Build A Tips About Loss In Income Statement

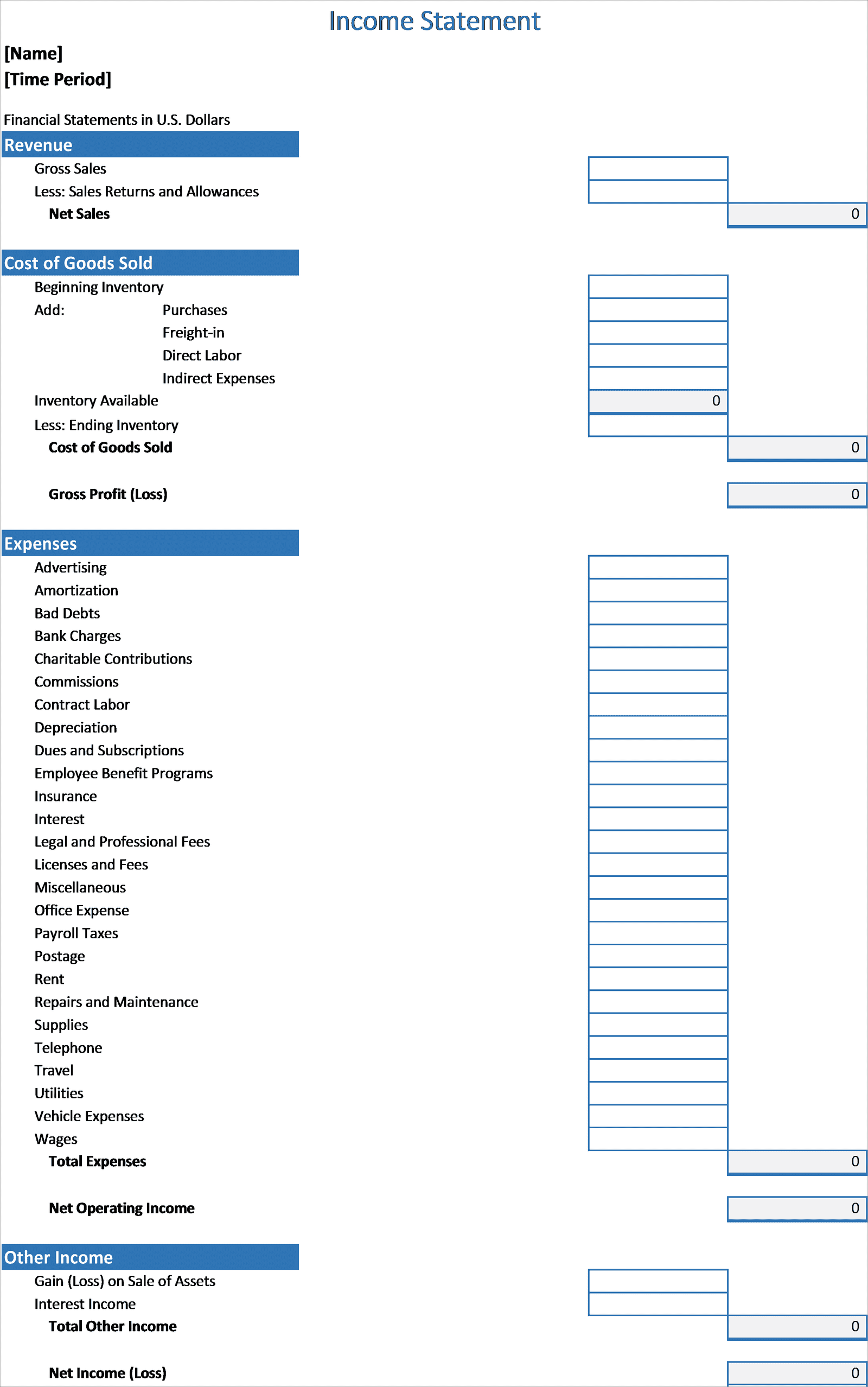

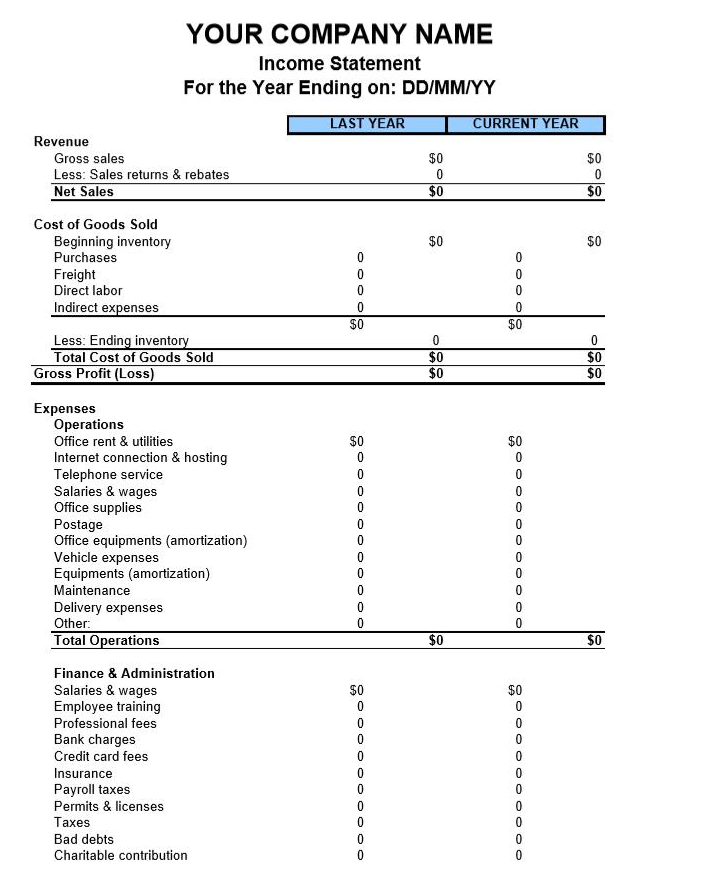

An income statement gives insights into your business’s operations, how efficiently it is being managed, what departments are.

