First Class Info About The Basic Financial Statements Include

The basic financial statements include all of the following except:

The basic financial statements include the. Balance sheet, income statement, and cash flow statements. If you can read a nutrition label or a baseball box score, you can learn to read basic financial statements. An overview (see related pages) both exeter investors (maxidrive's new owner) and american bank (maxidrive's largest creditor) used maxidrive's financial statements to learn more about the company before making their purchase and lending decisions.

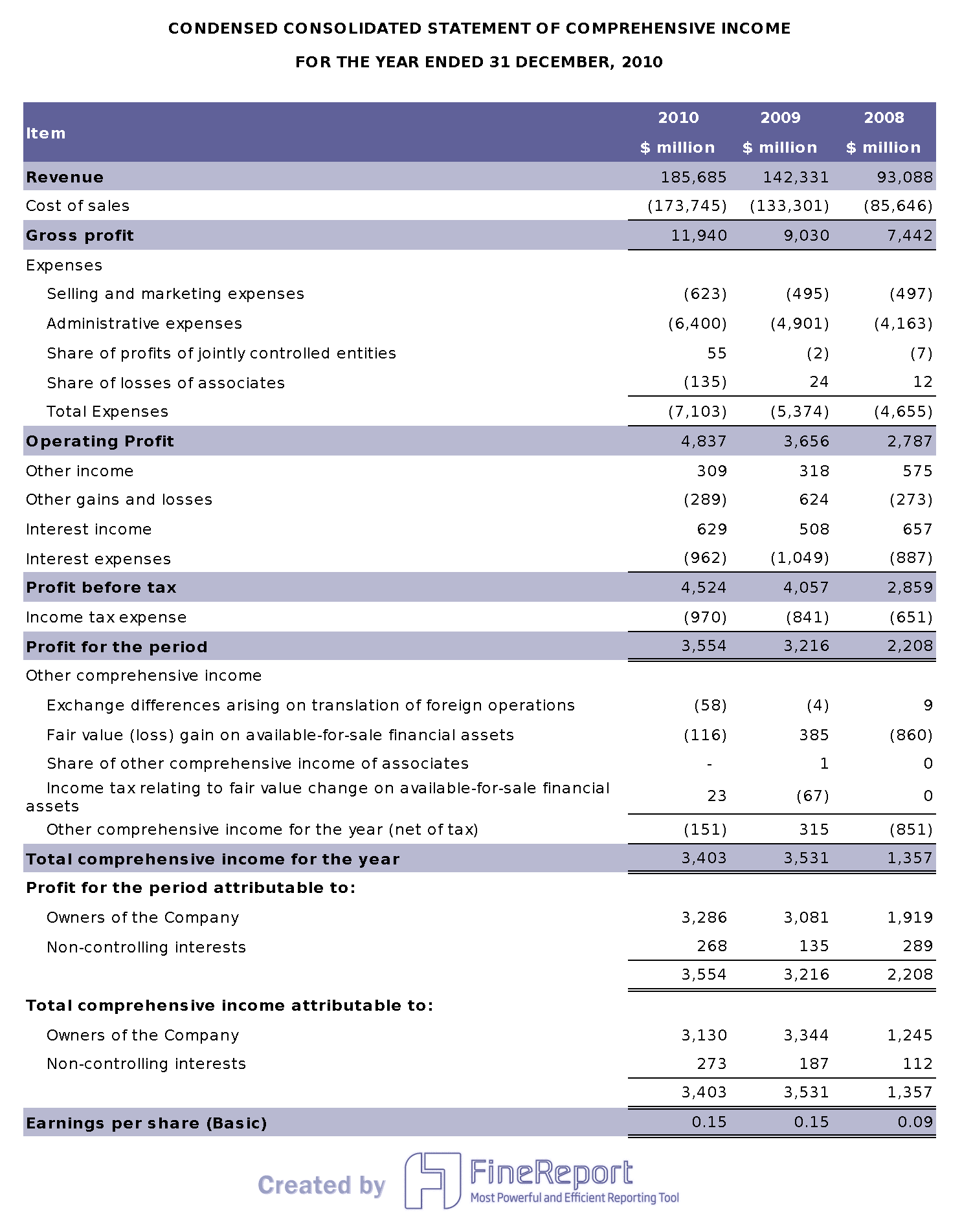

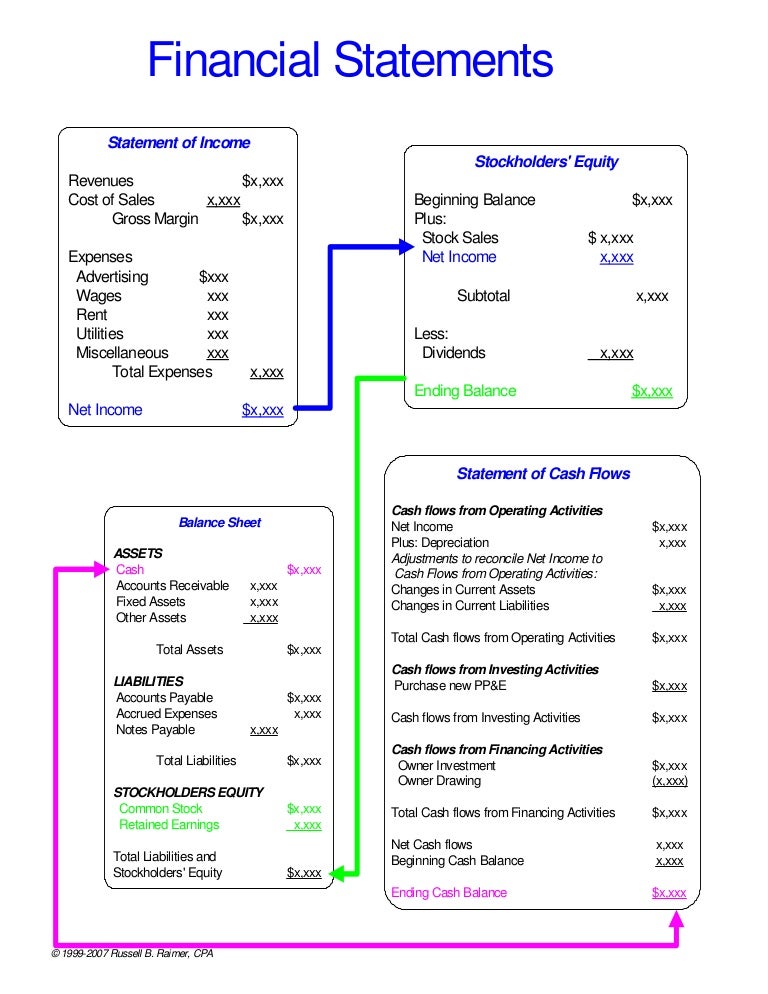

Financial statements explained financial statements video financial statements provide a representation of a company’s financial performance over time. In short, the balance sheet is a financial statement that provides a. It allows you to see what resources it has available and how they were financed as of a specific date.

The standard requires a complete set of. Financial statements can help you make these critical business decisions. Brent corporation had retained earnings of $529,000 at january 1 of the current year.

Another $50,000 of dividends were declared late in december, but were unpaid at. The income statement is the most common financial statement and shows a company's revenues and total expenses, including noncash accounting, such as depreciation over a period of time. They'll show you and your potential investors how healthy your business is.

