Supreme Info About Trial Balance Revenue

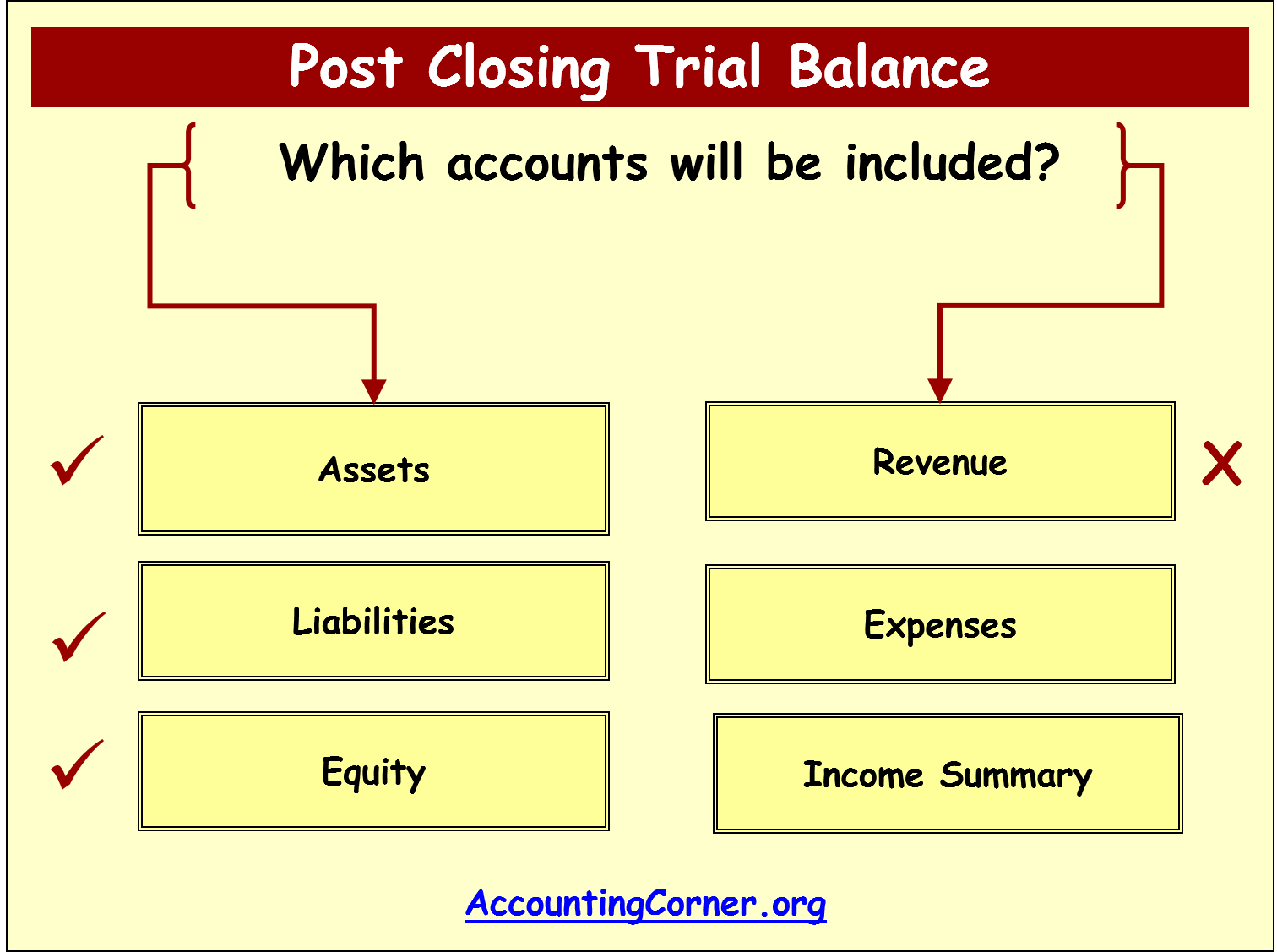

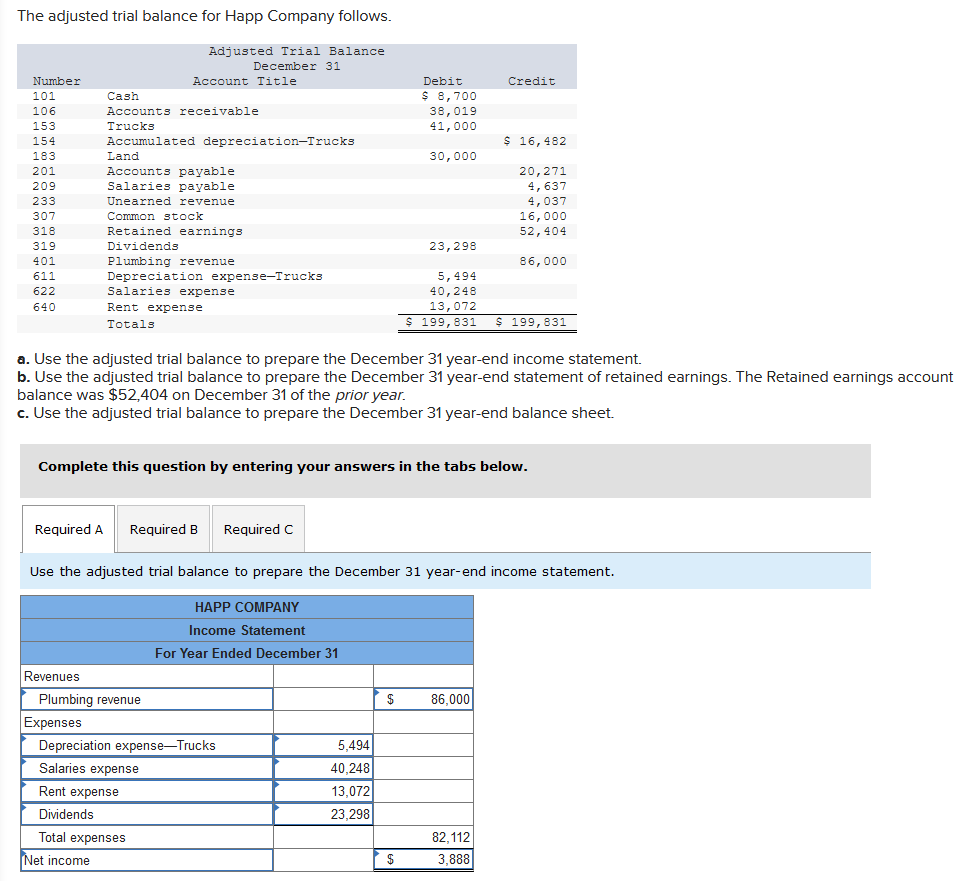

In the trial balance, revenue accounts (which have credit balances) are expected to have corresponding expense accounts (which have debit balances).

