Breathtaking Info About Financial Ratios Used By Lenders To Evaluate A Company

Based on these ratios, lenders determine the terms and conditions of loans or credit.

Financial ratios used by lenders to evaluate a company. The formula for it is: A financial analysis of a company's financial statements—along with the footnotes in the annual report. A company’s stock is trading at $50 per share.

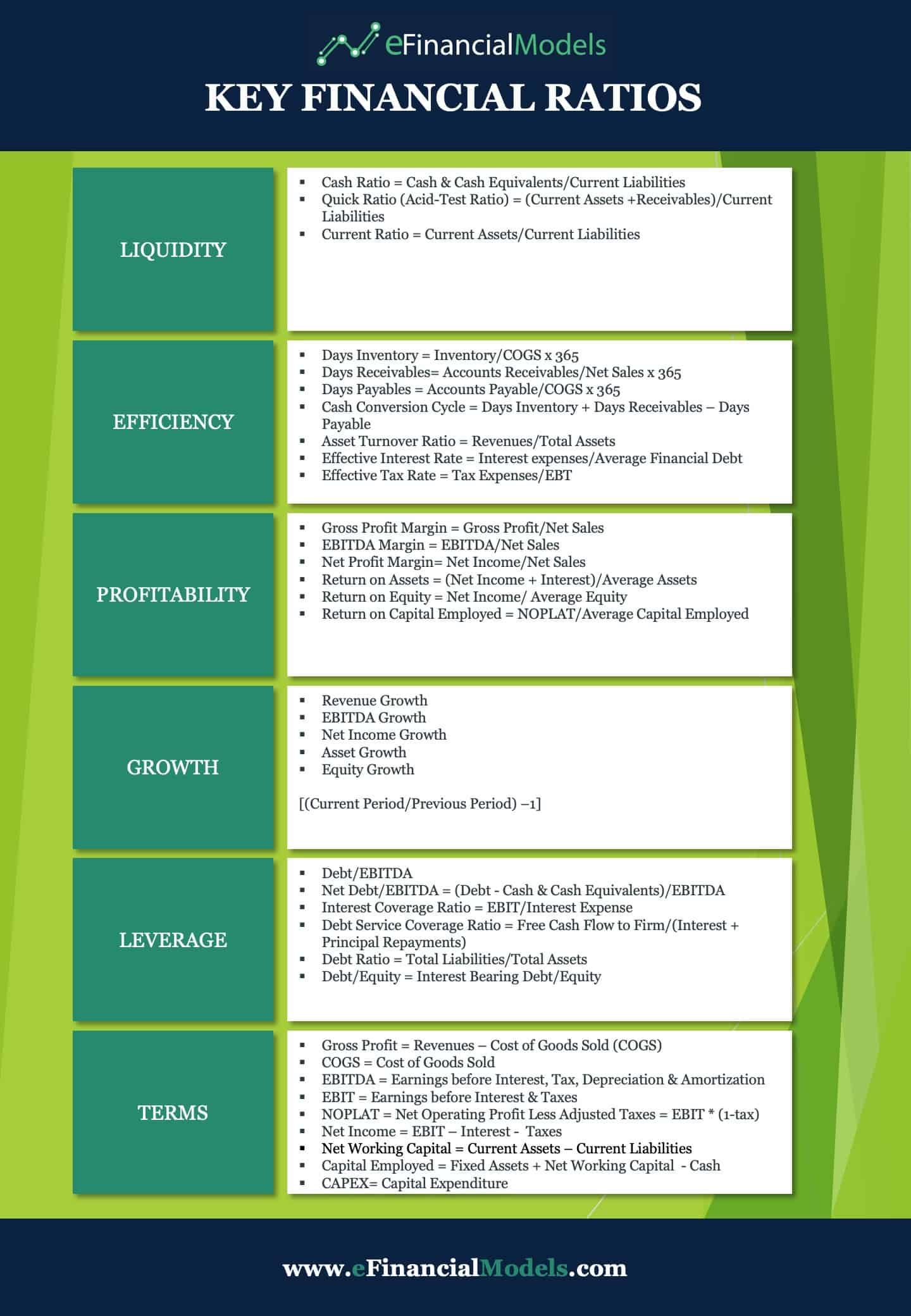

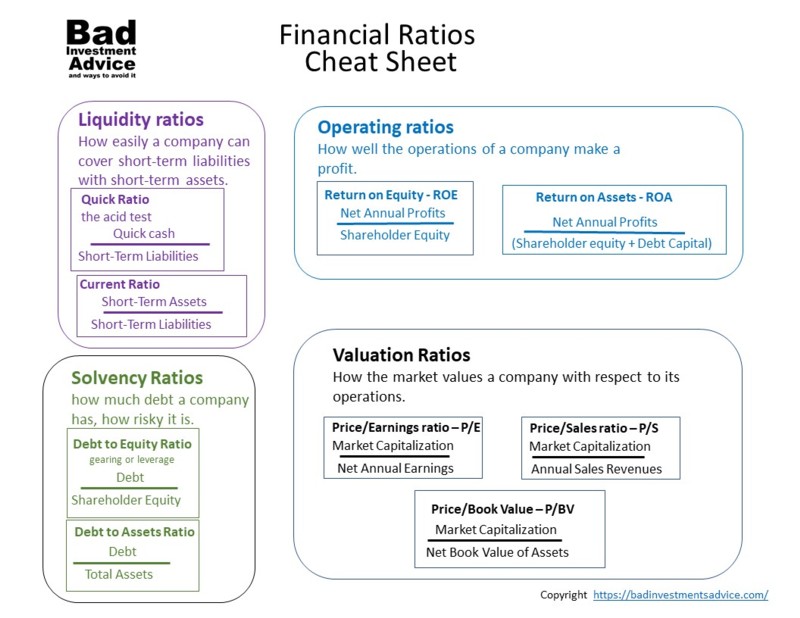

The leverage ratio is used to evaluate the capital structure of a company. Uses and users of financial ratio analysis. These ratios enable banks to confirm whether an applicant will be a worthy borrower.

