Build A Info About Typical Balance Sheet Accounts

Accounts on the balance sheet.

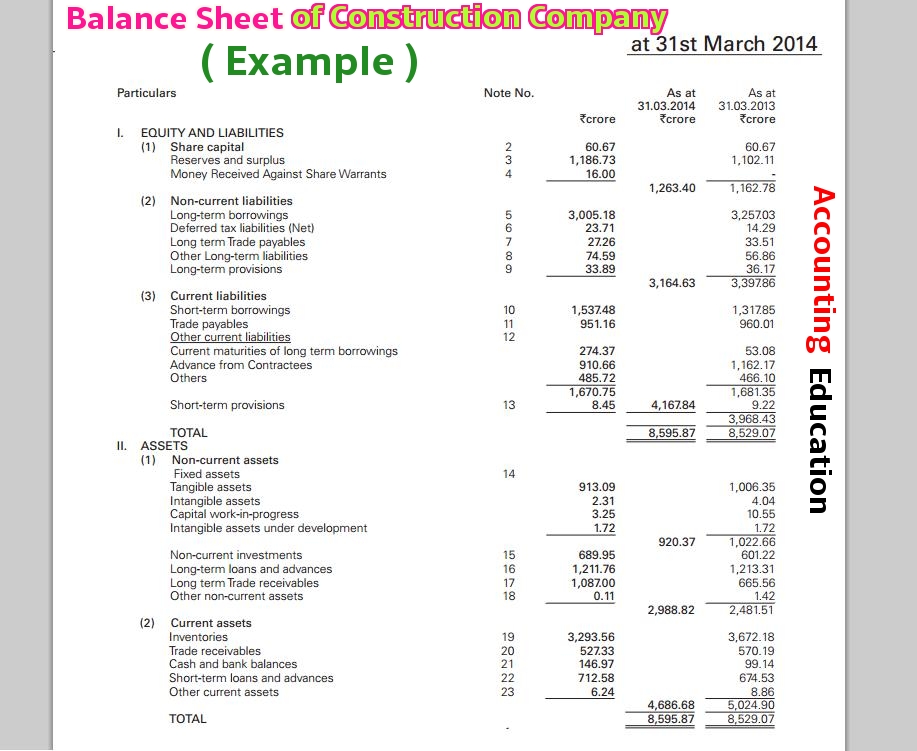

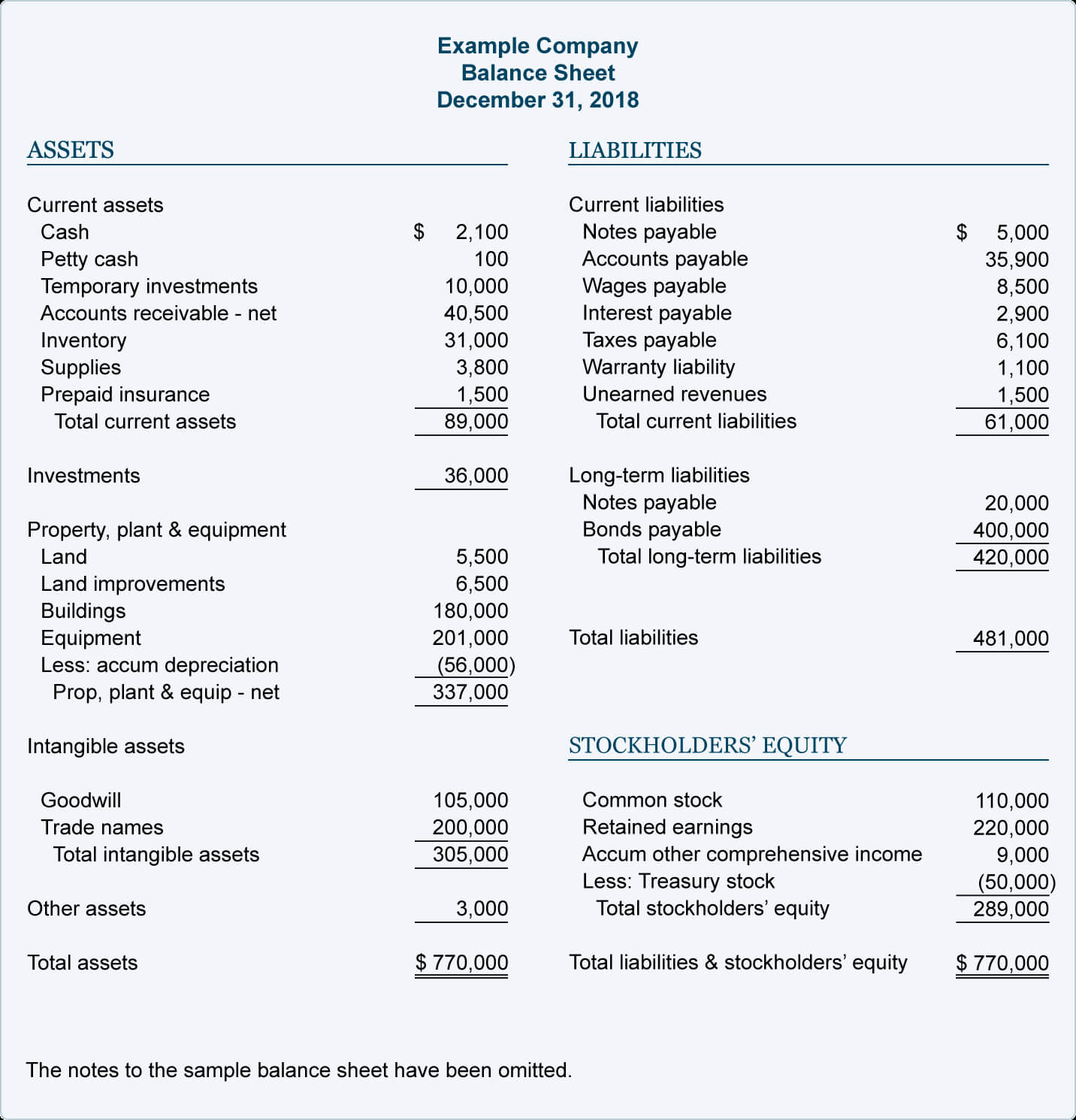

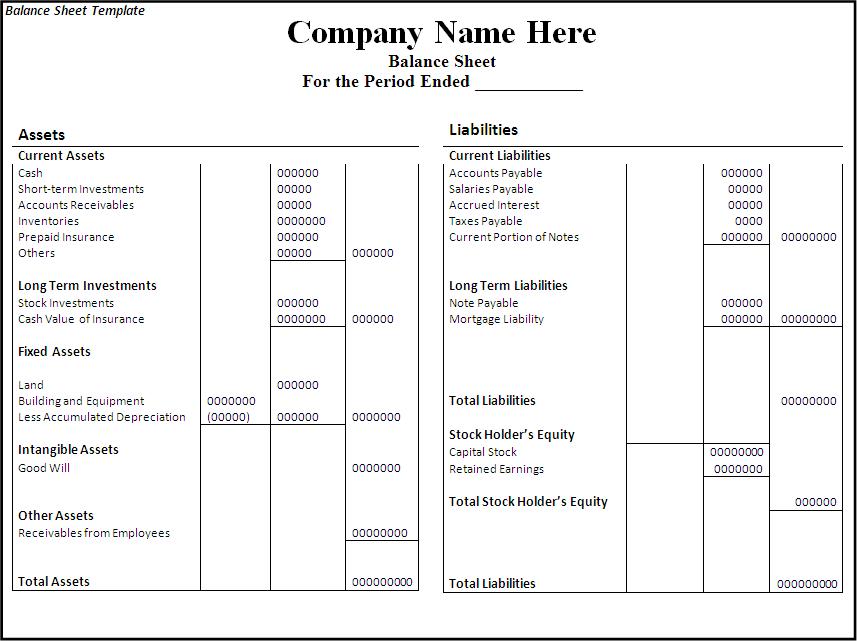

Typical balance sheet accounts. The first line presents the name of the company; Understanding a balance sheet (with examples and video) balance sheets can help you see the big picture: Assets represent things of value that a company owns and has in its possession, or something that will be received and.

What is a balance sheet? For instance, when you sell inventory and receive payment, this is documented in the cash account. Your balance sheet accounts list, will include:

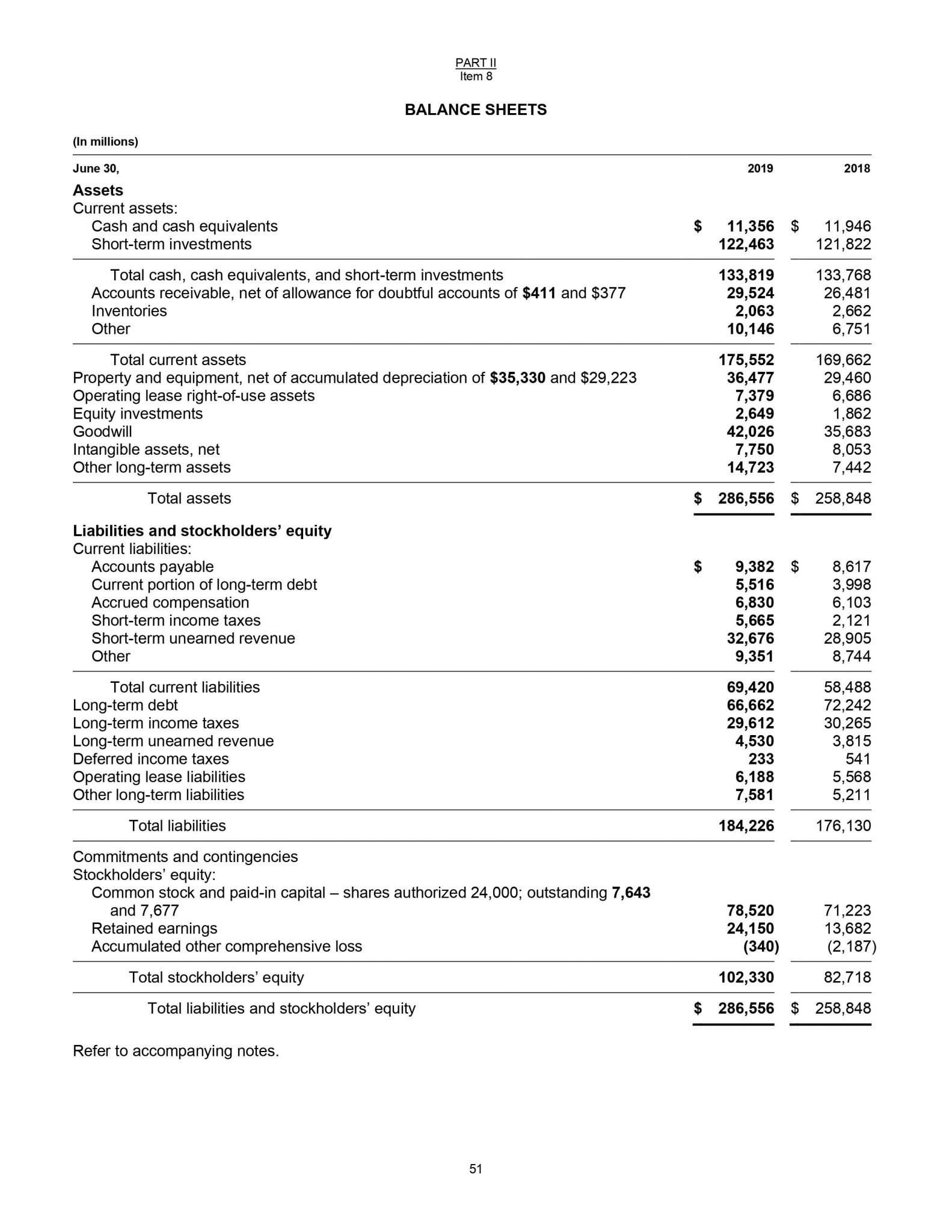

Assets like cash, inventory, accounts receivable, investments, prepaid expenses, and fixed assets. Hence, the balance sheet is often used interchangeably with the term “statement of. Balance sheet accounts tend to follow a standard that lists the most liquid assets first.

The balance sheet shows a company’s. The balance sheet is based on the fundamental equation: They’re also essential for getting investors, securing a loan, or selling your business.

The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. Balance sheet information is used to calculate key rates of return for investors: Vertical representation or horizontal representation.

