Who Else Wants Info About Financial Statements Are Prepared From The Adjusted Trial Balance

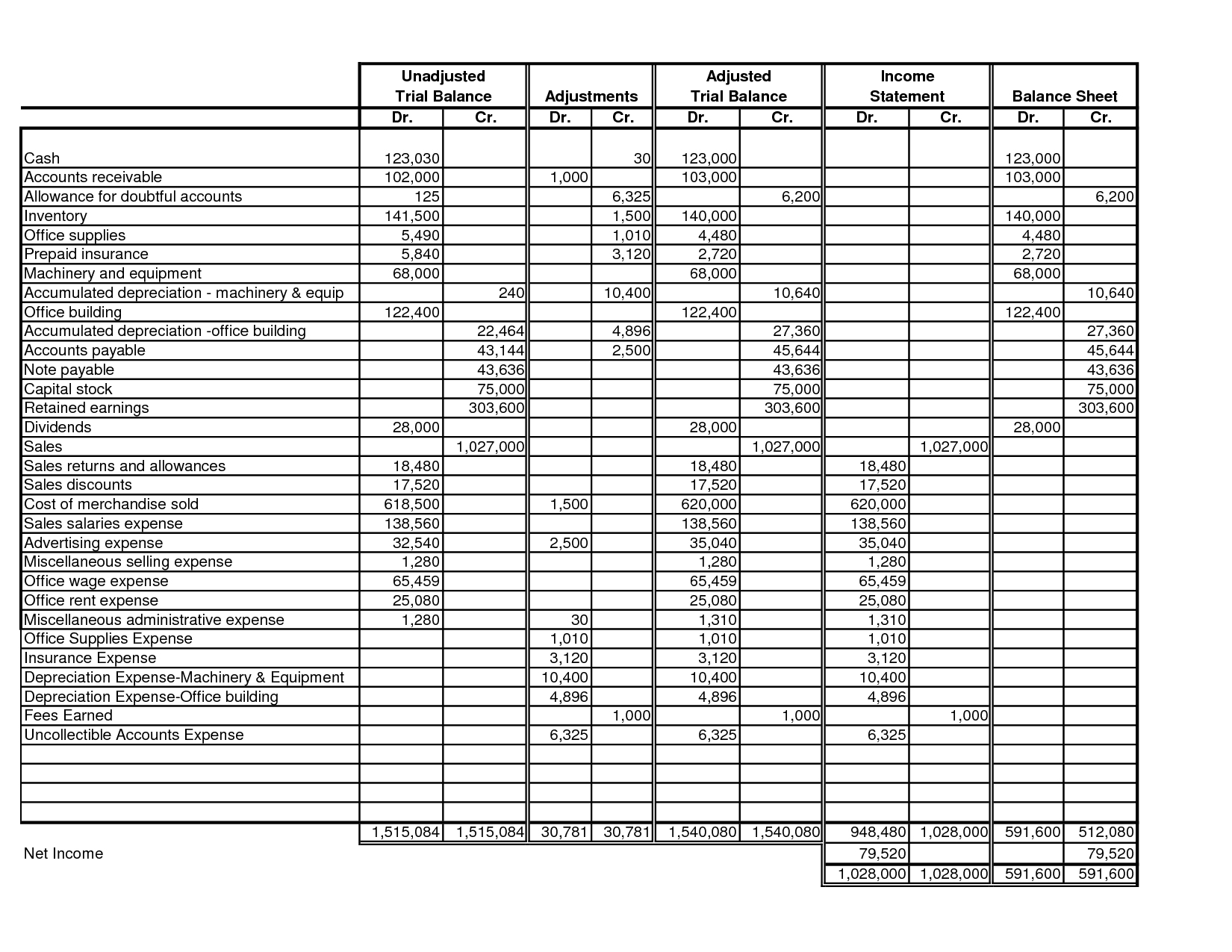

After adjusting entries are made, an adjusted trial balance can be prepared.