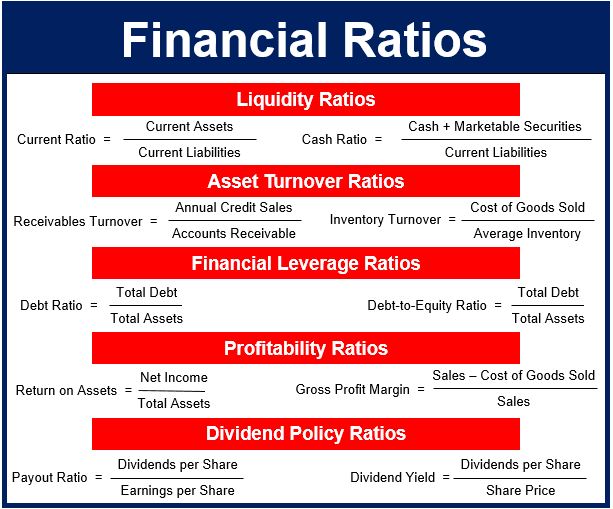

Debt to equity (d/e) debt to equity or d/e is a leverage ratio. Financial ratios are grouped into the following categories: Liquidity ratios liquidity ratios measure a company’s ability to.

Financial ratios are calculated by comparing key financial metrics derived from the income statement, balance sheet, and cash flow statement. All else equal, lenders consider companies with a. $100 million x 0.5% = $500,000 since at any given time, depositors only withdraw a small fraction of their deposits, the bank does not need to keep all those deposits as cash on hand and can instead maintain only a small reserve while loaning out the remainder of those deposits.

