Marvelous Tips About Do Expenses Go On A Balance Sheet

Accounts payable (ap) is an account in a company's general ledger.

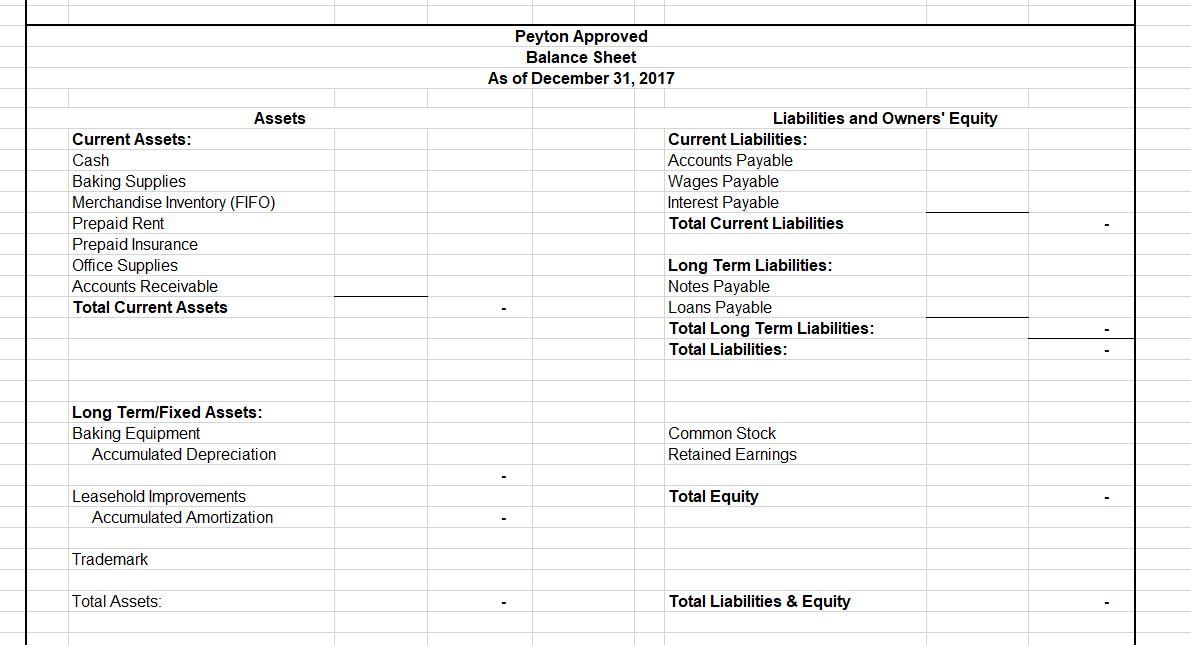

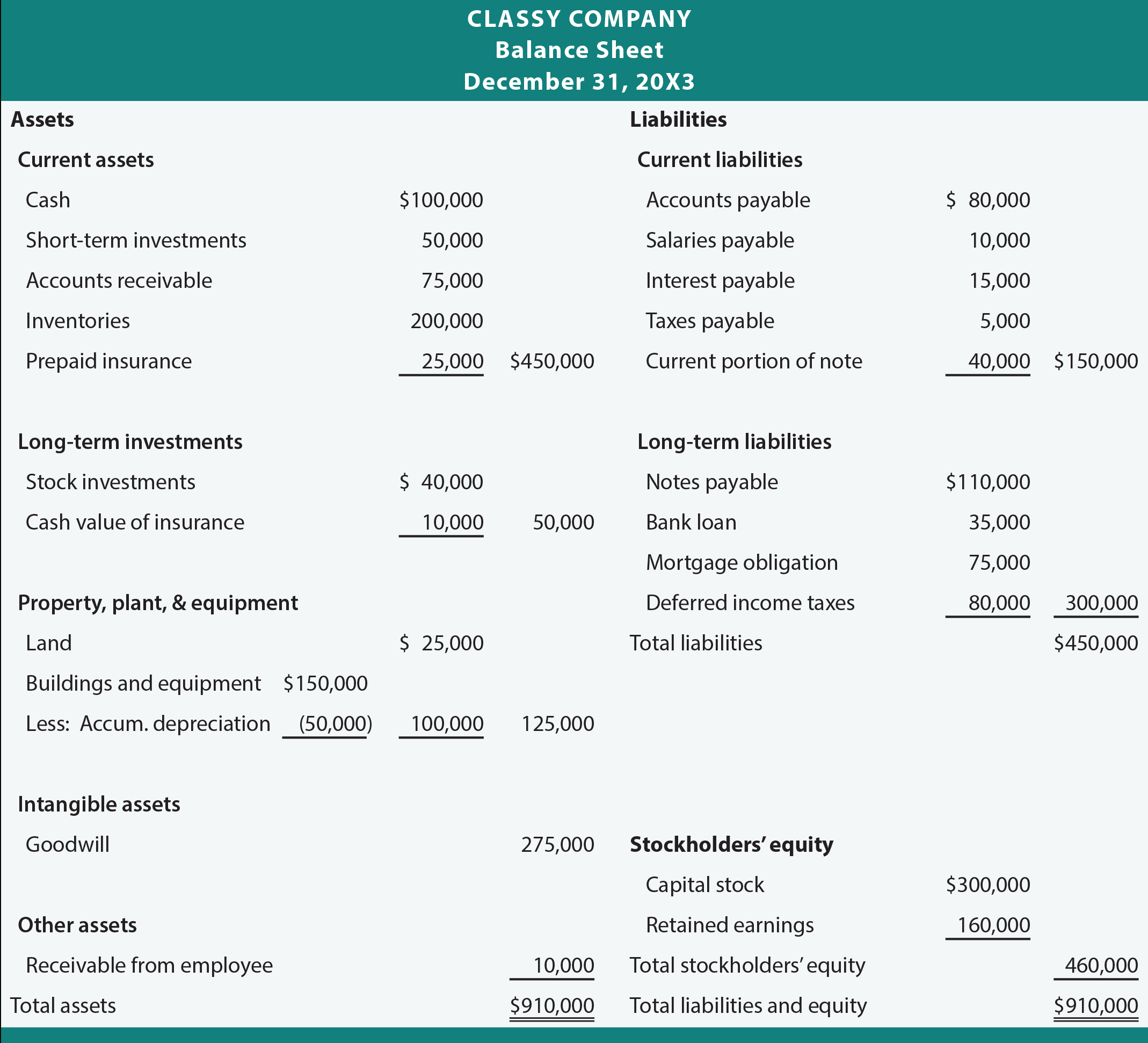

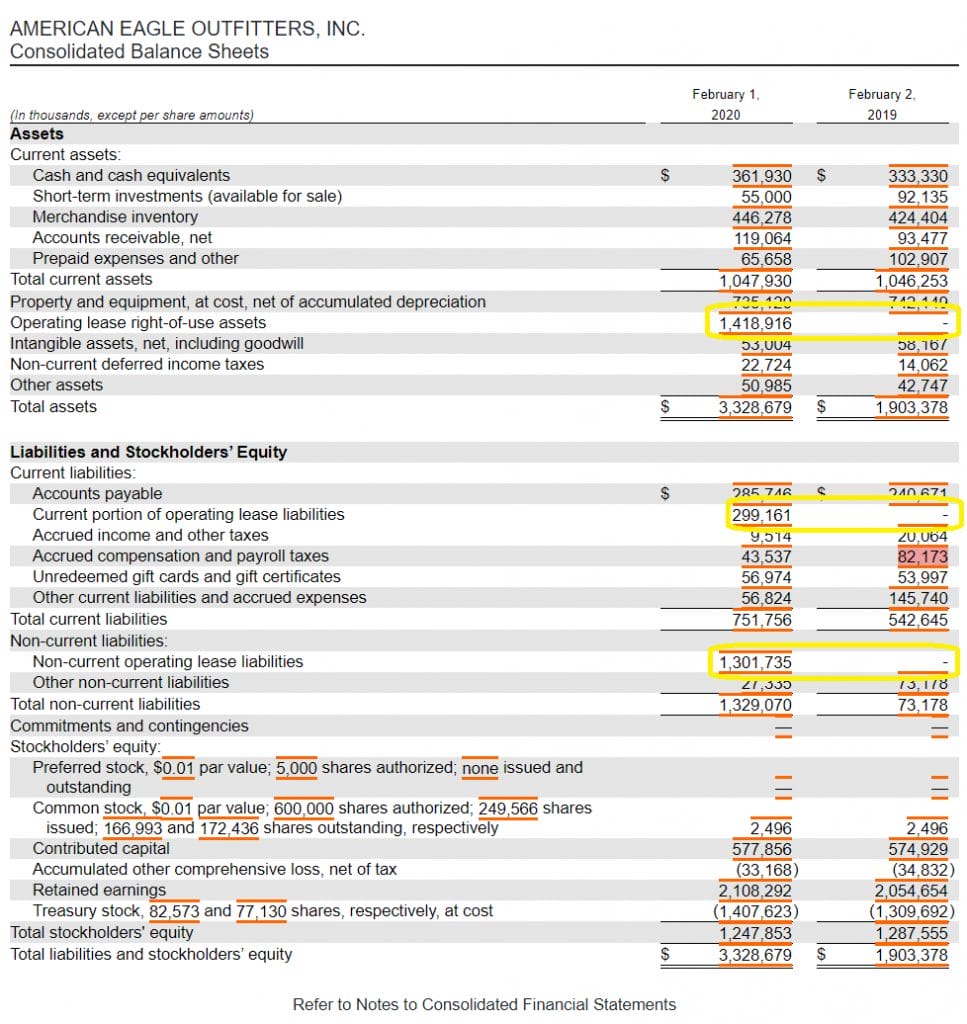

Do expenses go on a balance sheet. The term balance sheet refers to the way assets always equal (or balance) liabilities plus owners' equity. Where is interest expense on the balance sheet? Prepaid expenses are recorded on the balance sheet as an asset, most often as a current asset.

