Inspirating Info About Loss On Disposal Double Entry

There can be many reasons for disposing or selling a fixed asset these include theft, sales, broken or withdrawn from use.

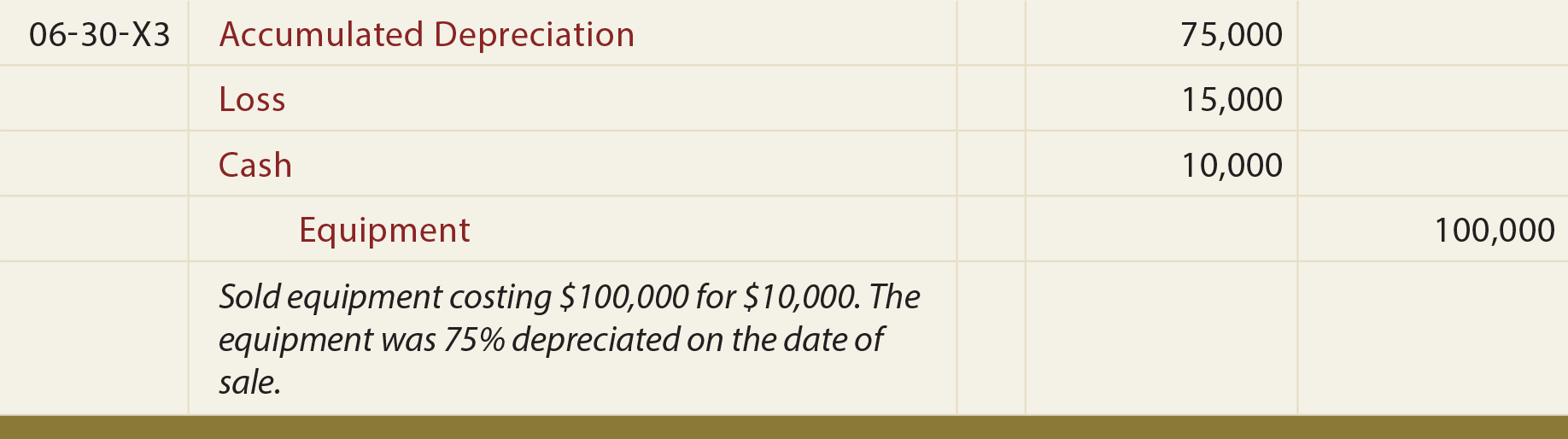

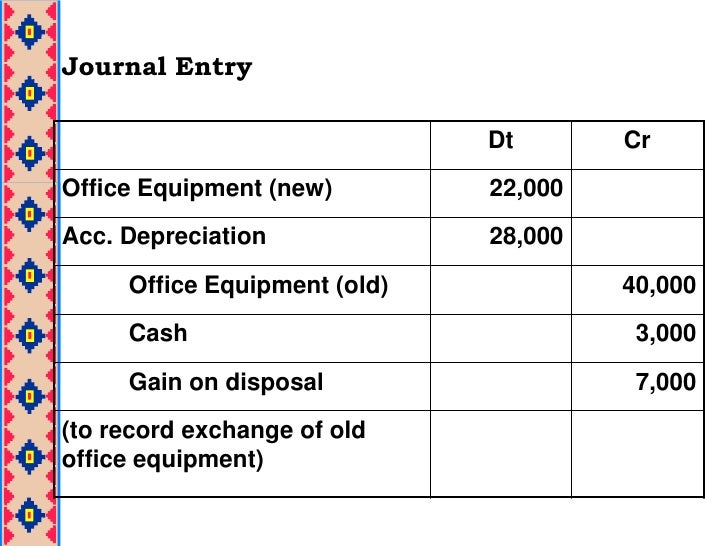

