Nice Tips About Trial Balance Debit And Credit Examples Of Owners Equity

This can include money owed to suppliers, money owed.

Trial balance debit and credit examples of owners equity. A trial balance is a list of the balances of all of a business's general ledger accounts. If you take the total assets of cheesy. Asset accounts normally have debit balances and the debit balances are increased with a debit entry.

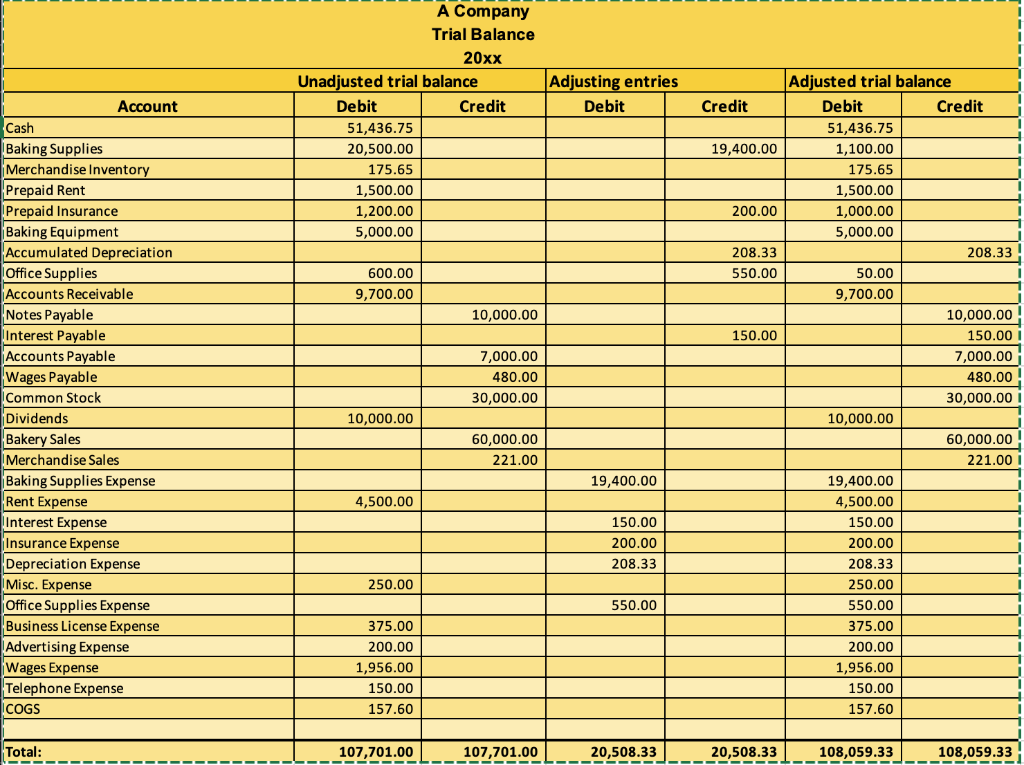

Welcome to our tutorial on the journal entry for owner's equity, where we'll go through the previous example with our sample business, george's catering, and see what the debit. In the case of printing plus, the balances equal. At the end of an accounting period, the accounts of asset, expense, or loss should each have a debit balance, and the accounts of liability, equity, revenue, or gain.

