Supreme Tips About Dividend Revenue On Income Statement

Here are some of the uses of an income statement:

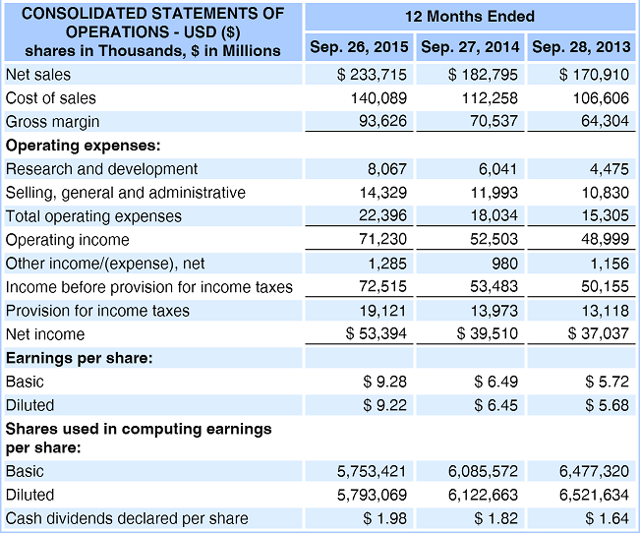

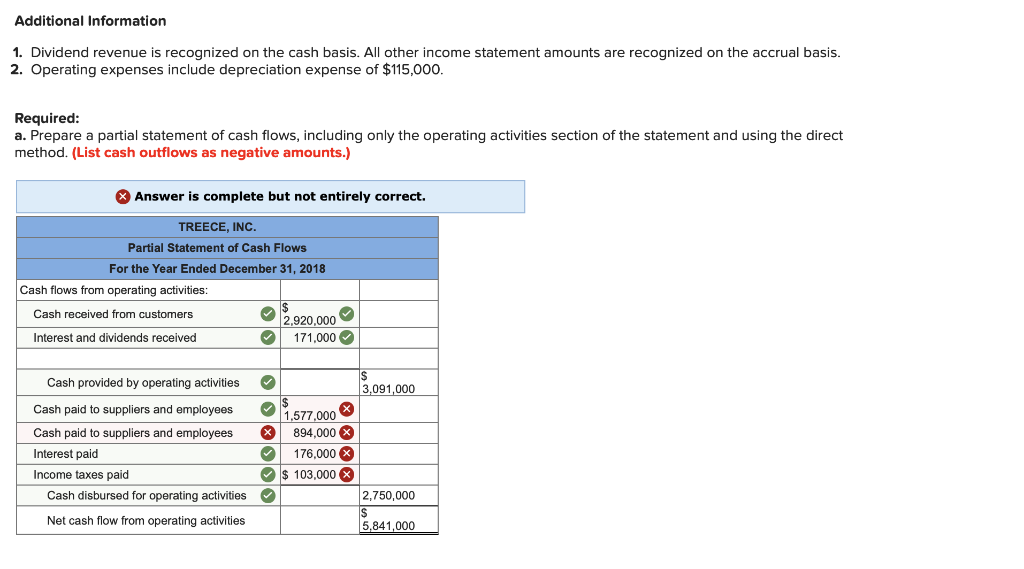

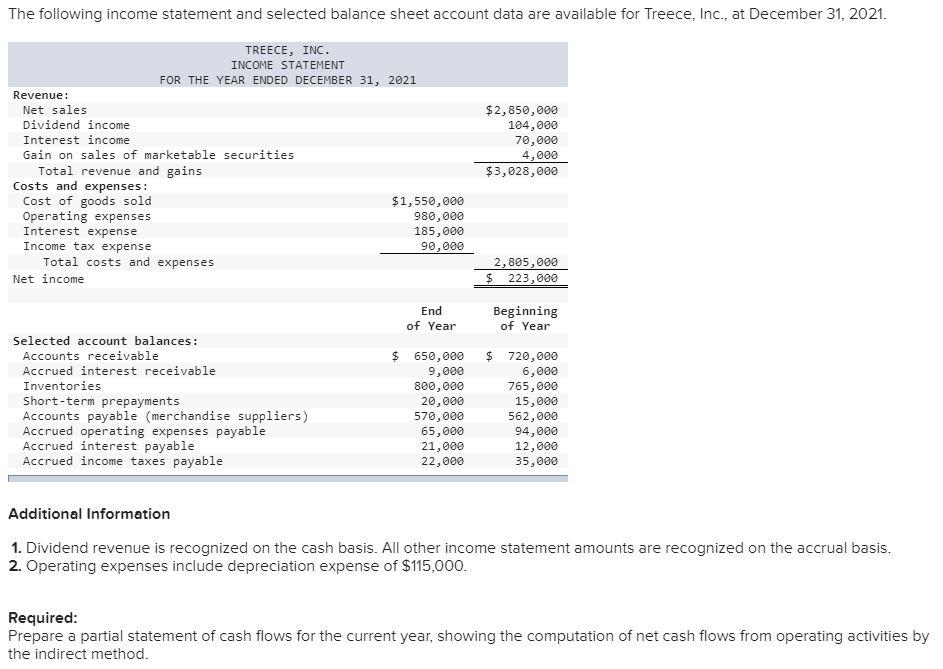

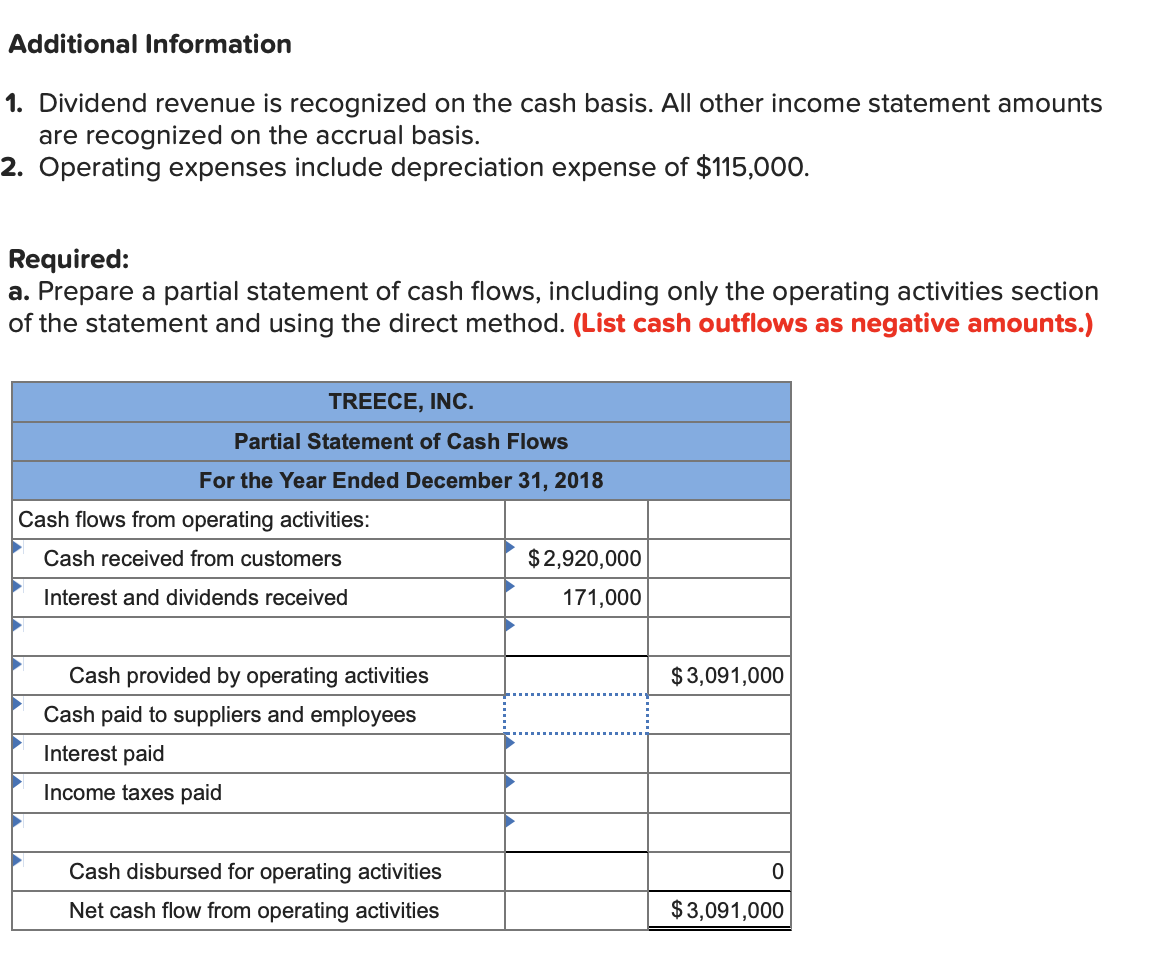

Dividend revenue on income statement. Nvda) today reported revenue for the fourth quarter ended january 28,. Free cash flow before m&a and customer financing € 4.4 billion; The first step in calculating dividends from the income statement is to obtain a copy of the company’s income statement.

Dividend income is defined by the irs as any distribution of an entity's property to its shareholders. Key definition revenue: Net cash € 10.7 billion.

Strong increase in revenue and recurring operating income which are expected to continue in 2024 paris, february 15, 2024 fy 2023 adjusted data revenue:. While they are usually cash, dividends can also be in the. Santa clara, calif., feb.

