Smart Tips About Goodwill Impairment Double Entry

The issue of shares at market value usually results in the receipt of cash, the nominal (par) value.

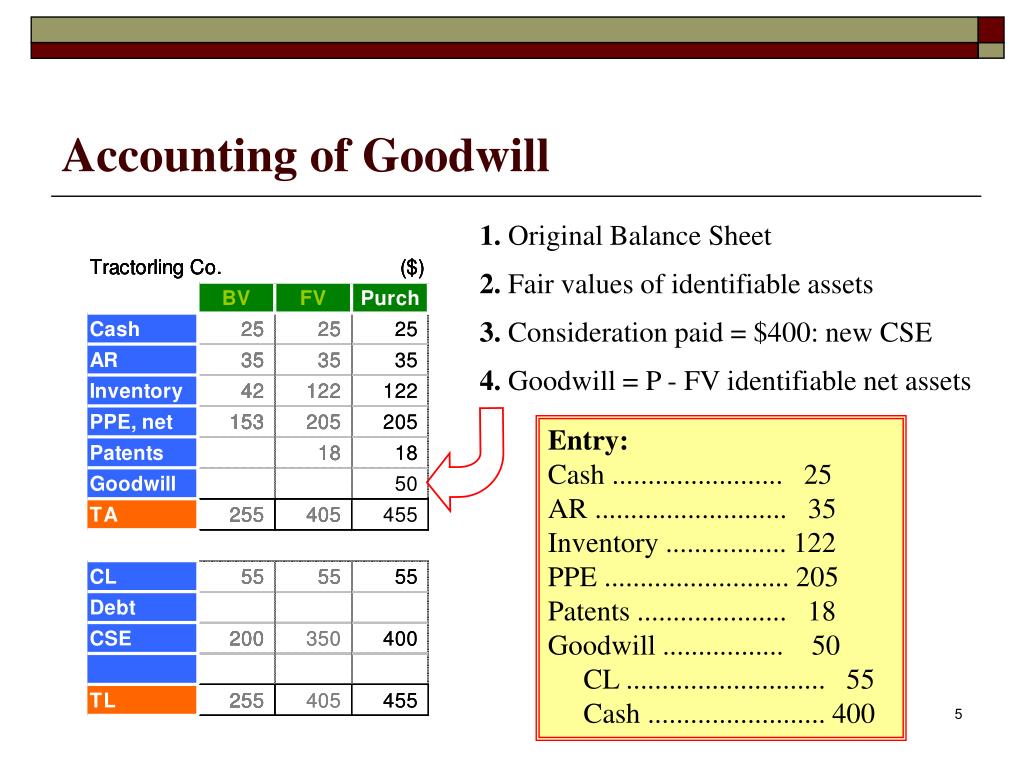

Goodwill impairment double entry. Entry to record the loss is shown below. Frequency of goodwill impairment under ind as, cgus to which goodwill has been allocated are required to be tested for impairment annually. The double entry for this is similar to the double entry for a normal share issue.