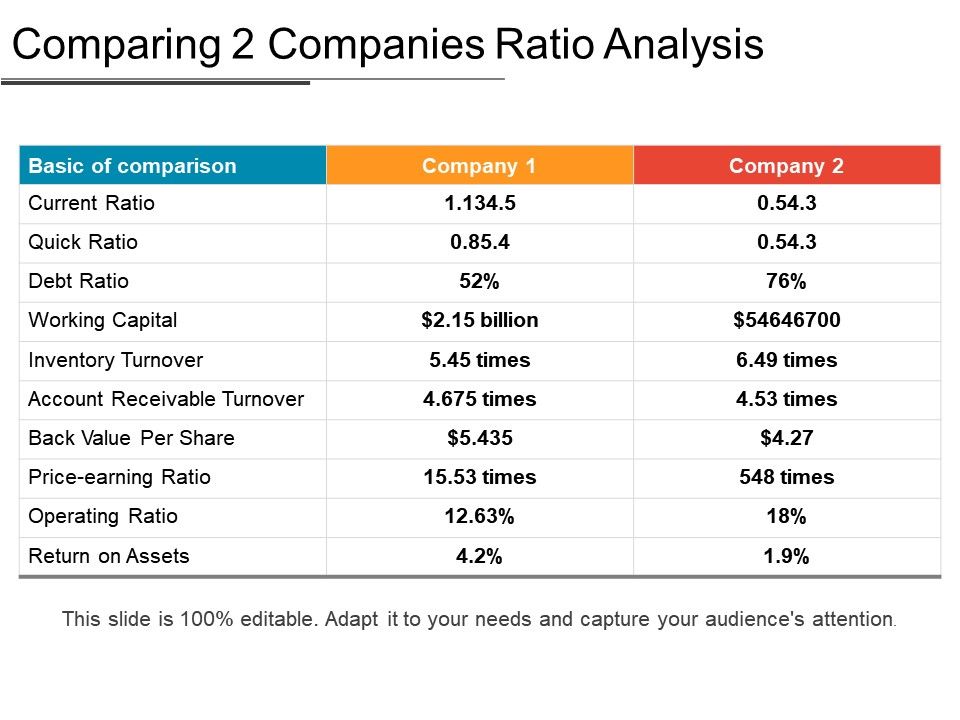

Analysis of financial ratios serves two. Credit analysis involves both qualitative and quantitative aspects. These ratios are used by financial analysts, equity research analysts, investors, and asset managers to evaluate the overall financial health of businesses, with the end goal of making better investment decisions.

In order to calculate it, all current assets are divided by all current liabilities. These terms and conditions are set by the lenders to ensure that borrowers are strong enough. Lenders considering loans to a business use a variety of ratios calculated from the financial statements of the company seeking to borrow.

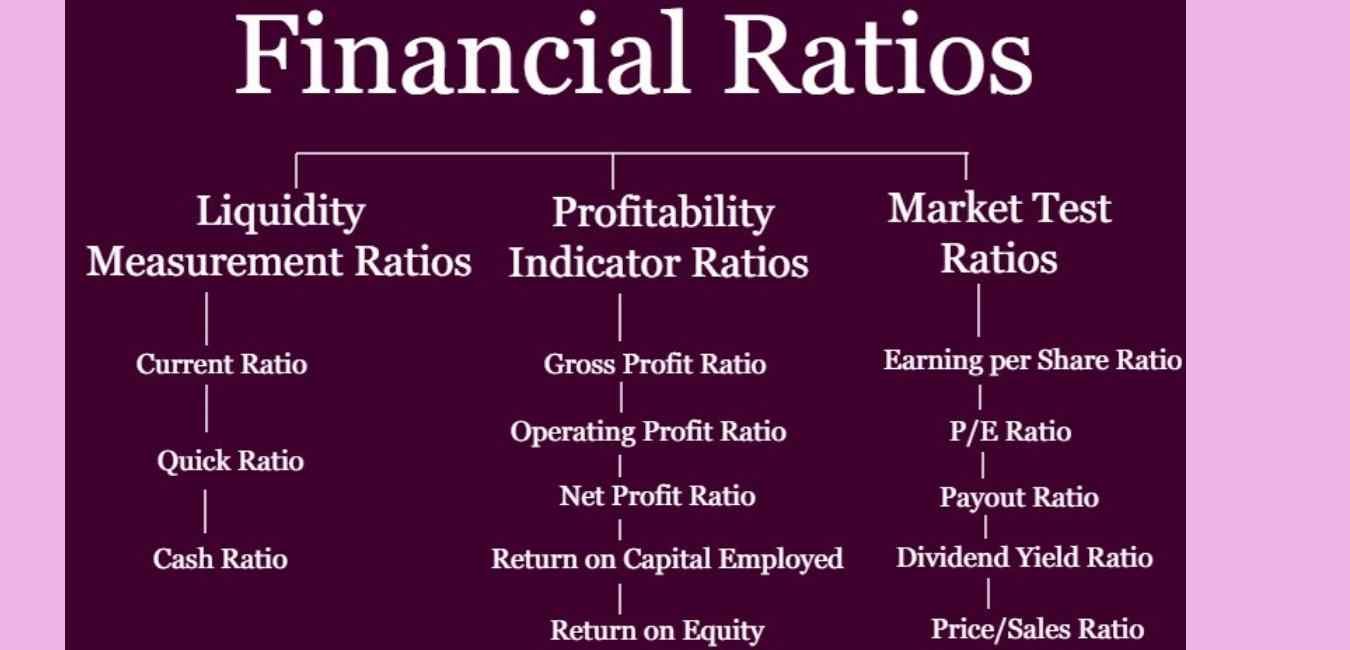

Summary lending ratios exist to conduct credit and financial analysis of potential borrowers before loan origination. The common financial ratios every business should track are 1) liquidity ratios 2) leverage ratios 3)efficiency ratio 4) profitability ratios and 5) market value ratios. Michael logan what is ratio analysis?

