Brilliant Info About Accounting For Ifrs 16

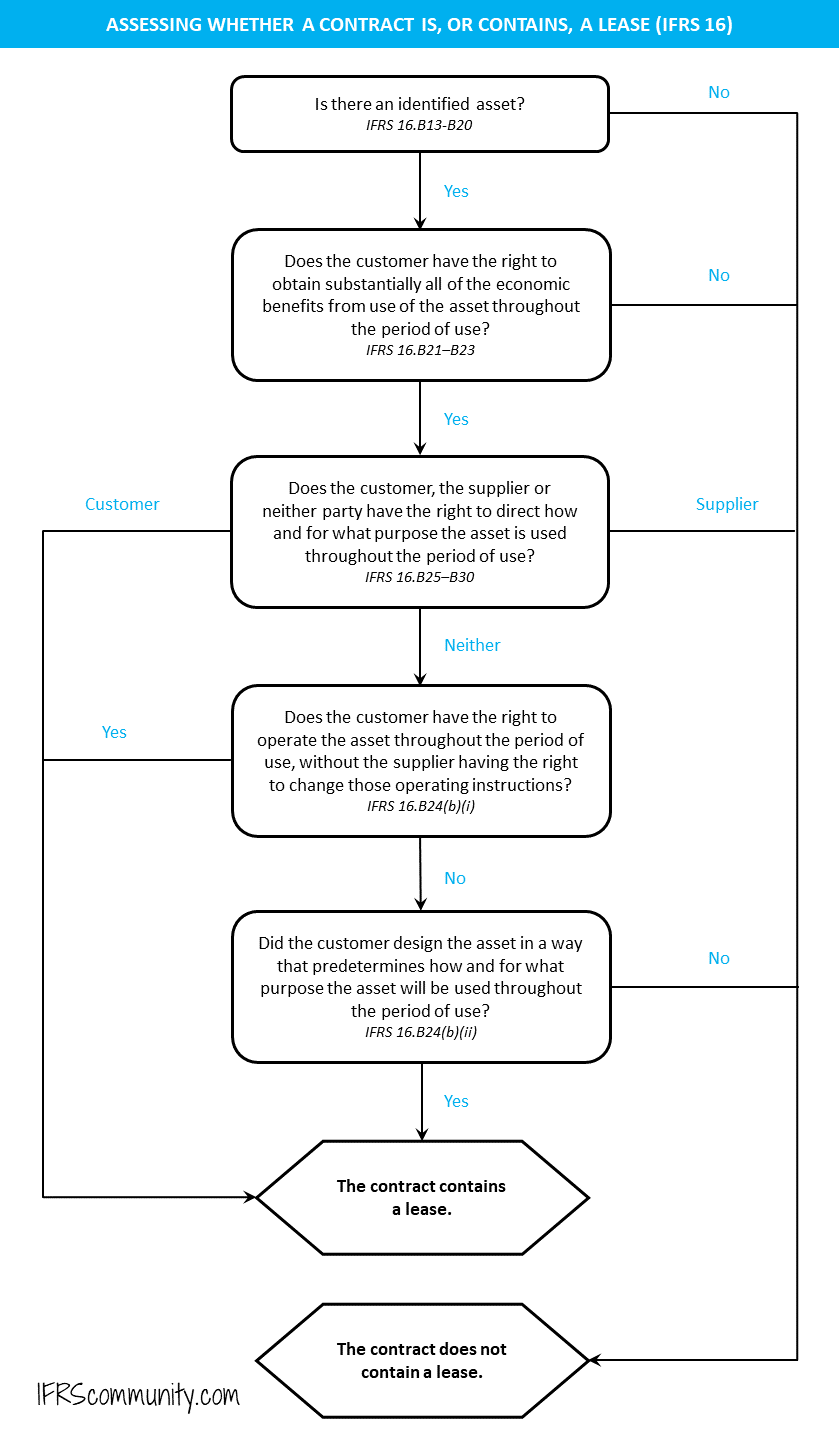

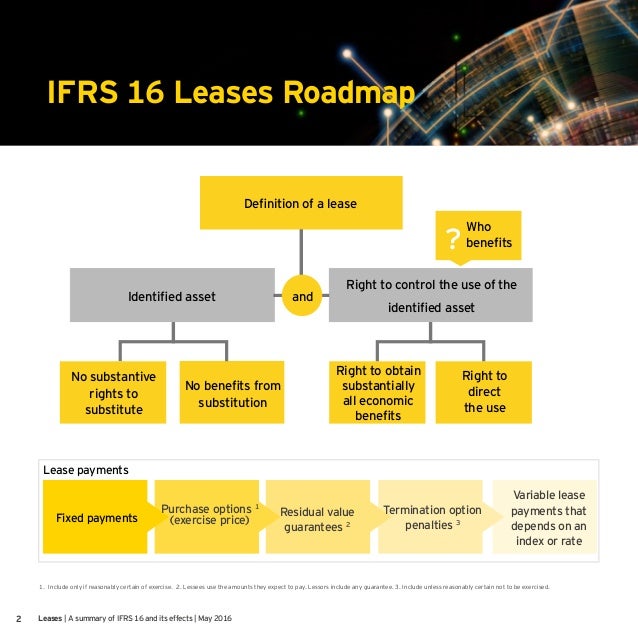

A contract is, or contains, a lease if there is an identified asset and the contract conveys the right to control the use of the identified asset for a.