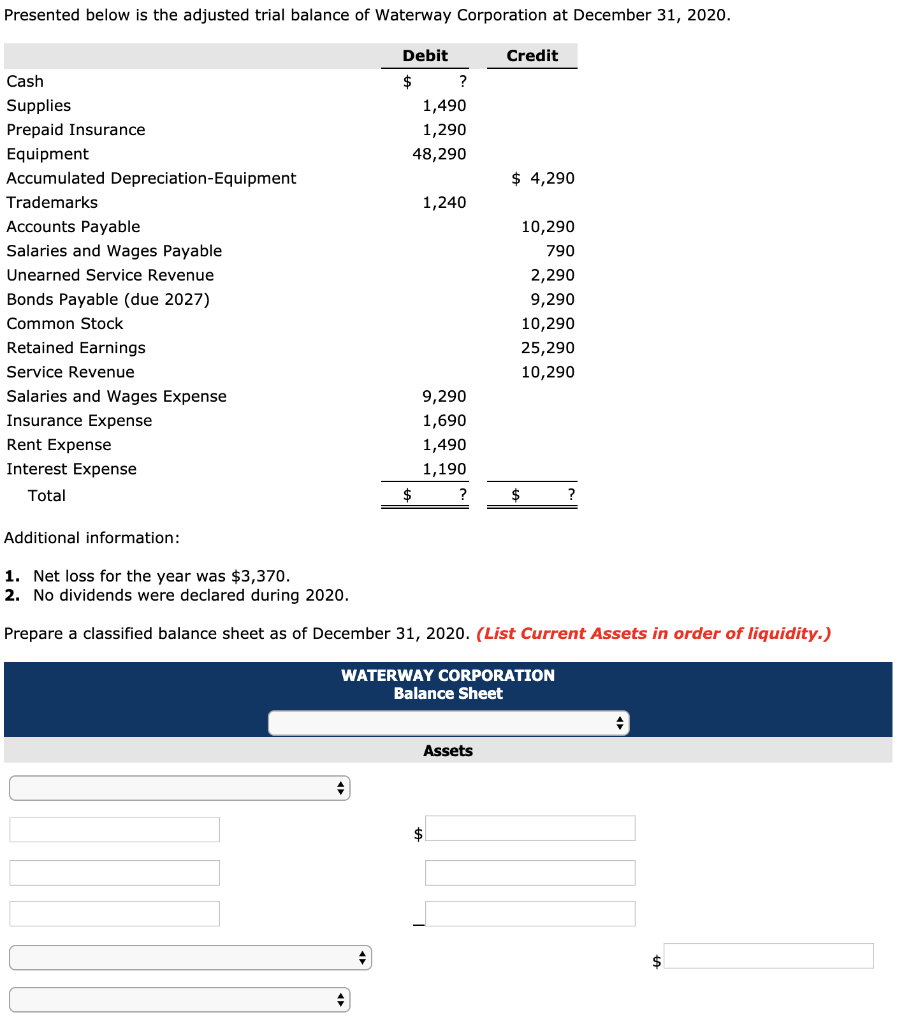

Trial balance revenue. An unadjusted trial balance is an unprocessed list of ledger account balances at the end of the. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. To get the $10,100 credit balance in the.