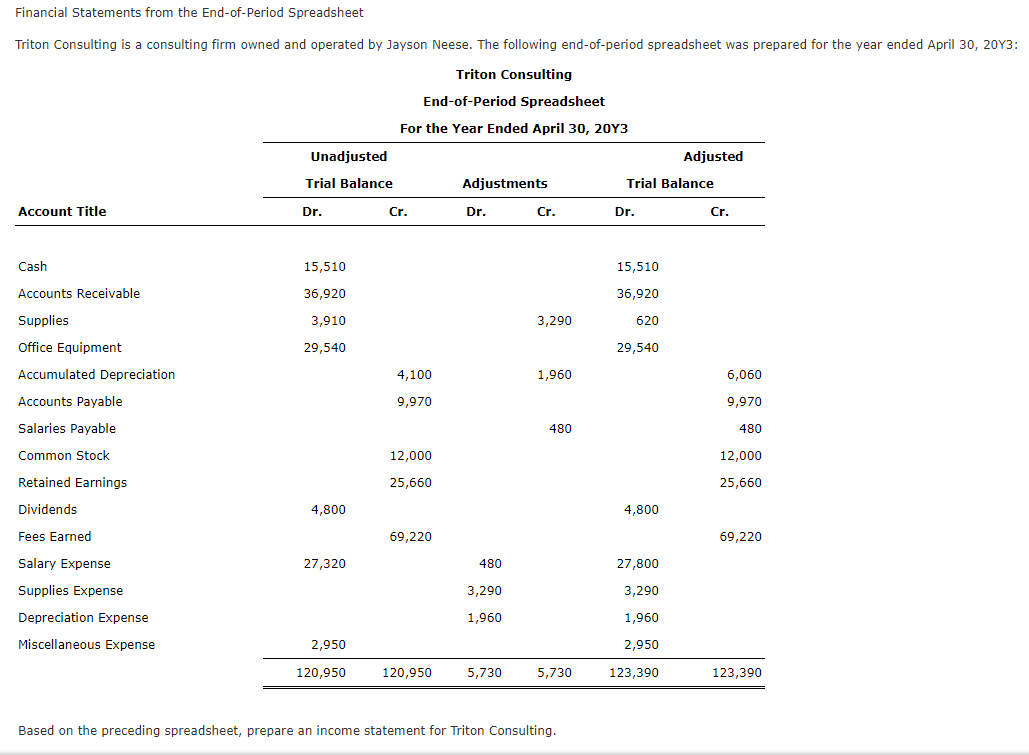

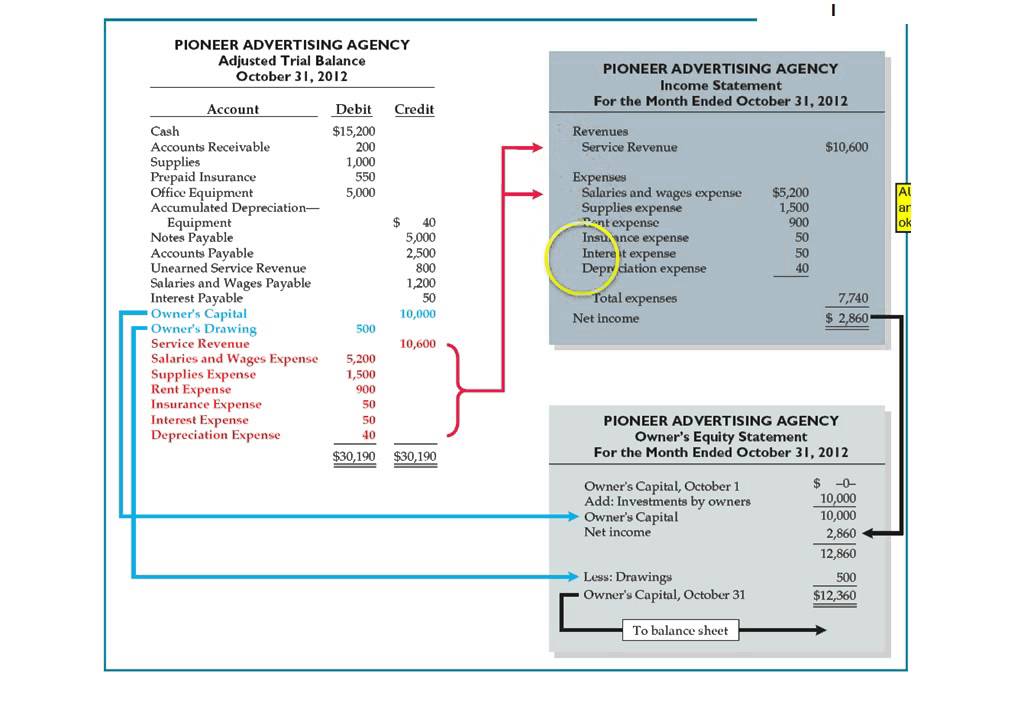

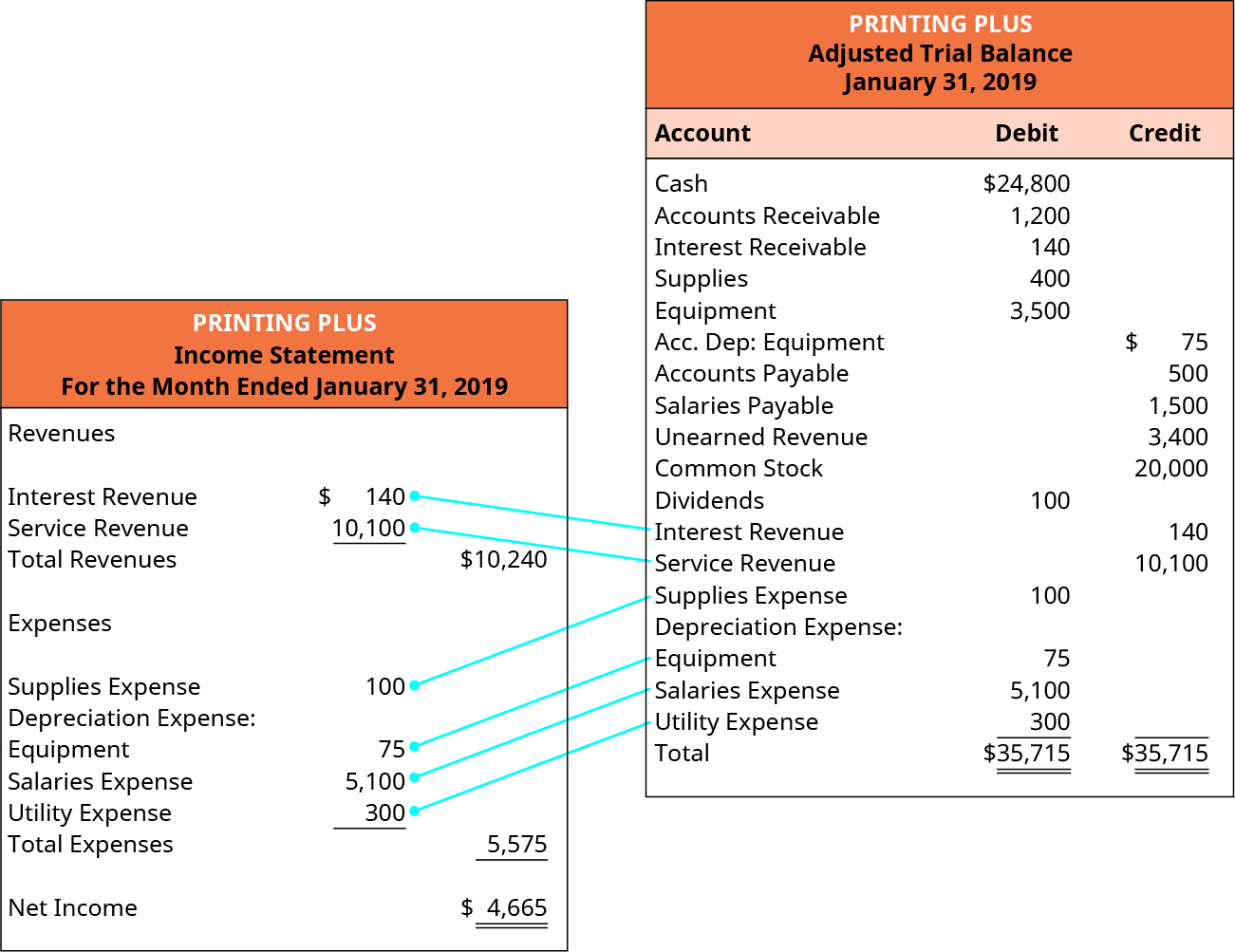

Financial statements are prepared from the adjusted trial balance. Once you have prepared the adjusted trial balance, you are ready to prepare the financial statements. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