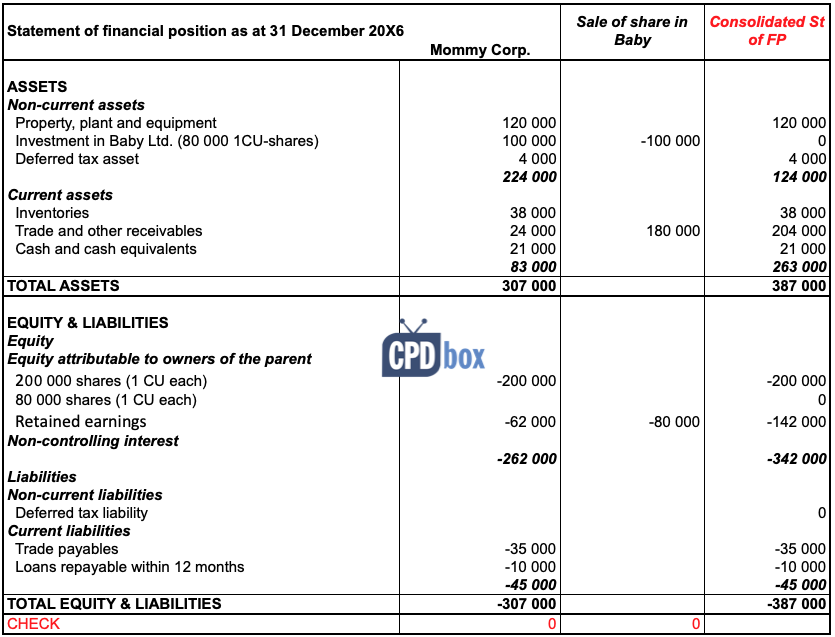

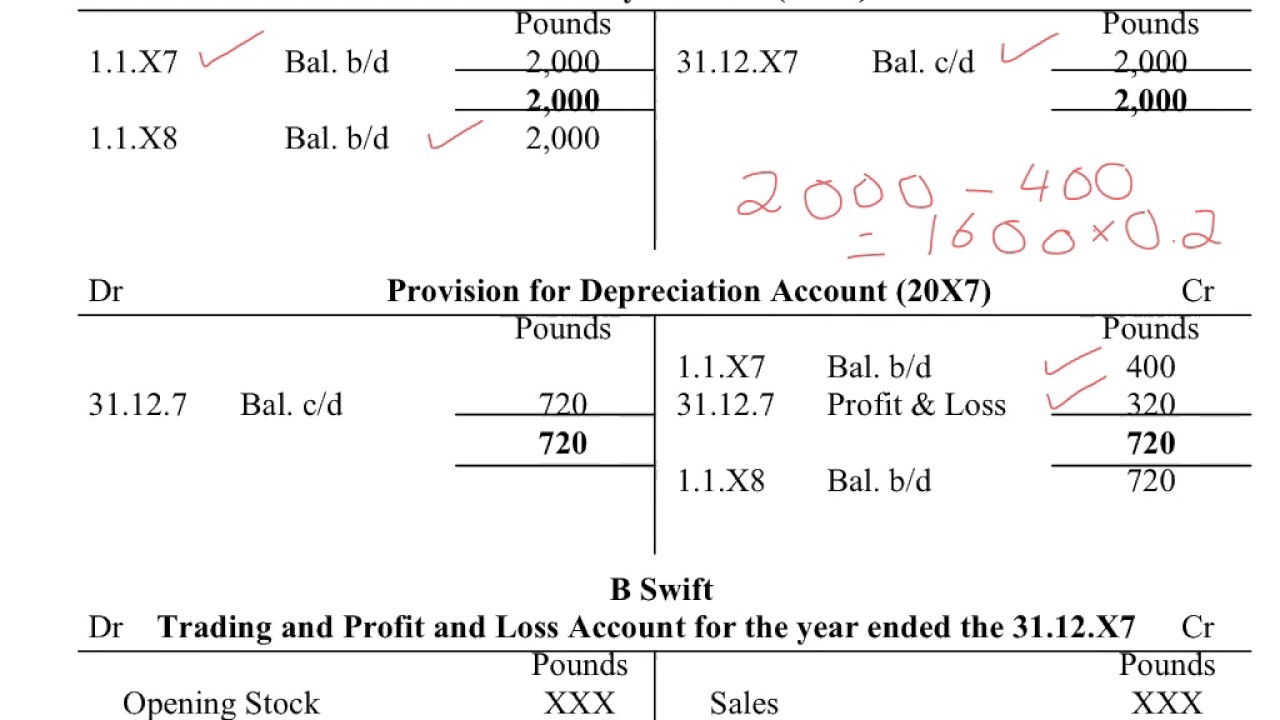

Loss on disposal double entry. The profit or loss on disposal can also be calculated as. The correct double entry to record the purchase is: At the year end, you will need to complete a fixed asset.