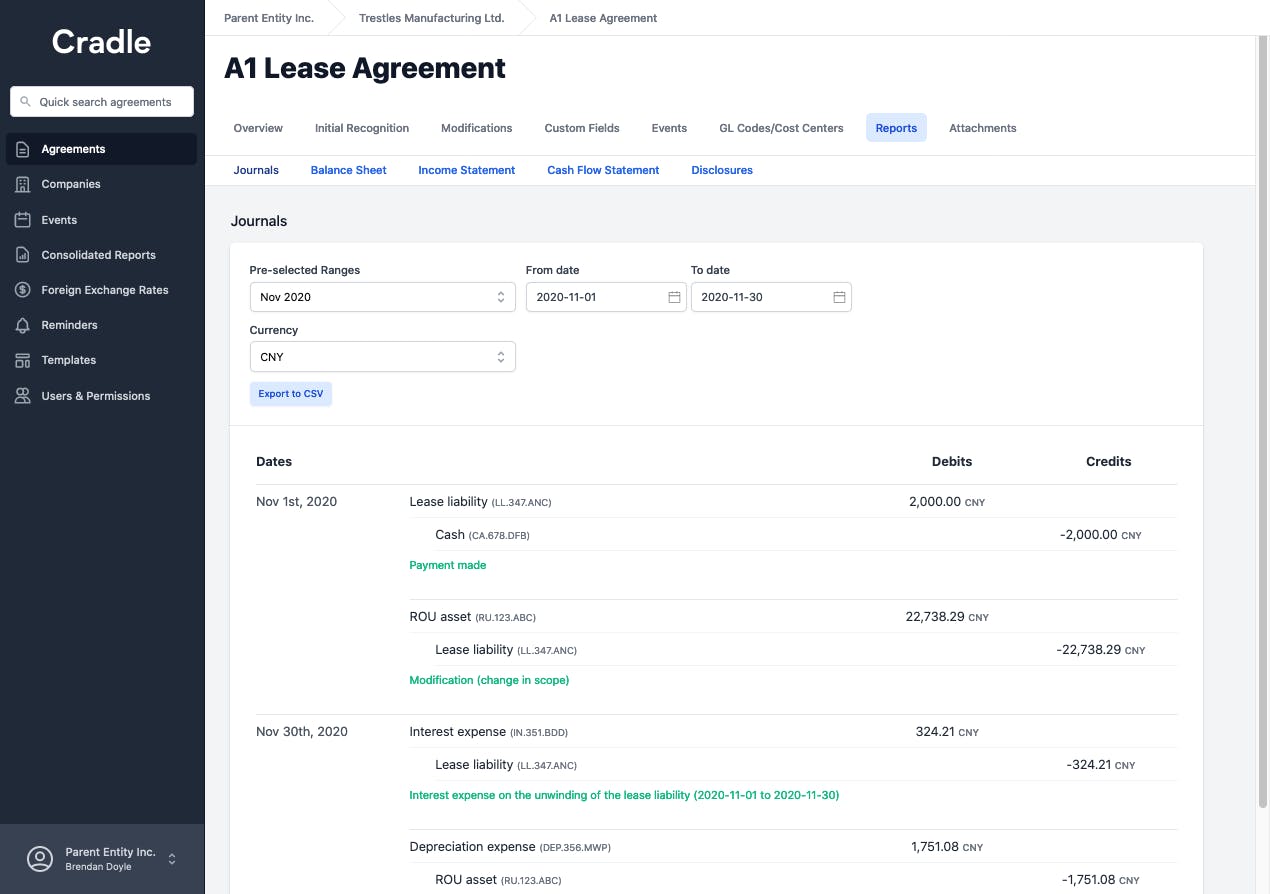

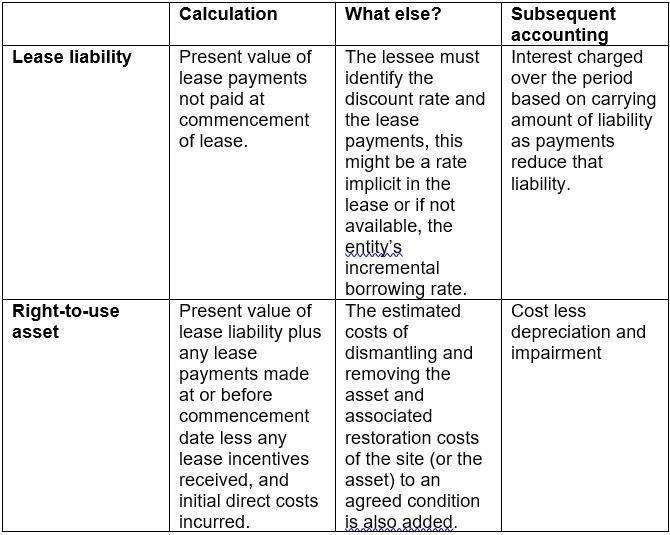

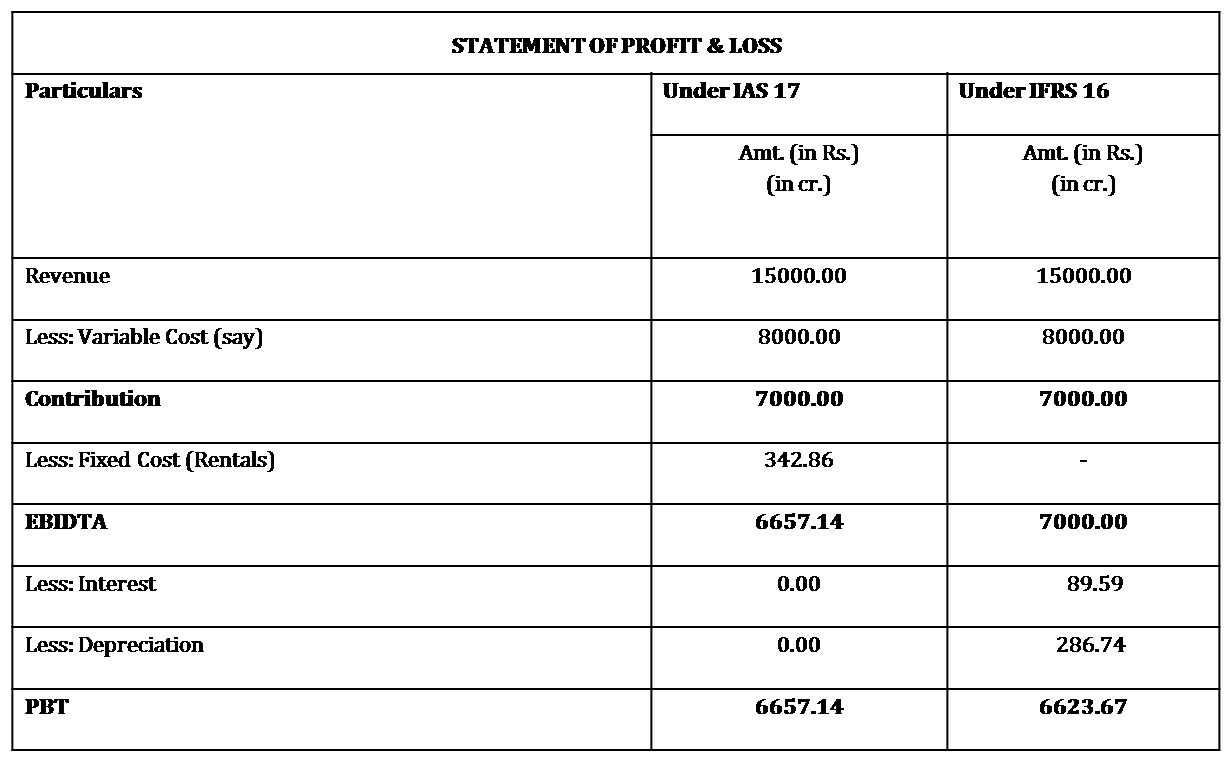

Accounting for ifrs 16. It enables companies to use property, plant, and equipment without. An estimate of costs expected to be incurred by the lessee for dismantling and removing the underlying asset, restoring the site where it is located or restoring the. Within the lessee accounting model under ifrs 16, there is no longer a classification distinction between operating and finance leases.

Lessor accounting (ifrs 16) last updated: Iasb chairman hans hoogervorst introduces the new leases standard. The key matter, in determining the accounting for lessors, is whether the.

Under ifrs 16 brings new lease accounting requirements when accounting in compliance with ifrs 16/aasb 16 as a lessee, the party leasing the. However, a lessee could