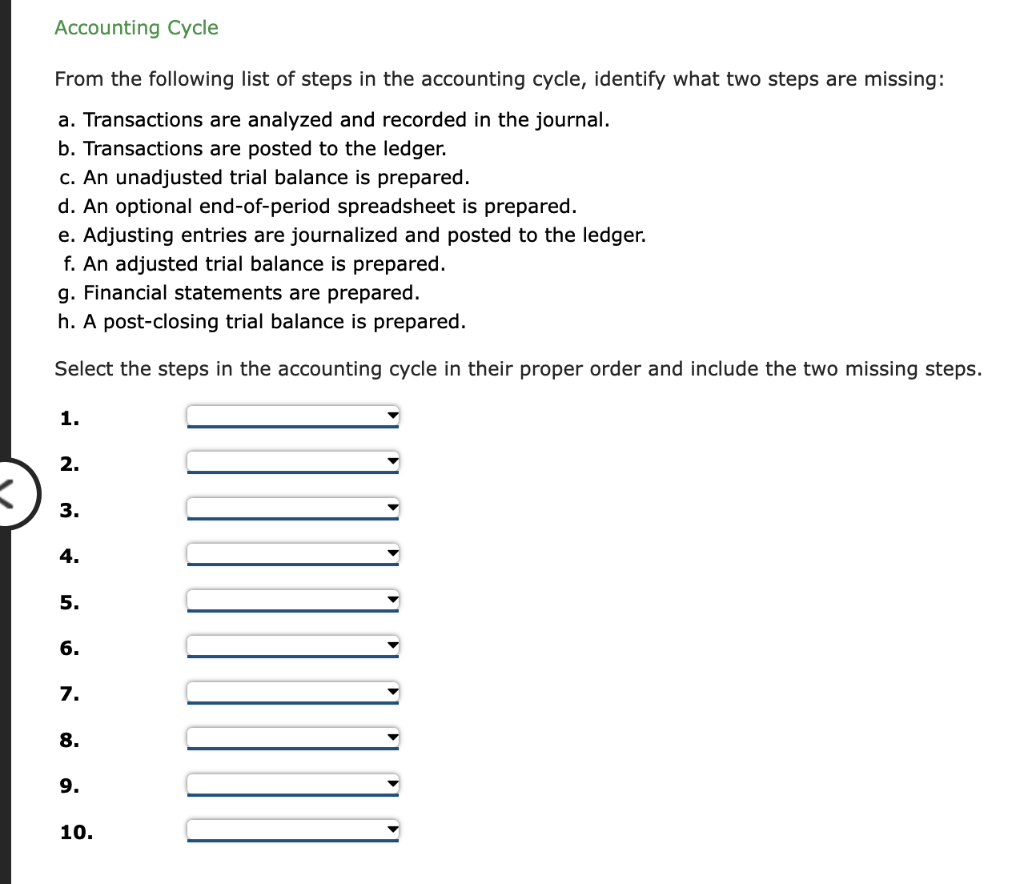

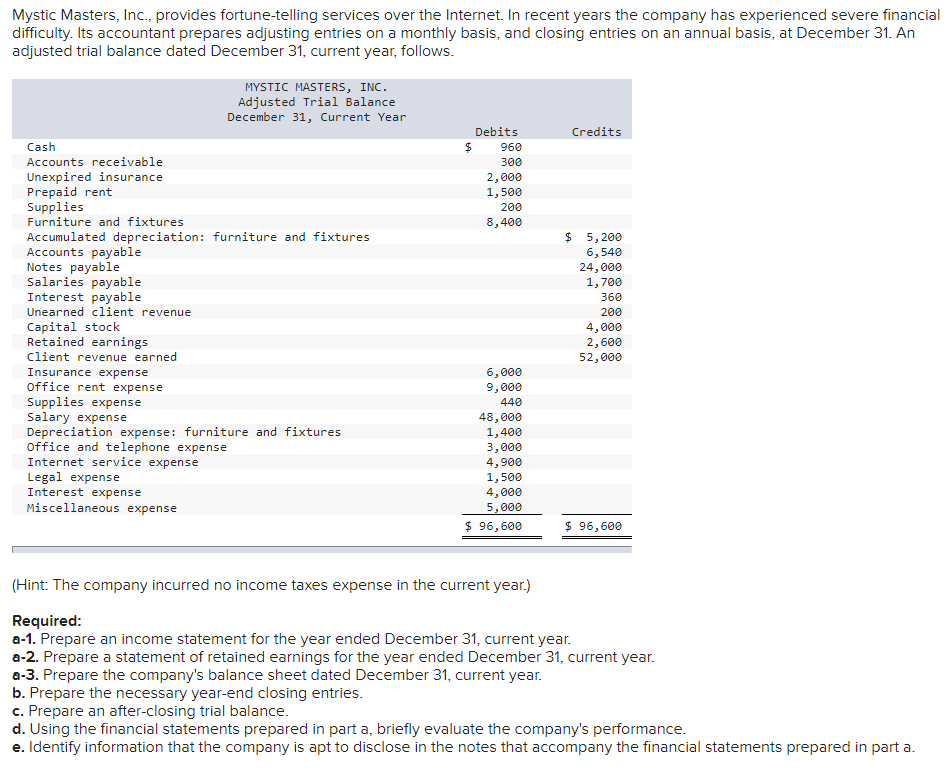

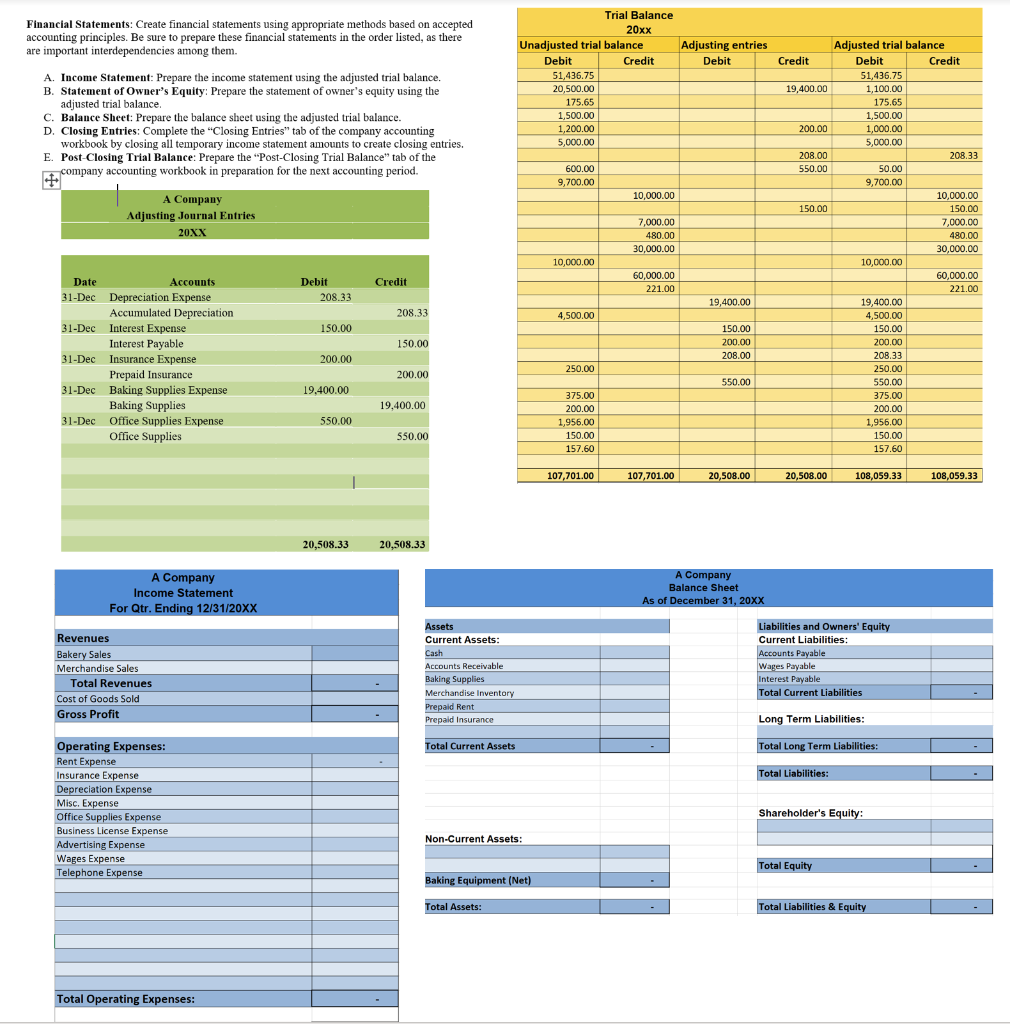

An adjusted trial balance is prepared by creating a series of journal entries that are designed to account for any transactions that have not yet been completed. Preparing financial statements is the seventh step in the accounting cycle. To prepare the financial statements, a company will look at the adjusted trial balance for account information.

The intent of adding these entries is to correct errors in the initial version of the trial balance and to bring the entity's financial statements into compliance with an accounting framework , such as generally accepted. An adjusted trial balance is prepared to check that the accounting records are still in balance, after having posted all adjusting. An income statement, a statement of retained earnings, a balance sheet, and the statement of cash flows.