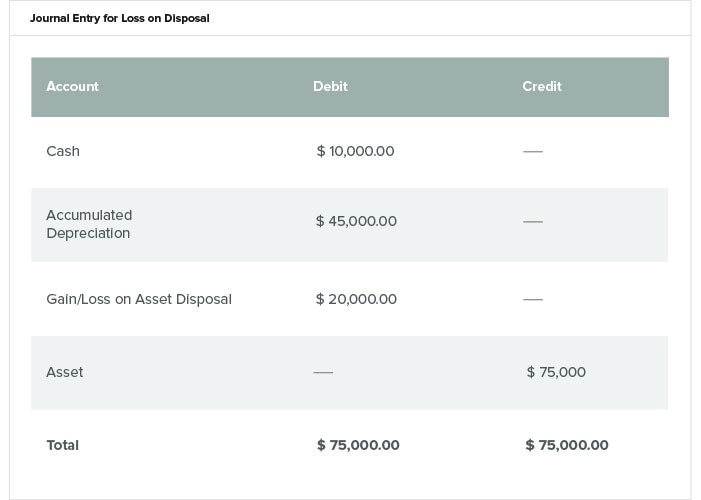

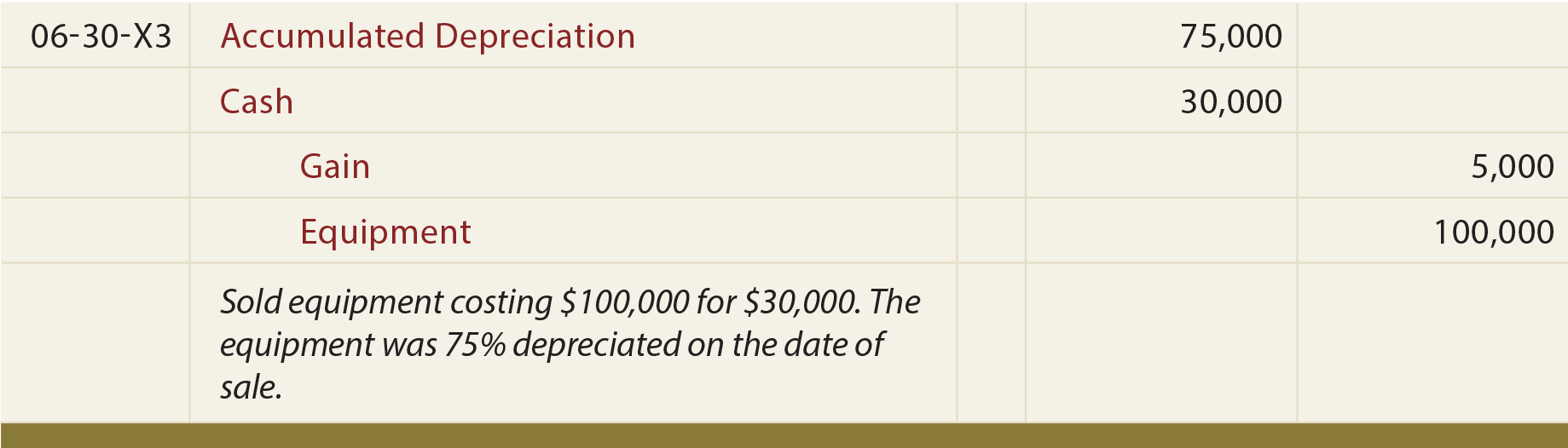

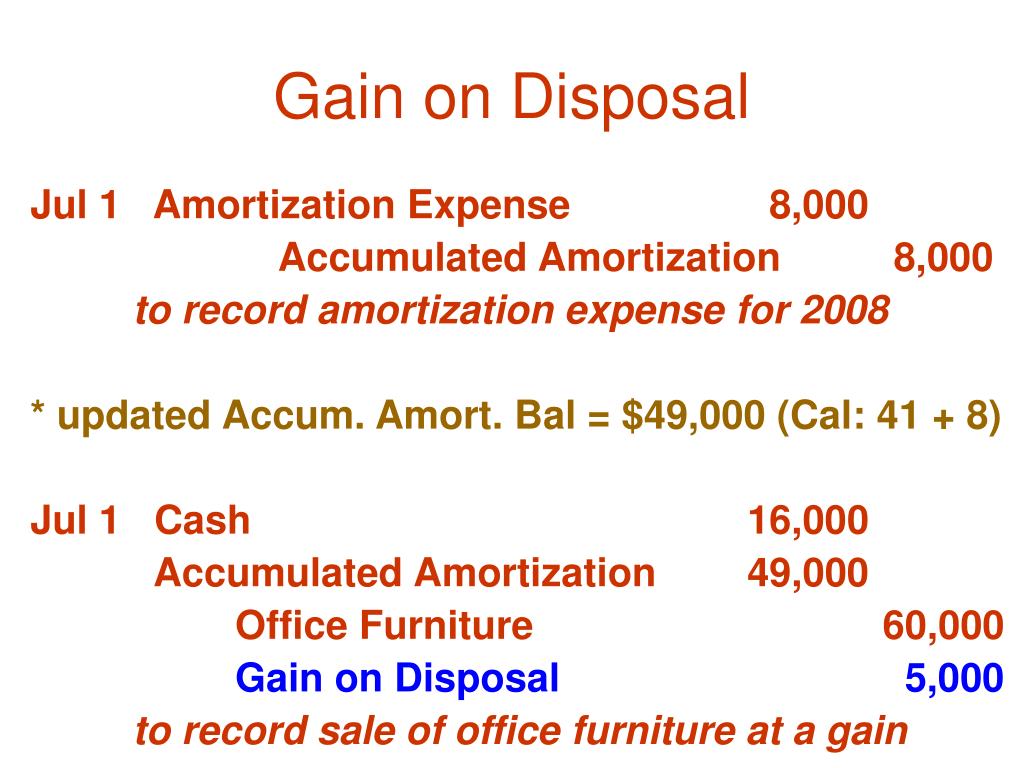

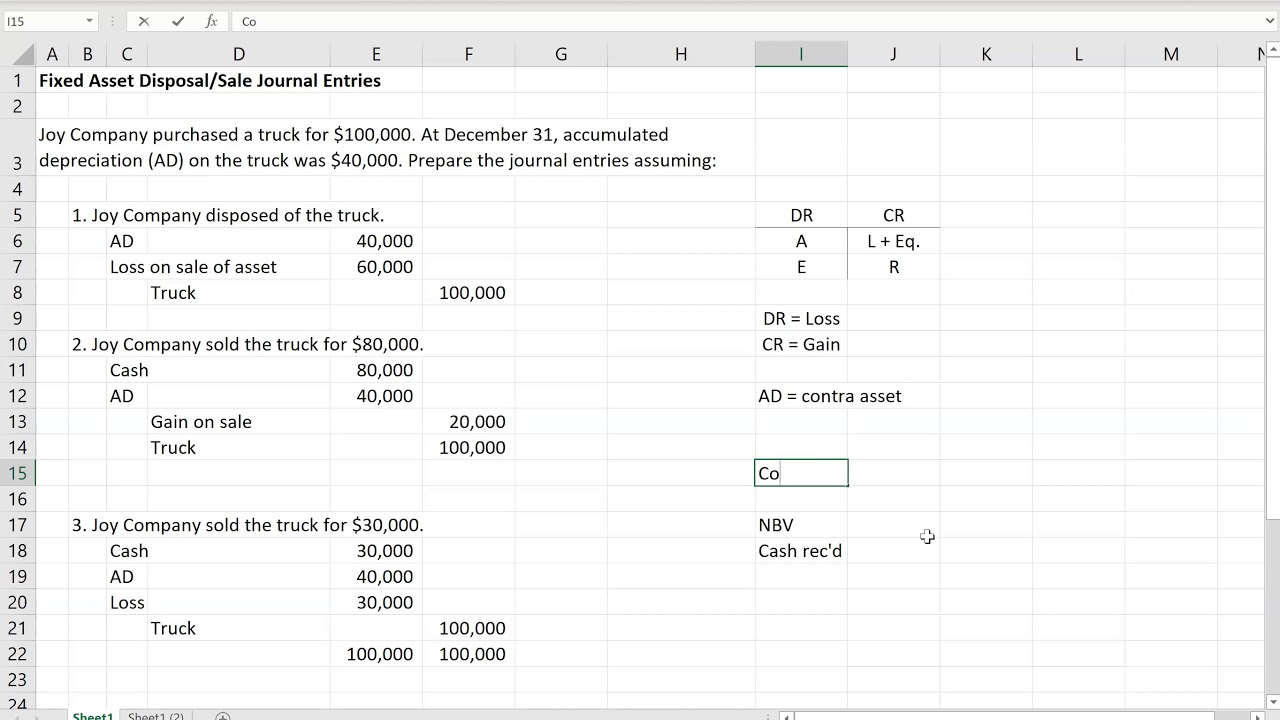

This is needed to completely remove all traces of an asset