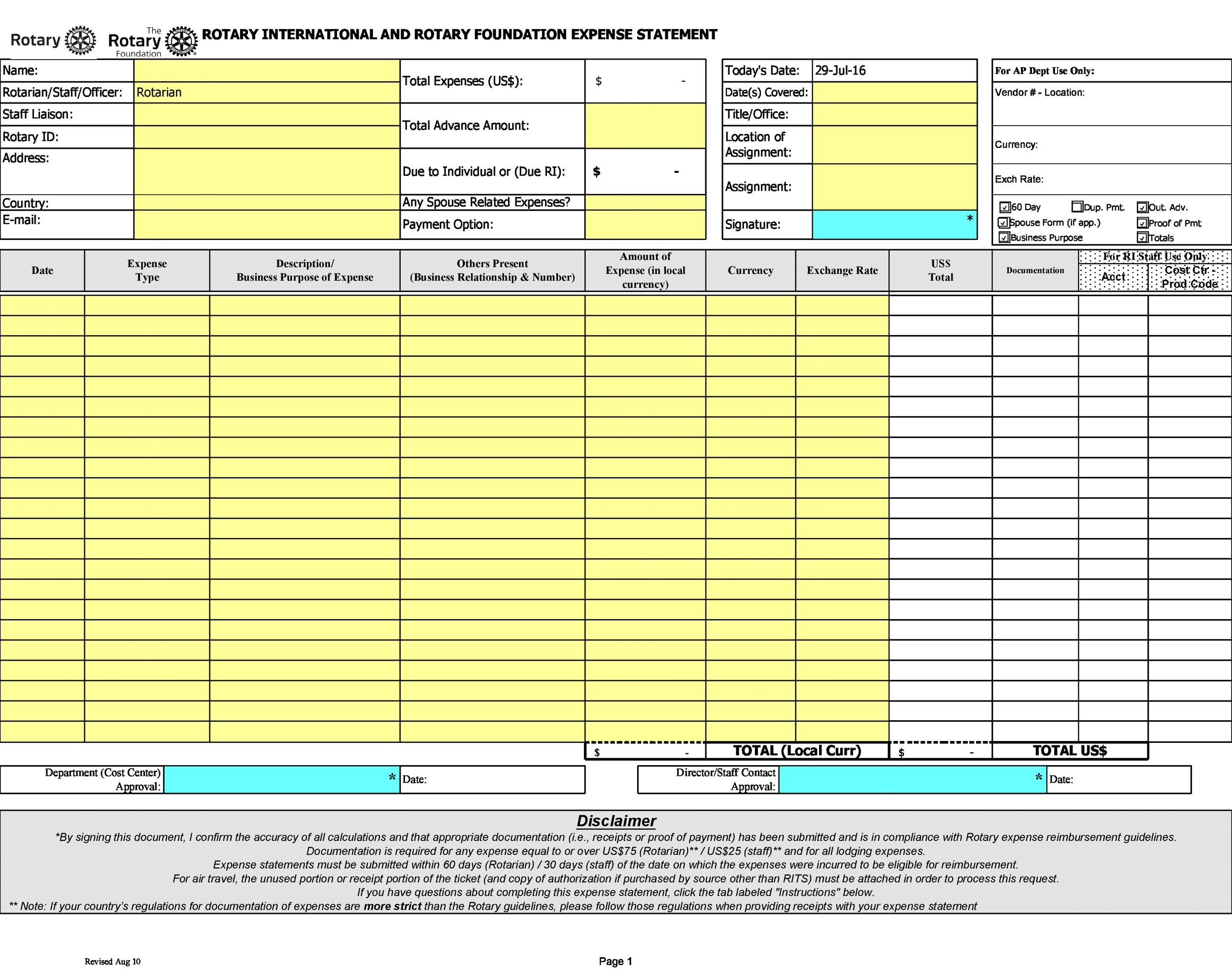

You can customize the template by changing the column headings for categorizing expenses, or adding new columns if. It lists the revenue income, costs, and expenses to determine the financial solvency of the individual or the business. The header can be made to outline the title “income statement,” company details, and date.

An income statement compares company revenue against expenses to determine the net income of the business. Calculate how much revenue your business is making, how much expenses you're spending, and how much profit you're generating on a monthly and annual basis. If you are using the printed sheet, you can take it with you in your wallet and edit it whatever you make a purchase.

Revenue minus expenses equals profit or loss. An excel template does not replace the. Subtract operating expenses from business income to see your net profit or loss.

An income statement might use the cash basis or the accrual basis. Provide detailed data on your business revenues and expenses including additional costs and taxes. Knowing how much revenue is coming in, how much money is going out, and how much profit you are making is essential to making smart business decisions.that’s why you need an accounting system that helps you stay organized.