Casual Info About Financial Year For Income Tax

Choose the assessment year for which you want to calculate the tax.

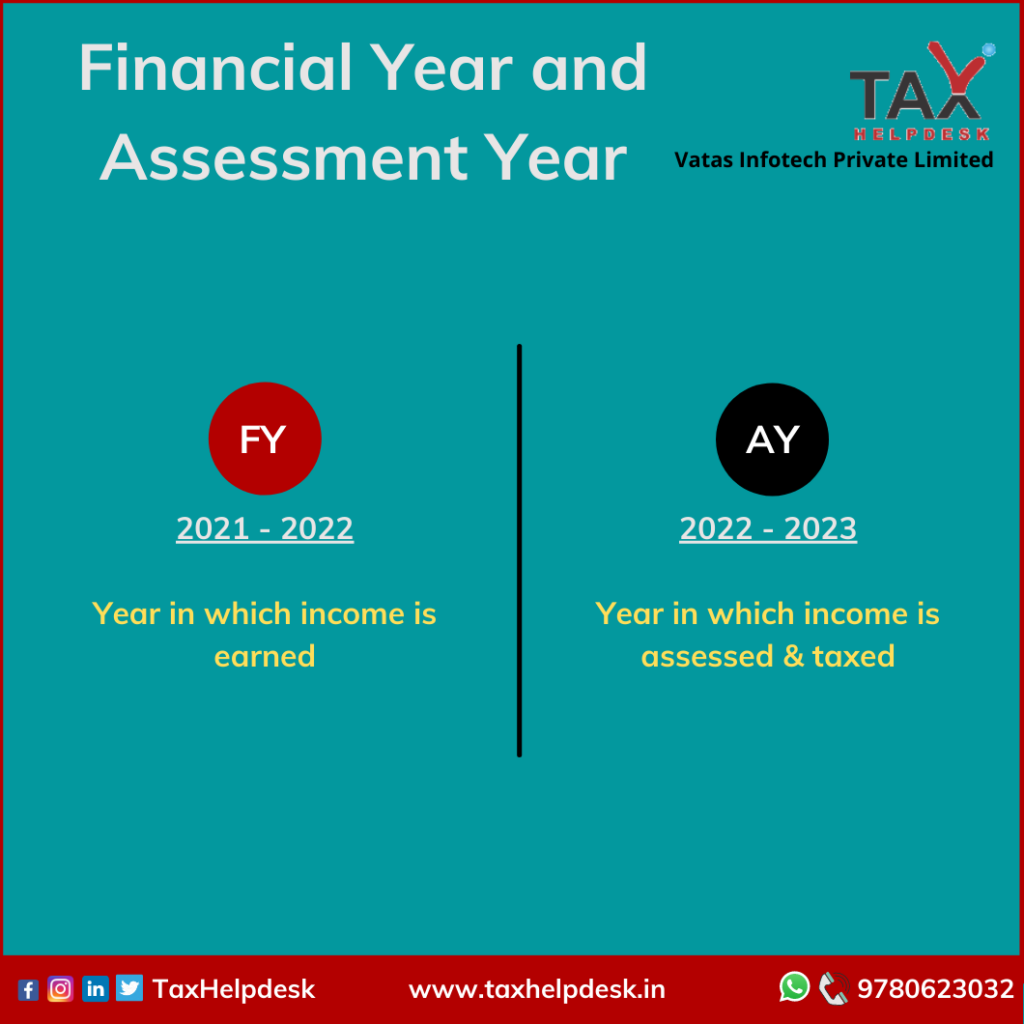

Financial year for income tax. Ay is the year following the financial year in which you have to evaluate the. Full year operating income of $2.279 billion; This income is subject to tax in the assessment.

Record full year operating revenues of $21.833 billion, reflecting strong demand for air travel; Taxpayers in over 20 states who received tax rebates last year received clarification from the irs. In layman terms, the assessment year is the year in which income is taxed and all taxes are paid and tax returns are filed.

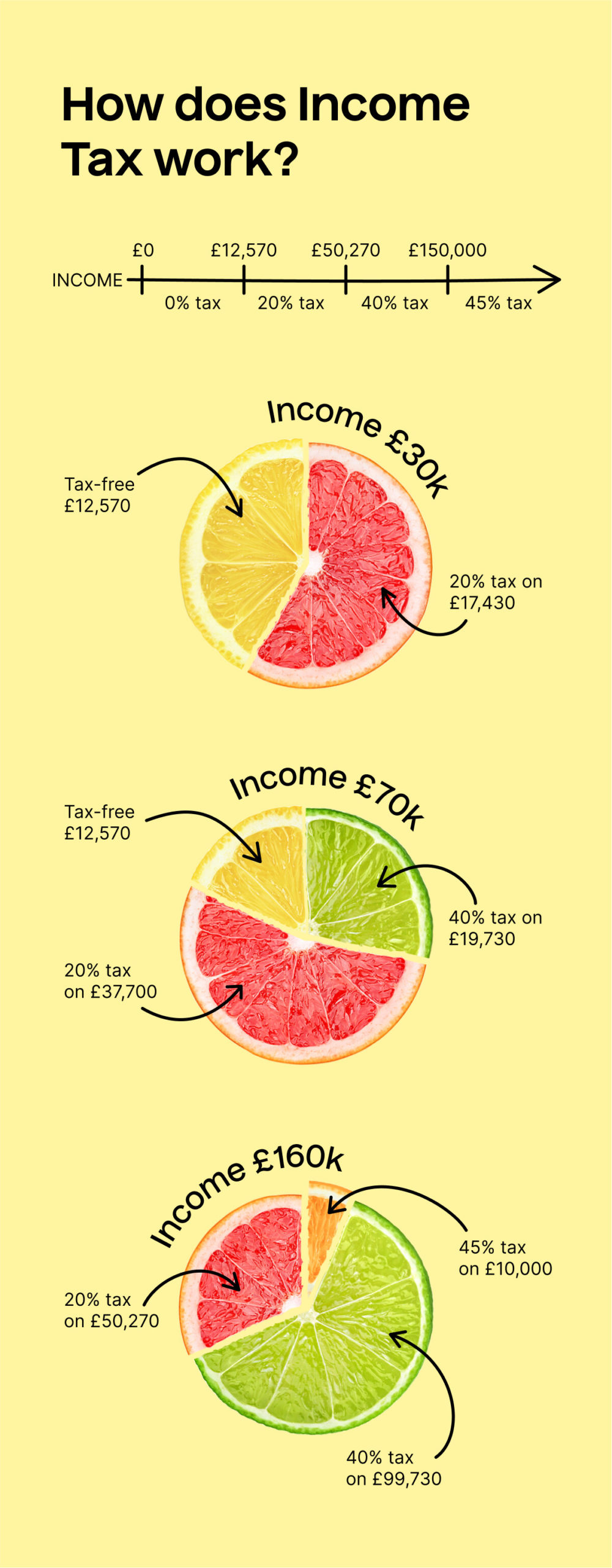

States where tax rebates may not be considered taxable income. Uk government finances saw a record surplus in january due in part to a big rise in income tax receipts, with more britons forced into paying tax. The assessment year follows the end of the previous financial year, which runs from april 1st to march 31st.

The tax years you can use are: For example, the assessment year for the financial. The enhancements for taxpayers without a.

Always remember to file your income. Timely payment of taxes not only gets you immense benefits in terms of savings but also keeps you out of troubles like penalization, bad credit score due to non. As you navigate the 2024 tax season, use our cheat sheet to.

You can also estimate how much income tax you should pay this year without signing in. From an income tax perspective, fy is the year in which you earn an income. The standard financial year, or tax year, of 6th april to 5th april applies to the government and individuals.

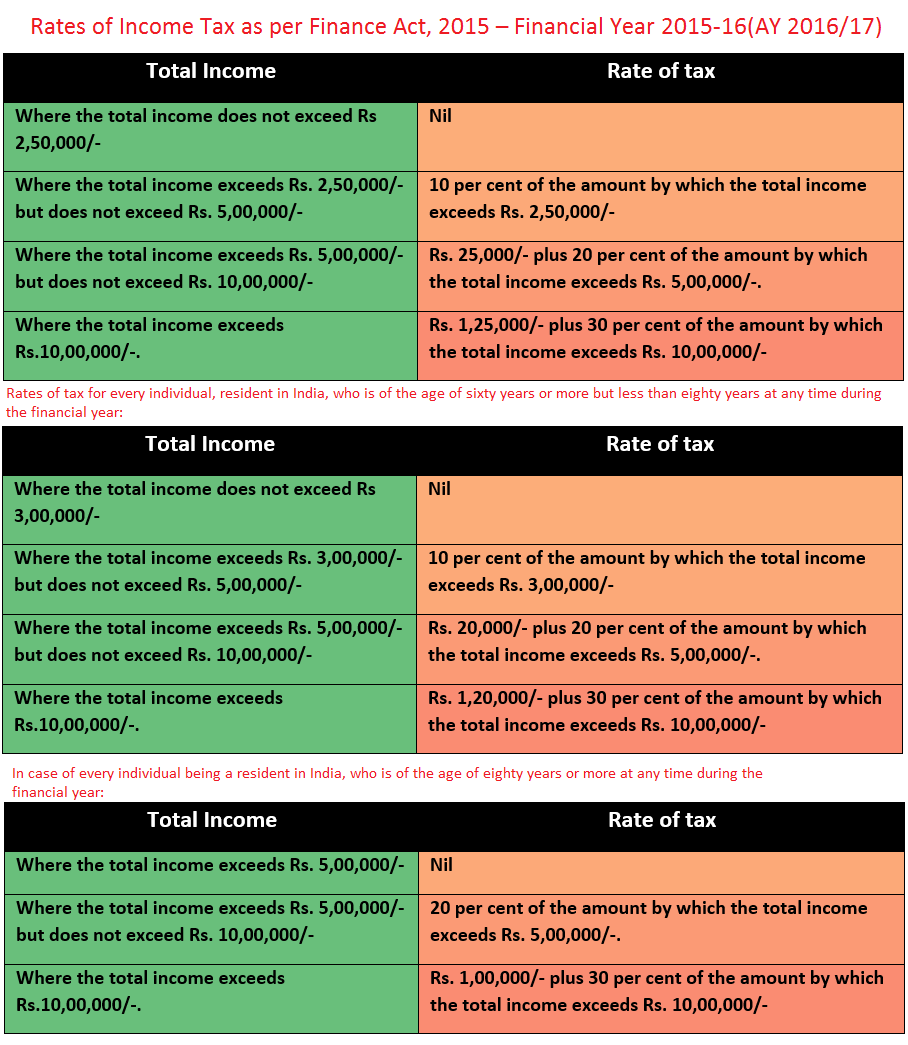

The rules vary by year and person, depending on your filing status, age, income and other factors. We have updated our tool in. A financial year (fy) is the period between 1st april to 31st march, the year in which a taxpayer earns his income.

Check tax for previous years there’s a different way to check how much income tax. An income tax calculator is an online tool that helps individuals calculate the amount of income tax they will owe to the government based on their taxable income. 5 rows the assessment year is the year after the financial year in which the prior year's revenue.

During the first 10 months of the. A fiscal year (fy) is a period that a company or government uses for accounting purposes and preparing financial statements. Under current law, for tax year 2023, the following currently apply:

Apr 12th, 2023 | 21 min read contents [ show] new income tax regime from budget 2023 as soon as the filing season begins, salaried classes are in a frenzy.