from the balance. Record the sale amount of the asset. The journal entry for gain or loss on fixed asset disposal above will remove both the disposed fixed asset and its related item (e.g.

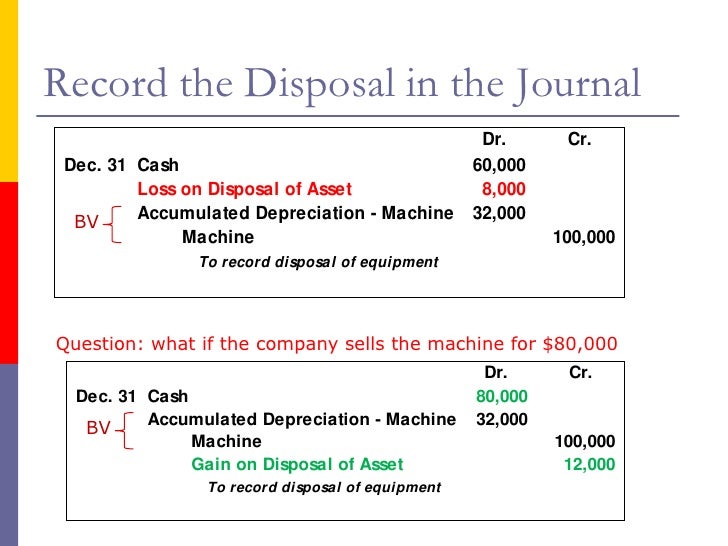

Disposal by asset sale with a loss. Let’s consider the same situation as in scenario 2, but the selling price was only. 5 rows a disposal can occur when the asset is scrapped and written off, sold for a profit to give a gain.

