Great Info About Difference Of Balance Sheet And Income Statement

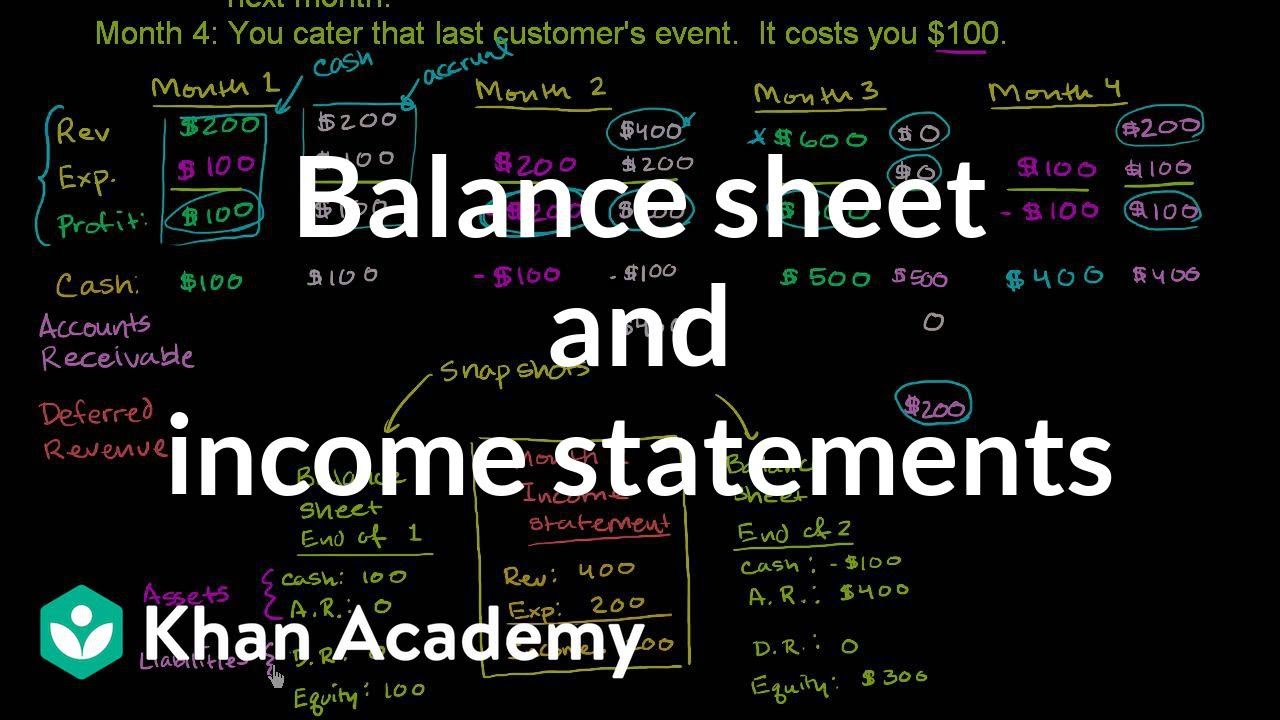

As mentioned earlier, the financial statements are linked by certain elements and thus must be prepared in a certain order.

Difference of balance sheet and income statement. An income statement shows how profits/gains are earned and expenses/losses are incurred. The income statement also notes any tax expense, while the balance sheet. The income statement, often called the profit and loss statement, shows the revenues, costs, and.