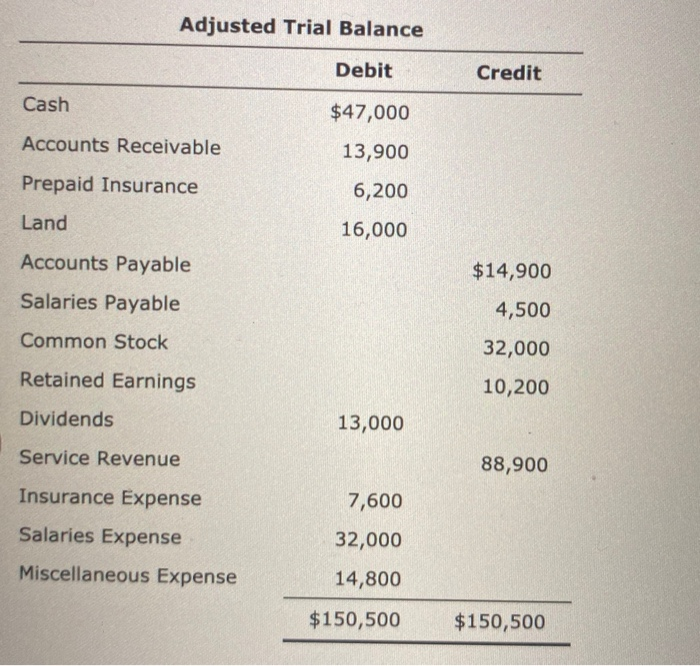

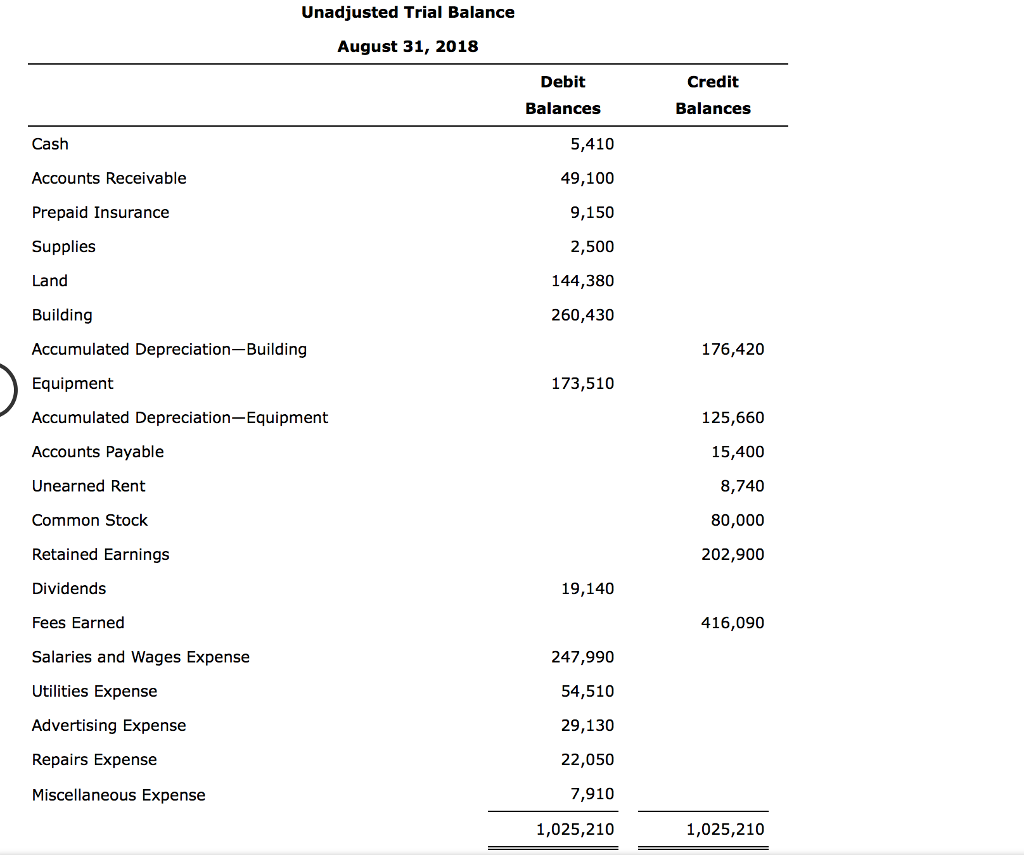

Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other. If the total of all debit values equals the total of all credit. On a balance sheet or in a ledger, assets equal liabilities plus shareholders' equity.

Accounting articles trial balance trial balance a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger. Basic accounting debits and credits examples. Recall that equity is also called net assets (assets minus liabilities).

There are two methods accountants use to show credits and debits for financial transactions. First of all, we take all the balances from our ledgers and enter them into our trial balance table. Can you think of another way to confirm the amount of owner’s equity?