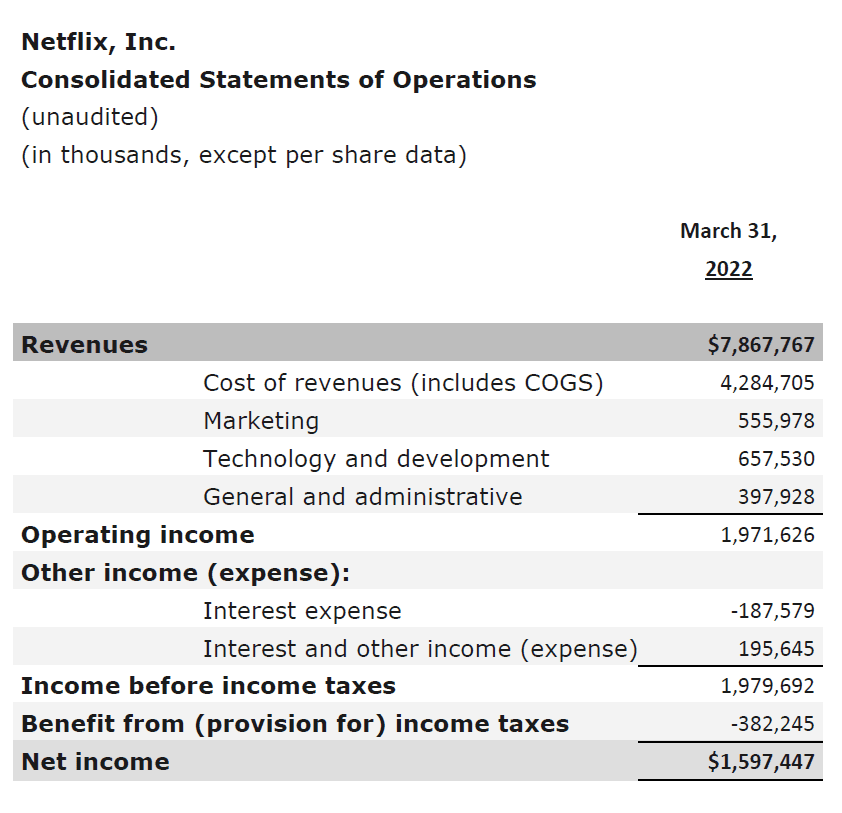

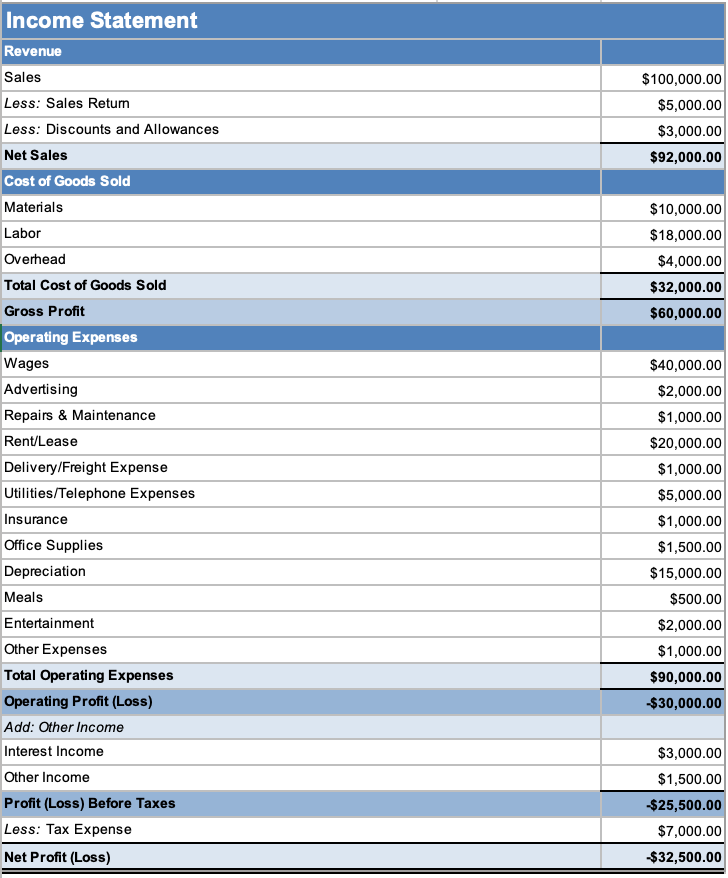

Loss in income statement. Shareholders, investors, lenders, and competitors use this document for interpreting and comparing financial performance. Creating one is a standard way to compile historical data for your business to tell its financial story over time. The purpose of the income statement is to show managers and investors whether the company made money (profit) or lost money (loss) during the period being reported.

It shows your revenue, minus expenses and losses. Net income was $273 million, or $1.04 a share, compared with a loss of $557 million, or $2.46, a year earlier, coinbase said in a shareholder letter thursday. An income statement helps business owners decide whether they can generate profit by increasing revenues, by decreasing costs, or both.

What is the income statement? Average annual income grew slowly at $1998 during the average 6.4 years of disease duration (14% of the value predicted by the u.s. The basic equation underlying the income statement, ignoring gains and losses, is revenue minus expenses equals net income.

An income statement is a financial report detailing a company’s income and expenses over a reporting period. The income statement is also known as a profit and loss statement, statement of operation, statement of financial result or income, or earnings statement. Income statements are also known as statements of earnings, statements of income, net income statements, profit and loss statements or simply “p&ls,” among other names.

Income statements depict a company’s financial performance over a reporting period. A profit and loss (p&l) statement, sometimes called as an income statement, is a financial report that provides investors and outsiders with a financial overview of a company. A profit and loss statement is also called an income statement, a statement of profit, or a profit and loss report.

The income statement can either be prepared in report format or account format. You are free to use this image on your website, templates, etc, please provide us with an attribution link. However, when income exceeds expenses, net profit is reported rather than the loss on income statement.

Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions. This contrasts with the balance sheet, which represents a single moment in time. The civil fraud ruling on donald trump, annotated.

Importance of an income statement. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. It is identical to profit/loss for the period attributable to equity owners of the parent as defined by ifrs rules.

Airbus se continues to use the term net income/loss. Your p&l statement shows your revenue, minus expenses and losses. Revenue, expenses, gains, and losses.

It reflects the revenues and expenses of a firm for a fiscal year. Analysts had forecast a loss. Small business owners have two reporting options when preparing an income statement:

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

![17+ Profit And Loss Template EDITABLE Download [Word, PDF]](https://www.opensourcetext.org/wp-content/uploads/2020/07/pal-6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)