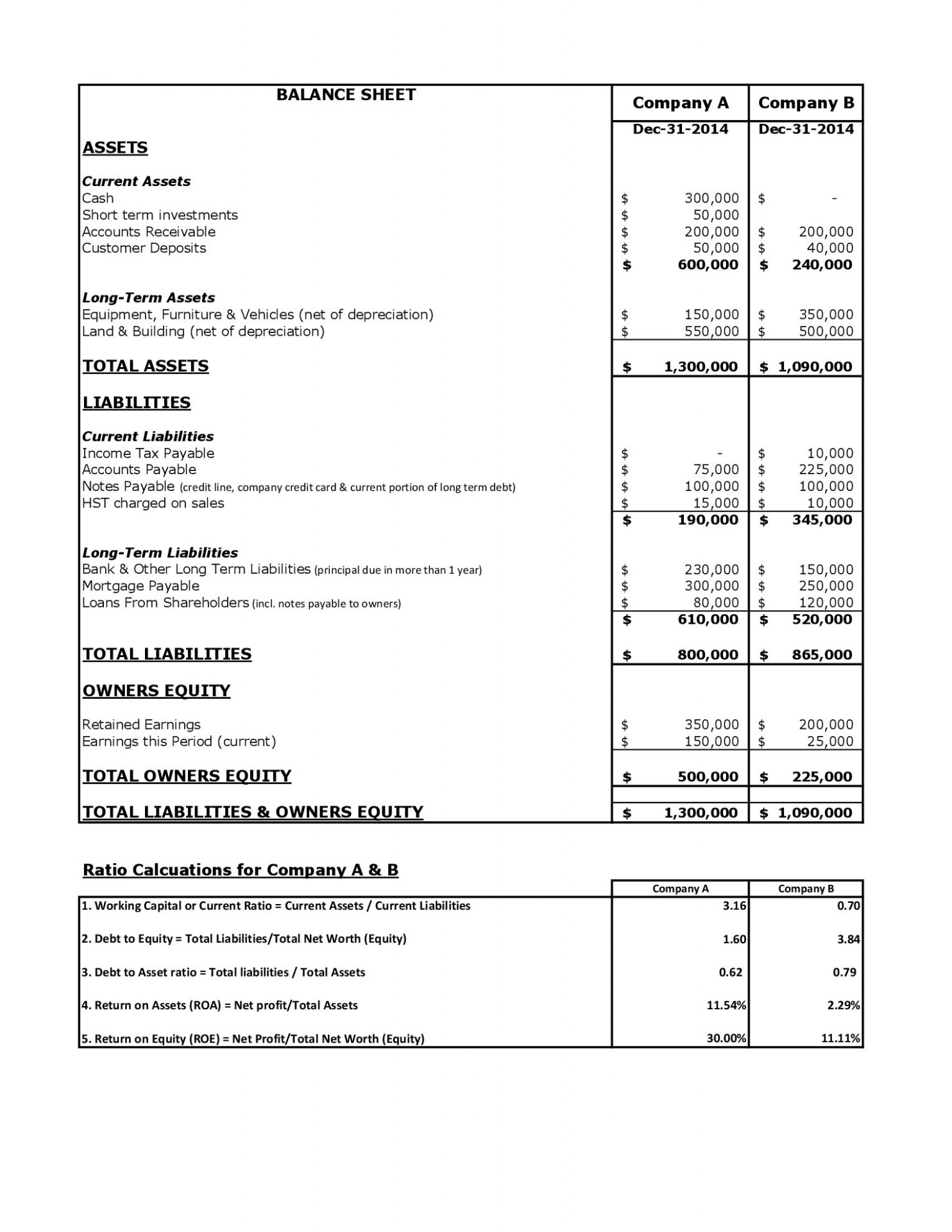

Jordan dipietro many or all of the. Typically, balance sheets record information according to quarterly periods, although some companies use these statements of financial position as part of a yearly report. It is usually assessed “as of” a given date.

Amortization affects intangible assets like patents and copyrights. The balance of an account is transferred to the capital account in the balance sheet. And (3) detailed revenue streams.

The income statement provides the company’s business performance during the given period. Whereas an income statement provides a broader perspective of business performance, balance sheets include a detailed view of the amount of value and risk of the business. All income and expense accounts are closed and not carried forward.

Net income and retained earnings. The income statement was first since net income (or loss) is a required figure in preparing the balance sheet. The balance sheet reports assets, liabilities, and equity, while the income statement reports revenues and expenses that net to a profit or loss.

A company's balance sheet provides details about assets, liabilities and shareholders' equity over a specific period. Simply put, the income statement can be represented by this formula. It reduces their value on the balance sheet gradually.

We’ll clarify the differences between the two and cover why. Updated january 31, 2024 reviewed by margaret james what is a balance sheet? Together, they tell a more complete story.

Income statements show whether a company is profitable during a specific period. Unlike the balance sheet which represents a snapshot of a single moment in time, the income statement is a range that covers the revenue and expenses that took place from year to year. A balance sheet shows a company’s assets, liabilities and equity at a specific point in time.

A company income statement measures how profitable a company is over a period of time. Instead of expenses, you add up your liabilities. Analyzing a balance sheet vs.

The balance sheet and the income statement are monetary reports organisations create toward the end of a bookkeeping period. Balance sheets income statements; Instead of revenue, you add up your assets.

.png)