choose to account for leases of such. The goal of ifrs 16 is to offer a comprehensive model for lessee and lessor accounting, covering new, existing, and future leases.

To meet that objective, a lessee should recognise assets and liabilities arising from a lease. Leasing is an important financial solution used by many organisations. The standard provides a single lessee accounting model,.

It then takes a deeper dive into critical. Definition of a lease—substitution rights (ifrs 16) economic benefits from use of a windfarm (ifrs 16) ibor reform and its effects on financial reporting—phase 2;. 7 february 2024 lessors are required to classify each of their leases as either an operating lease or a finance lease.

The table below summarises the requirements for lessor accounting under ifrs 16. Ias 16 2021 issued ifrs standards (part a) ias 16 property, plant and equipment in april 2001 the international accounting standards board (board) adopted ias 16 property,. Initial measurement with the interest rate of 6%, we can calculate the discount factor using the formula of 1/ (1+r) ^n,.

Ifrs 16 introduces a single lessee accounting model and requires a lessee to. Overview ifrs 16 specifies how an ifrs reporter will recognise, measure, present and disclose leases. A lessee is not required to apply ifrs 16 to leases of intangible assets not covered by the exceptions above.

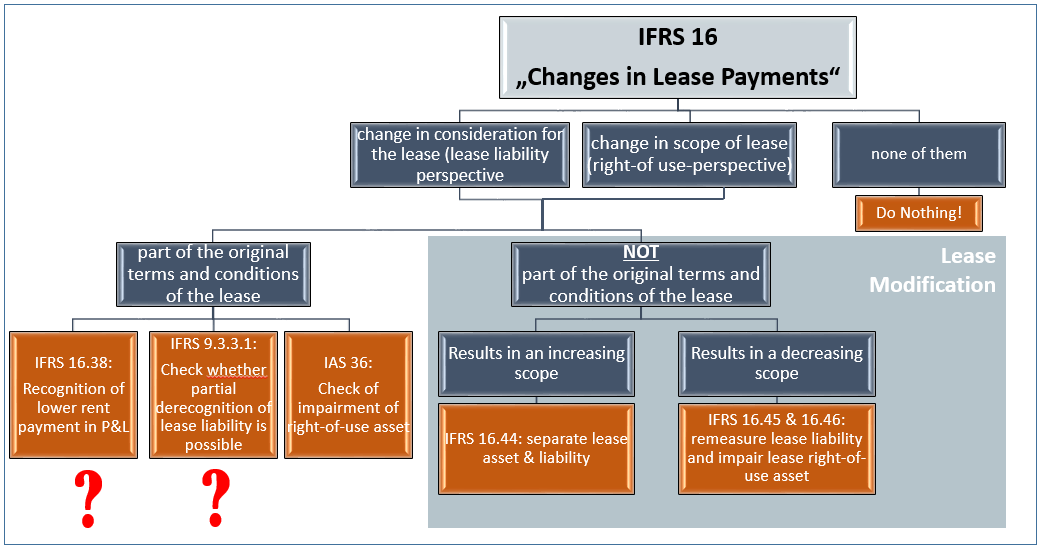

Ias 8 accounting policies, changes in accounting estimates and errorschanges in accounting estimates and errors. Changes in accounting estimates and errors. The ifrs 16 lease accounting standard is a recent standard issued by the ifrs foundation and the international accounting standards board (iasb) setting out the.