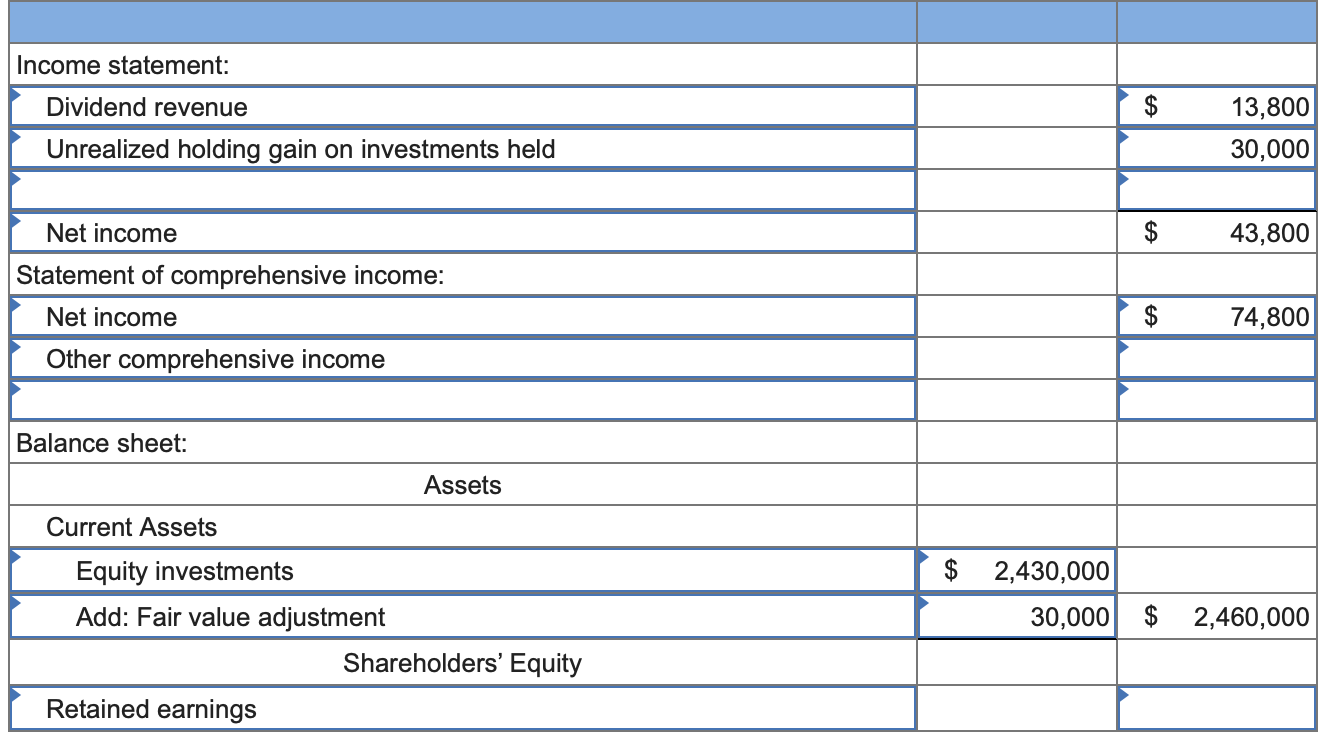

An income statement is a type of financial statement. The income statement focuses on a company’s. Dividends in the balance sheet.