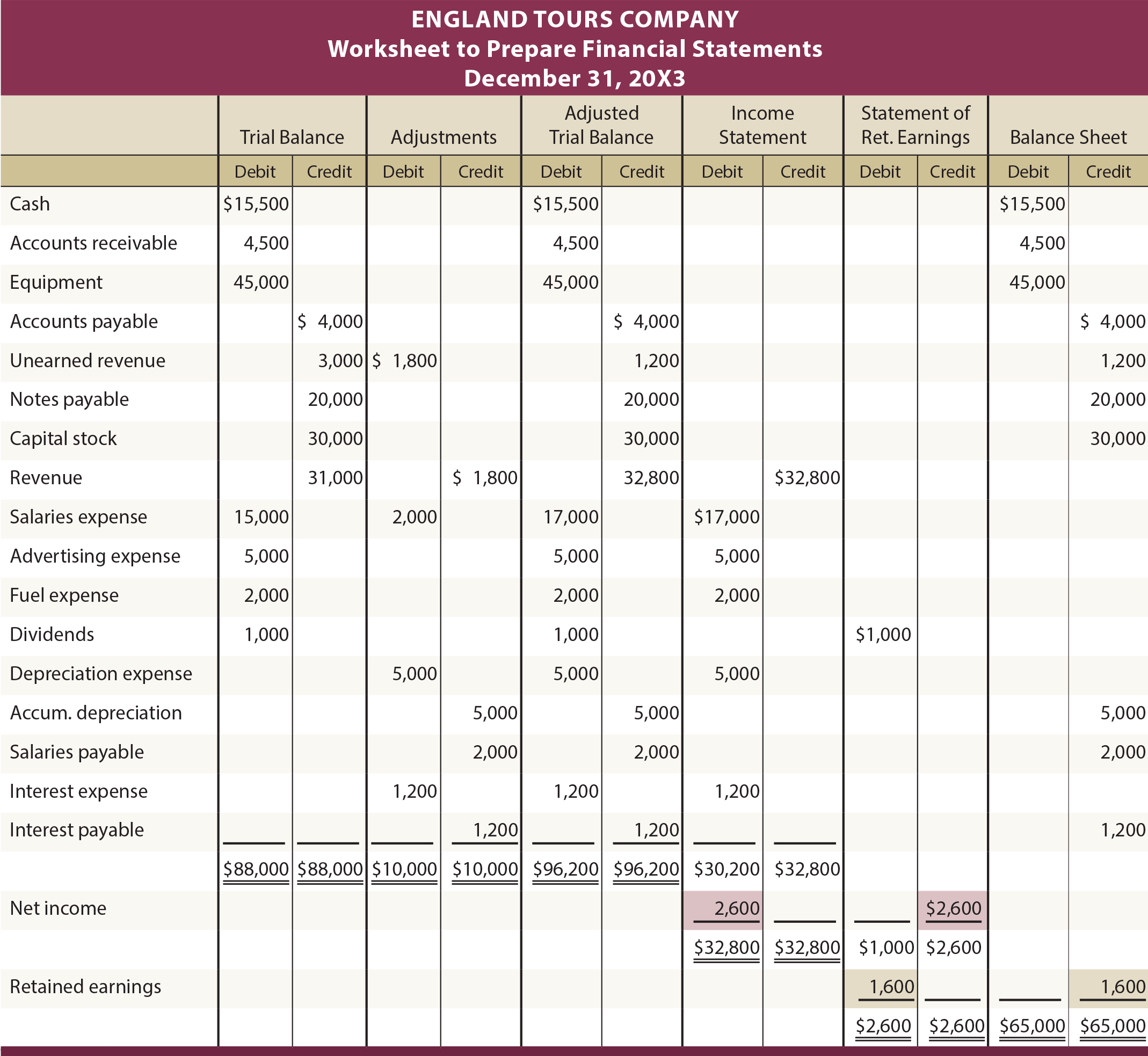

Once the adjusted trial balance has been prepared, we are ready to prepare the financial statements. An adjusted trial balance represents a listing of all the account balances after posting of all the necessary adjusting entries in ledger accounts.¹ the purpose of preparing an adjusted trial balance is to correct any errors and to make the entity’s financial statements compatible with the requirements of an applicable accounting. The financial statements are prepared directly from the adjusted trial balance.

An adjusted trial balance is a list of all accounts in the general ledger, including adjusting entries, which have nonzero balances. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Preparing an adjusted trial balance is the sixth step in the accounting cycle.

Remember that we have four financial statements to prepare: Preparing financial statements is the seventh step in the accounting cycle. Financial statements are prepared directly from the o a.

Using information from the revenue and expense account sections of the trial balance, you can create an income statement. B) proves the equality of the total debit balances and total credit balances of ledger accounts after all adjustments have been made. 3.1 describe principles, assumptions, and concepts of accounting and their relationship to financial statements;

3.2 define and describe the expanded accounting equation and its relationship to analyzing transactions; Because it is only used as an internal document. The next step is to post the adjusting journal entries.

In our detailed accounting cycle, we just finished step 5 preparing adjusting journal entries. 3.3 define and describe the initial steps in the accounting cycle; These statements, which include the balance sheet, income statement, cash flows, and shareholders equity statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels.

An adjusted trial balance is a listing of the ending balances in all accounts after adjusting entries have been prepared. From this information, the company will begin constructing each of the statements, beginning with the income statement. This will involve adjusting for the following items: