Favorite Info About Trial Balance Is A Statement Or Account

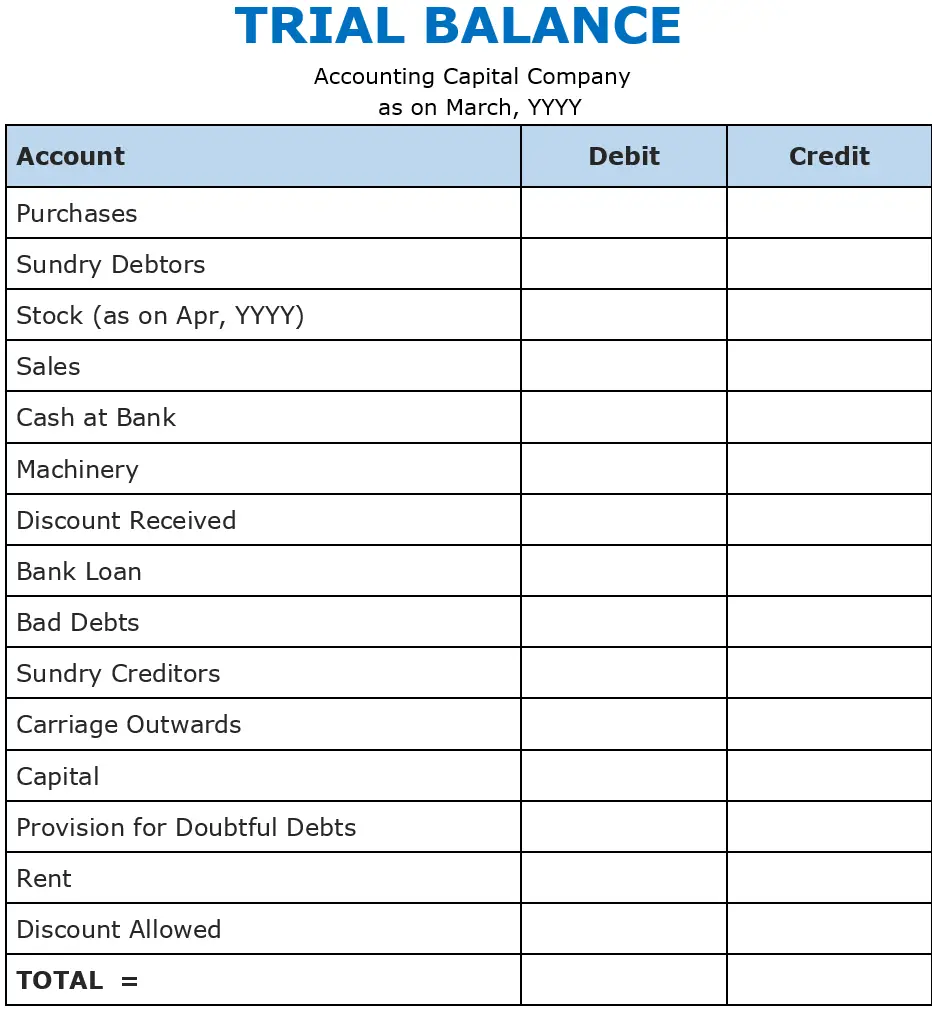

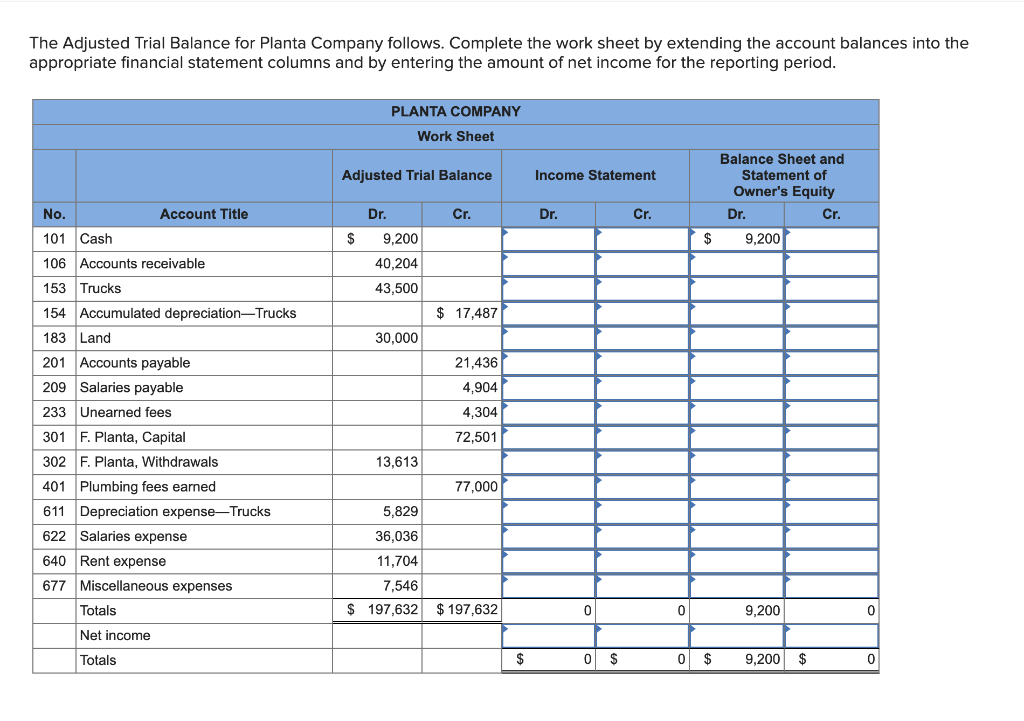

A trial balance is a statement that keeps a record of the final ledger balance of all accounts in a business.

Trial balance is a statement or account. One, it is a summary of all ledger account balances at the end of the given period and two, it is used to assess whether there was erroneous accounting entries. Elena cardone is organizing this fundraiser. A trial, which trump tainted with histrionics and contempt for the judicial system, and judge arthur engoron’s final, stinging judgment, revealed four foundational codes that explain trump’s.

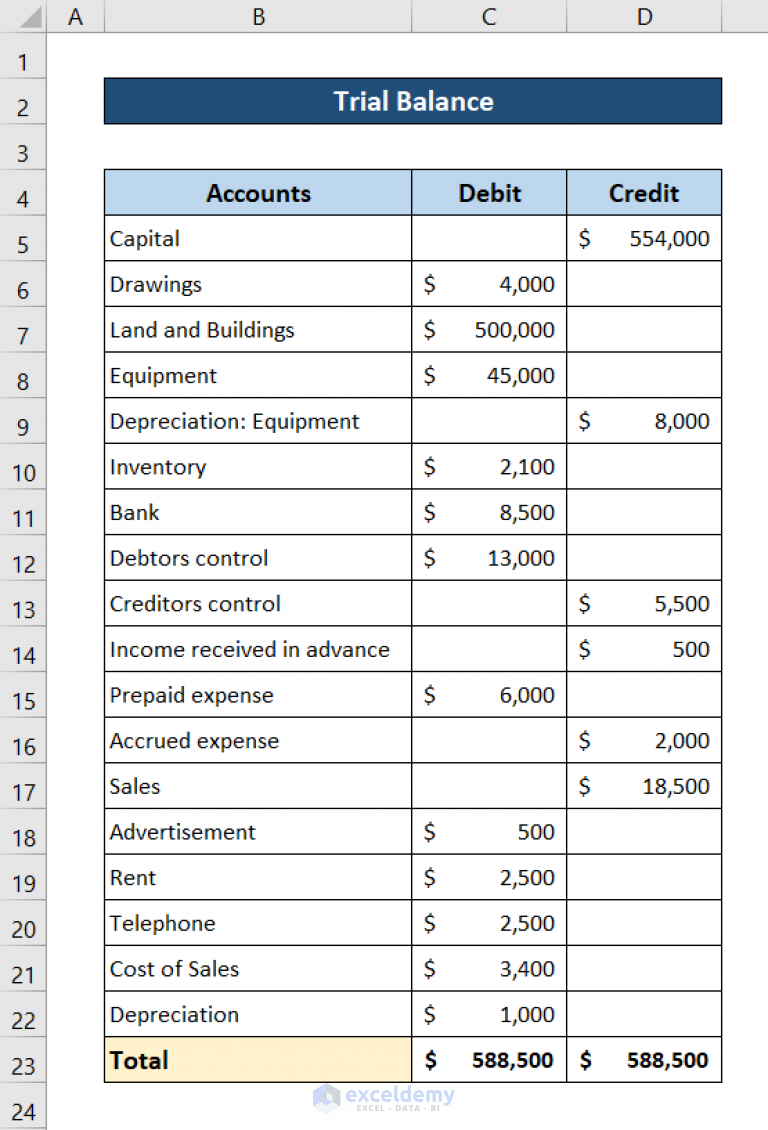

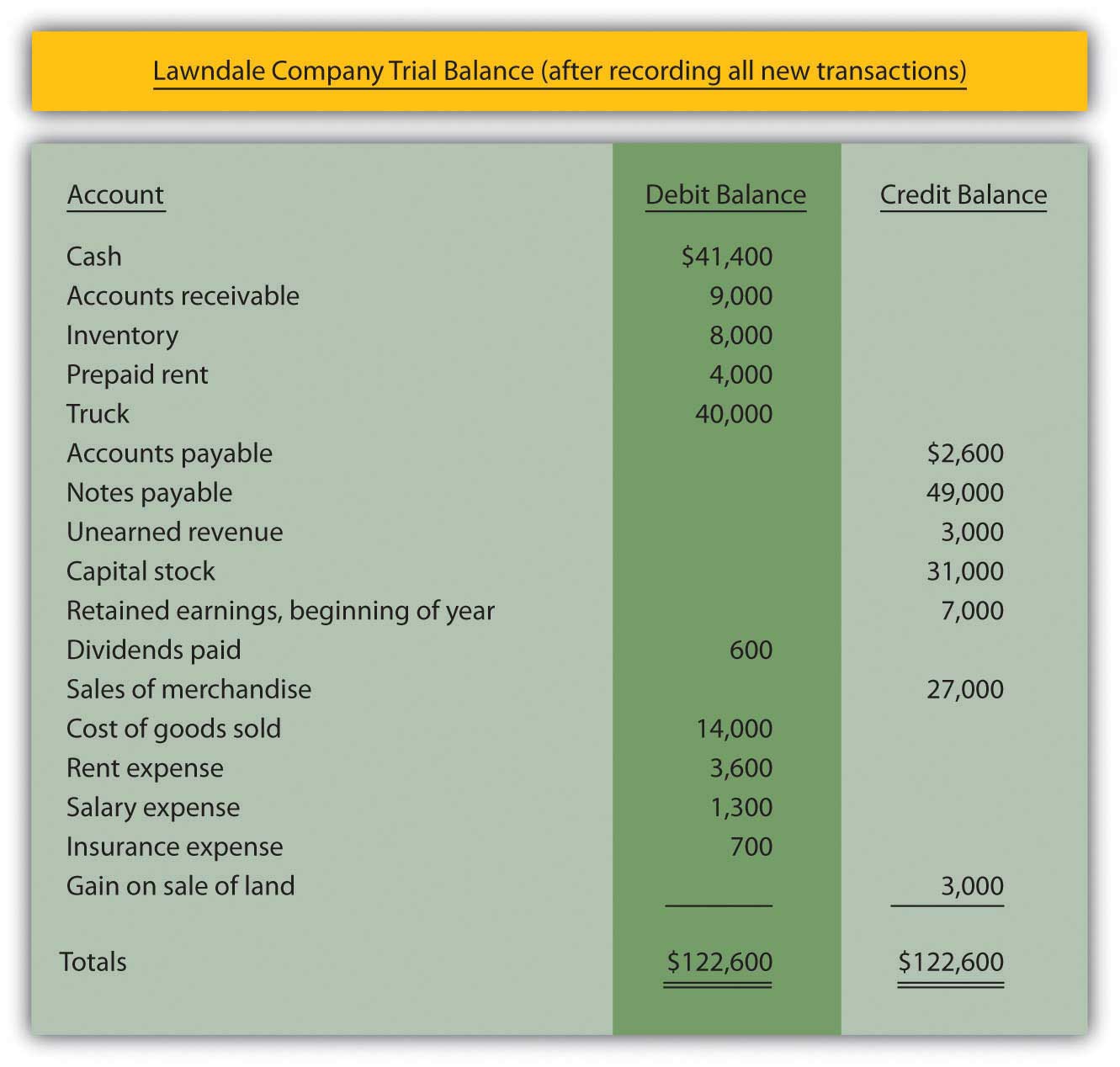

Example of a trial balance document It is a statement of debit and credit balances that are extracted on a specific date. Although a trial balance may equal the debits and credits, it does not mean the figures are correct.

It is an internal document that provides a clear image of a company’s financial health, summarizing all the. This statement comprises two columns: A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

A company prepares a trial balance. Income statement s will include all revenue and expense accounts. The general ledger accounts ' debit and credit column sums must equal one another to.

The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit account columns. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate. The accounts reflected on a trial balance are related to all major accounting items, including assets , liabilities, equity, revenues, expenses , gains, and.

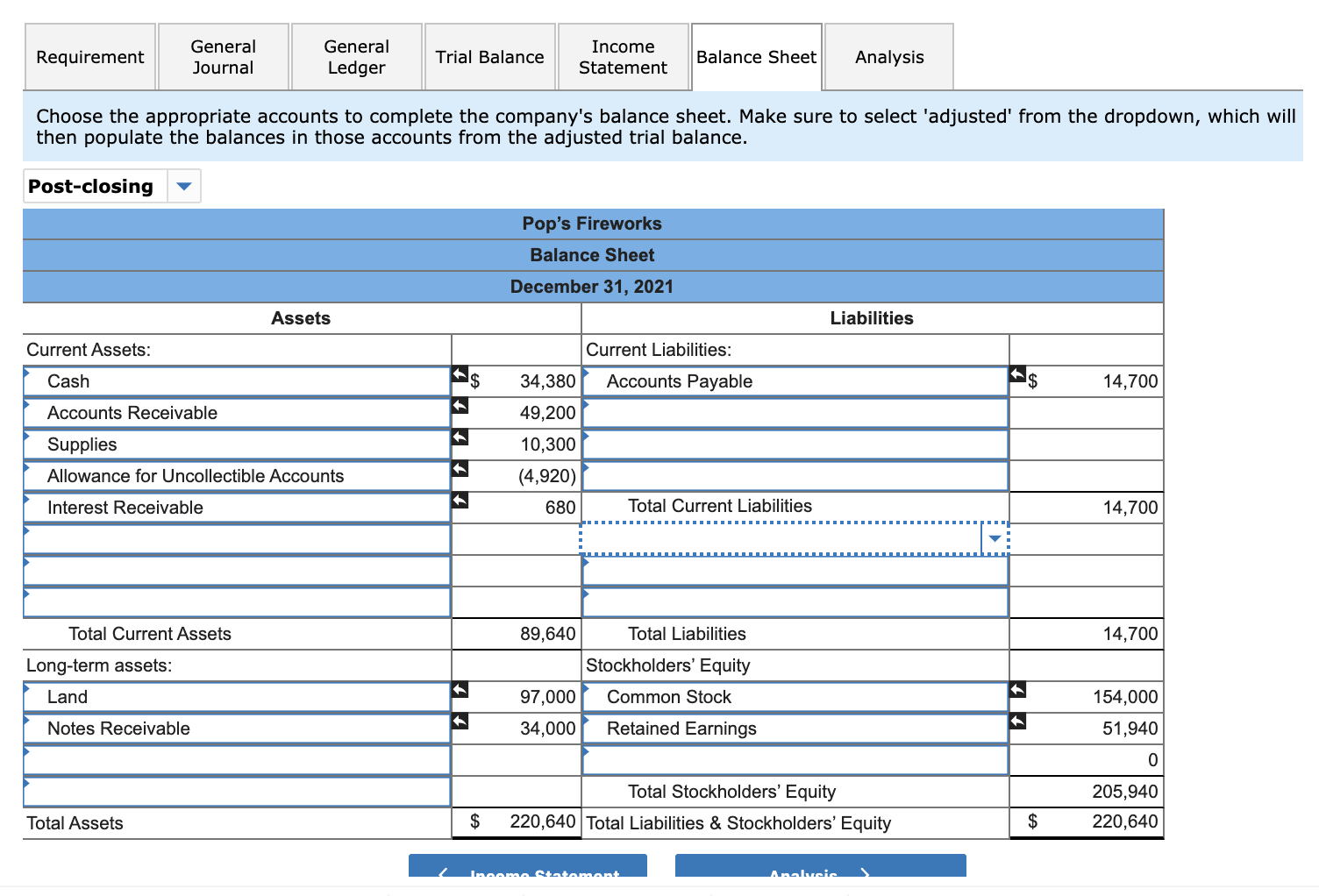

A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. Balance sheet is a statement expressing the position of assets and liabilities of the firm, as on a particular date. From this information, the company will begin constructing each of the statements, beginning with the income statement.

Trial balance of tyndall at 31 may 20x6. To check the arithmetical accuracy of the accounting entries passed. A trial balance is a statement or report generated at the end of an accounting period, listing all the accounts and their balances.

He was charged last week with giving false statements to the fbi. Illustration 1 – preparation of financial statements. Trial balance is prepared at the end of a year and is used to prepare financial statements like profit and loss account or balance sheet.

The trial balance of tyndall at 31 may 20x6 is as follows: A trial balance includes the figures from the profit and loss (income statement) and the balance sheet financial statements. Therefore, if the debit and the credit sides of the trial balance are the same, it is assumed that.

Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. In trial balance, all the ledger balances are posted either on the debit side or credit side of the statement. The learner needs to understand that a trial balance is prepared for twofold reasons.