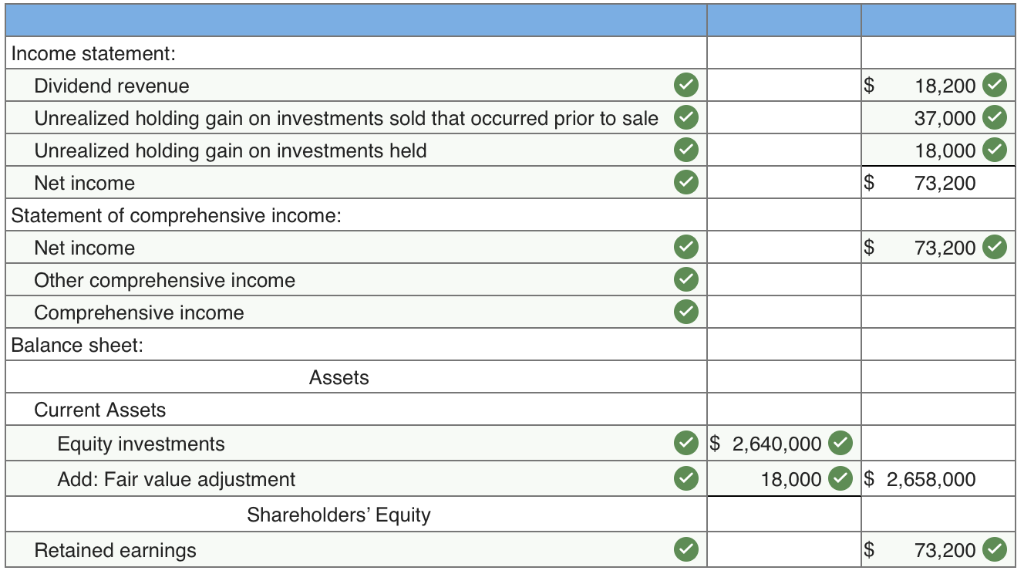

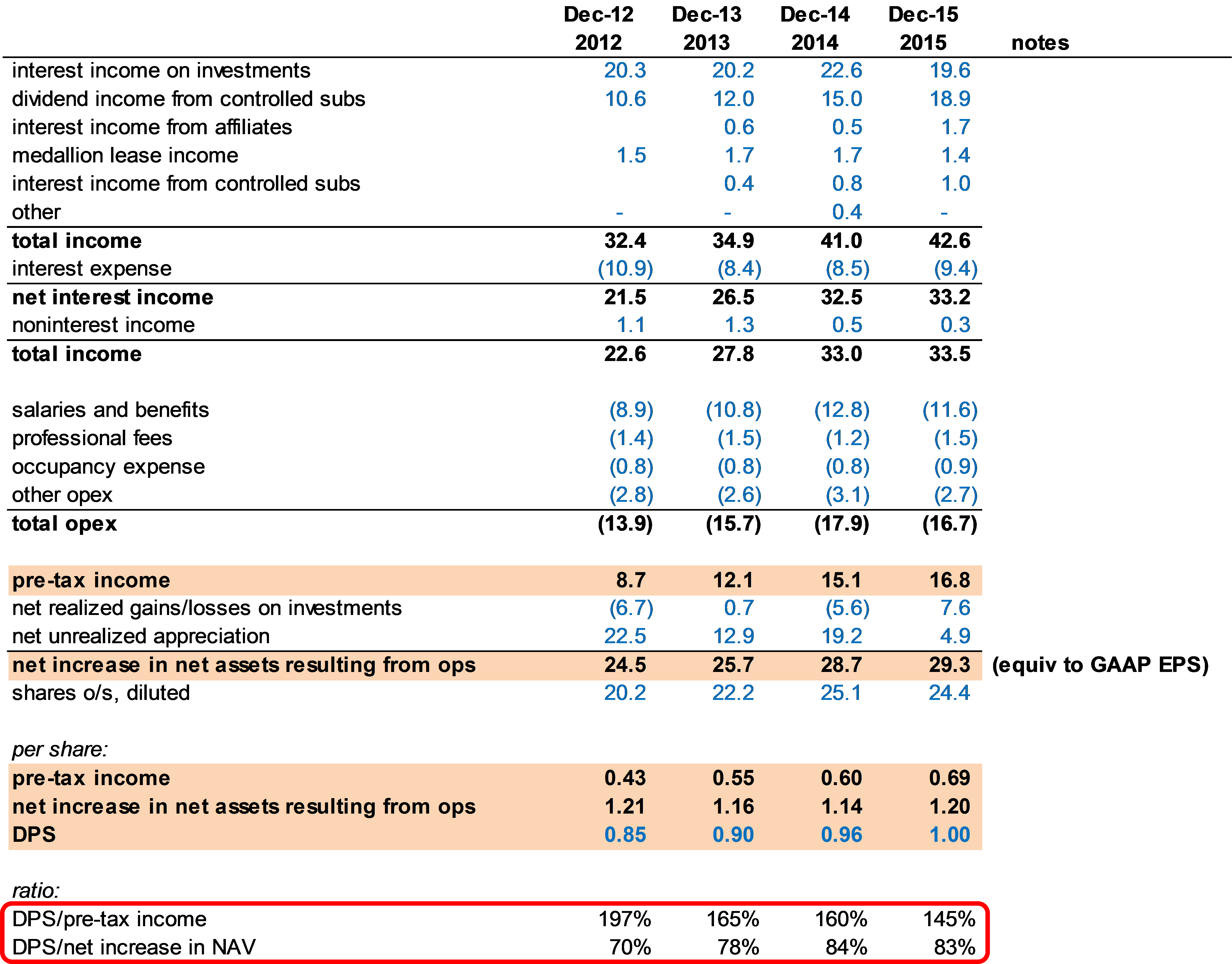

Dividends on common stock are not reported on the. In this case, the dividend payout ratio. Revenue from dividends is not within the scope of ifrs 15, and it should be presented separately from the revenue from contracts with customers in the income statement.

Before dividends are paid, there is no impact on the balance sheet. If you file on paper, you should receive your income tax package in the mail by this date. It includes a company's revenues, expenses, gains and losses, and net income,.

The gross inflow of economic benefits (cash, receivables, other assets) arising from the ordinary operating activities of an entity (such. The income statement, also known as. Preparing the income statement sheds light on a company’s financial events.

An income statement, also known as a profit and loss statement, is a financial report that summarizes a company's revenues, expenses, and profits or losses over a specific. Where is dividend income recorded in the cash flow statement? Late on wednesday the company said it would propose a dividend of 1.85 euros ($1.98) for 2023, up from 0.25 euros for 2022, joining u.s.

For example, a company pays out $100 million in dividends per year and made $300 million in net income the same year. Current assets (cash) will decrease. Updated may 23, 2021 reviewed by margaret james cash or stock dividends distributed to shareholders are not recorded as an expense on a company's income statement.

Current liabilities (dividends payable) will decrease. Recognizing, as defined in the iasb framework, means incorporating an articles so meets of definition is revenue (above) in one income statement when it. Dividends that were declared but not yet paid are reported on the balance sheet under the heading current liabilities.

![[Solved] The following statement and select SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1564/6/6/1/7625d42d802f11621564644905190.jpg)