The financial leverage ratio is used to assess the worth of a company’s financial risk by estimating the value of debt compared to the company’s equity or assets. Interest coverage = operating income / interest expenses these leverage ratios are very important for the company’s internal users as well as external users. Credit analysis ratios are tools that assist the credit analysis process.

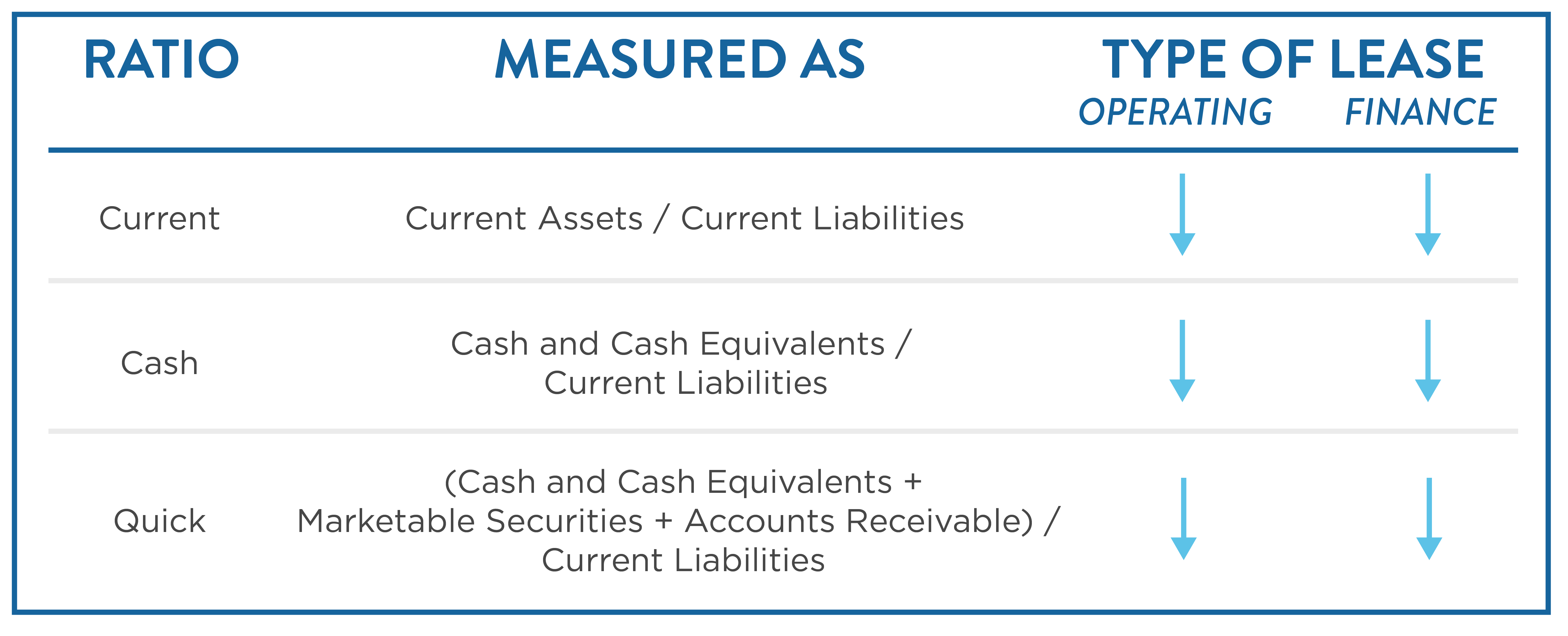

Its goal is to compare and quantify magnitudes objectively in order to better visualize corporate performance and make decisions based on certain goals. Creditors and lenders use financial ratios to evaluate a company’s creditworthiness and ability to repay loans. Current, quick, cash, and net working capital ratios are the different types of liquidity ratios.

From stock ratios to investor ratios, our expert guide walks you through 20 of the most important financial ratios to analyze a company. Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational efficiency, and profitability by studying its. Recommended articles key takeaways banks and other financial institutions use lending ratios while reviewing loan applications.