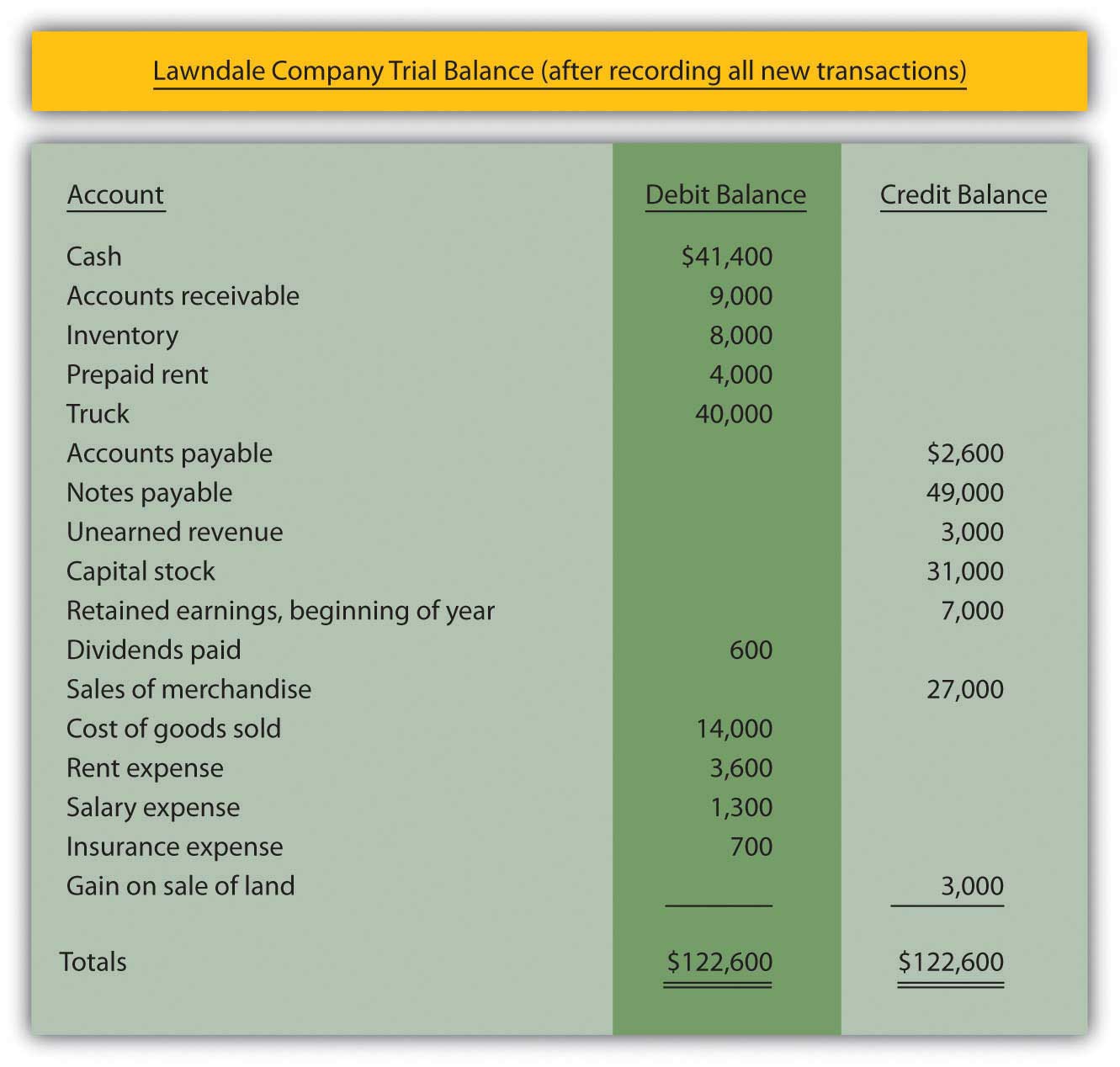

The trial balance and its role in the accounting process. Follow the process below to prepare a balance sheet from the trial balance: A trial balance includes a list of all general ledger account totals.

In addition, it should state the final date of the accounting periodfor which the report is created. In this case, the trial balance indicates a balanced equation: This means that it states the total for each asset, liability, equity,.

To prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts. Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available; Revenue is the income the business generates from production activities.

The purpose of a trial balance is to check the math and facilitate the preparation of financial statements. For example, utility expenses during a period. To get the $10,100 credit balance in the.

Expenses refer to the costs. Each account should include an account number, description of the account, and its final debit/credit balance. Service revenue had a $9,500 credit balance in the trial balance column, and a $600 credit balance in the adjustments column.

Bookkeepers and accountants use this report to. Service revenue had a $9,500 credit balance in the trial balance column, and a $600 credit balance in the adjustments column. A trial balance is an internal document that lists all the account balances at a point in time.

A trial balance is an internal financial statement that lists the adjusted closing balances of all the general ledger accounts (both revenue and capital) contained in the ledger of a. Trial balances are a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger accounts,. The form and content of a.

The trial balance is an accounting report that lists the ending balance in each general ledger account. There were no depreciation expense and accumulated depreciation. In this example, the debits and credits balance.

Locate all revenue accounts in the trial balance, such as sales revenue, service revenue, and other income sources. Eliminate any expense or revenue. The total debits must equal total credits on the trial balance.