In contrast, accrued expenses are costs incurred by a company but not yet paid for, typically due to the absence of an invoice (i.e. An expense will decrease a corporation's retained earnings (which is part of stockholders' equity) or will decrease a sole. Instead, it is recorded on the income.

Interest expense does not appear directly on the balance sheet. No, expenses do not directly appear on a balance sheet. How an expense affects the balance sheet.

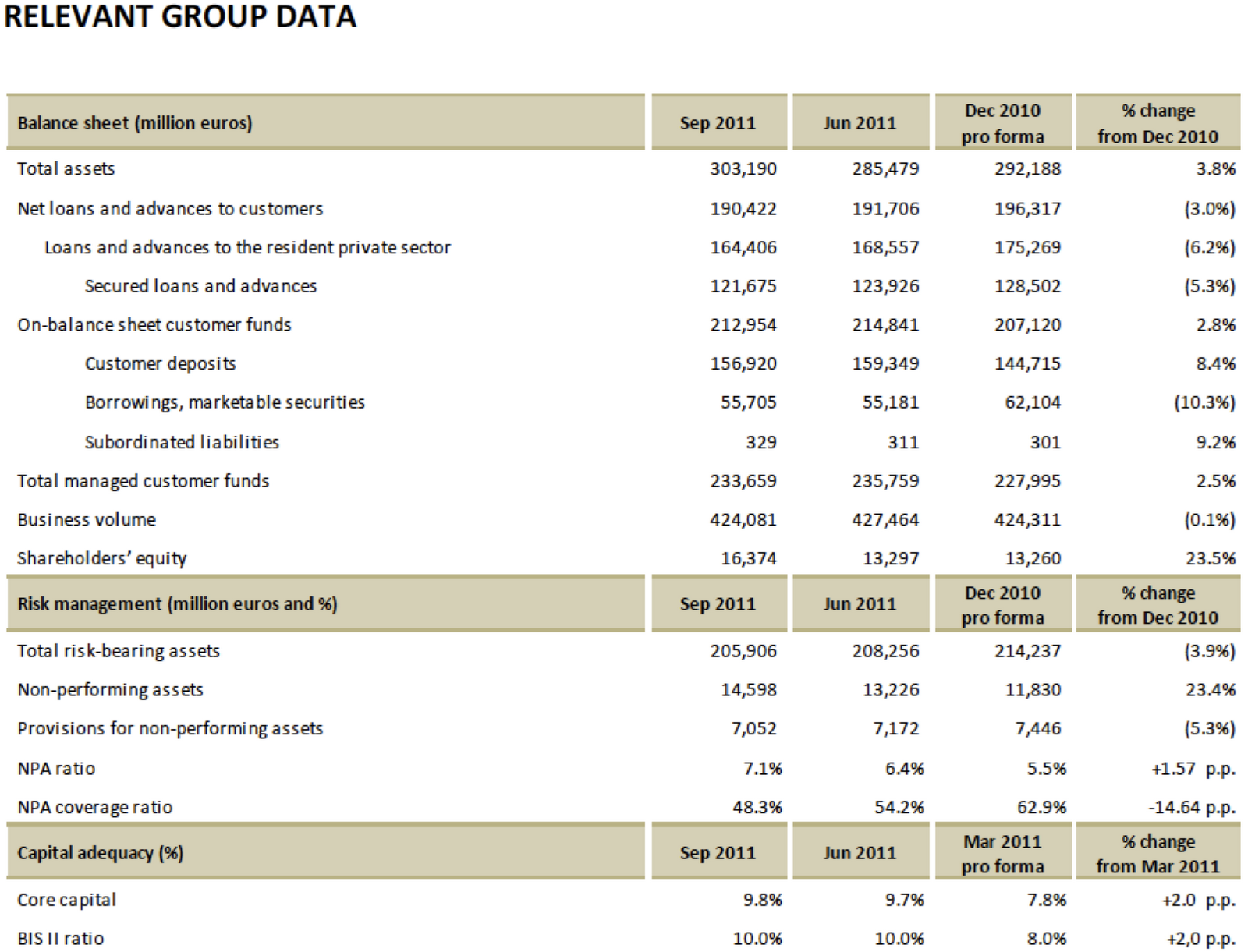

Therefore, balances remaining at the end of an accounting period for personal accounts appear on the balance sheet. A balance sheet provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a. A balance sheet shows all of a company's income, property and other value (listed under assets) and all of its debts and expenses (listed under liabilities).

In short, expenses appear directly in the income statement and indirectly in the balance sheet. The impact of expenses on the balance sheet november 16, 2023 when a business incurs an expense, this reduces the amount of profit reported on the income. Also known as a statement of financial position or a.

It is useful to always read both the income statement and the balance sheet of a company, so that the full effect of an expense can be seen. Business expenses, on the other hand, are charged. Capital expenses some fixed costs are incurred at the discretion of a company’s management, such as advertising.

Income and cash flow statements the income statement, or profit and loss statement,. An accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received, or revenue that has not yet been.