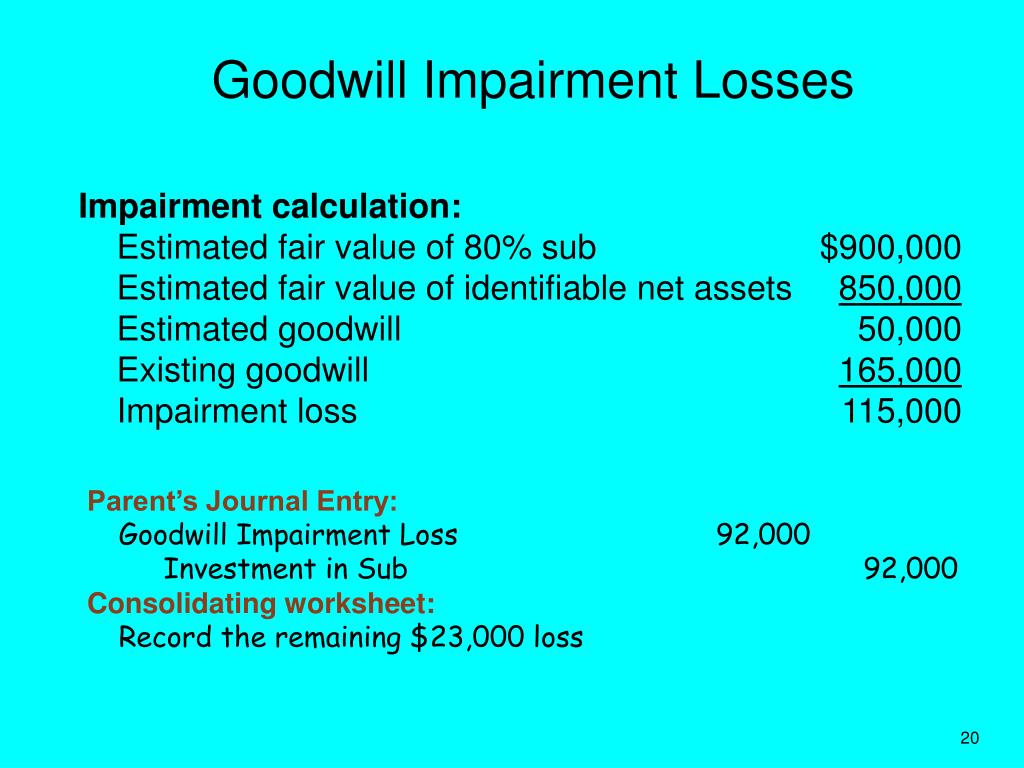

Impairment of goodwill according to ifrs® 3, business combinations, there are two ways to measure the goodwill that arises on the acquisition of a subsidiary and each has a. Ias 36 prohibits any reversal of impairment losses recognised on goodwill. The net carrying value for goodwill after the impairment is $20,000 ($40,000 − 20,000).

Goodwill impairment cannot be reversed. Calculate the gross goodwill arising on the acquisition of high, ie using the. The guidance addresses various aspects.

Goodwill impairment is an expense item on the income statement in. Both ifrs accounting standards and us gaap require annual impairment testing of goodwill1 and prohibit reversing a goodwill impairment loss. With the information in the example, the company abc can determine the goodwill on acquisition to be $3,000,000 as it pays $7,000,000 for the $4,000,000 net.

Had the impairment amount exceeded the. Goodwill is tested for impairment at least annually and the amount by which its. Goodwill impairment is when the carrying value of goodwill exceeds its fair value.

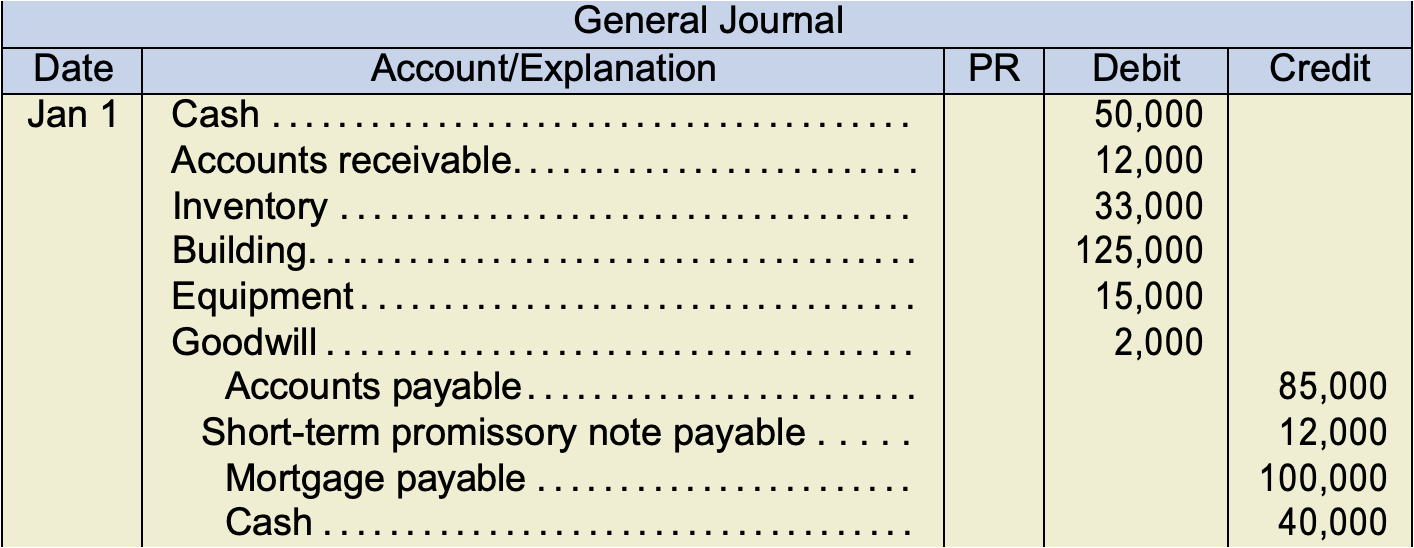

The company can make the journal entry for goodwill impairment by debiting the goodwill impairment account and crediting the goodwill account when it finds out that there is an impairment of goodwill as a result of periodic review. The current guidance requires companies to calculate the implied fair value of goodwill in step 2 by calculating the fair value of all assets (including any.