Part of that system is the use of debits and credit to post. Remember that debit means left side. What is a trial balance?

Liability account the liability account on a company’s balance sheet includes all of the money that the company owes. Items that appear on the credit side of the trial balance. You need to implement a reliable accounting system in order to produce accurate financial statements.

At the time of the distribution of funds to an owner, debit the owner’s drawing account and credit the cash in bank account. It is prepared at the end of. It is important to note that just because the trial balance balances, does not.

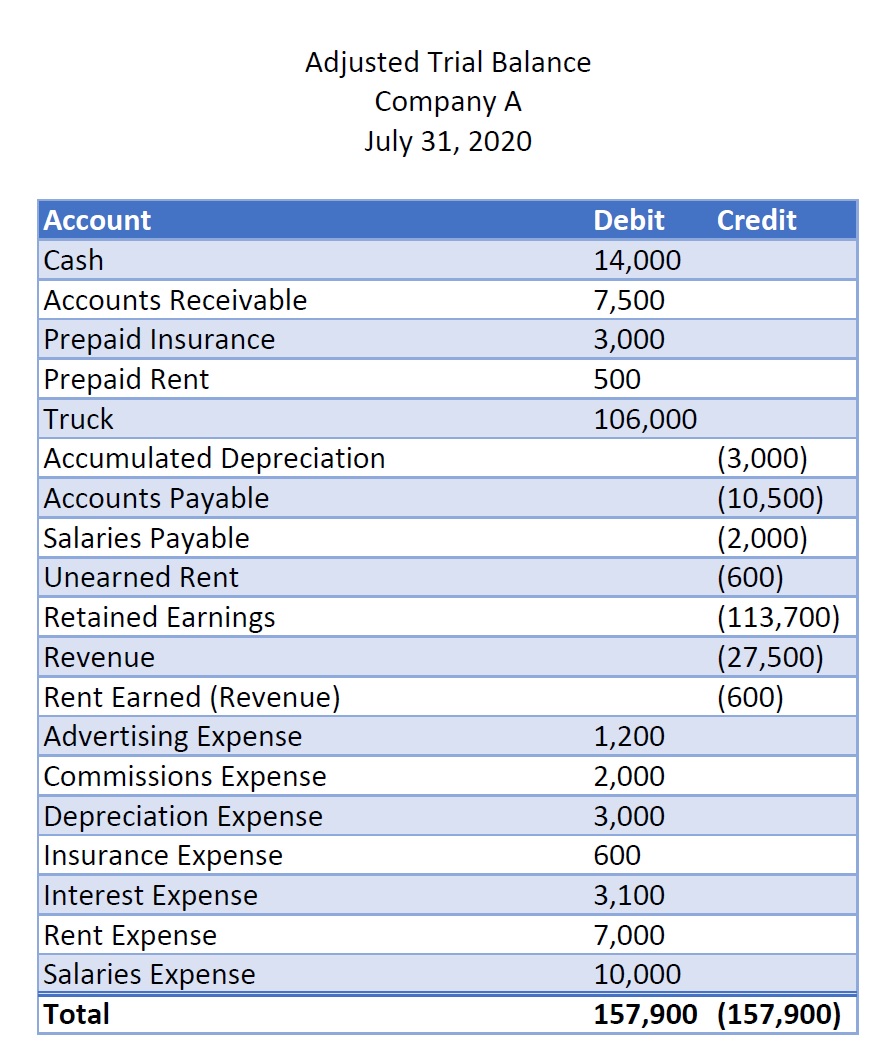

The trial balance ensures that the debits equal the credits. Once all accounts have balances in the adjusted trial balance columns, add the debits and credits to make sure they are equal. This means that stockholders' equity accounts such as common stock, retained earnings, and m j smith, capital should have credit balances.

An increase in the value of assets is a debit to the account, and a decrease is a. Adjusted trial balance for the month ended october 31, 20xx; Generally capital, revenue and liabilities have credit balance so they are placed on the credit side of the trial balance.