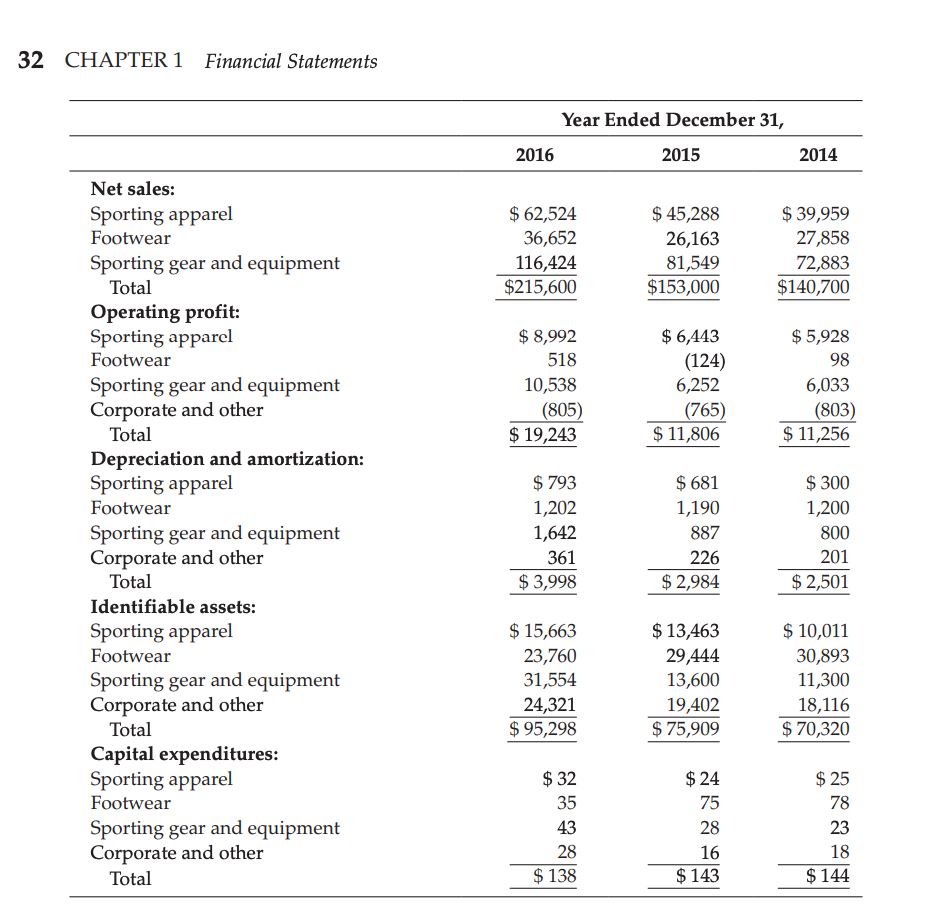

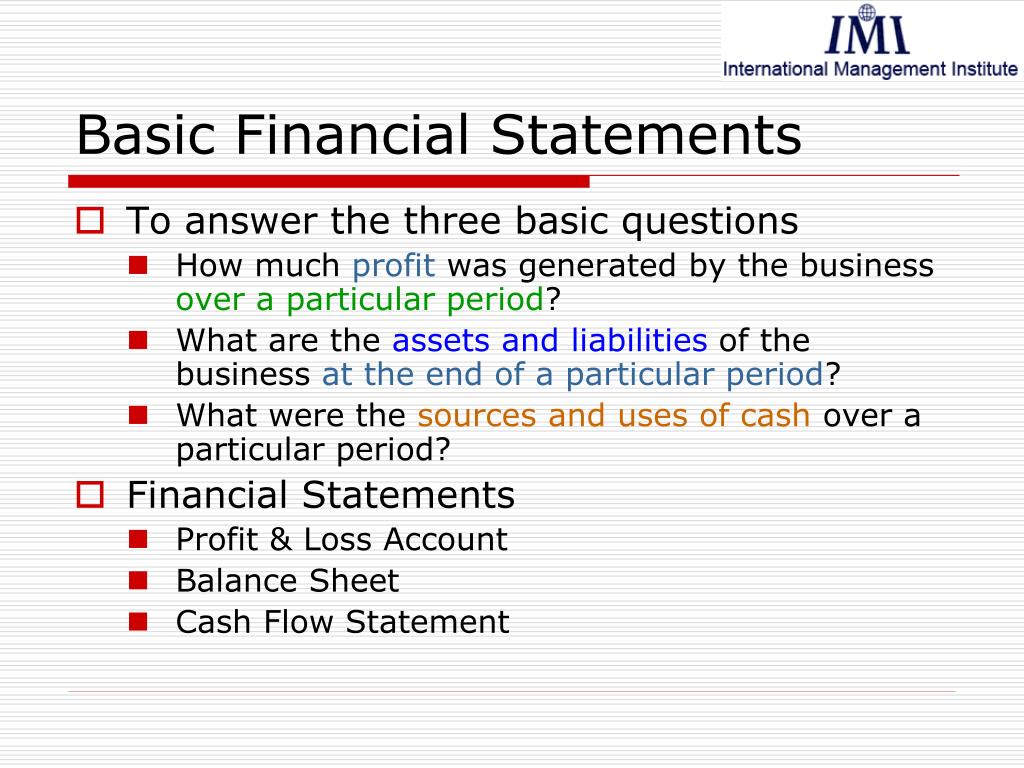

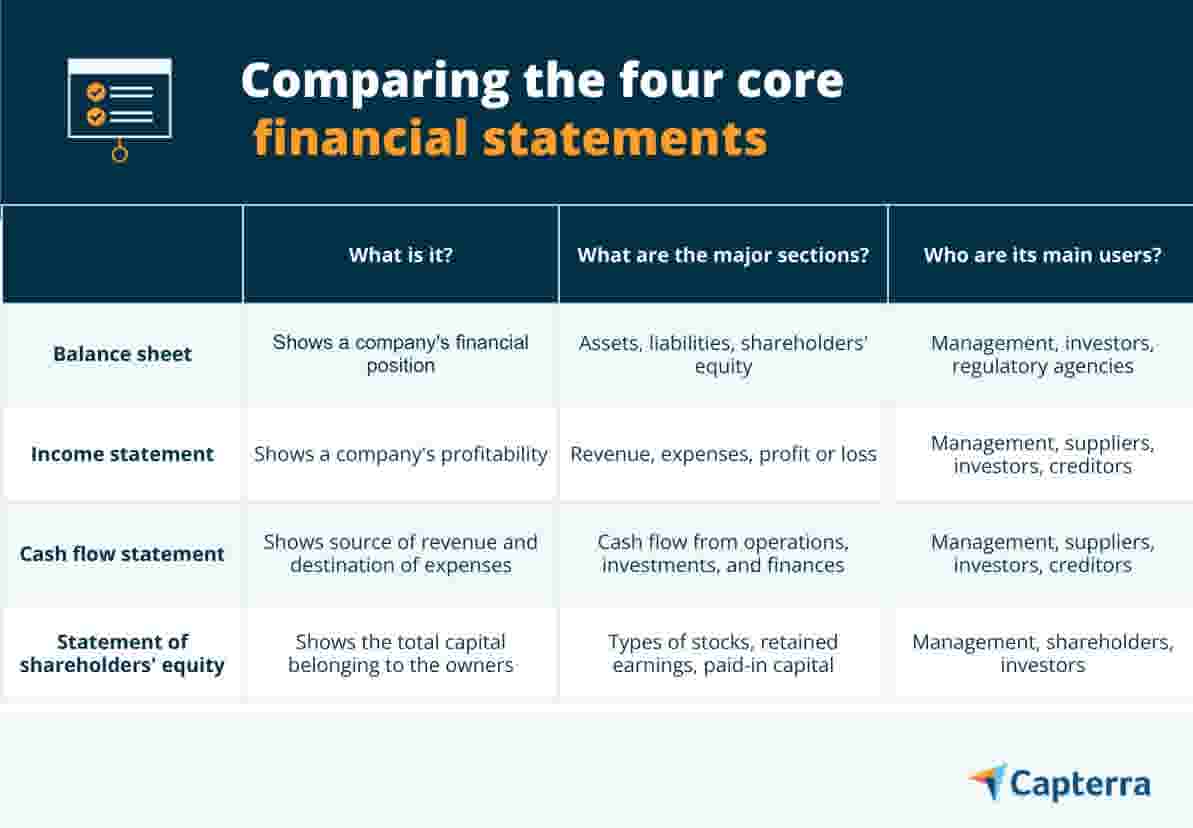

What are the four basic financial statements? The four basic financial statements that businesses and organizations use to track profits, expenses and other financial information work together to form a complete picture of a company's financial health. Financial statements to use the financial statements used in investment analysis are the balance sheet, the income statement, and the cash flow statement with additional analysis of a.

What does it tell us? The four basic financial statements: If you can follow a recipe or apply for a loan, you can learn basic accounting.

The balance sheet provides the details of the company’s sources and uses of funds. Each of the financial statements provides important financial information for both internal and external stakeholders of a company. The balance sheet presents the assets, liabilities, and equity of the entity as of the reporting date.

Net income for the year was $2,496,000 and cash dividends of $750,000 were declared and paid. The basic financial statements of an enterprise include the 1) balance sheet (or statement of financial position), 2) income statement, 3) cash flow statement, and 4) statement of changes. These three statements together show the assets and liabilities of a.

This opens the window for decision making and strategic planning, as well. Financial statements are reports or statements that provide the details of the entity’s financial information, including assets, liabilities, equities, incomes and expenses, shareholders’ contributions, cash flow, and other related information during the period of time. How to read a balance sheet a balance sheet conveys the “book value” of a company.

Recognize key elements in every financial statement, including assets, liabilities, revenues, expenses, change in net assets, change in. Financial statements are written records that convey the business activities and the financial performance of a company. If you're a business owner, you should also know how to prepare and read these four statements:

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/exxonIS09-30-2018-5c5dc83c46e0fb00017dd129.jpg)