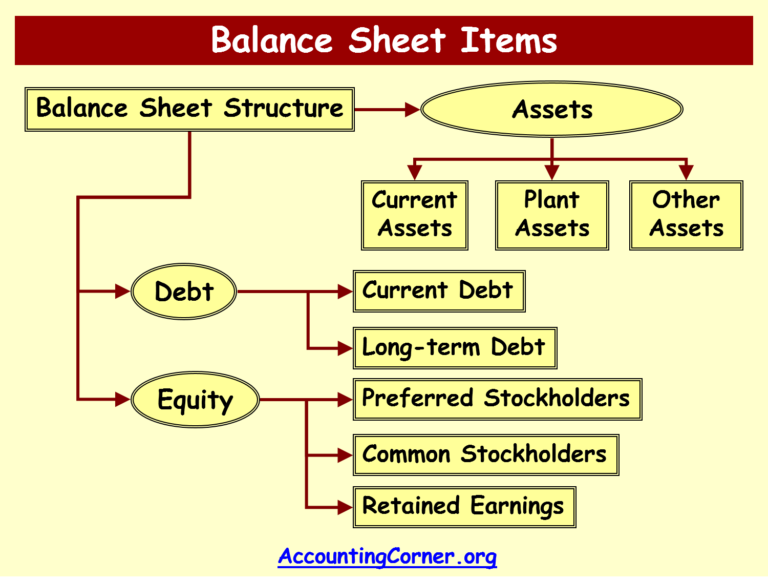

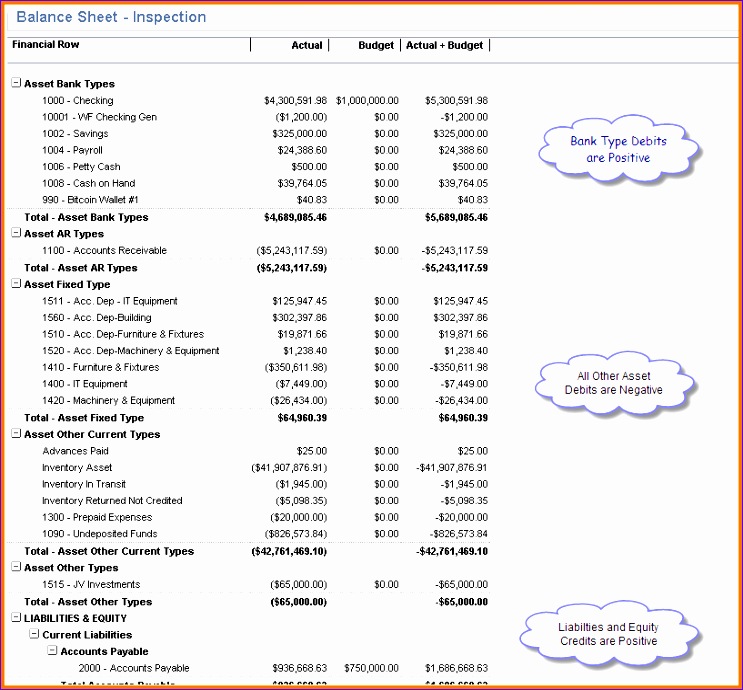

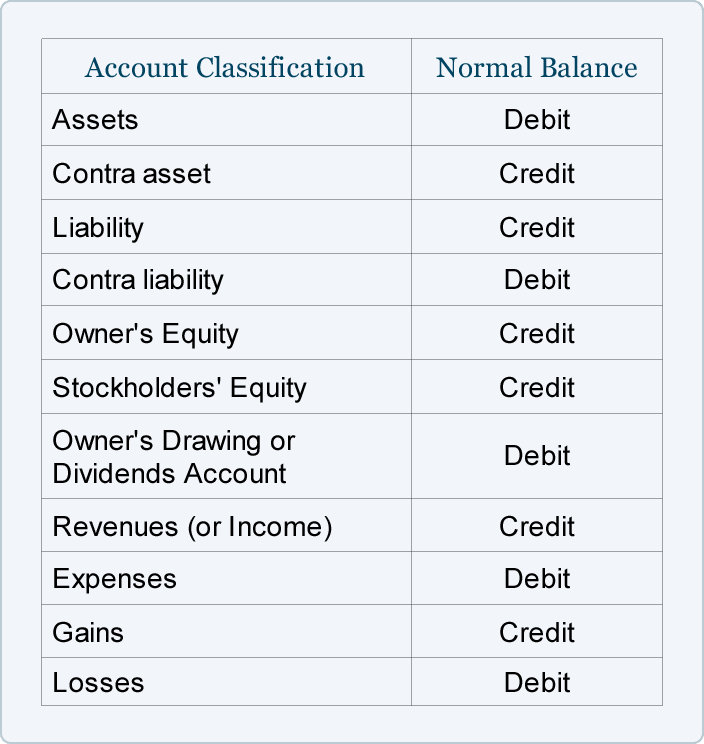

Liability accounts, which record all the company’s debts; The items which are generally present in all the balance sheet includes: The balance sheet accounts comprise assets, liabilities, and shareholders equity, and the accounts are broken down further into various subcategories.

Assets = liabilities + equity. Balance sheet accounts are one of two types of general ledger accounts. And the third states the date of the report.

Example of a balance sheet using the account form. If prepared correctly, the total assets on the balance sheet. Thus, it is also called statement of financial position.

It reports a company’s assets, liabilities, and equity at a single moment in time. This is the cash you receive during regular transactions at your business. Revenue and expense accounts tend to follow the standard of first listing the items most closely related to the operations of the business.

A balance sheet shows the financial position or condition of the company; The balance sheet is one of the three financial statements businesses use to measure their financial performance. Balance sheets are typically used to track earnings and spending but can also show the profitability of a business to those interested in buying shares.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)