This is the difference between the net sale price of the asset and its net book value at the time. In this section, we focus on what happens when a nca is sold. Cash inflows from disposal of fixed assets is reflected in the.

Step 3 enter any proceeds from the sale of the asset in the disposal account. If things don't add up, make a new. The journal entry for the disposal should be:

You need to calculate parent’s gain or loss on the disposal of shares and recognize it in profit or loss, which will have effect on retained earnings: If you sold your asset, record the gain or loss from the sale. Assets should be removed from the accounting records when an asset has been disposed of.

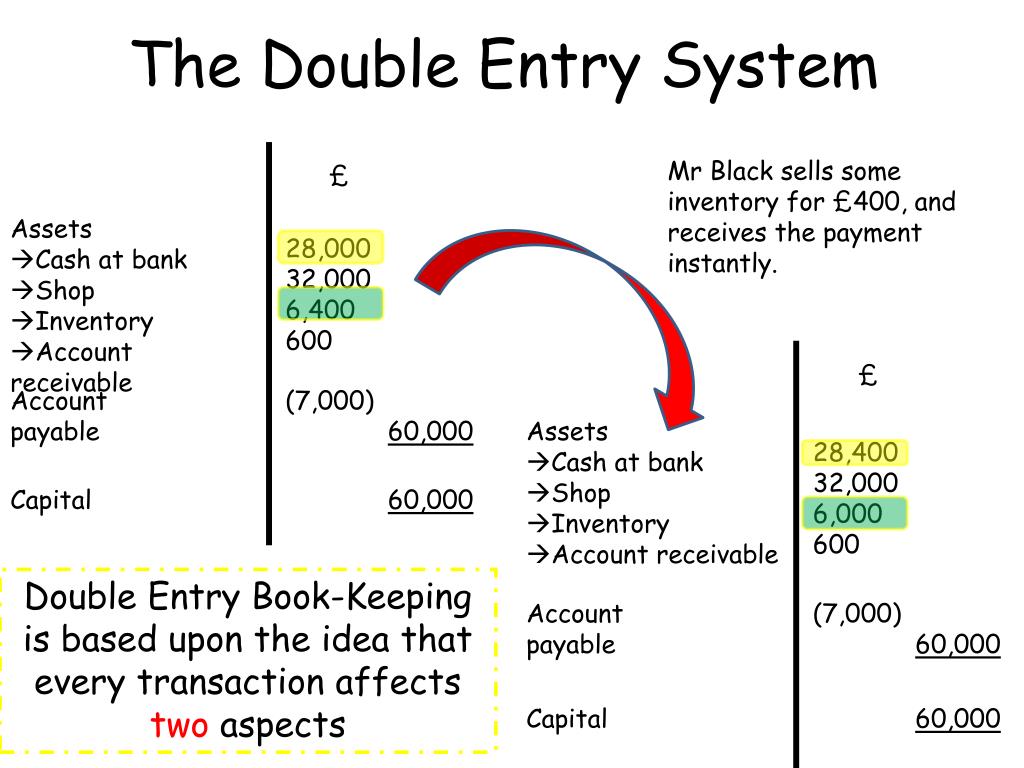

Fixed asset disposal accounting. A gain or loss on disposal is recognised as the difference between the disposal proceeds and the carrying amount of the asset at the date of disposal. Double entry accounting the most fundamental concept of double entry accounting is that debits always equal credits.

Step 1 open a disposal account. Record cash receive or the receivable created from the sale: Step 2 transfer the two amounts to the disposal account.

The disposal of assets involves eliminating assets from the accounting records. The write down of inventory journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double. And if it is negative, it shows a loss on disposal.

The journal entry to dispose of fixed assets affects several balance sheet accounts and one income statement account for the gain or loss from disposal. The accounting for disposal of fixed assets can be summarized as follows: This gain or loss is.